7 years after Lehman, regulatory and market-induced cost pressure remains high

The beginning of the financial market crisis in 2008 marks both the starting point of a confidence crisis on the international interbank market never before seen in a comparable depth and breadth as well as the beginning of the end of bilateral, uncollateralized transactions between banks.

Supervisory authorities worldwide have since unleashed a veritable flood of regulatory initiatives aimed at reducing counterparty risks which are invariably connected to uncollateralized transactions. These include for example:

- EMIR/Dodd Frank/BCBS- & IOSCO Framework:

Introduction of clearing obligation and thus also margin requirement for certain derivatives as well as expansion of margin requirement to off-market / bilateral transactions - Basel III:

Tightening of RWA regulations and introduction of CVA fees esp. for uncleared and uncollateralized derivative transactions as “implicit” provision of collateral; increase in various short to long-term liquidity requirements (LCR, NSFR); introduction of SA-CCR for preferential RWA treatment of collateralized derivative transactions in connection with extended netting options

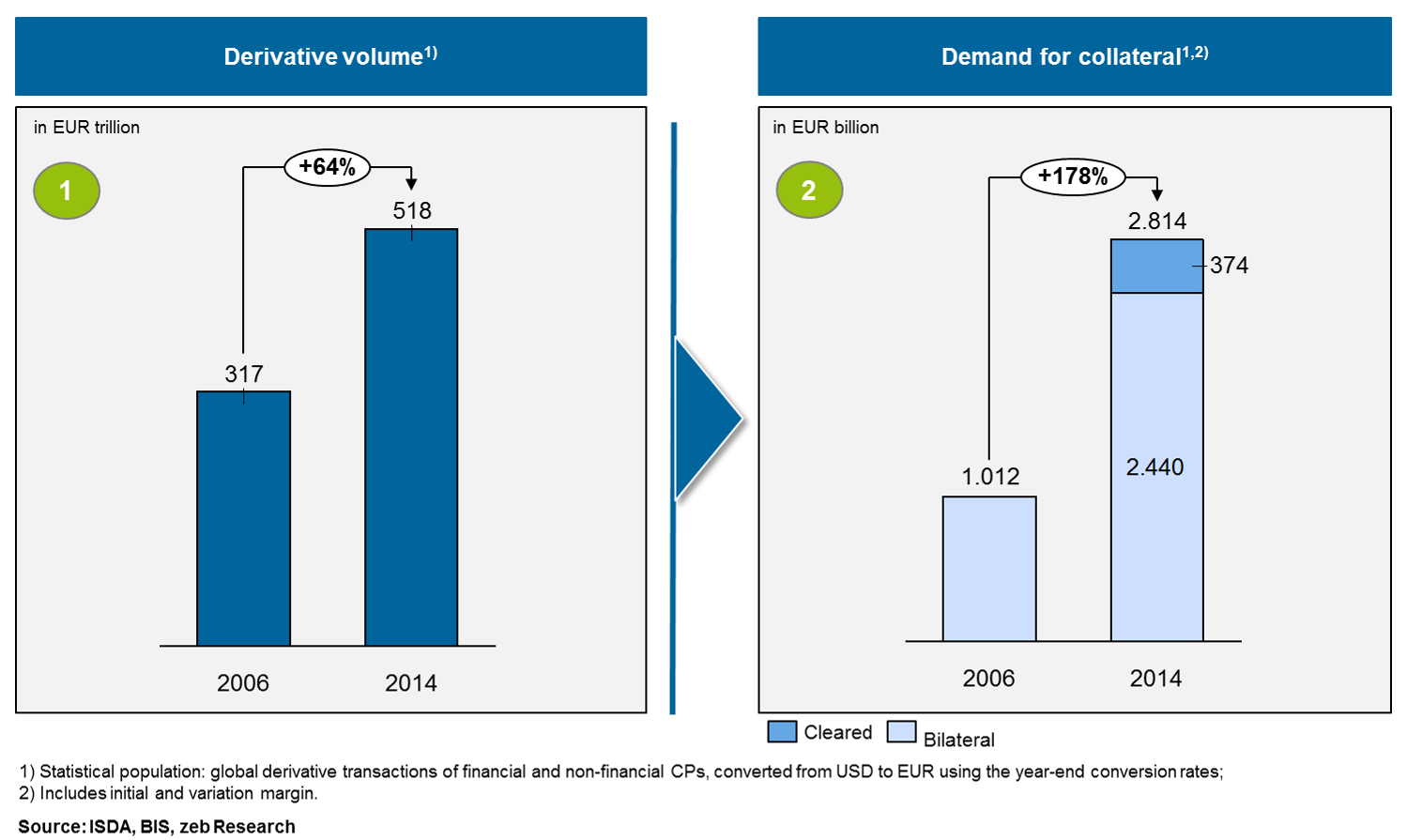

Taking the global derivative market since 2006—the last full “non-crisis year”—as an example, the collateralization of transactions to reduce counterparty risks rose by 178% in 2014, whereas the derivative volume merely rose by 64% in the same period (see also Fig. 1).

