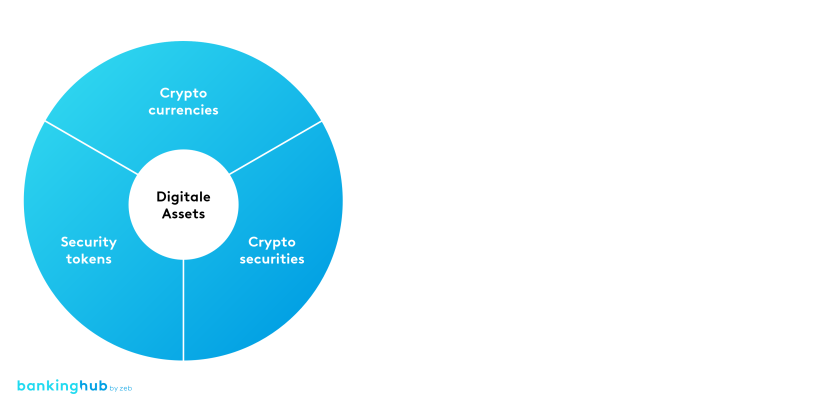

What are digital assets? Formats of digital assets

Digital assets exist on a blockchain in the form of cryptocurrencies or security tokens (crypto-assets pursuant to section 1 (11) sentence 10 of the German Banking Act (KWG)) and are deposited in so-called wallets (“digital lockers”). Currently, the market potential of digital assets is primarily driven by the two aforementioned formats until the conditions for crypto-securities (crypto-securities according to Art. 4 (3) of the German Electronic Securities Act (eWpG)) will be in place.

Differentiating these three digital assets and comparing them to traditional securities is important for analyzing the market environment in more detail.

Cryptocurrencies – hype or relevant asset class?

Cryptocurrencies are cryptographic values that are based on a decentralized payment system and do not represent a currency in the strict sense. Apart from the increasing acceptance of some cryptocurrencies as an alternative means of payment to so-called fiat currencies[1] such as the euro, more and more professional and institutional market participants are entering the cryptocurrency market alongside private investors in order to unlock new diversification and performance potentials.

After a strong rally at the beginning of the year, there is currently a new phase of euphoria for cryptocurrencies. The reasons for the renewed rise in investor interest could be the low interest rate environment, increasing market liquidity, occasionally high valuations for other asset classes and growing inflation expectations in Europe. The European market share for cryptocurrencies is gaining momentum as the degree of legal certainty for investors and financial services providers advances. Consequently, exciting times are ahead and we will see whether cryptocurrencies will make their way as an alternative asset class.

Security tokens – use cases and prospects

In addition to cryptocurrencies, standardized products for issue such as shares or bonds have so far been mapped and transferred via blockchain using security tokens, albeit to a limited extent.

The tokenization of more illiquid and non-fungible assets (e.g. real estate) is currently being accelerated by some market participants due to the easier transfer of ownership via blockchain. Nonetheless, security tokens tend to be in a transitional phase until the conditions for the introduction of crypto-securities are in place. Crypto-securities thus enable the transfer of digital assets into the securities business and will thereby set the next milestone for digital assets.

Crypto-securities – transferring digital assets to the securities business

The act on the introduction of electronic securities (hereinafter “eWpG”) by the German legislator came into force in the second quarter of 2021 and has been allowing the issuance of crypto-securities as an alternative format to securitized assets.

The differences to traditional securities lie in the type of issuance (electronic versus securitized). Analogously to securitized assets, crypto-securities are classified as safe custody business pursuant to Art. 1 (1) (2) (5) of the German Banking Act, whereas the custody, management and safeguarding of cryptocurrencies and security tokens as a financial service are classified as crypto custody business pursuant to section 1 (1a) sentence 2 no. 6 of the German Banking Act (KWG).

