Do the unique financial needs of the 56.4 million migrants in Europe remain unmet?

Is this the uncomfortable truth? While banks pursue the same affluent domestic customers, they leave billions on the table by overlooking Europe’s fastest-growing customer segment.

zeb’s comprehensive research into the demographics, behaviors, needs and challenges of migrants and expats reveals that despite their considerable purchasing power, their banking experience is often frustrating, costly and inadequate. The question isn’t whether this market matters – it’s whether your institution will be among the first to capture it.

Who are these underserved customers really?

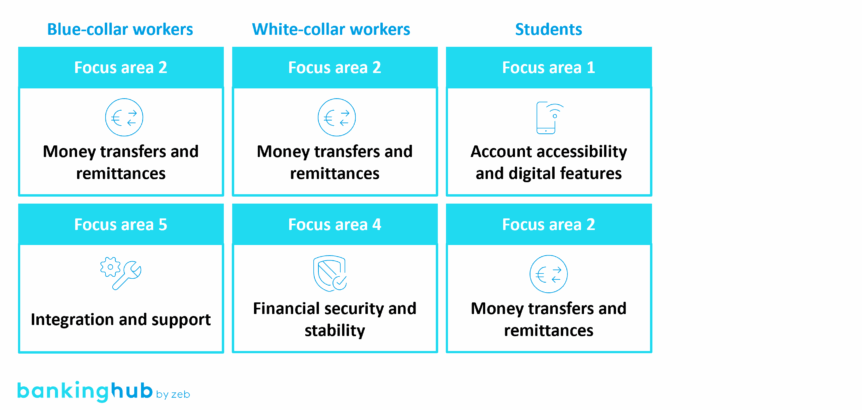

Do all migrants have the same banking needs? Absolutely not. Our analysis identifies five distinct segments, each with unique priorities and pain points:

- Blue-collar workers often send large portions of their income home, prioritizing secure and affordable transfer options. Yet most banks overlook a critical fact: this group faces significant legal and language barriers that traditional providers completely ignore. They are not just price-sensitive; they are also trust-sensitive.

- White-collar workers are better informed about financial services and expect more from their providers. They save and invest a substantial portion of their income, seeking flexible, low-cost solutions. Unlike blue-collar workers, they are less loyal and actively explore alternatives when dissatisfied.

- International students represent the digital-first generation. They rely heavily on family support and seek low-fee banking with seamless digital experiences. However, they often lack financial management experience, creating both an opportunity and a risk for providers.

- Family members– typically spouses or parents – struggle to establish independent financial histories.

- Job seekers require inclusive, basic tools during their transition period.

Which providers are winning – and which are following behind?

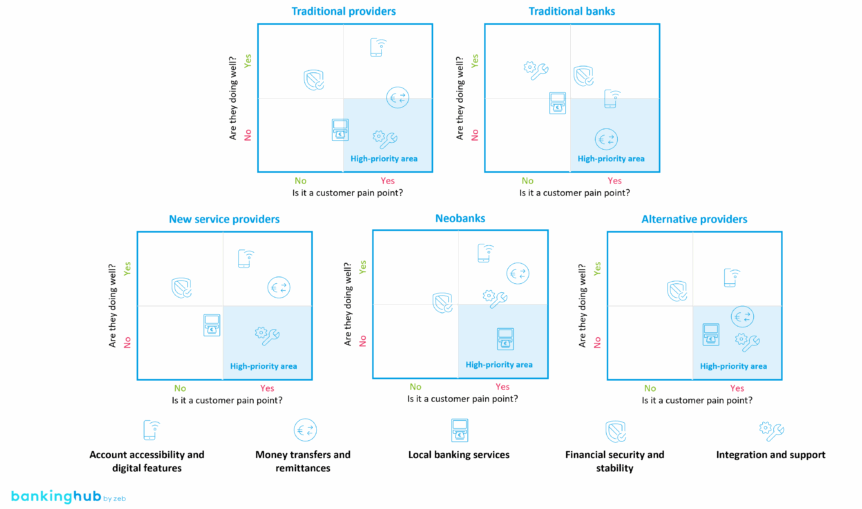

We asked ourselves the question: “Are banks truly meeting these customers’ needs – or merely collecting their deposits?” In our analysis we identified five distinct provider categories, each with critical gaps:

- The established leader – traditional banks: They remain the most widely used institutions, despite poorly addressing migrant needs. They offer security and a wide range of services, but their pricing is often prohibitive, and administrative hurdles are insurmountable for many. The reality is this: international transfers are costly and slow, with limited country coverage. Onboarding foreign nationals remains unnecessarily complex.

