Business successions as a source of income for regional banks

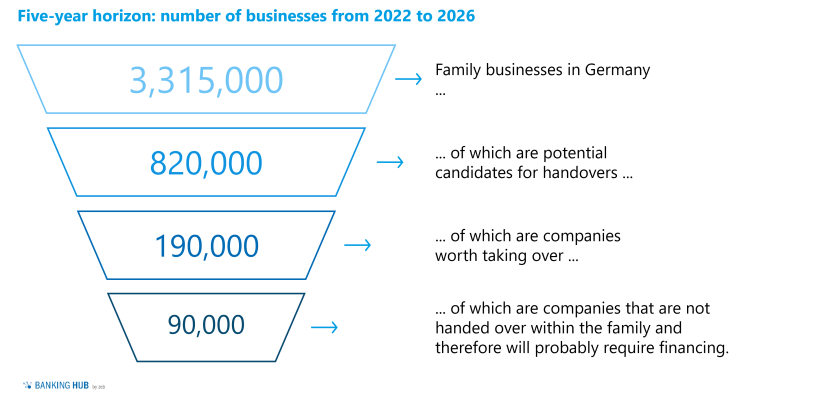

“I’m outta here” is what probably around 820,000 entrepreneurs in Germany will say between 2022 and 2026.[1] This corresponds to around 25 percent of the 3.3 million family businesses in Germany whose owners will (statistically) retire within the next five years for age or health reasons.

Not just the potential successors to this retiring generation, i.e. young entrepreneurs and all those aspiring to be one, should prick up their ears at this. Banks, and especially those responsible for corporate banking, are also well-advised to pay particular attention to this development.

Expanding and systematically developing the topic of business successions helps to address two strategic issues:

- Generating new sources of income by financing the takeover of a company and providing related services

- Securing future income from existing customer relationships, even under new ownership

Banks need to address the following key questions in order to position themselves successfully and make the best possible use of the available earnings potential:

Why is business succession in the German SME sector a topic for banks?

Business succession planning is of considerable (emotional) importance for entrepreneurs. At the end of their working lives, they are most likely to remember two key events: the founding or their own takeover of the company and also the moment when their life’s work is passed on.

Business succession is thus a key moment for banks to position themselves as a central partner to support entrepreneurs – in every situation.

How relevant is business succession – in numbers?

The Institut für Mittelstandsforschung (institute for SME research) in Bonn has calculated that between 2022 and 2026, around 820,000 family businesses are due for succession as a result of the age or health-related retirement of their owners.[2]

Taking into account the economic viability of the companies in order to find out how many of them can be deemed “worthy” of being taken over from a purely financial point of view, 190,000 companies remain.[3]

Assuming conservatively that takeovers within the family have no or only low financing requirements, there will still be around 90,000 companies left within five years – this corresponds to around 18,000 companies per year in Germany.

The average borrowing requirement for these 18,000 companies not transferred within the families can be estimated at about 60–70 percent of the purchase price.[4] In addition to the earnings potential from financing these ventures – interest and commission for supporting the complex process including any structuring of the financing – the bank (as a rule) also maintains the existing customer relationship or gains a new one.

Banks should also bear in mind that the entrepreneurs handing over the business now have significant investment needs, thereby generating cross-selling opportunities in private banking.

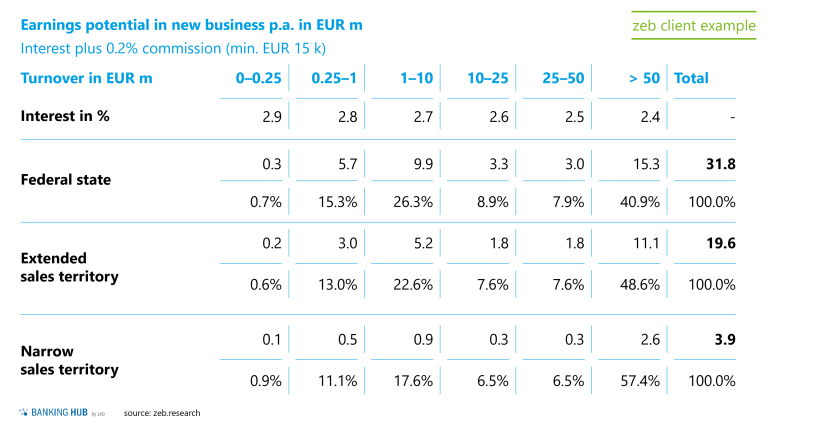

zeb has developed a regionalized potential model to assess the earnings potential in the context of business successions according to region and company size, thus enabling a reliable planning basis for each institution. This opens up the possibility of identifying concrete potential for regional banks in their sales territory. The model shows that regional banks in particular can exploit a great potential when supporting small and medium-sized enterprises with external sales of up to around EUR 50 million.

