Being able to accurately identify the target companies or even the sector most exposed to ESG trends is be a fundamental factor to effectively understand, seizing and promptly identify the new opportunities linked to the support and financing the green transition.

Based on a zeb research, about 90% of European companies belong to the so called “transition business” cluster, namely businesses with a high potential given their need for transition towards a more sustainable model. According to the study, such cluster constitute the main addressable market for banks to exploit new opportunities in terms of volumes and margins linked to the need of new investments to reach ESG objectives.

The remaining share consist of “dark green business”, activities which are already cutting-edge in terms of sustainability (e.g. wind power plants), and “brown business”, activities that will remain brown in any case or that cannot turn into green (e.g. mining companies).

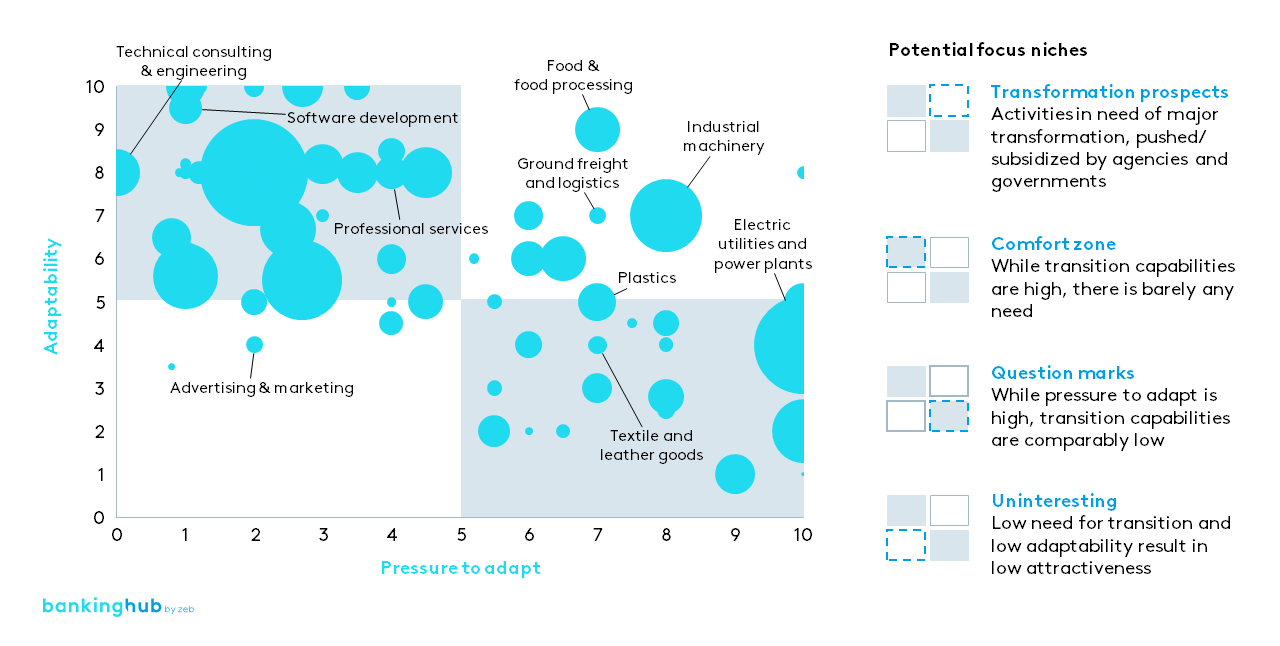

Within the addressable market, the prioritization for the definition of the offering should start from the analysis of two main variables: the “pressure to adapt” – pressure for the climate transition by both governmental institutions and the marked demand – and the “adaptability”– promptness and capability to adjust business and operations in response to the changing ESG requirements.