Currently there is no legal definition nor a universally accepted framework for classifying crypto-assets

Although there is currently no legal definition nor a universally accepted framework for classifying crypto-assets, there are already several existing taxonomies with different objectives, such as MiCAR, EFRAG, Basel Committee and others. From an accounting perspective, the categorization is based on the EFRAG taxonomy, which reflects the economic functions and intended uses of the various crypto-assets.

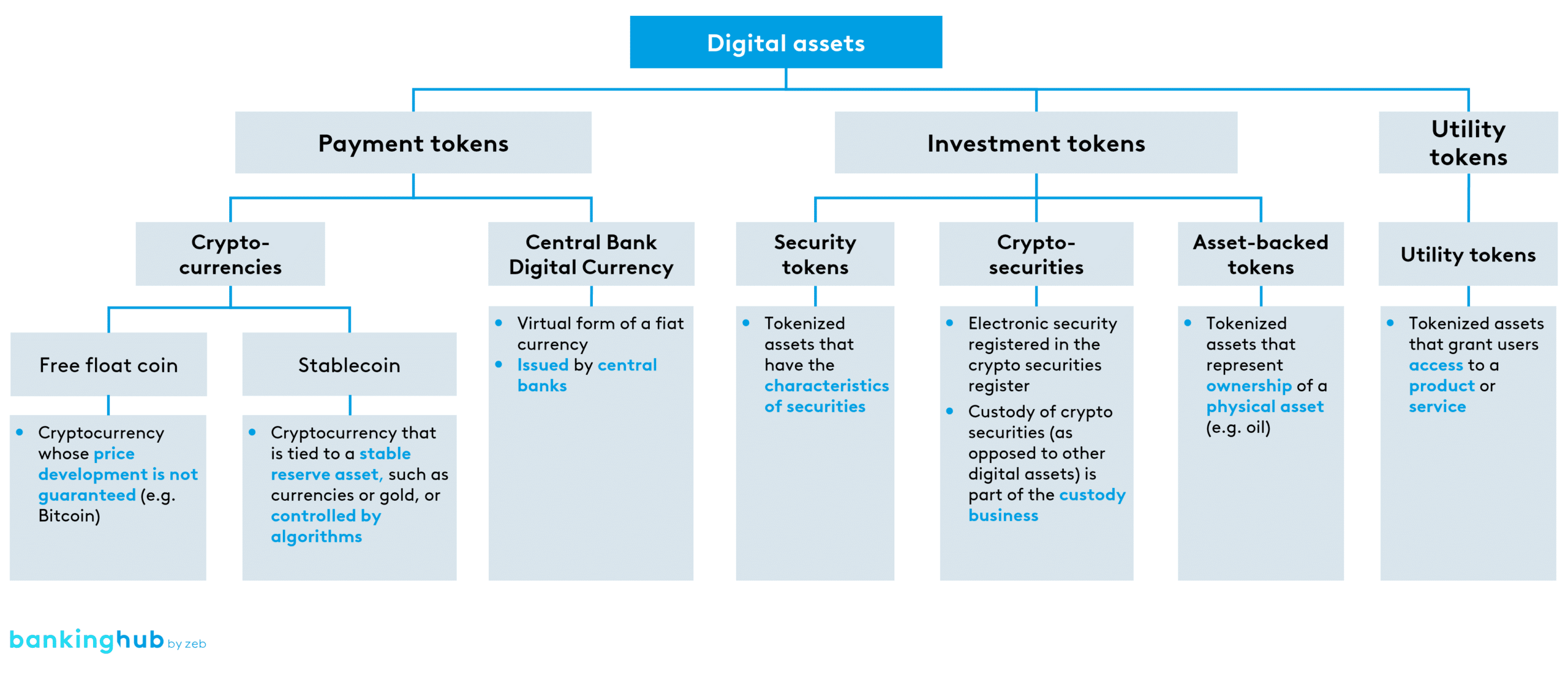

Broadly speaking, digital assets can be divided into three categories based on the asset’s purpose.

- While payment tokens are mainly used as cash (equivalent) and as means of exchange,

- investment tokens can be understood as debt claims as well as investment opportunities.

- Utility tokens as the third category grant holders certain rights to use specific products or services.*

The chart above illustrates each of these categories, taking into account their economic function in relation to the underlying digital assets.

* The terms “payment token”, “investment token” and “utility token” were derived to simplify classification for accounting purposes. There are no universally used terms for these categories in the specialist literature.