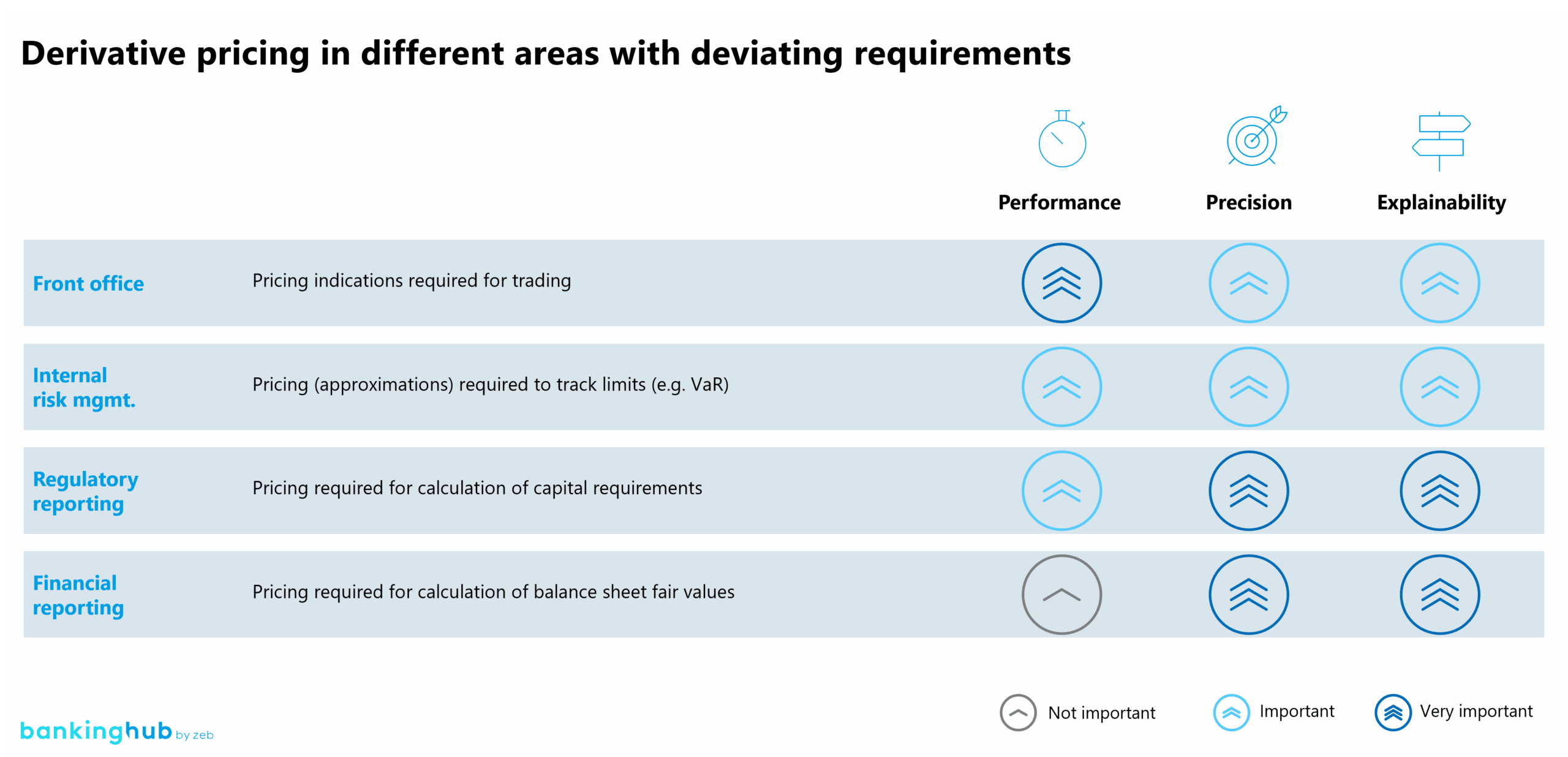

Derivatives are complex financial instruments broadly used within financial institutions. As such, their prices are an important information in the different areas of these institutions ranging from relevant pricing information for the front office to calculating their fair value for the financial statements.

Currently, the main models used for derivative pricing are based on arithmetical models, which excel at precision and explainability. Their weakness, however, is their performance. Especially for more complex options, time-consuming methods like Monte Carlo simulations or stochastic partial differential equations are currently used.

To increase the performance, linearization models such as delta-normal or regression models could be used in theory. However, these models are not very precise due to their nature and hence their use for financial institutions is very limited.

Due to the vast development of machine learning methods within recent years, these new technologies provide the possibility to fill this white spot. Once trained, machine learning models offer a very fast and, as demonstrated in our case study below, relatively precise pricing mechanism.