Credit events: a global perspective

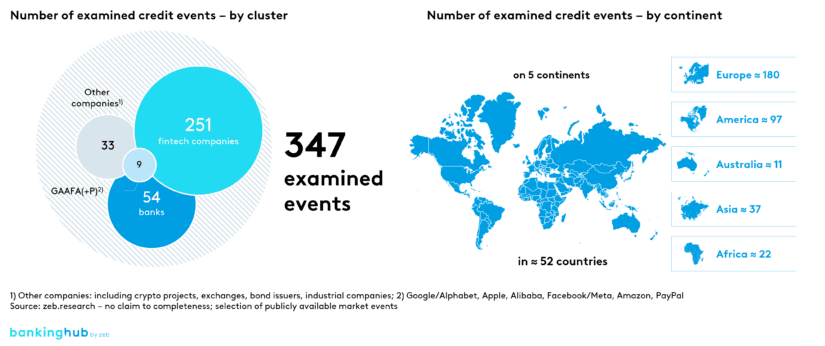

In our review of the 2022 lending business, we examined credit events and trends around the world on the basis of prestigious German and international newsletters (Finanz-Szene, Finextra, Der Treasurer and many more), as well as news and corporate websites. This allowed us to identify 347 events in 52 countries on 5 continents for the year 2022.

Lending business: topic cluster 2022

For the purposes of the evaluation, the credit events of the year 2022 were divided into six topic areas.

Comparing these lending business topics and their development to the previous year reveals a heterogeneous picture – some have changed little or only in certain facets, while others have undergone remarkable developments. Another interesting finding is that there is a new driver of change in the areas of data-driven lending and E2E lending, known as financial inclusion.

What was going on in the lending business in 2022?

Green finance

Compared to the previous year, green finance / green lending generated much more interest and momentum in 2022. We have observed an increase not only in the granting of so-called green loans (financings that must be used for a sustainable purpose), but also of financings with individual conditions linked to sustainability criteria (so-called sustainability-linked loans (SLLs)).

Furthermore, there were a large number of events that reflected the increase in regulatory requirements. These events mostly involve increasingly complex reporting and disclosure requirements related to ESG issues. Fintech companies in particular are very eager to develop solutions to meet these requirements.

A driver of innovation – financial inclusion

Although financial inclusion cannot be classified as a topic area of its own, it was identified as a key driver for both E2E lending and data-driven lending. Financial inclusion refers to measures aimed at approaching and attracting customers who have not previously been focused on by banks and financial services providers – often due to factors that would result in a negative assessment of debt servicing capability or creditworthiness (e.g. irregular or low income) under the application of classic evaluation criteria.

Another important target group for financial inclusion are customers living in remote areas, many of which were consequently provided with access to the banking network. In addition, processes and products were developed and digitalized explicitly for these customer groups.

Digital E2E lending

As in the year before, the design of an end-to-end digital lending process (E2E) was identified as an important topic. While the focus in previous years was on digital loan offerings, we observed a focus on the digital conclusion of loan agreements in 2022.

Corporate and retail customers alike expect a seamless digital omnichannel customer journey.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Data-driven lending (DDL)[1]

In the past few years, there have already been quite a few events related to data-driven lending, and there will likely be more in the years to come. In 2022, artificial intelligence and machine learning (ML) were increasingly used in the lending business to issue individualized loan offers as well as to rate creditworthiness or perform debt servicing capability checks based on alternative data (mobile phone data, social media, etc.).

AI has various applications along the lending process, some of which are already in use (see “Document verification: detecting fraud using AI”, German version only, English version coming soon)

Lending platforms and ecosystems

Lending platforms and ecosystems remain prevalent topics. With the various platforms around (comparison platforms, sales platforms and credit marketplaces), financial institutions are challenged to develop their own solutions or to cooperate with platform providers, for example via embedded finance.

Buy Now, Pay Later (BNPL)[2]

In 2022, there were many events in the BNPL business. A significant proportion of these events is accounted for by the funding rounds of fintech companies willing to enter the BNPL business, or of established players that have not been actively promoting BNPL before (e.g. Apple). There were also some acquisitions and consolidations. In the context of current developments, the future prospects of the BNPL market are very exciting.

Decentralized finance lending[3]

Decentralized finance, in particular decentralized lending, was strongly affected by the 2022 crypto market downturn. Accordingly, there was only a small number of credit events to be identified in that area.

Due to various fraud scandals and cyber attacks, the overall trust in cryptocurrencies has been shaken. Nevertheless, we see great potential in blockchain technology and smart contracts, especially in terms of decentralized lending.

Examples of credit events identified in 2022

How will the lending business develop in 2023?

Top five most important trends and theses for the year 2023:

1) Green finance is establishing itself and becoming a challenge

In 2023, credit institutions will continue to offer more and more forms of sustainable financing for corporate as well as retail customers. The challenge will be to define transparent and reasonable product criteria that actually have a positive impact on sustainability and thus contribute to the institutions’ “green asset ratio”. At the same time, (financial) companies will need to develop new solutions for handling the additional burden imposed by ESG reporting regulations.

In particular, these companies will have to address the question of how to best cooperate with their customers in order to collect the necessary data and information in the most resource-efficient way possible.

Taxonomy audit for banks

In order to simplify the taxonomy audit for banks, zeb has developed the zeb.taxonomy tool to support banks in the audit process.

2) The focus of digital E2E lending processes is on credit analysis, lending decisions and contract conclusion

Digital E2E processes remain a key topic in 2023. Credit institutions need to ask themselves: “How are my processes designed and how do my customers want to experience them?” It will be particularly challenging to determine how newly designed digital solutions along the credit process and core banking systems should interact in order to achieve the optimal outcome.

3) The use of artificial intelligence in the lending business will take a big leap forward in the near future

With ChatGPT, OpenAI has shown us what artificial intelligence is already capable of – even if the application fields and benefits in the lending business of this AI in particular have not yet been clearly identified. We do, however, already observe AI being used to analyze data in order to approach customers and create offers. We therefore expect a quick advancement thanks to AI technology in the near future, especially in terms of increasing process efficiency.

4) The big BNPL hype is over, but the payment option has established itself

BNPL is slowly developing from a novel and innovative B2C solution into a widely used and established one. However, the future market will be shaped to a large extent by the current environment of macroeconomic uncertainty as well as the upcoming strict regulations. Recently, banks and fintech companies have started venturing into digital factoring solutions to make BNPL viable in the B2B sector – whether this will lead to the same hype as in B2C remains to be seen.

5) Lending platforms will continue to grow resulting in the emergence of entire ecosystems

In a highly fragmented market with lots of different services, products and providers, platforms and ecosystems are key to a smooth customer journey. We are already observing platform operators increasingly trying to approach end customers directly and thus deliberately ousting intermediaries.

Due to the current economic development, the demand for and granting of loans are in decline. It is thus becoming more and more important for banks to incorporate platform business in their strategy and to ensure its technical and organizational operability in order to remain successful in the lending business.

Conclusion on the lending business

The credit market is changing rapidly and the pace continues to pick up. Banks will need to not only keep a close eye on overall developments, but also focus on the identified trends.

In the lending business, the topic of green finance will be of particular significance – with a continued focus on the development of sustainable credit products. With regard to the digital E2E lending process, there will be a particular focus on analysis, decisions, and contract conclusion. Lending platforms and ecosystems will significantly shape the lending business of banks.

Our findings imply that institutions should actively promote the three topics “green finance”, “digital E2E lending process” and “lending platforms and ecosystems”, and make according investments.