|

LISTEN TO AUDIO VERSION:

|

Status quo—big tech platforms on the rise

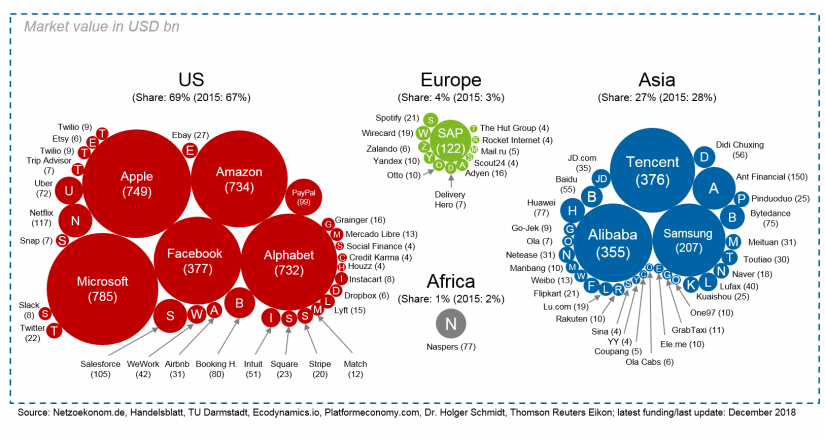

The largest digital platform players, also known as big tech companies, are based in the US (Alphabet, Amazon, Apple and Facebook) and Asia (Alibaba, Tencent and Samsung) with a respective combined share of 96% of global platform business (see figure 1).

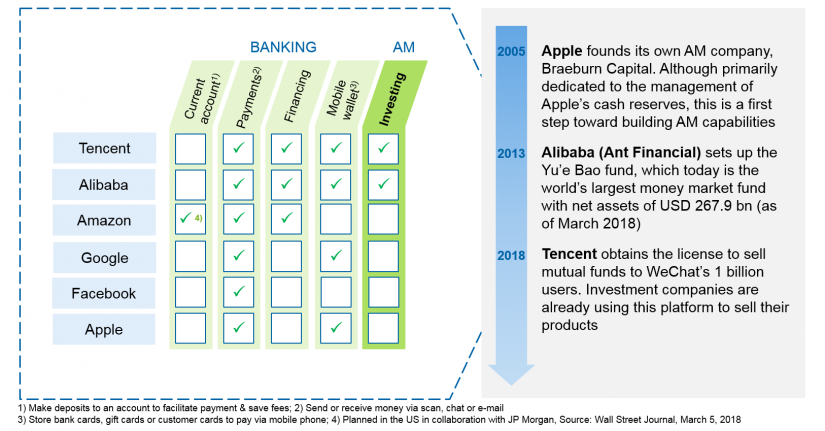

Big tech companies have already started to expand their business into the financial services sector, as shown in figure 2, thereby challenging established market players. Most of their product offerings, such as payments, financing and mobile wallet, however, focus on pure banking rather than on asset management services., Amazon, for example, launched its financing program in 2015 to offer loans to its customers and, by now, also its own reward credit cards.

Nevertheless, asset management is considered a highly attractive business for several reasons[1]:

- Comparatively low (regulatory) capital requirements

- Asset management is one of the most profitable markets compared to other industries and also within the financial service industry, boasting high operating margins of 37%, compared to only 34% in banking or 4% in insurance

- The market has grown steadily at 14% per year over the last half decade

- Global megatrends will continue to drive the demand for asset management and support ongoing growth (e.g. through a growing middle class, a shift from deposits to financial assets, an increasing life expectancy)

Big tech companies are therefore predestined to make full use of their strong access to retail customers and of their ability to reroute asset flows through their platforms.

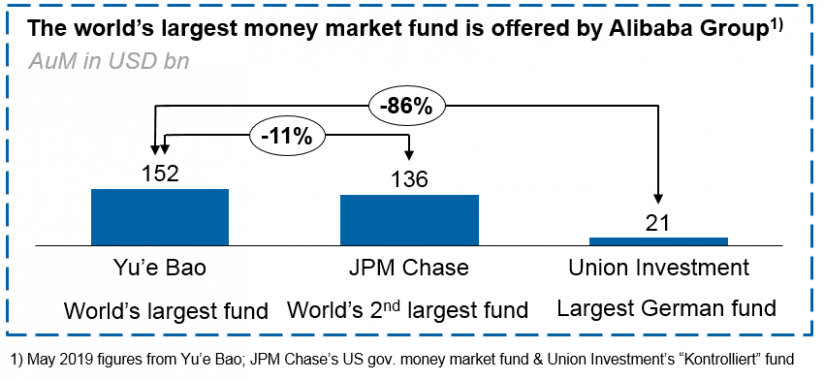

As figure 2 shows, big tech companies have already recognized the opportunity of offering asset management services and are gaining initial experience. In 2004, Alibaba founded Alipay, offering payments and related services, and in 2014 expanded its range to include asset management products by founding Ant Financial Services Group. Today, Alibaba’s Yu’e Bao fund is the largest money market fund worldwide with net assets of USD 152 billion as of May 2019 (see figure 3), to which over 588 million users of Ant’s mobile payment network Alipay contribute, representing more than a third of the Chinese population. Alibaba also offers innovative equity products such as funds that track the CSI Taojin Big Data 100 e-commerce-based equity index, which is created by taking into account the online sales figures of CSI All Share Index companies that are extracted from the Alipay information service platform. This index tracks e-commerce activities to gauge business performance by combining the Chinese internet shopping giant’s data troves with its financial services aspirations.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Besides other services, in 2015 Ant Financial launched Ant Fortune, a wealth management platform with fund products from many different Chinese fund institutions. Since 2018, another Asian big tech, Tencent, has owned a license to sell mutual funds to its 1 billion monthly WeChat users. In addition, pawnbrokers already use the platform to sell their products.

