35 financial institutions participated in the MiFID II survey

Numerous publications deal with the operational implications of MiFID II on the securities business. But what are the specific changes that can be expected by financial institutions regarding their business model? zeb asked 35 financial institutions to answer these questions as part of a survey. The participating institutions could make estimations based on 15 questions on the topic areas of market transparency and investor protection. By conducting this survey, zeb aims to present the challenges from the perspective of the European financial market. The findings and their consequences are illustrated below using four key insights:

MiFID II differentiates between dependent and independent advisory in providing investment services. Approx. 60% of surveyed institutions indicated that they plan to provide dependent advisory in future. This will have substantial consequences for affected institutions as e.g. retaining inducements is permitted, but only if these are justified by quality-enhancing measures. Investment firms need to clearly prove how inducements will enhance the quality of services provided to the customer. All inducements received are to be recorded in the internal inducements list. A second list needs to be maintained to record how inducements were used. Any form of retained inducements that cannot be justified by quality-enhancing measures need to be disclosed to the customer. MiFID II allows investment firms in return to limit their dependent advisory to own products or products of associated parties.

In comparison, only 5% of participating institutions plan to provide independent advisory in the future. This model requires both an absolute ban on inducements and a wide product range including third-party products. A hybrid solution—dependent advisory with a small share of independent advisory—will be offered by approx. 25% of the respondents.

Second insight: Drop in profits in combination with increasing cost

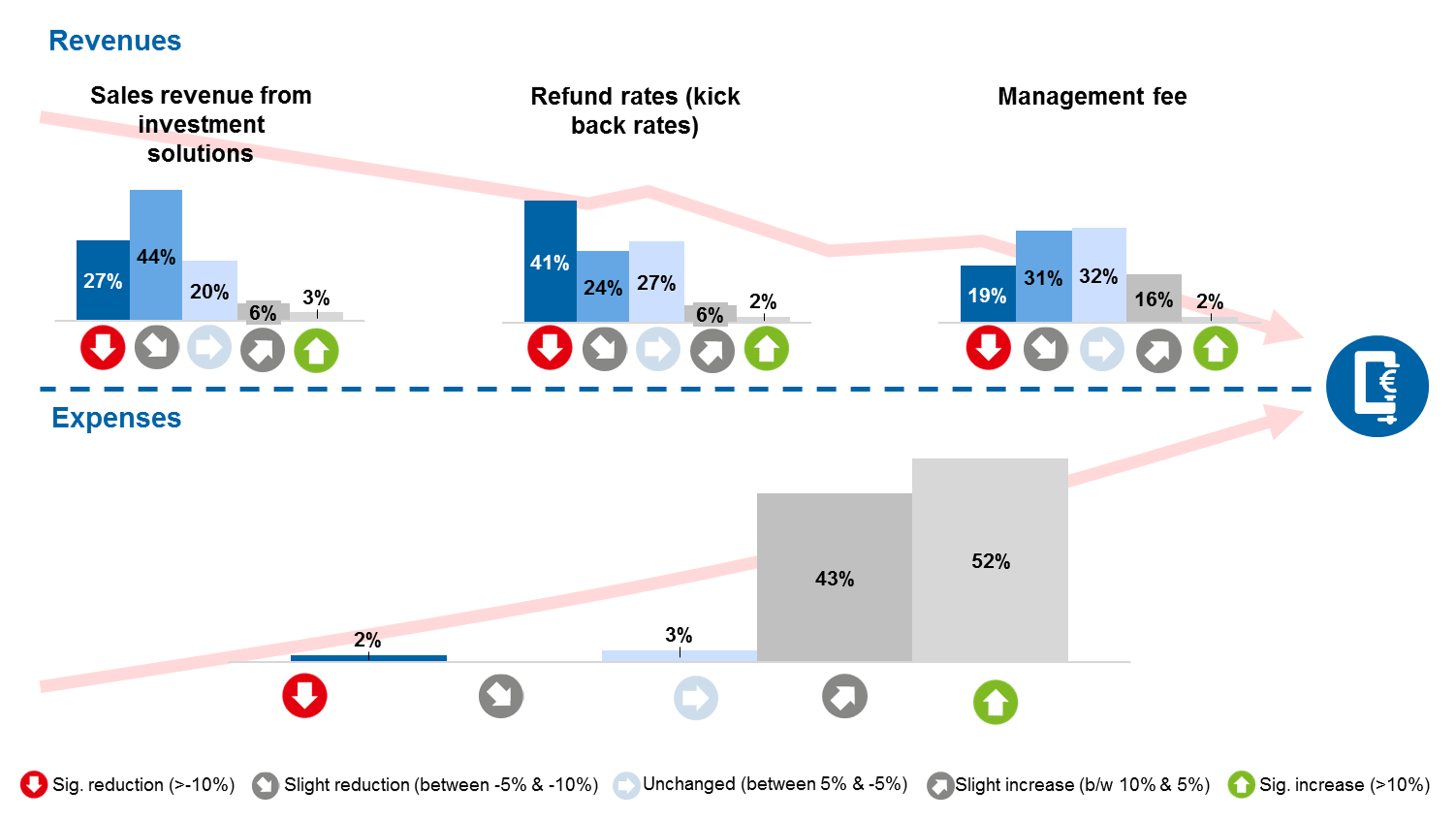

A look at the profit and cost side reveals the enormous pressure that the 35 participating institutions need to face. Due to regulations and increased transparency on the markets, e.g. significant profits and commissions from transactions involving inducements are reduced.

27% of respondents expect a significant decrease in revenues from investment solutions by more than 10%. With respect to refund rate, a total of 41% of respondents predict this significant reduction. The expectations for expenses indicate a similar outlook. In this context, more than half of the participating institutions assume that expenses will increase by more than 10% in future (see Figure 1).

Both developments are a result of the new MiFID II regulations among others. Increased information obligations and cost transparency will enable the customer to compare market offers more easily than today. For investment firms, this means that margins will decrease for individual products and this will have an overall negative impact on the attractiveness of the securities business. In addition, costs and expenses are increasing for financial institutions to effectively implement regulations. Consulting processes and the entire IT architecture need to be fundamentally adjusted in this context.

Third insight: Shift of off-market trade to trading venues

The survey has clearly revealed the following fact: about 80% of participating institutions are convinced that the implementation of MiFID II regulations cause an increasing shift of off-market trade of financial instruments to trading venues. This development is regarded as a consequence of the new regulations which makes OTC trading less attractive and more complex for investment firms due to increasing legal restrictions and requirements. It is true that transparency is increased for supervisory authorities and market players in particular. However, this also implies that investment firms can no longer achieve existing margins in OTC business in the future.

Survey respondents confirmed the decrease in OTC trading volumes. They expect a significant reduction of OTC trading volumes. This development is expected for both equity and liability instruments as well as derivatives. 31% of respondents assume a decrease in OTC trading volumes in liability instruments and derivatives by more than 10%. This indicates once more that a key objective of regulators to shift OTC trade to trading venues will be achieved.

The OTC trading income and revenues reveal a similar image. The dynamics are most noticeable in derivatives business. In this segment, 42% of respondents expect a reduction of more than 10% (see Figure 2).

Fourth insight: OTC trading limited to small number of market players

If investment firms should continue to systematically and frequently conduct off-market trading business on own account, they are obliged to register as systematic internalizers (SI). By registering as an SI, investment firms are classified as execution venues and need to fulfill comprehensive requirements.

Meeting SI requirements entails both substantial organizational implementation effort and IT-related costs. Investment firms should therefore analyze early if a registration as SI is advisable. Market players with a high share in off-market trading business with customers will not be able to avoid registration if they want to keep up their business model. 62% of participants in the MiFID II survey share this opinion. For other—mostly small—institutions that want to avoid comprehensive SI obligations, the only option is to drastically reduce their OTC trading offers to thus remain below the SI threshold or to completely shift their trading activities to regulated and transparent trading venues.

The MiFID II survey reveals the need for action—zeb specifies fields of action

The MiFID II survey has shown that financial institutions are facing major challenges. Numerous institutions have made initial strategic landmark decisions. The majority of institutions are still discussing core questions. However, it is crucial to consider both the implementation of purely regulatory and technical requirements and the future-proof orientation of the business model.

Currently, zeb supports clients in ten EU countries in the implementation of MiFID II regulations and in the strategic realignment of their business models. Besides holistic regulatory knowledge, the zeb reference model offers clients the possibility to implement requirements quickly and efficiently and thus become compliant to MiFID II requirements by the beginning of next year. Afterwards, it will be necessary to adjust structural changes to the respective business model. In this context, a holistic analysis of the sustainability of individual service and product offers is required. Individual business segments will have to be realigned due to numerous regulatory requirements and resulting market changes. This is an indispensable step to ensure profitability in securities business and trading with financial instruments despite MiFID II.