Mario Draghi, European Central Bank president, July 2012Within our mandate, the ECB is ready to do whatever it takes (…)

Fighting the post-2008 corrosive effects of asset devaluations, refinancing impairments and a confidence crisis, the ECB has undoubtedly become the single most-important guarantor of economic stability in the Eurozone. By becoming a lender of last resort and pushing interest rates all the way to zero, the ECB not only enabled, but in actuality mandated banks to reliquify the economy, also by potentially applying generous standards to the credit processes. When money becomes easy for an extended period of time, the risk of irrational exuberance, to borrow a term coined by Alain Greenspan, in the credit cycle is becoming very real.

Alan Greenspan, former Federal Reserve chairman, October 2013Bubbles go up very slowly as euphoria builds. Then fear hits, and it comes down very sharply. When I started to look at that, I was sort of intellectually shocked.

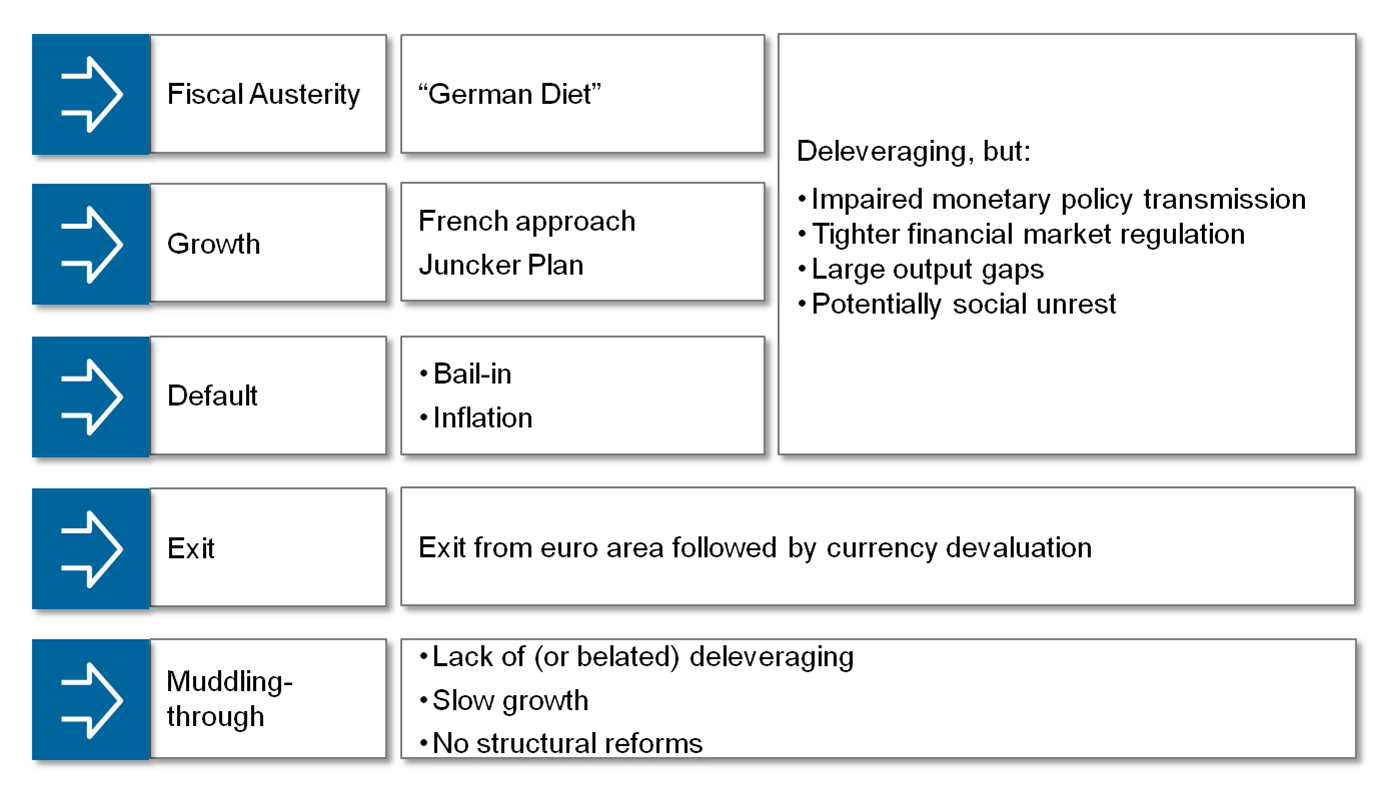

While the ECB is buying policymakers more time to tackle structural problems in the European economy, there is far from consensus among European politicians about how to deal with the aftermath from the Eurozone crisis. In fact, the policy mix is under more discussion than ever since Syriza’s win in the Greek elections. Conceptually, there are only four paths open to policymakers: Austerity, growth, default and exit. One may add “muddling through” as a somewhat questionable, although often favorable amongst politician, fifth option.