- Can neobanks really solve everything? Neobanks offer attractive digital solutions at competitive prices, but their local presence and support for additional services remain limited. They win on convenience but fall short on comprehensive service.

- The specialized cross-border providers:

- Traditional cross-border providers excel at remittances but charge high fees.

- New entrants are emerging as strong competitors by combining low costs with fully digital, user-friendly solutions tailored to migrant needs.

- Niche providers tend to offer more specialized services, which may be valuable in specific cases but lack broad applicability or scalability.

What do 300+ migrants truly want from their financial institutions?

To better understand the needs and frustrations of Europe’s migrant and expat communities, we conducted a comprehensive survey involving more than 300 participants. The results reveal a nuanced landscape of expectations and pain points that go far beyond the obvious need for affordable remittances.

Both blue-collar and white-collar workers consistently emphasize the importance of simple and cost-effective money transfers. For these groups, the ability to send funds quickly and affordably is not just a convenience – it’s a necessity. Yet, their priorities do not end there.

Blue-collar workers, for example, often face limited corridor and country coverage, insufficient foreign currency support, and slow transaction speeds. Many admit to sticking with expensive remittance solutions simply out of habit or due to a lack of awareness of better alternatives. Language barriers and a limited financial literacy further compound these challenges, leaving many feeling underserved and frustrated.

White-collar workers, on the other hand, tend to be more discerning and less loyal. They actively seek competitive pricing and a broader range of services, including investment and wealth management options. When their expectations are not met, they are quick to explore alternatives. Their demand for tailored solutions means that a one-size-fits-all approach simply doesn’t work.

International students, representing the digital-first generation, bring their own set of expectations. While they also value affordable transfers, their primary concern is seamless digital access to banking services. For them, intuitive apps, low fees, and smooth integration with other financial tools are non-negotiable.

Across all segments, a common theme emerges: traditional banks and providers often fall short, not just in pricing and flexibility, but also in their ability to deliver comprehensive, user-friendly, and inclusive solutions. The gap between what migrants need and what is currently offered remains significant and closing it will require more than incremental improvements. It demands a fundamental rethinking of how financial services are designed and delivered to this diverse and rapidly growing customer base.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

How can your institution turn these challenges into a competitive advantage?

To capture Europe’s growing migrant market, institutions must act quickly and decisively. The first step is rethinking the onboarding process: accept a wider range of identification documents, including foreign IDs, and make account opening as seamless and digital as possible. This approach not only lowers barriers but also signals a genuine commitment to inclusion.

Developing the right products is equally crucial. Affordable remittance services with broad corridor coverage, credit-building tools, and small loans can help establish financial histories for newcomers. Digital-first banking solutions tailored to students and young professionals, along with culturally relevant products for specific communities, are essential to meeting diverse needs.

Leveraging technology is another key differentiator. Modern migrants expect more than basic banking – they seek personalized recommendations, predictive tools, and proactive support. By harnessing data analytics, institutions can anticipate customer needs based on life stages or remittance patterns. Features like phone-number IBAN detection and AI-driven financial advice can significantly enhance the customer experience.

Compliance should be viewed not as a hurdle, but as an opportunity. Flexible, risk-based KYC procedures – such as accepting humanitarian documents or alternative IDs – enable institutions to serve newcomers quickly while maintaining regulatory standards. Institutions that innovate in compliance are often the first to capture new segments as migration flows shift.

Finally, the real winners will be those who combine robust digital platforms with strong local presence and relentless focus on customer-centric innovation. The migrant market represents a huge opportunity. Now is the time to act: focus on speed, flexibility, and support, or risk watching others take the lead.