What increasingly starts to resemble the almost 20 years of deflation in Japan, is poison to the European banks. When asset prices fall, the value of loan collaterals go down, causing higher loan default rates and/or preemptive write-offs in loan portfolios (see my comments “A fire sale of epic proportions” from January). It is no coincident that the divergence in interest rates on the back of varying probabilities of deflation in the U.S. and Europe is also reflected in bank valuations. Graph 2 illustrates this by comparing Deutsche Bank to J.P. Morgan.

Graph 2: Also since around Q3:2013 divergence between share price of German bank (Deutsche) and U.S. bank (JPM) – Coincident?

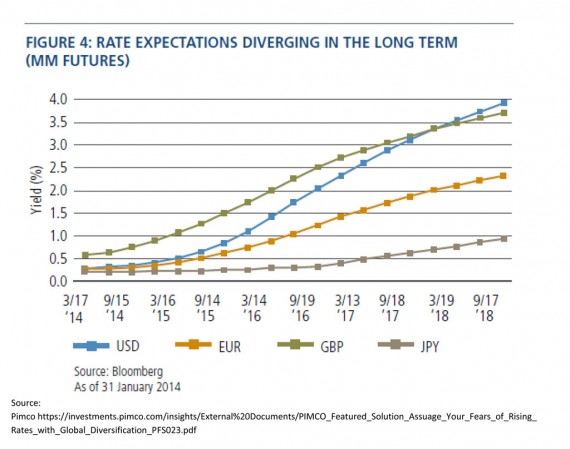

Graph 2: Also since around Q3:2013 divergence between share price of German bank (Deutsche) and U.S. bank (JPM) – Coincident?Turning to forward-looking rate expectations extracted from futures prices (as opposed to backwards-looking historical yields), a similar picture emerges: U.S. and GBP rates are moving up, while Europe is halfway stuck between the U.S. and Japan. See chart 3. It is basically a coin flip, whether or not Europe is becoming the new Japan.

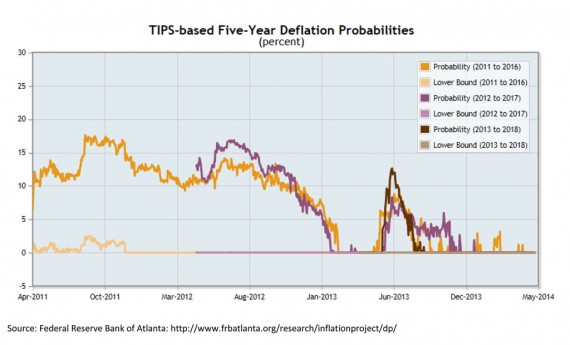

To further illustrate the point that deflation risk is no longer an issue in the U.S. I attach graph 4, in which the Atlanta Fed nicely extracted the implied deflation risk from U.S. TIPS (inflation bonds). No equivalent study was done for Europe to my knowledge (probably due to the lack of equivalent inflation products), but my guess would be that if it was, it would show a 25-50% risk of deflation in Europe.

Having established the notion that deflation risk in Europe is very real, one can proceed on to ask what can be done about it, from a bank’s perspective. Clearly, collateralized lending does not appear to be a successful strategy during deflation, so getting out of that business is a first good step. Instead, moving into risk-free uncollateralized lending starts making sense, which is essentially equivalent to buying German government bonds. Putting money with the ECB works too, but yields no interest. Second, leverage is not a good thing anymore due to the fact that borrowing money (issuing bonds with coupons > 0%) is detrimental in deflationary times. Thus, deleveraging makes sense, i.e. shrinking balance sheet, paying back loans and reducing financing transactions (repo etc.). Equity is probably the better source to finance the operation (if share holders can be convinced to put in more money). Third, as consumers and corporates alike postpone investments and hoard money, banks can act as middle-men to help “park” that money. Real investments abroad, investments in commodities, cross-currency notes and the like are very much in vogue with investors during deflationary times. Just remember animals like Power Reverse Dual-Currency Notes (PRDC) that have been sold to Japanese Investors in large quantity, much to the benefit of the issuing banks.

Some creativity is needed when deflation hits – merely offering free checking accounts won’t do.