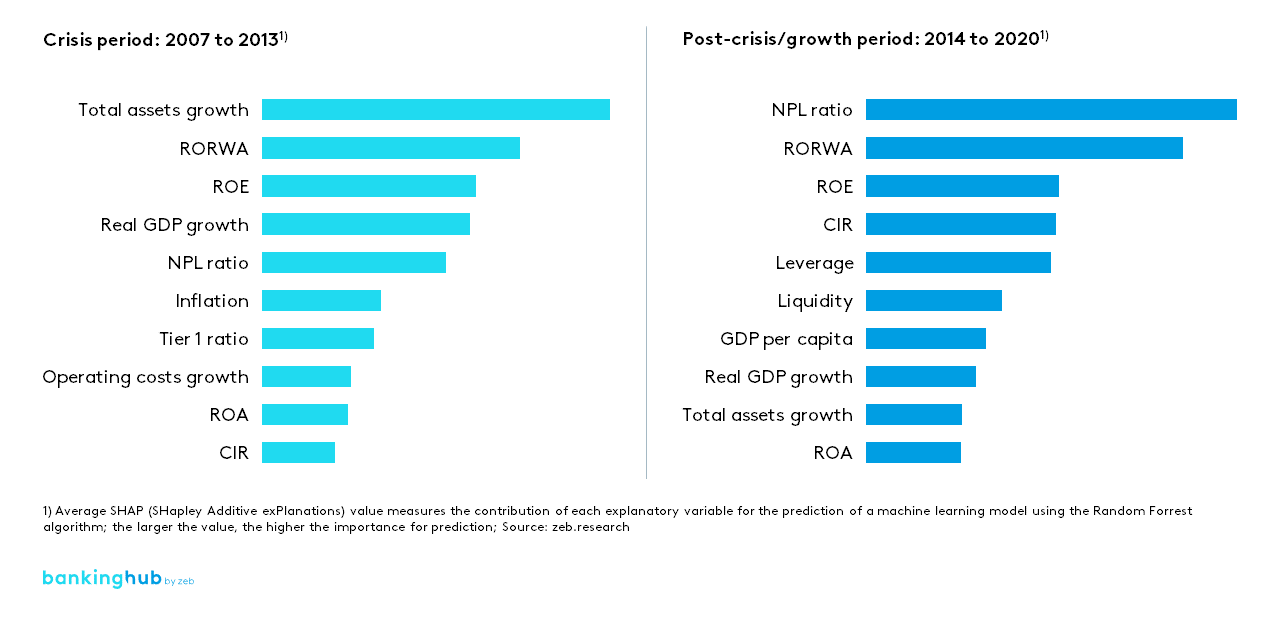

Top 10 explanatory variables for predicting global top 100 banks’ P/B ratios via supervised machine learning

For the global top 100 banks, for instance, total asset growth and RORWA are among the most important explanatory variables during the crisis and post-crisis periods, but are not relevant for the boom period from 2003 to 2006. The Tier 1 ratio is relatively important during the crisis period (2007 to 2013), while liquidity is relevant in the post-crisis period (2013 to 2020).

Finally, when using those bank KPIs and economic variables to derive predictions of banks’ P/B ratios (in the sample), we were rather surprised by the validity of these predictions. On average we achieved a (classification) accuracy of between 80% to 90%.