As pretty much the same political actors are mandated with solving the European crisis that have been the architects of the European single-currency regime, there is little enthusiasm for a sovereign default or an member’s exit from the Eurozone. Instead, a somewhat offsetting medicine mix of fiscal austerity and growth is administered, or the wait-and-see approach of a muddling-through approach is taken. Both, fiscal austerity and growth policy create an inherent risk of sparking the “next” credit bubble. In simplified terms, the following dynamics may take place: In a regime of fiscal austerity, consumers lack purchasing power and overextend themselves with consumer loans; firms react to the slack in the economy by offering interest-free loans to finance consumer goods; banks underestimate risks and rely on credit business to make up for otherwise lower bank profitability in a zero interest-rate environment. In a growth-regime, in which the government stimulates demand by deficit spending, consumers come to rely on fiscal growth-package, overestimate their long-run sustainable income and spend too much; corporates issue more debt, based on low-yield environment and a (false) hope for growth; banks once again underestimate risks and overly rely on credit business.

Meanwhile, the ECB is running out of time to reverse, or partially reverse, their exceptionally loose monetary policy.

Anshu Jain, Deutsche Bank co-CEO, January 2015A disruptive credit event following a Fed turn would be at the top of my worry list.

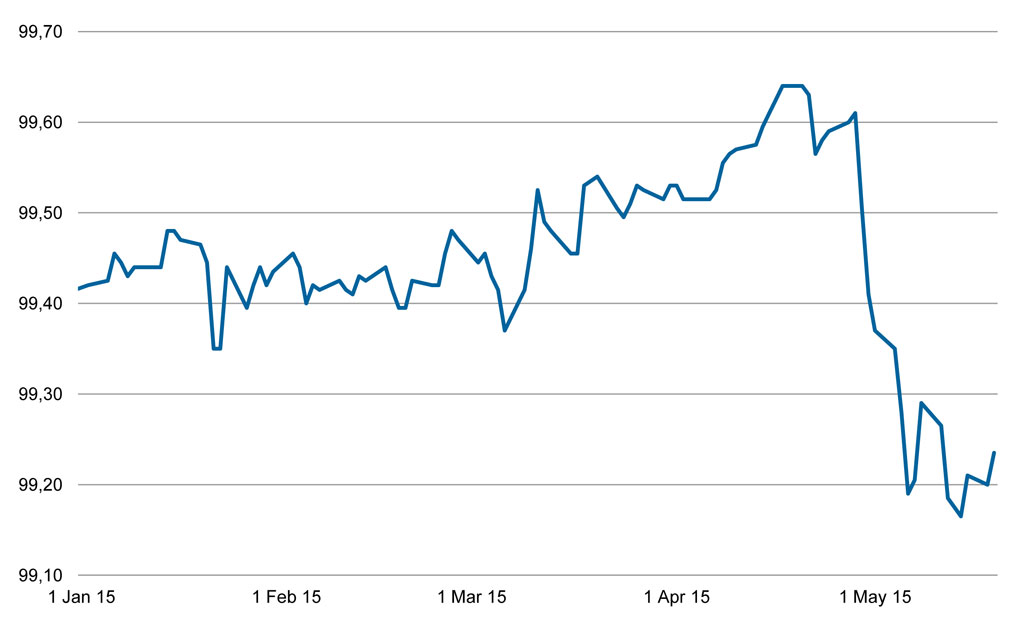

There is a broad body of literature concerning itself with the propagation mechanism of credit shocks to the economy. In fact, credit frictions are often referred to a “financial accelerators,” believed to amplify and accelerate macroeconomic fluctuations. But credit shocks are often the result of exogenous factors themselves, triggered by events such as a risk shock (increase of uncertainty, eg about ECB policy), an equity/net-worth shock (destroying collateral value) or an increase in interest rates (eg, through a change of forward-guidance by the ECB). Looking at forward rates, such an increase in interest rates appears to have started already.

