From human-initiated to autonomous: what are agentic payments?

The term “agentic payments” refers to transactions that are initiated, authorized, and executed autonomously by AI agents, operating under predefined user rules and constraints. These agents analyze the user’s intent, compare merchants and offers, and complete transactions using pre-approved payment instruments such as tokenized cards, wallets or account-to-account rails.

In some cases, agentic payments can support both one-off purchases and recurring transactions, dynamically adapting to changing user preferences, budgets, or external conditions. However, unlike traditional standing orders, agentic payments allow AI systems to decide if, when and how a payment should be executed.

Why this matters now: the economics of agentic commerce

The timing is not coincidental. Agentic commerce is moving from experimentation to scale. Market estimates suggest that its global value could grow nearly nine-fold by 2034[1], driven by accelerating consumer adoption of AI-powered assistants and growing merchant investment in automation-ready checkout experiences (75% of retailers have agreed that AI agents will be critical to compete in the future[2]).

More broadly, the use of AI to support consumer purchasing decisions is becoming mainstream, with 76% of surveyed European consumers already relying on AI-powered tools when shopping online[3]. This shift places increasing pressure on banks to modernize their payment capabilities in line with evolving client behavior. As AI agents take on a greater role in purchasing decisions, transaction choices are likely to be driven less by brand loyalty or user inertia and more by measurable, machine-readable criteria, elevating the importance of agent-ready data, APIs, and decision-making logics. Product discovery has already begun to shift toward agent-led interactions, and over time, payment execution is expected to follow, gradually increasing the share of transactions that are initiated and completed autonomously.

While payments represent the most immediate point of impact, the implications of agentic decision-making extend well beyond transaction execution.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

How is the industry shifting from the research phase to agent-enabled payment execution?

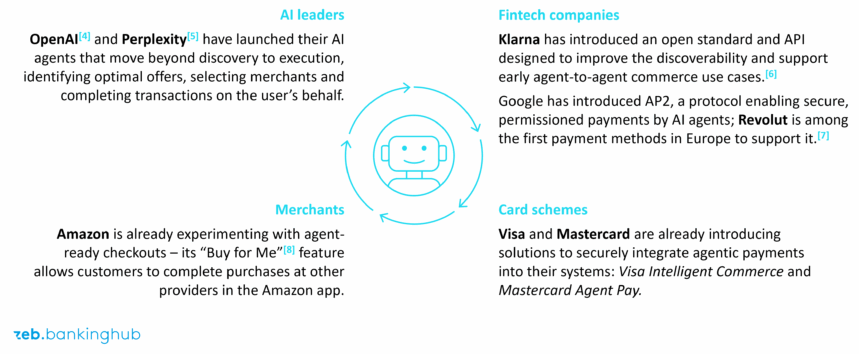

Agentic AI is reshaping how customers interact with financial services on a broader scale. Decision-making is increasingly shifting from humans toward algorithms that optimize for measurable outcomes. Leading institutions are already translating this shift into practice through early experiments.

The following examples showcase how front-runners are beginning to deploy agentic AI across core client interactions:

[4] OpenAI’s Instant Checkout and the Agentic Commerce Protocol

[5] Perplexity’s Instant Buy

[6] Klarna’s Agentic Product Protocol

[7] Revolut’s compatibility with Google’s AP2

[8] Amazon’s Buy For Me

What new revenue pools are being unlocked for issuers and acquirers?

While agentic payments remain an emerging development, financial institutions should not just keep an eye on them but assess their strategic potential. As more and more solutions are implemented, the technology should be assessed by issuers and acquirers as a potential new revenue stream. Rather than competing directly with AI platforms or merchants, they could seize the opportunity to position themselves as critical enablers of process within the agentic payments landscape, monetizing new services.

The risk agenda: why agentic payments require a new control framework

The benefits of agentic payments such as streamlining the process and reducing friction introduce material new risks that financial institutions have not faced previously. As a result, the existing risk, compliance and technological processes may not fully address the upcoming challenges. Thus issuers and acquirers must actively mitigate the risks to ensure safe and compliant adoption.

As agent-initiated transactions evolve and adoption increases over time, financial institutions may need to reassess whether their existi fraud, compliance, and technology frameworks remain fit for purpose.

A significant opportunity for corporate clients to benefit from bank-enabled agentic payments

By offering agentic payment capabilities, banks and other financial institutions could differentiate their corporate propositions and strengthen their role within increasingly automated client workflows. For corporate clients exploring the use of agentic AI, they can provide conditional payment capabilities and real-time connectivity to payment rails.

As an example, embedded into corporate procurement-to-pay systems, these capabilities can allow payments to be executed automatically once certain previously defined conditions, such as invoice approval or goods receipt, are met, thus reducing manual intervention, processing delays and operational friction.

In parallel, banks can support transaction reliability by monitoring account balances and liquidity in real time, enabling AI agents to anticipate funding needs, trigger liquidity solutions where required and ensure that payments are completed seamlessly.

These examples represent only few of many areas where financial institutions could support corporates through agentic payments, alongside broader opportunities to enhance cash management (cash sweeps), trade finance, chargebacks, FX execution or real-time liquidity within corporate banking.

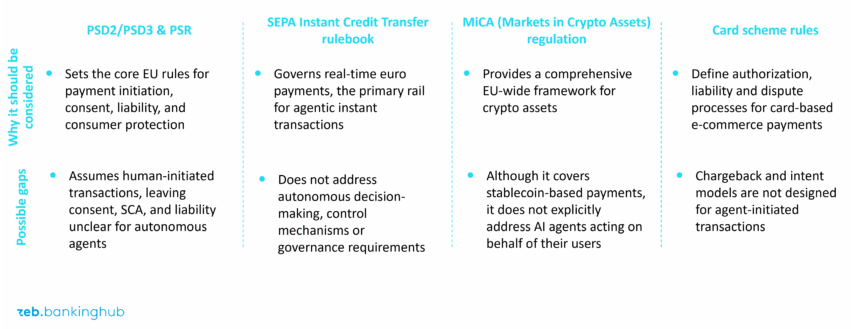

Why must regulation catch up with autonomous transactions?

A final (and critical) dimension is regulation. Today’s payment regulations are largely built around human-initiated transactions. As agents become transaction initiators, these frameworks must be reinterpreted and, in some cases, further developed:

Clarifying how these frameworks apply to agentic payments will be essential to ensure accountability, consumer protection and scalable adoption. Issuers and acquirers should participate in the creation of these frameworks, aiming to shape them in the most favorable way. Simultaneously, they should prepare for anticipated changes by designing agentic capabilities with transparency and auditability in mind, maintaining detailed step-by-step records of agent-initiated transactions.

What is the strategic imperative for financial institutions in this evolving landscape?

Agentic payments are no longer a distant future concept. They are an emerging reality reshaping e‑commerce payments today. For issuers and acquirers, the question is no longer if they should engage, but how fast and how boldly. Institutions that invest early in trust frameworks, agent-ready infrastructure, and regulatory leadership can secure a central role in the next generation of payments.

Banks should ensure they are prepared for potential developments, as payments have historically been among the first areas to adopt innovations that later extend across other banking processes. Doing so will require the definition of new processes (such as agent onboarding, agent mandate, agentic transactions risk scoring) and the evolution of technology architectures capable of analyzing data generated by AI agents and maintaining detailed, auditable records of agent-initiated transactions supporting effective dispute resolution and regulatory review as frameworks evolve.