The study analyzing the top 50 banks in Europe comes to the conclusion that only by following a holistic approach in performance management—considering the central dimensions of profit and loss, balance sheet, capital and liquidity—can the vast range of current challenges and the growing complexity be properly managed. Once again performance management has become not only a key factor to survive the economic turmoil and its consequences, but also to sustainably manage strategic measures required for establishing value creation in the long run.

In addition to a difficult market environment and highly restrictive regulatory trends, digitalization (especially big data) represent another challenging hurdle that needs to be mastered along the way. Performance management addressees (supervisory boards, management, market divisions, etc.) have developed a strong demand for data availability and quality and expect its customized and fast reporting. Considering the “more, faster, better” paradigm, shaped by new technological possibilities, performance management frameworks need to take into account these developments and be able to constantly adapt accordingly.

The reality of performance management in banks reveals a state of ineffective and outdated models

However, the current situation at banks tells a different story. Strategic decisions in banks are mainly driven by opportunist chances and are influenced by short-term market developments. Only very rarely, banks have defined clear targets that are also reflected in their overall business strategy. Moreover, existing Key Performance Indicators (KPIs) are in most cases outdated, do not have a link to the targets of banks and hence do not enhance value creation. When diving from the top management level to business units, another common phenomenon is that KPIs are not consistent throughout all hierarchies and a drill-down is thus not possible.

KPIs are most times perceived as basic ratios without having a real understanding of what really drives and impacts them. Performance management consequently plays rather a “reporting only” role in most banks, however, additional value can only be generated if business model-specific management levers are identified on all levels and can be controlled proactively.

The lacking effectiveness has also a strong process-based and governance-related component. Performance management reports are delivered too late with inconsistent data due to a high level of manual corrections along the production line. Further, roles and responsibilities are not defined in a governance framework and workflows are not established following a holistic view which results in superfluous process steps. Consequently, the high effort for pure data processing does not allow a deep and challenging analysis of results.