Figure 2: September 2019 three-month Euribor Futures prices show an increase in forward rates in 2019 from around 40bp to 80bp within the last month; sources: Bloomberg, zeb

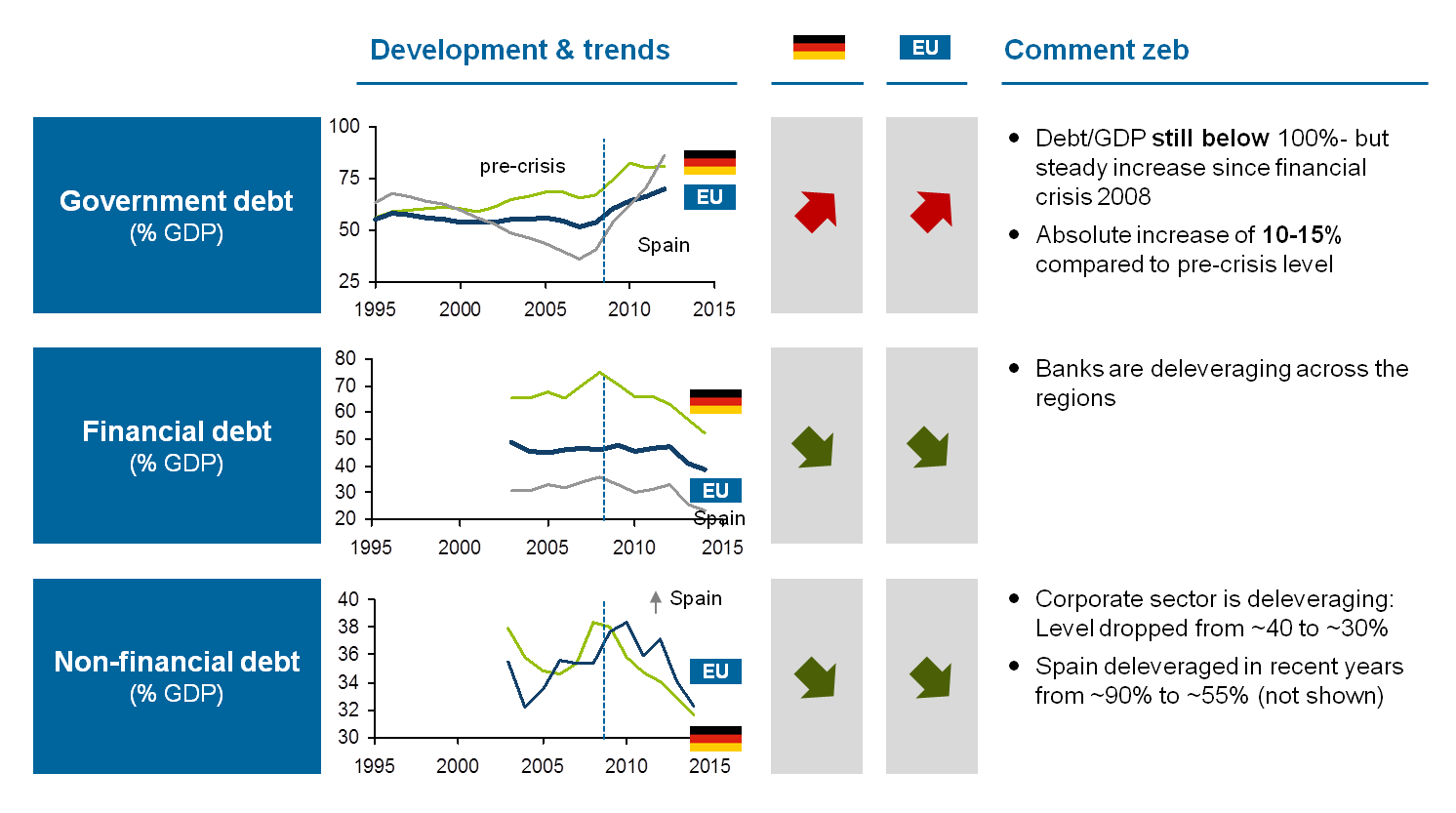

Figure 2: September 2019 three-month Euribor Futures prices show an increase in forward rates in 2019 from around 40bp to 80bp within the last month; sources: Bloomberg, zebSome market participants may suggest that the European economy is back to its pre-crisis strength and that a disruptive credit event has become less likely. Economic data, however, cast doubt on such an assessment. As far as debt is concerned, it is quite obvious that leverage (excessive debt) has merely migrated from financials’ and non-financials’ balance sheets to the government. Since deficit spending cannot go on forever, the private sector will eventually face the costs of the government bail-out.

