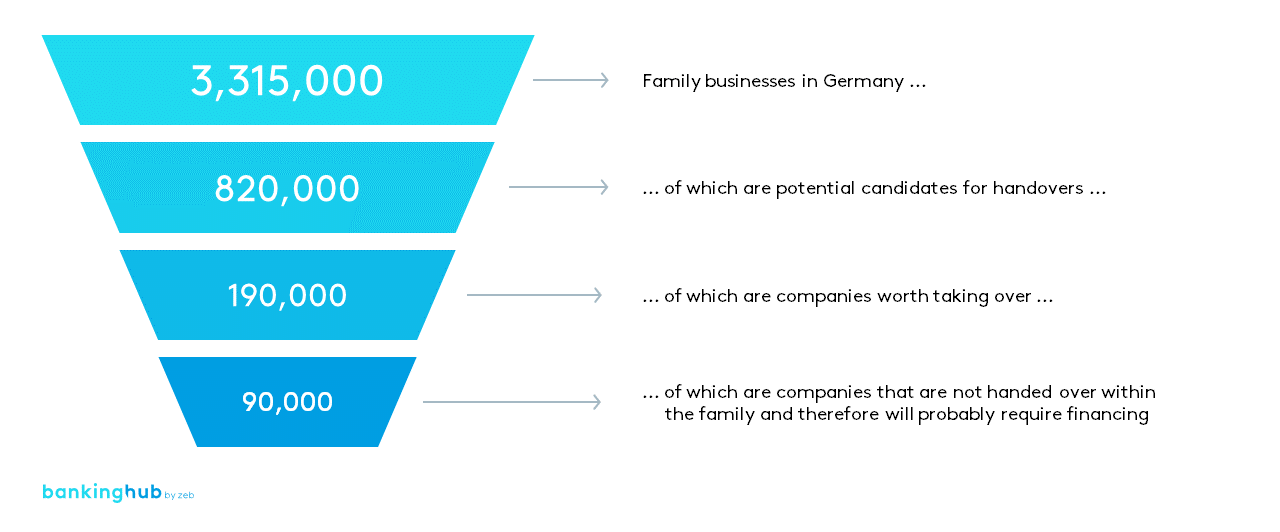

How relevant is business succession – in numbers?

The Institut für Mittelstandsforschung (institute for SME research) in Bonn has calculated that between 2022 and 2026, around 820,000 family businesses are due for succession as a result of the age or health-related retirement of their owners.[1]

Taking into account the economic viability of the companies in order to find out how many of them can be deemed “worthy” of being taken over from a purely financial point of view, 190,000 companies remain.[2]

Assuming conservatively that takeovers within the family have no or only low financing requirements, there will still be around 90,000 companies left within five years – this corresponds to around 18,000 companies per year in Germany.

Corporate banking: Derivation of company takeovers requiring financing

The average borrowing requirement for these 18,000 companies not transferred within the families can be estimated at about 60–70 percent of the purchase price.[3] In addition to the earnings potential from financing these ventures – interest and commission for supporting the complex process including any structuring of the financing – the bank (as a rule) also maintains the existing customer relationship or gains a new one.

Banks should also bear in mind that the entrepreneurs handing over the business now have significant investment needs, thereby generating cross-selling opportunities in private banking.

zeb has developed a regionalized potential model to assess the earnings potential in the context of business successions according to region and company size, thus enabling a reliable planning basis for each institution.

[1] Cf. Fels et al. (2021)

[2] The following factors are taken into account: generation of an appropriate profit for the entrepreneur, the return on the equity capital employed and an imputed risk premium

[3] Assessment based on zeb expert assessment and previous project experience as well as Rosenbaum & Pearl (2013)