What happened in the lending business in 2022?

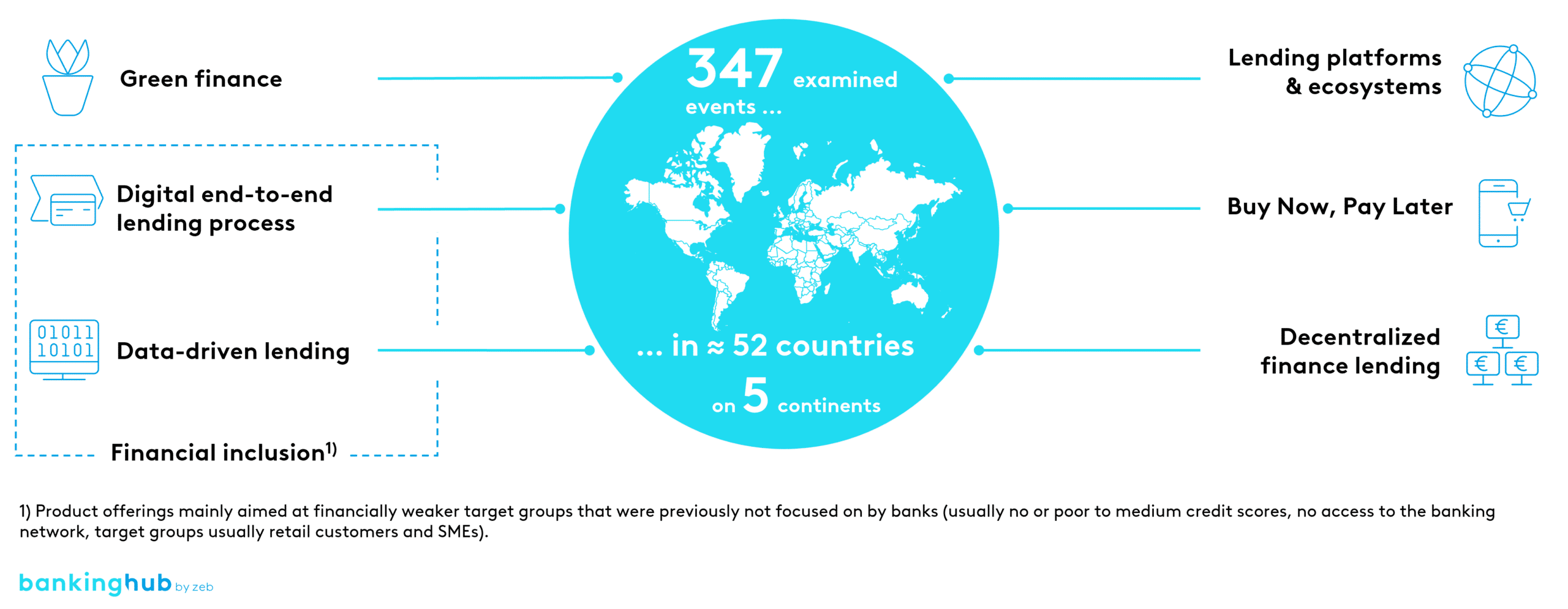

In our review of the lending business in 2022, we evaluated 347 events and trends in 52 countries on 5 continents, using prestigious German and international newsletters (Finanz-Szene, Finextra, Der Treasurer and many more), as well as news and company websites.

The 2022 credit events can be divided into the following six themes for the purposes of analysis:

Green finance: Green lending and sustainability-linked loans (SLLs) will grow in popularity in 2022, with more regulatory requirements and reporting around ESG issues. Fintech companies are developing solutions to meet these requirements.

Digital end-to-end lending process: Digital origination of loan agreements was a focus in 2022, with corporate and retail customers expecting a seamless digital omnichannel journey.

Data-driven lending (DDL): AI and machine learning were increasingly used in 2022 to provide individualised loan offers and assess creditworthiness based on alternative data.

Lending platforms & ecosystems: Lending platforms challenge financial institutions to develop their own solutions or partner with platform providers, such as through embedded finance.

Buy Now, Pay Later (BNPL): There have been many events in the BNPL industry in 2022, including funding rounds, acquisitions and consolidations. The future outlook for the BNPL market is exciting.

Decentralized finance lending: The crypto market downturn in 2022 affected decentralized finance lending, but blockchain technology and smart contracts still have potential in this area.