Introduction

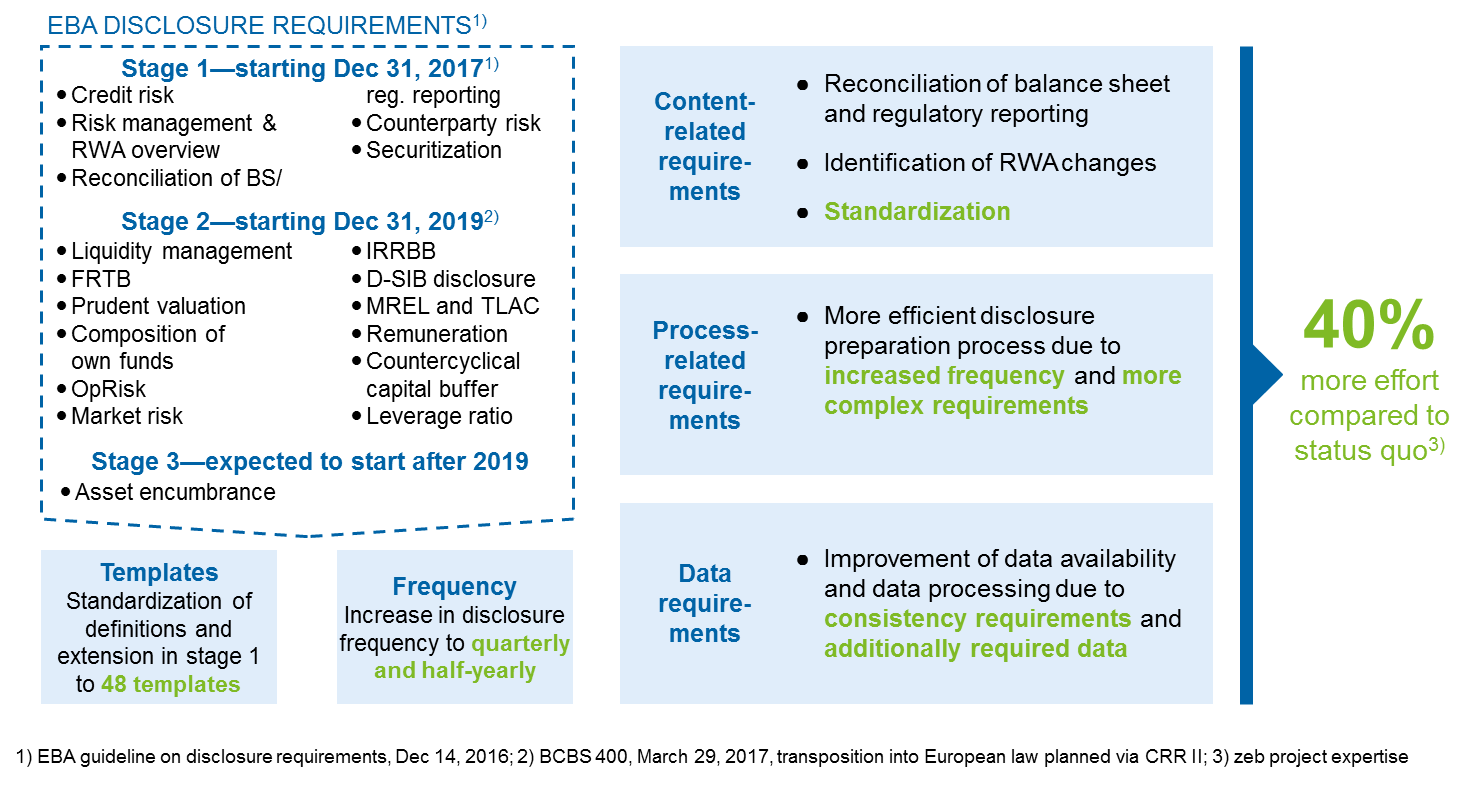

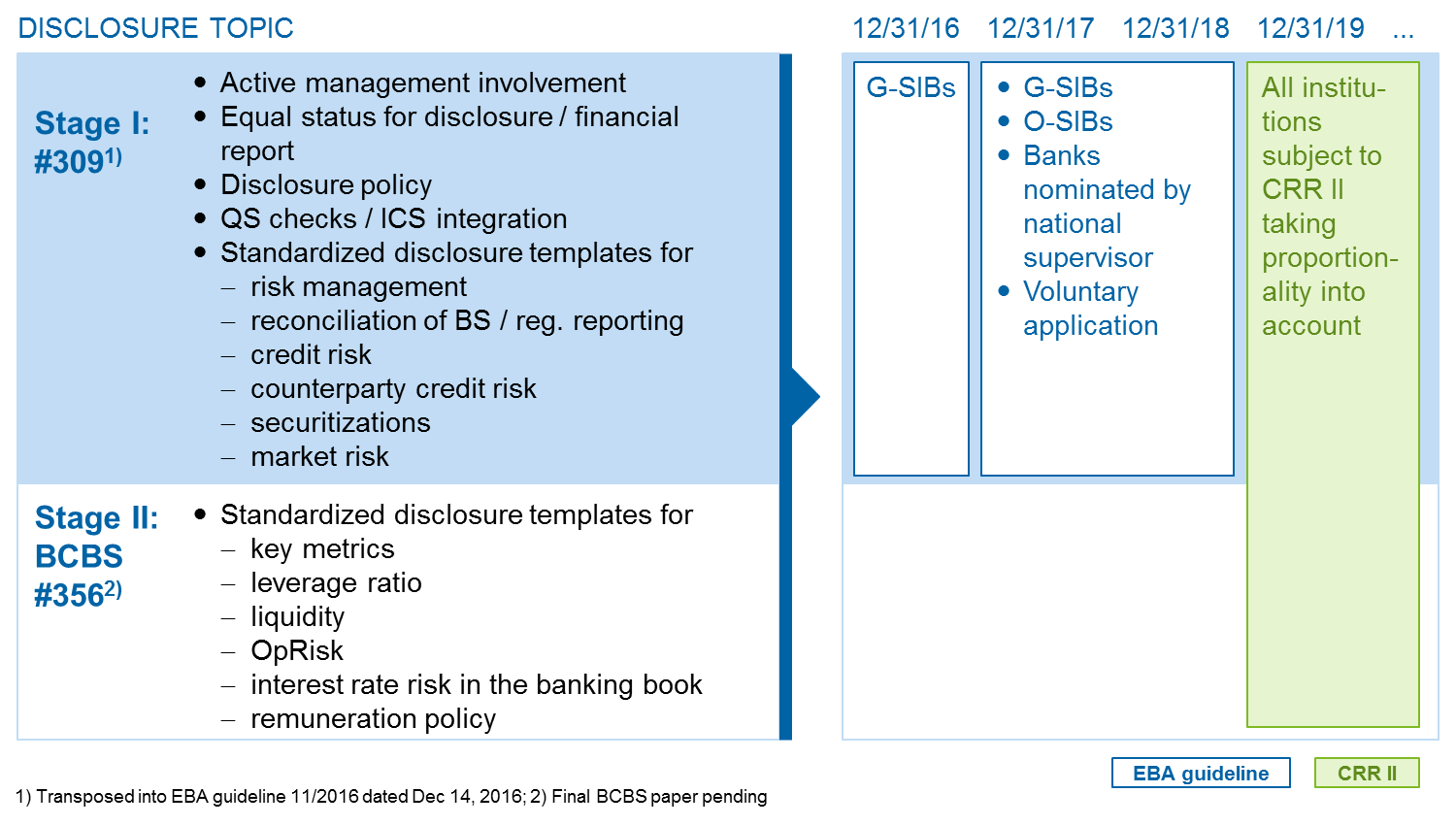

As part of the regulation tsunami of the past decade, Basel III represented a comprehensive overhaul of the minimum requirements for own funds and liquidity (Pillar I) while MaRisk involved a revision of risk-bearing capacity calculation and supervisory review process (Pillar II). Basel IV now aims at revising market discipline / disclosure (Pillar III) as well. Specifically, with BCBS #309 (Stage I) and BCBS #400 (Stage II), the Basel Committee has adopted new standards for disclosure which will be applied for the first time upon their transposition into European law via the EBA Guideline as of the key date of December 31, 2017 for Stage I (BCBS #309). G-SIBs already have to disclose selected content on the earlier key date of December 31, 2017. Initial application of Stage II (BCBS #400) is expected for the key date of December 31, 2019 in the course of the CRR II introduction. In a possible Stage III, the Basel Committee is considering revising the content of disclosures for asset encumbrance.

