An illustrative example

At the start, different scenarios are used for medium-term planning. Depending on the development, existing tools are used to correctly calculate planning parameters of relevance for P&L, e.g. net interest income and valuation results for the positions held as customer and direct investments. This is usually done by means of software-based simulation. For a duration-controlled specialized fund, certain distributions are planned in line with the agreed investment strategy.

In a second scenario (yield curve normalization), interest and indices, in particular, rise compared with the initial situation and, as expected, have some positive and some negative effects on medium-term planning for new lending business and treasury operations. While in this example, securities forming part of the liquidity reserve have higher valuation requirements, the specialized fund convincingly plays its role as a “strategic black box” and distributes the returns as planned regardless of the changed framework conditions.

Where is the problem?

The example presents a specialized fund that has a medium duration commonly found in practice and whose valuation results by far offset the return effects of rising coupons in reinvestment in the scenario of rising interest rates: Economically speaking, distributions would not make sense. At best, the P&L contribution simulated for medium-term planning only allows for significantly reduced distributions if any hidden reserves available are released. A first focused analysis clearly shows that the expressiveness of medium-term planning considerably suffers when specialized funds are insufficiently considered: stabilizing effects for returns that are included in the plans do not materialize in each scenario.

The second focus relates to management: depending on the orientation and integration of the fund mandate in bank-wide management, it might even have been possible to optimize return effects by modifying the fund’s investment structure in due time—but where should you start? Due to the structure of the investment in the specialized fund, it is only considered as one asset in line with the principle “for duration/on average” in planning. In spite of its high impact on returns, there is a lack of transparency about possible developments of future returns and risks, especially with regard to valuation results and ongoing returns.

How can the problem be solved?

The approach to solving the problem presented here consists in breaking up the “black box” of strategic specialized funds. In order to ensure distributions in medium-term planning and, as a result, to identify correct control signals with the aim of guaranteeing the right operational strategy, the specialized fund has to be represented in a transparent and integrated fashion—while taking account of the segment structure and functioning of the fund’s wrapper in the bank-wide context.

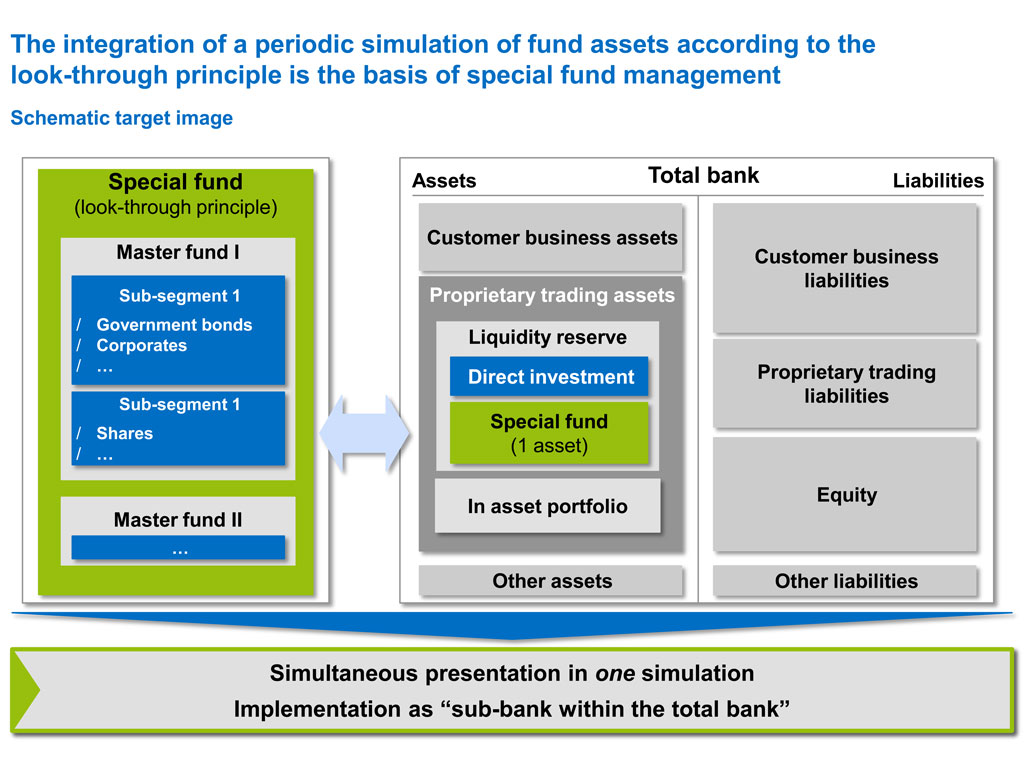

The target picture is based on a period-oriented simulation of fund assets in the entire bank—implemented as a “bank within the bank”.