On the one hand, the financing volumes are sufficiently large with adequate margins to represent attractive business – on the other hand, however, they are usually too small to attract superregional competitors without customer relationships. In summary: yes, business succession in the German SME sector is also relevant for regional banks and an interesting business area with growth and earnings opportunities.

What should banks consider when supporting business succession?

Business succession is no day-to-day business. Entrepreneurs spend a long period of time dealing with questions related to their succession, such as:

- “When is the right time?”

- “How does the process work and which business partners can help me?”

- “Who is a suitable successor or how do I find that person?”

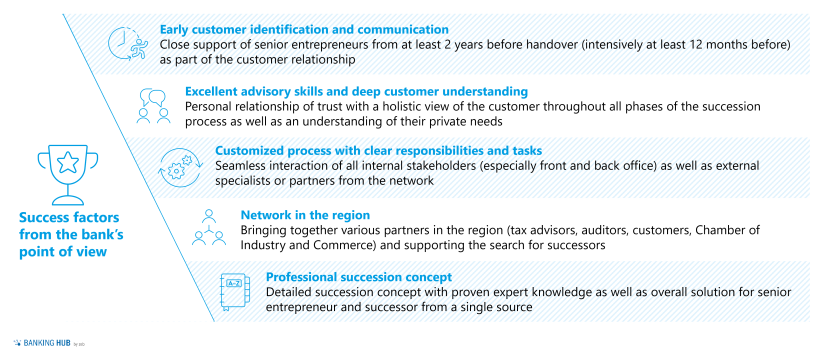

Banks can help their customers find answers to these questions. For this purpose, early identification and a proactive communication is a first starting point. At the same time, banks must demonstrate excellent advisory skills and a clear understanding of their customers’ needs. A relationship of trust with personal contact to the customer is highly important in this context. In addition, a structured process with clear responsibilities is necessary to manage the complexity of financing business successions.

This type of financing often requires extended customization (e.g. risk-adequate pricing or special contractual features), which must be reflected in suitable organizational structures and processes. Access to regional networks (e.g. Chamber of Industry and Commerce, legal and tax advisors, etc.) can also be helpful if support is required beyond financing.

These aspects should be summarized and formulated in a coherent succession concept for entrepreneurs. The success factors mentioned are shown in Figure 3.

All in all, it can be said that regional banks are in a good starting position when it comes to supporting business successions:

First, they usually maintain long-term and stable customer relationships with companies in their region and therefore have good customer access.Second, they also have a better understanding of regional peculiarities and local circumstances than superregional banks. Third, they can draw on a broad regional network of partners.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What approach can banks take to establish or expand this business area?

Regional banks, in particular, have so far not pursued the business area of corporate succession at all or only unsystematically and at half-throttle. As a result, they not only miss out on income from financing the takeover and investing the purchase price, but also jeopardize existing customer relationships (e.g. by not continuing the business or by losing the customer relationship to the bank that finances the takeover).

Banks can take a four-step approach to address these issues:

- Defining the strategic framework: which companies (size, industry and regional location) are relevant and which service should be offered with which risk appetite?

- Preparing a market and potential analysis: what market potential can be opened up given the defined strategic framework and the circumstances of the specific region?

- Developing an individual support model: what approach is suitable for supporting these customers and what are the associated organizational requirements?

- Adapting necessary management mechanisms: what cost and income targets are realistic for this business segment and how can these be integrated into the bank’s management logic?

Conclusion about financing business successions as new revenue streams

There is no denying the increasing importance of business succession in Germany in the coming years. Providing financing for these ventures can be an attractive business area as a source of income as well as a means of securing existing customer relationships.

At the same time, regional banks in particular can fulfill their mandate in their own region and ensure the continued existence of local enterprises. Establishing and successfully exploiting this business area, however, requires a professional and systematic approach. Banks wishing to be able to act quickly and reliably in this area should therefore place the business succession topic at the top of their agenda.