This article looks at key contents of the new disclosure requirements in Stage I (BCBS #309) and provides answers as to how institutions can compensate for additional costs arising from the extended requirements.

Standardized disclosure is based on four principles

The new requirements regarding standardization of disclosure are based on four core principles:

Principle 1: Disclosures should be clear

Disclosures should be easily understandable for key stakeholders (investors, analysts and customers) and clearly described. Important information is highlighted and easy to find. Complex issues have to be explained in simple language with key terms defined. Related risk information should be presented together.

Principle 2: Disclosures should be meaningful

The contents of disclosures should be meaningful to users. Disclosures should highlight the bank’s most significant risks and how those risks are measured and managed, including information that is likely to receive market attention. To increase meaningfulness, risk positions must be linked to line items on the balance sheet and/or the profit and loss statement.

Principle 3: Disclosures should be consistent over time

The structure of the disclosure report must be consistent over time to enable stakeholders to identify trends in a bank’s risk profile across all significant aspects of its business. Additions, deletions and other important changes in structure and content compared to previous disclosure reports—including those arising from specific, regulatory or general market developments—should be highlighted and explained.

Principle 4: Disclosures should be comparable across banks

The disclosure reports of all institutions must be comparable with each other. The level of detail and format of presentation of disclosures should enable key stakeholders and market participants to perform meaningful comparisons between banks’ business activities, regulatory metrics, risks and risk management.

Disclosure is to follow a comparable procedure to regulatory reporting using mandatory disclosure templates required by the supervisor

Due to BCBS #309 and its transposition into European law with the EBA Guideline dated December 14, 2016, the standardized disclosure requirements already have to be applied as of the disclosure key date of December 31, 2017 for key disclosure topics. Specifically, for the topics of

- risk management and RWA overview,

- reconciliation of balance sheet and regulatory reporting,

- capital requirements,

- credit risk,

- counterparty risk and

- market risk,

the fixed format templates defined by EBA must be used for qualitative and quantitative disclosure.

This is to ensure that the disclosure contents are interpreted and disclosed consistently by all institutions so that the intended comparability of disclosure contents of various institutions is achieved. For instance, credit risks arising from various dimensions such as asset class, geographical distribution, sector / customer groups and time to maturity must be represented in fixed templates and formats. Additionally, material changes in the quantitative templates compared to the previous disclosure report must be accompanied by qualitative comments. A major challenge lies in the disclosure of balance sheet and regulatory data in consistence with financial and regulatory reporting. The new disclosure requirements thus lead to significant demands regarding data quality and consistency checks. In terms of content-related challenges, the reconciliation of balance sheet and regulatory reporting (allocation of balance sheet items to regulatory risk categories) as well as the quarterly representation of RWA changes for banks with internal models should be highlighted (see also the BankingHub article RWA Flow Statement – Veränderungen verstehen—article in German language).

Apart from the fixed disclosure templates, G-SIBs, O-SIBs and institutions nominated by the national supervisory authorities also have to disclose certain disclosure templates on an intra-year basis (quarterly or half-yearly).

As a result, it can be observed that, compared to the status quo, the expansion in disclosure contents in combination with intra-year disclosure leads to a 40% increase in efforts[1] for the disclosure process.

For the implementation of quantitative disclosure, it is also important to note that in many cases the contents to be disclosed do not fully correspond to the representation in COREP reporting or are not part of COREP reporting (e.g. information on sectors / customer groups, geographical distribution, times to maturity, collateral eligibility, netting effects for counterparty risk items, etc.) and thus require separate preparation based on the regulatory data repository.

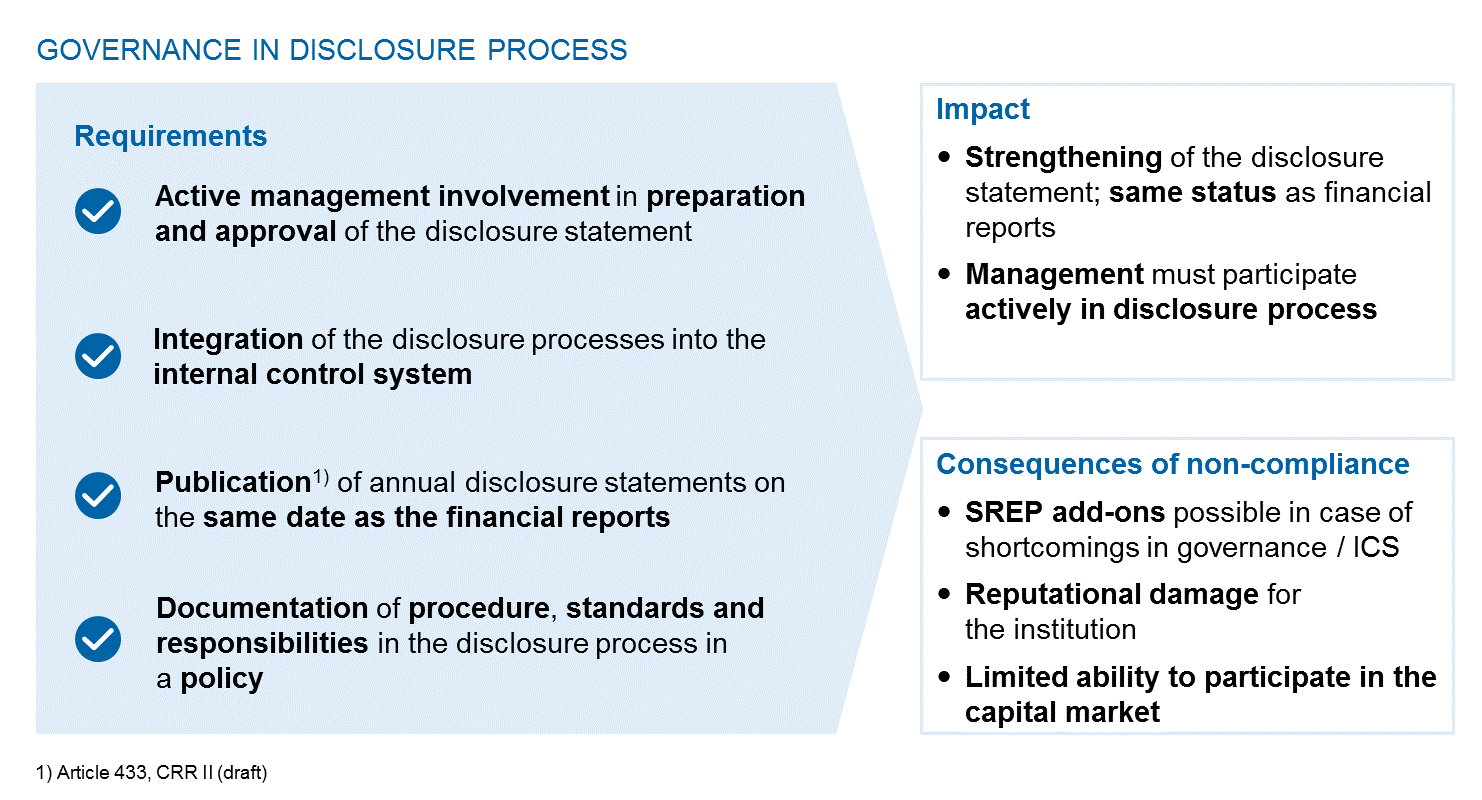

New governance requirements boost the importance of the disclosure report and put disclosure and financial report on an equal footing

In applying the new EBA Guideline and in connection with article 431 of the CRR, institutions have to ensure that their disclosure processes are subject to at least the same level of internal review and control processes as the preparation of the financial report. This requirement thus puts the disclosure production process on an equal footing with the financial report. The increase in the disclosure report’s status is also reflected in the involvement of senior management in the disclosure process: the EBA Guideline explicitly demands approval of the disclosure report by senior management. In addition, the disclosure process must be integrated into the internal control system.

According to the EBA Guideline, every institution is also obliged to define the process for the preparation of the disclosure report in a policy. In this policy, apart from a description of the processes and responsibilities, especially review and quality assurance steps must be defined.

Senior management is responsible for the determination and maintenance of an effective internal control structure for the disclosure process. Similarly, senior management takes responsibility for the disclosed contents. This means that before each disclosure, one or more senior officers must confirm in writing that the disclosure has been prepared in accordance with the internal policy based on the requirements states in the EBA-guideline and CRR. Moreover, key contents of a bank’s internal disclosure policy must be described in the disclosure report due at the end of the year.

On top of that, the draft CRR II requires same-day publication of the financial and disclosure reports. This requirement highlights the necessity of efficient processes.

Compared to the previous disclosure process, the EBA Guideline defines stricter requirements for governance. Non-compliance can impact the SREP add-on and thus lead to higher capital requirements. Furthermore, reputational damage and consequently a limited ability to participate in the capital market are possible.

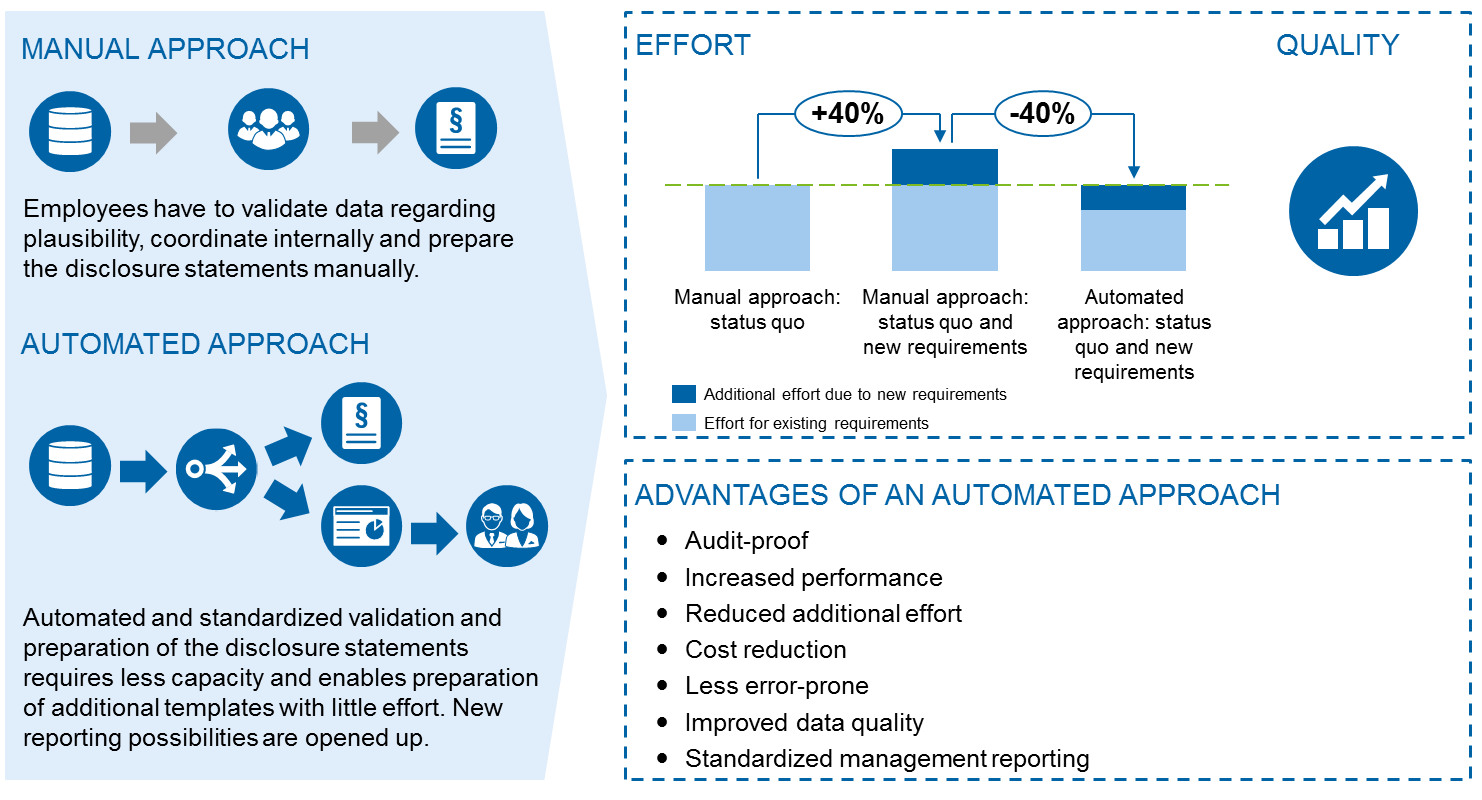

Standardized disclosure as an opportunity

Currently, the annual disclosure process in many institutions is characterized by a large number of workarounds and individual data preparations. With the EBA Guideline, efforts are significantly increased due to the large number of fixed disclosure templates and intra-year disclosure (zeb project expertise: additional effort +40%). This additional effort can be considerably simplified and reduced by using a standardized and automated preparation process. At the same time, automated processes contribute to low production costs, reduce coordination and revision efforts and accelerate processes. zeb project expertise shows that the additional effort due to the new disclosure requirements can almost be offset by means of standardization and automation and that the quality of the reporting is also increased.

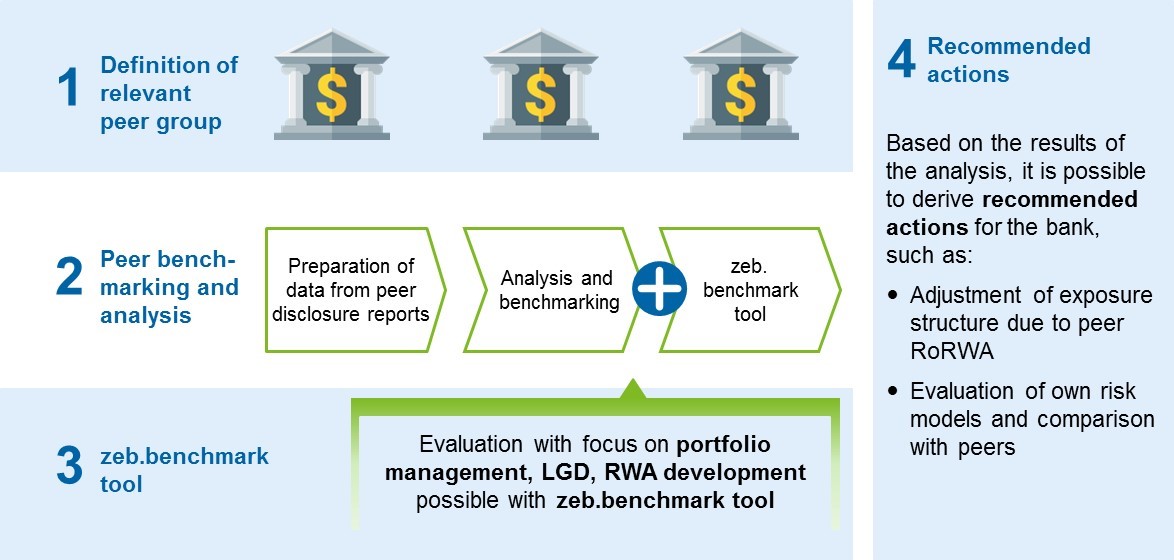

The standardized disclosure templates also allow institutions to use and analyze competitors’ disclosure data to derive important impulses for regulatory capital and liquidity management by means of peer benchmarking.

Outlook

Until CRR II enters into force, the new disclosure requirements defined by the EBA guideline must be applied by G-SIBs, O-SIBs and institutions nominated by national supervisory authorities[2]. For Stage II of disclosure standardization (BCBS #400), it is expected that this will be transposed into European law via CRR II and thus be applied for the first time on the key date of December 31, 2019.

Upon entry into force of CRR II, the standardized disclosure templates of Stage I and II will for the first time also have to be applied by non-systemically important banks and those not nominated by the national supervisor, taking proportionality into account. The draft CRR II from November 24, 2016 envisages staggered disclosure frequencies and contents based on the principle of proportionality:

- large institutions[3] with capital market orientation:

- comprehensive annual disclosure incl. intra-year disclosure for selected disclosure contents

- large institutions without capital market orientation:

- comprehensive annual disclosure

- semi-annual disclosure of key metrics on solvency, leverage ratio, LCR and NSFR

- small institutions[4] without capital market orientation:

- annual disclosure of remuneration report, statement of key metrics on solvency, leverage ratio, LCR and NSFR as well as selected information of risk management targets and policy

- capital market oriented small institutions as well as all other institutions:

- annual disclosure on key contents of disclosure

- semi-annual disclosure of key metrics on solvency, leverage ratio, LCR and NSFR

Until CRR II enters into force, voluntary application of the disclosure templates developed by the EBA is recommended for capital market oriented institutions to ensure better comparability of key metrics for institutional investors. The stress test conducted in the summer of 2016 showed that there is considerable uncertainty in the capital market with regard to European banks. Market transparency in line with international standards supports the strengthening of a bank’s ability to operate on the capital market. In addition, the “voluntary” use of the standardized disclosure templates lays essential foundations for efficient processes and low production costs in disclosure.