Figure 3: Uneven de-leveraging in the Eurozone; sources: International Monetary Fund, Worldbank, countries’ National Statistical Offices, OECD, zeb

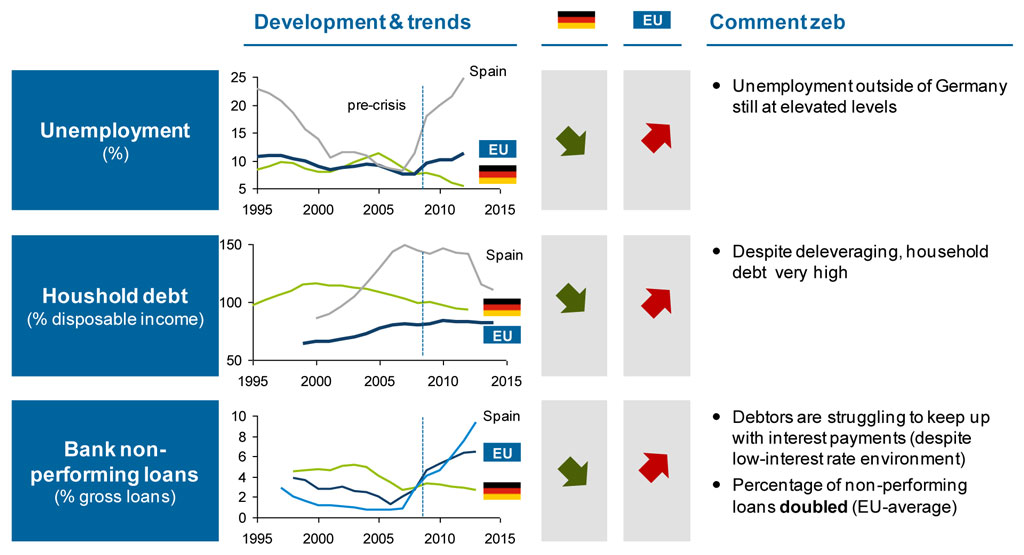

Figure 3: Uneven de-leveraging in the Eurozone; sources: International Monetary Fund, Worldbank, countries’ National Statistical Offices, OECD, zebLooking at the consumer, countries in the Eurozone, with the notable exception of Germany, are plagued by high unemployment, elevated household debts and increasing non-performance of bank loans. By reacting to attractive financing opportunities offered by banks, producers and retailers, households, on average, have extended themselves.

Figure 4: Consumer far from being out of the wood yet; sources: International Monetary Fund, Worldbank, countries’ National Statistical Offices, OECD, zeb

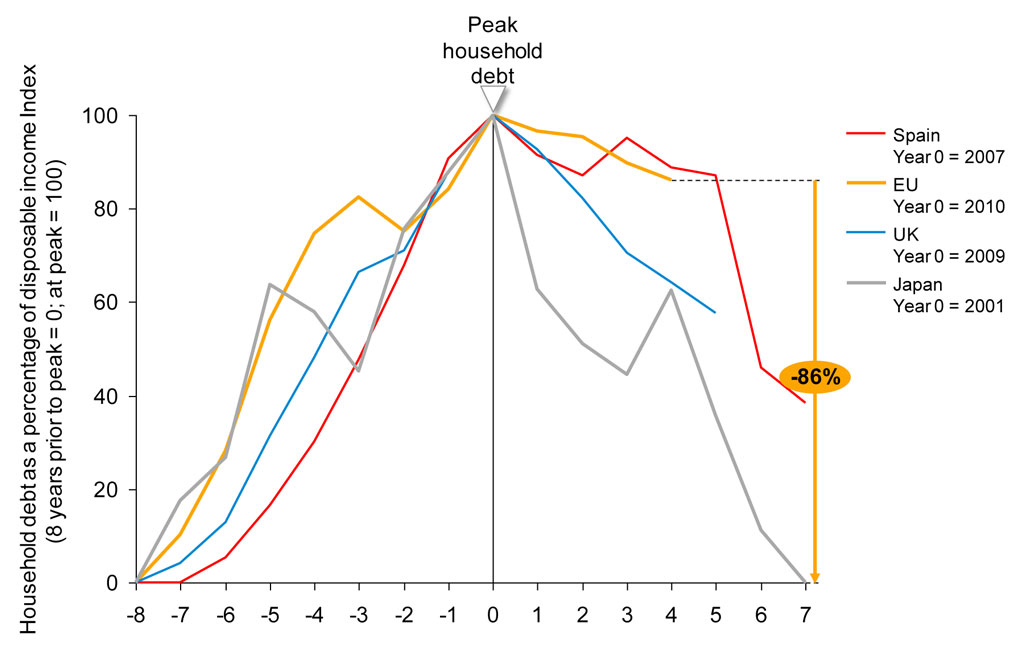

Figure 4: Consumer far from being out of the wood yet; sources: International Monetary Fund, Worldbank, countries’ National Statistical Offices, OECD, zebTo us, it is far from obvious that the worst of the European crisis is yet behind us. From a consumer credit perspective, the cycle of household debt reduction has not been completed and much of the pain following the 2007-2010 crisis may still be ahead of ourselves. Benchmarked to the Japanese crisis of 2001, the Eurozone has some 86% household deleveraging to come!