First of all, the entire fund has to be represented with its sub-structures down to individual securities. The data on current holdings provided in the fund manager’s report are used as a starting point. Thereby, current net interest income and valuation results can be simulated on the basis of individual securities. Moreover, actions taken by the fund manager to maintain / achieve the desired target duration as well as potential changes must be integrated into simulation. The aggregation of all results into management-relevant rating classes and sub-segments provides in-depth insights into the effects and interactions within specialized funds.

By including this dynamic fund portfolio into medium-term planning and management at the bank-wide level, strictly separate P&L cycles of funds and the entire bank are integrated in simulation:

- One P&L cycle per specialized fund (segment) has the following key elements:

- Valuation results

- Interest and dividend payments

- Reinvestment and management measures

- Liquidity position

- Distributions/additions/withdrawals from the fund’s perspective

The bank-wide P&L cycle takes account of:

- Valuation results based on the fund’s market value and book value, including distributions

- Distributions / additions / withdrawals from the bank-wide perspective

The fund bank and entire bank only “communicate” through distribution planning, additions and withdrawals as well as valuation results. This adequately takes account of the actually existing wrapper of the fund because—in spite of the economically correct modeling of individual asset classes and securities within the fund—investments in specialized funds still have to be valuated as one asset in accounting.

Conclusion

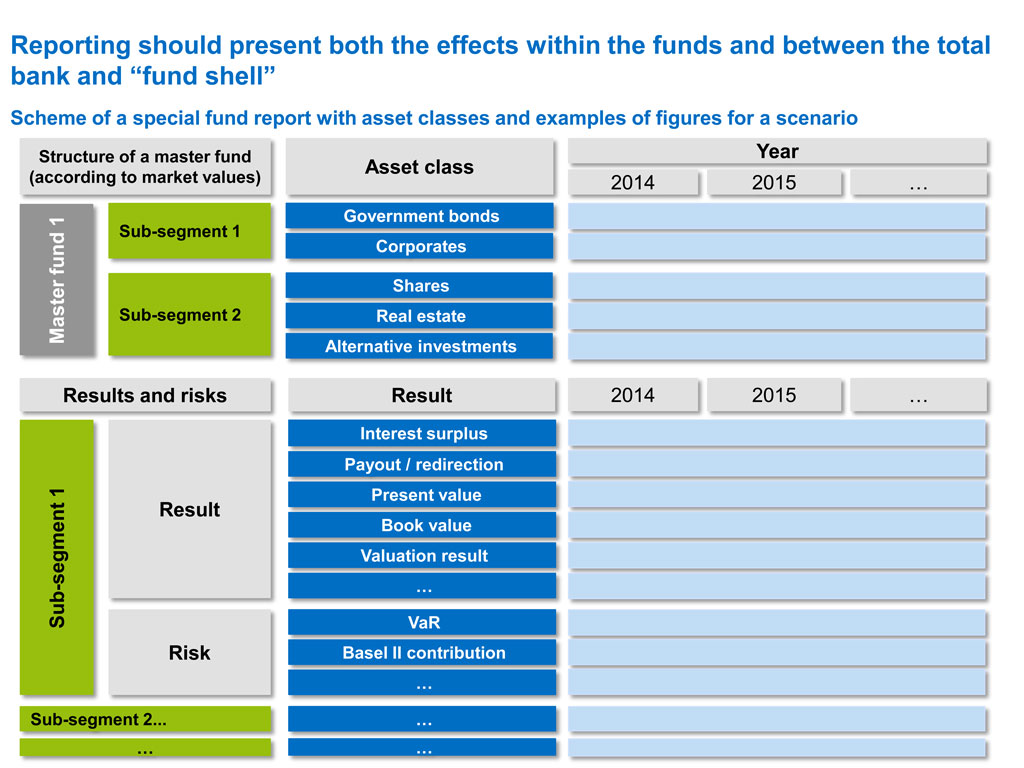

The integrated simulation of specialized funds breaks down the black box in the strategic management of proprietary trading in line with their high importance for returns in a controlling and management-oriented way in the bank-wide context! Of course, the new insights gained should also be reflected in reports that should present at least the following information per scenario:

Figure 2: Scheme of reports on specialized funds with examples of asset classes and data for a scenario

Figure 2: Scheme of reports on specialized funds with examples of asset classes and data for a scenarioSubsequent aggregation of data into a general return matrix is advisable.

In summary, implementation only requires:

- a simulation and reporting engine that can handle the simulation of a “bank within the bank”;

- market data / forecasts for designing alternative future scenarios; and

- current fond structures with regard to individual securities that are made available by the fund manager anyway.

This is the only way in which it becomes possible to validly design medium-term planning and, at the same time, to put to the test current and planned activities related to specialized funds from a management perspective and to identify return-effective measures.