American big tech companies have been acting more cautiously so far. In 2005, Apple founded its own asset management company called Braeburn Capital. Although its purpose is to manage Apple’s large cash reserves, it could be a strategic first step in expanding its own asset management capabilities to also serve external clients in the future.

What the consumer wants—convenience beats data protection

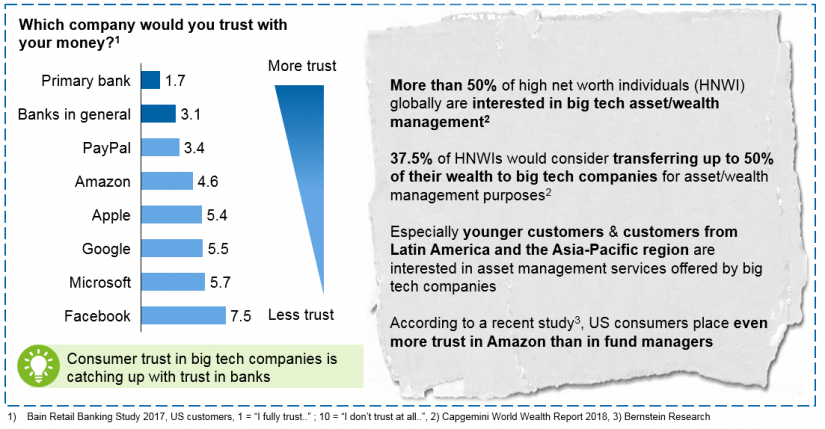

Despite some data leakage scandals in the past, consumer trust in big tech companies has now caught up with the long-standing trust in banks, which has taken years to develop.

As shown in figure 4, recent studies indicate that US consumers place even more trust in Amazon than in fund managers, and the majority of high net worth individuals (HNWI) express a strong interest in asset management services offered by big tech companies, as convenience outweighs the need for data protection.

5 strengths of big tech companies—how to master the asset management industry

Big tech companies have five advantages over traditional asset managers that allow them to offer asset management services to their customers:

- Availability of (big) data on customers, product sales and companies

- Technological capabilities to gain useful information from (big) data, e.g. data analytics (big data) and innovations (artificial intelligence)

- Efficiency and agility through both a fast-moving company environment and an attitude toward innovative changes

- Customer (knowledge) from existing business, e.g. sales attitudes and quality preferences

- Sales strength through brand loyalty, convenience benefits and increasing customer trust

Especially technological capabilities, high efficiency and an agile corporate culture play an important part in developing convenient offerings to digitally savvy customer. By gathering and analyzing large amounts of customer data (e.g. sales and quality preferences), big tech companies are able to provide cost-effective and tailor-made offers and can also monetize that data by developing new analytics as a basis for innovative investment strategy offers.

As Asian big tech companies are already building on their advantages and enjoying success in asset management, the question is no longer “if”, but “when” other big tech companies with similar activities will enter the asset management markets outside Asia.

How to enter the asset management market—possible options for big tech

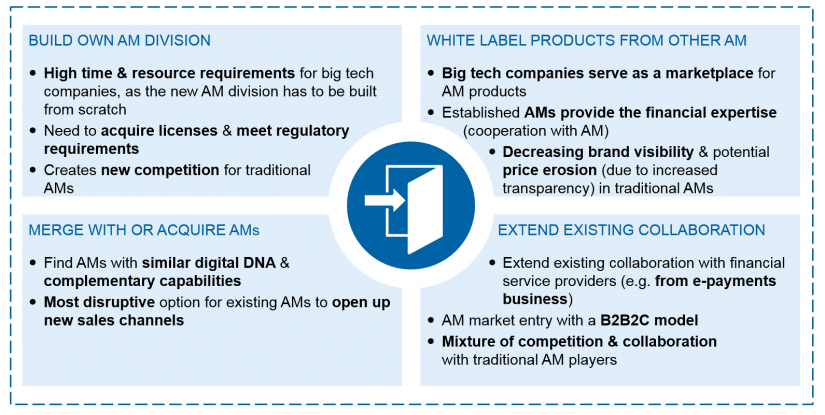

In general, there are four market entry options that big tech companies might consider and traditional asset managers should be aware of: building their own asset management division, white labeling products from other asset managers, merging with or acquiring other asset managers or extending existing collaborations. As shown in figure 5, each of these options has its advantages and disadvantages, which big tech companies need to consider when assessing and identifying their best option for a successful market entry.

zeb’s view on the future of big tech companies’ asset management offers

Because of their technological capabilities, efficiency and agility, their customer knowledge and their sales strength, big tech companies have already started to enter the asset management market. We expect this trend to intensify in the coming years. Therefore, the asset management industry needs to improve its digital service offering in order to ensure a sustainable business in a highly competitive environment.

Current asset managers should focus in particular on leveraging technological capabilities in order to increase efficiency and agility. This includes taking data management to the next level, i.e. making the most of data to optimize sales, activate customers and assess investments.

To learn more about the latest developments and upcoming challenges in the asset management industry, read our article and study: Asset management—the discomfort zone.

[1] BankingHub (2019): Asset management—the discomfort zone