The previously required global certificate has been replaced by an entry of electronic securities in a crypto-securities register in the form of bearer bonds (crypto-securities) and investment fund units (crypto fund units), thus making the central securities custody’s role of an intermediary in back-office processes obsolete. In the longer term, the German regulator will also allow so-called crypto shares as a new type of issuance in the domestic market.

Rregulatory initiatives lower barriers to market entry for digital assets

The increasing openness to digital assets also benefits from the removal of investment restrictions. In particular, the DLT pilot regime adopted as part of the European Commission’s Digital Finance Strategy on September 24, 2020, is expected to enable instant trade processing via blockchain, intermediary-free investor admission and the elimination of central securities custody. This regime is described as the introduction of a “sandbox” approach to DLT-based market infrastructures to allow temporary exemptions from existing rules so that regulators can gain experience in dealing with digital assets. In addition, the Digital Finance Strategy also includes a regulation on markets for crypto-assets (“MiCa”)[2], whereas crypto-securities are governed by the existing MiFID II regime[3].

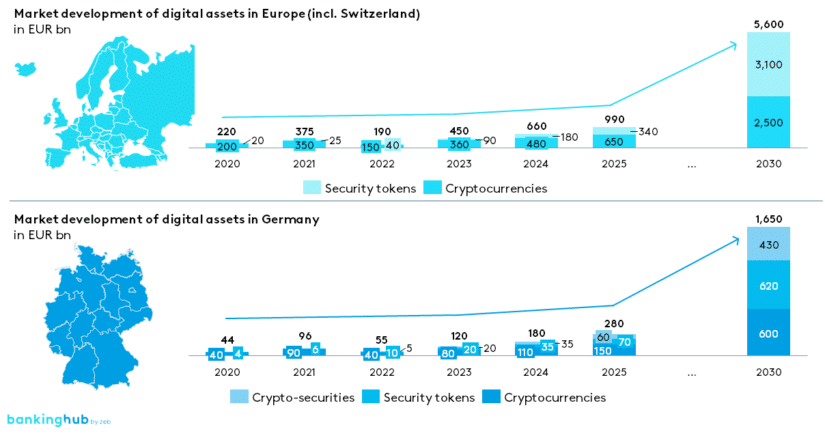

Market development assessment for digital assets in Europe and Germany

Figure 2[4] shows the forecast market development of digital assets in Europe compared to Germany in EUR billion. It reveals that the market volume of digital assets in Europe (including Switzerland) is expected to be close to EUR 1 trillion in 2025 and will rise to EUR 5.6 trillion by 2030. Germany’s share of the European market for cryptocurrencies and security tokens amounts to around 28%. In Germany, the market volume for all digital assets, including crypto-securities, is expected to increase by a factor of 2.5 between 2023 and 2025.

With the introduction of the eWpG and the creation of a new market infrastructure to enable this new type of issuance in the German financial market, crypto-securities (here including crypto fund units and, in the long term, crypto shares according to eWpG ) are estimated to reach a market volume of EUR 430 billion in 2030.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Key findings and required actions

Hence in the coming years, the market for digital assets will be growing into the billions, offering a wide range of earnings opportunities for new and established market participants. Five key findings can be derived from the current market dynamics:

- In the future, digital assets will be highly relevant for both private and institutional investors. Established institutions need to adjust their organization, processes and services along the entire capital markets value chain in order to meet customer needs.

- New market participants must deal in particular with the issue of applying for a license in order to be able to continue to provide their services under BaFin’s supervision. This transformation from a start-up to a regulated institution often presents challenges for these young companies, as a multitude of regulatory requirements must be met and documented.

- The German legislator would like to lead the way in Europe. As a result, digital assets in Germany are also becoming attractive for foreign fintech companies as well as established financial institutions that want to participate in this growing market.

- With the introduction of the eWpG, the setup of a professional and high-performance market infrastructure for digital assets will become more and more relevant. Established market participants need to observe the development and assess the impact on existing systems.

- Volume begets volume – the provision of liquidity on trading venues and platforms will be a major influencing factor for the market performance of crypto-securities.

For more information on asset management, read this feature article we wrote: