For an investment to be classified as sustainable, it must both serve an environmental objective and not harm any other environmental objective. In addition, it is required that minimum social safeguards defined in Article 18 of the Taxonomy Regulation are ensured. This refers to existing publications such as the International Bill of Human Rights.

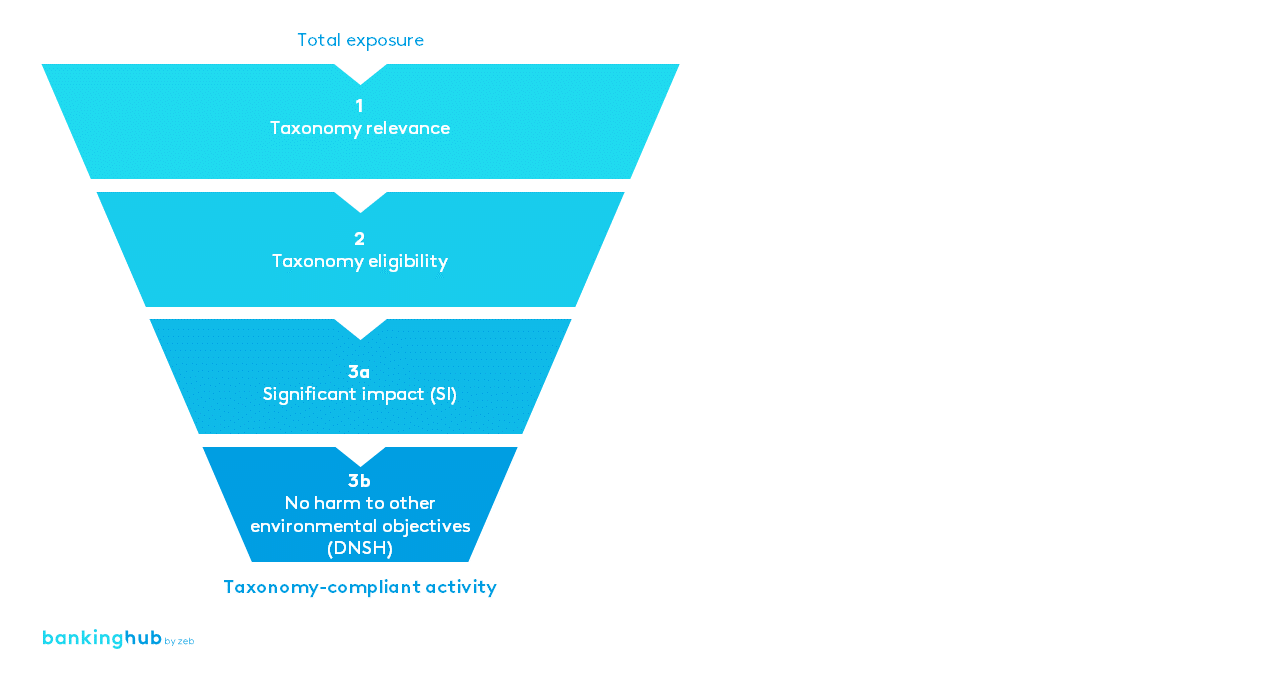

Essentially, the criteria for assessing the taxonomy alignment of economic activities can be divided into three steps, as illustrated in the figure above.

The first step is to determine the extent to which the activity under consideration is included in the current scope of the EU taxonomy (taxonomy relevance). Central and regional governments and public authorities, for example, are currently excluded. The reasoning behind this is above all the lack of sufficient information to determine taxonomy alignment.

In the second step, the taxonomy eligibility of the respective economic sector is assessed on the basis of the NACE code. Only those economic sectors are taxonomy-eligible which are explicitly mentioned in one of the lists published by the EU Commission. At present, companies or institutions from 136 economic sectors are generally considered taxonomy-eligible.

The third step then involves an initial assessment of the extent to which the economic activity makes a substantial contribution to the fulfillment of at least one of the six environmental objectives listed in Article 9 of the Taxonomy Regulation.