Figure 5: Houshold debt as a percentage of disposable income, before and after a credit crisis; sources: International Monetary Fund, Worldbank, countries’ National Statistical Offices, OECD, zeb

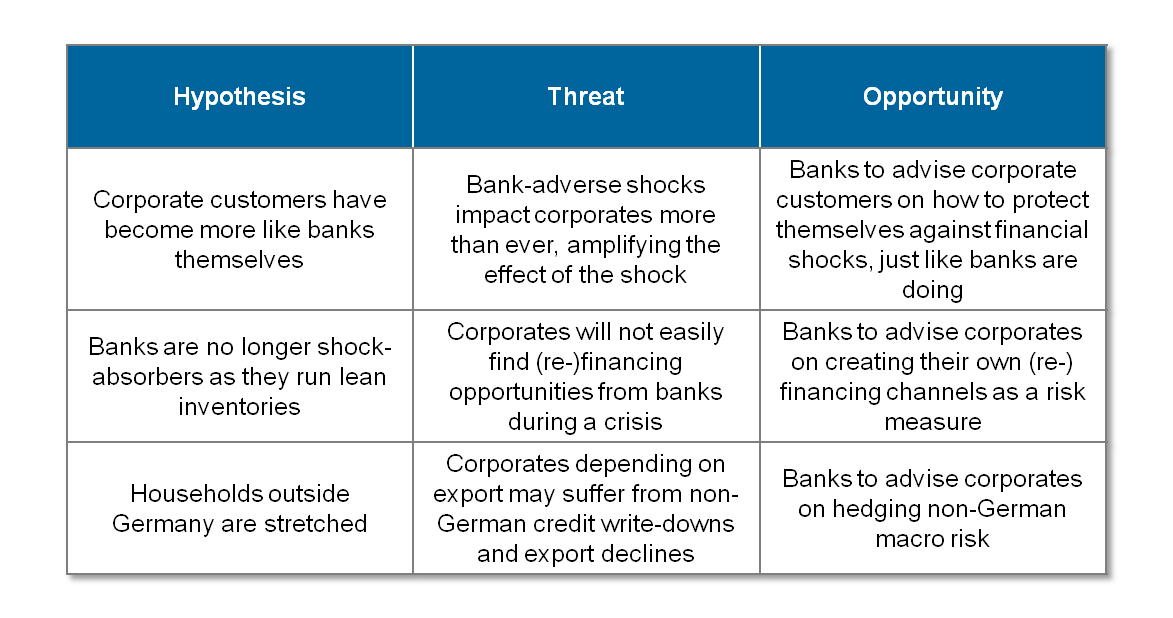

Figure 5: Houshold debt as a percentage of disposable income, before and after a credit crisis; sources: International Monetary Fund, Worldbank, countries’ National Statistical Offices, OECD, zebMaking things worse, there are fewer market participants other than the ECB able and willing to act as shock-absorbers in case of a credit crisis. Corporates by following the value-chain are now capturing larger parts of the end-user financing business, have essentially turned into bank-like institutions themselves. In case of a credit event-triggered liquidity crisis, they will be heading for the (same) exit as banks do. Banks, on the other hand, are focused on their own balance sheet repair, restoring profitability and curbing financing risks, leaving less and less room for becoming a liquidity provider during a crisis. This leaves the financial system vulnerable to credit shocks and places more importance on prudent risk-management and self-reliability.

Bruce LeeTo hell with circumstances; I create opportunities

While the looming danger of a turning credit cycle creates risks for the financial markets, it also creates new opportunities for market participants nimble enough to adapt to the new situation. For example, banks may reduce their role as a liquidity provider and become more of a trusted advisor on macro-hedging, risk-management and business model adoption to their clients. This requires shifting the focus from transaction banking to fee-based advisory.

Instead of waiting until the regulator is asking for it, or hoping that the ECB will dampen any possible dislocation resulting from a turning credit cycle, banks need to become pro-active now and immunize themselves as much as possible against such adverse scenarios. In our view, evaluating the right kind of scenarios should be the first step. Thus, instead of just meeting the stress testing requirements of ECB/EBA, banks should assess their vulnerability in case of a credit downturn using their own views and parameters.