From strategy to data—performance management requires a holistic approach

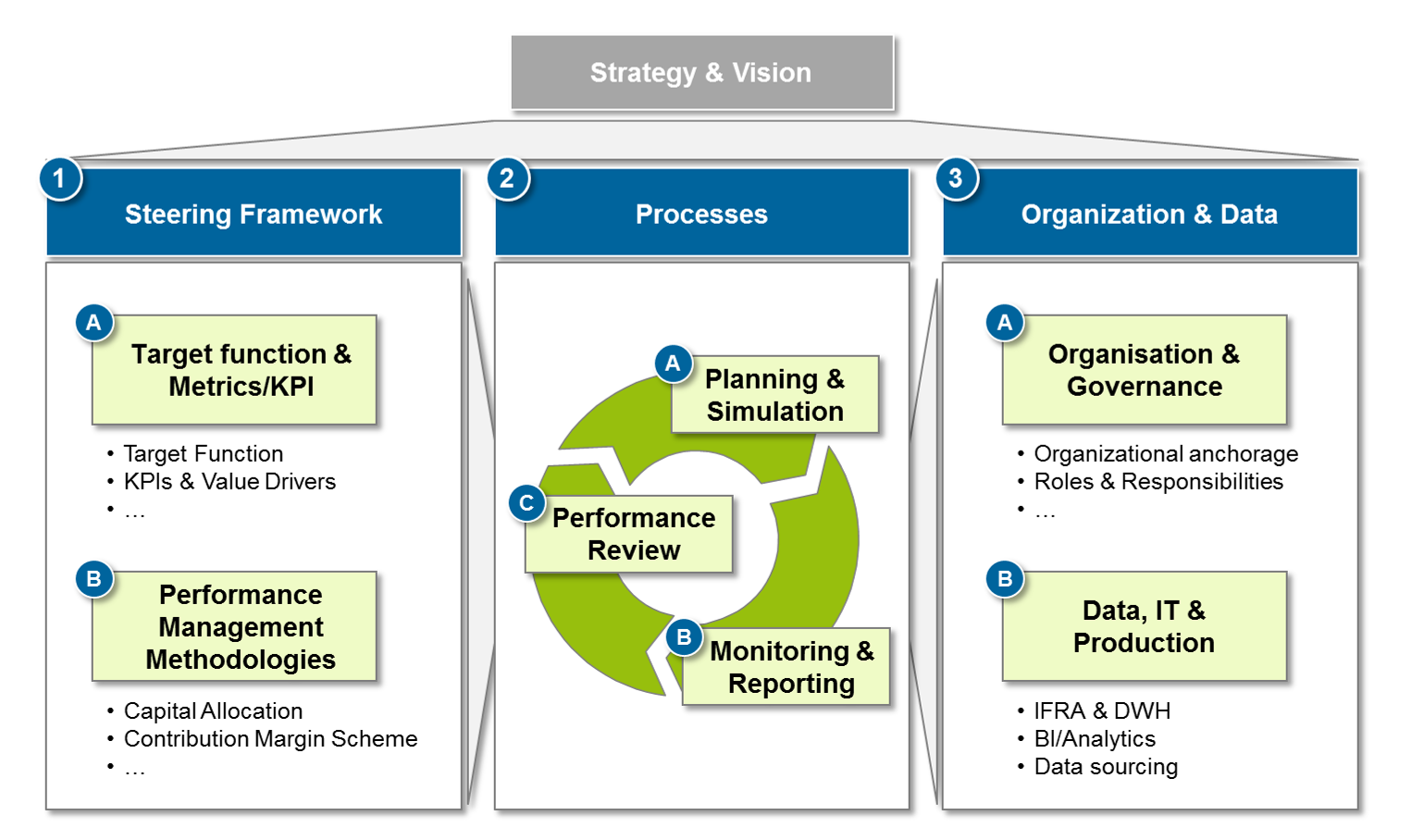

To tackle current market challenges and enhance the effectiveness of a bank’s performance management, zeb follows a holistic approach with a main focus on the performance management processes which support to operationalize the strategy and vision of banks. As a basis for this process, an integrated steering framework incl. the target function, KPIs and proper methodologies as well as an appropriate organizational anchorage and data / IT management are required.

A bank’s strategy must be translated into relevant KPIs and value drivers—experience is key

Every bank has its own individual targets. While a universal bank listed at the stock market might aim at maximizing its total shareholder return, a development bank will rather focus on boosting domestic industrial development. However, the translation of targets into clear strategic measures in line with corresponding KPIs and value drivers that have significant impact is still a key obstacle in managing performance. Further, strong experience and knowledge about various business models and corresponding targets are needed to develop effective models and KPIs along with value drivers (see zeb best practice reports & KPI library).

Performance management methodologies need to reflect current requirements and must be flexible and forward-looking

For fair allocation of results, methodologies and concepts like funds transfer pricing, cost allocation and capital allocation, etc. need to be adapted and developed accordingly. As regulatory changes have the tendency to occur very frequently and may have a significant impact on a bank’s performance, methodologies require a high level of flexibility and forward-looking capability to manage these changes. Within this context, managing multiple constraints is a key challenge for banks. Capital limiting constraints, such as the CET1 ratio and the leverage ratio, must be included in both the capital allocation framework as well as contribution margin schemes to have a complete picture. Furthermore, models must reflect all interdependencies throughout business units for a holistic analysis of constraining impacts on business decisions.

Performance management processes as an integrated cycle

To empower performance management and turn it into a well-functioning business challenging tool, an integrated cycle consisting of planning & simulation, monitoring & reporting and a regular performance review must be established. Planning & simulation aim at quantifying the overall bank strategy by establishing a link to corresponding balance sheet and P&L figures as well as KPIs and constraints. Both an as-is view and a forward-looking simulation are essential to prepare the management for potential scenarios and thus allowing the derivation of timely and appropriate measures. Moreover, performance management reports must be in line with the bank’s target function as well as its KPIs and constraints. A drill-down of figures from the top management down to business unit level and an intuitive visualization of deviations and critical points provide the management with crucial information for actions to be taken. This is key in order to establish performance management as a real business challenger rather than only a collector of financial figures. Moreover, the effectiveness of management initiatives and performance indicators must be tracked on a regular basis. Performance dialogs are therefore an indispensable tool. Again, only by fully reflecting KPIs in target agreements of the management and ensuring incentives via e.g. bonus schemes on all relevant levels, is an effective performance embedded in a bank’s overall target function possible.

The right governance approach and organizational design decide upon sustainability of performance management

Performance management frameworks only last a short time and are doomed to fail if measures are neglected that successfully incorporate performance frameworks in the organization. Only a strong governance that outlines the organizational anchorage of performance management along with roles and responsibilities throughout the bank safeguards the sustainability of performance management. Governance is the beating heart as it decides upon central versus de-centralized performance management, top-down versus bottom-up approaches, existing and new roles within the organization and their related responsibilities. The decision which approach to follow mainly relies on the bank’s business model, its current organizational setup and its size. Again, experience is a key success factor, as benchmarks of proven governance frameworks help to select effective performance management approaches.

Banking builds on data—performance management, too

As performance management requires data from different business lines and bank management perspectives (Accounting, Risk, Regulatory & Controlling) in a short time frame and in high quality, the production and delivery of data is an important cornerstone of performance management. Therefore, an integrated finance and risk architecture (IFRA) approach to tackle the challenges above and to overcome inconsistencies in data is required. A harmonized and holistic data architecture as well as a clear data governance to fulfill the information needs of banks appropriately are the core elements of an IFRA approach.

For quality and efficiency reasons, a lot of banks start to centralize these functions related to data and information in the form of a shared service center or information factory. This approach allows performance management to specify and source / receive data as and when required. This ensures enough time for the analysis of data and for challenging data contents instead of solely collecting and reporting information.

Start rethinking

Performance management is a key factor to tackle current market and regulatory challenges. For a bank’s success, it is inevitable to incorporate a holistic performance management effectively into all levels of the organization in order to have a central challenging function within the bank, to safeguard a bank’s target function and finally to enhance sustainable value creation.