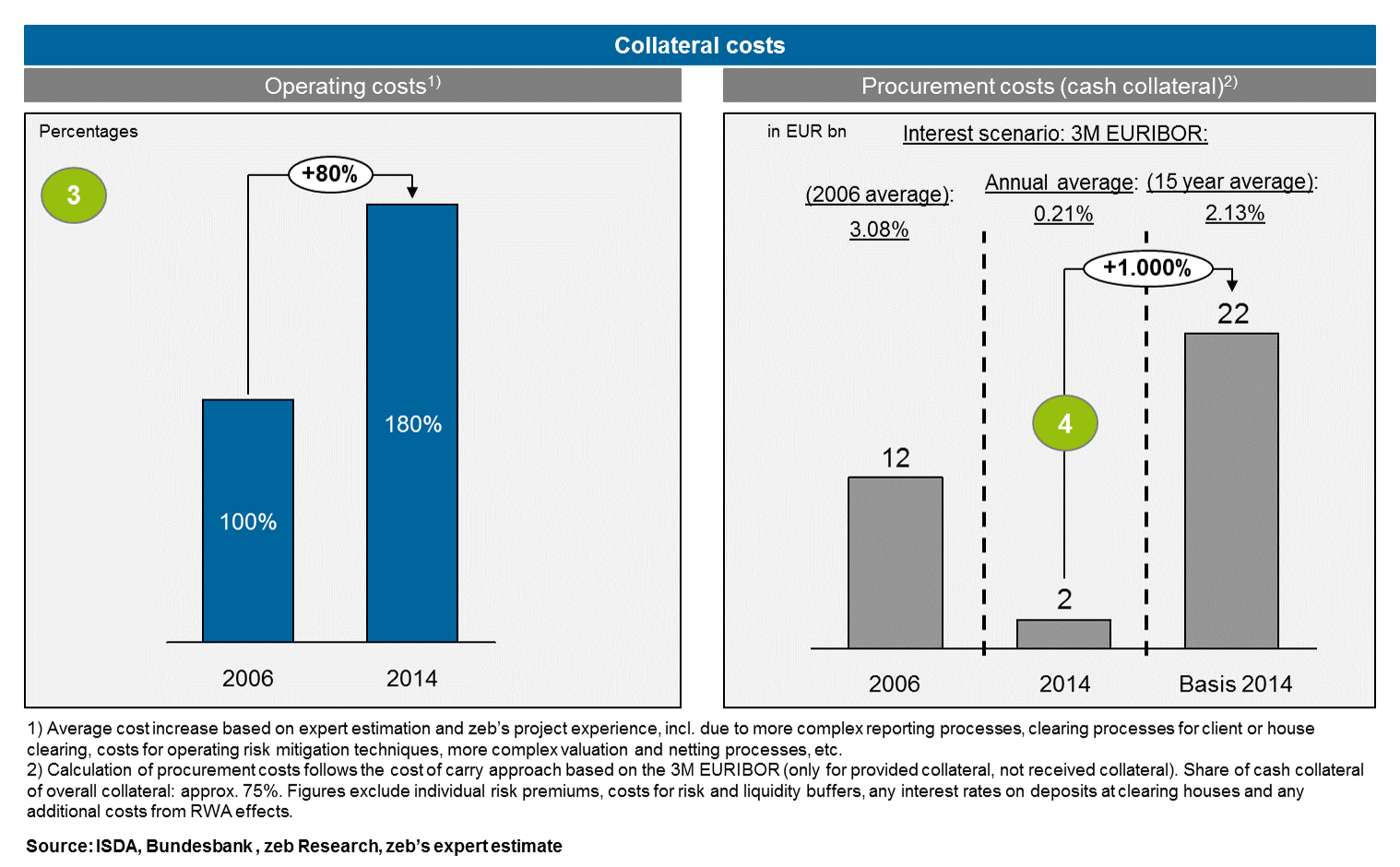

Over the same period of time, the average costs for banks to operate/maintain their collateral management functions went up by about 80% due to a considerable increase in complexity resulting from the new regulations (e.g. more complex reporting and clearing processes, risk mitigation techniques as well as more complex valuation and netting processes).

Sharp rise in operating costs due to increased complexity in collateral management—imminent interest rate turn in the US also carries high risk potential regarding future procurement costs of cash collateral

Despite the strong growth in the demand for collateral, the cash collateral costs[1] connected to derivative transactions have decreased since 2006, which is mainly due to the sharp drop in interest rates that has occurred in the meantime. These statistics however are treacherous: Even a return to a normal interest rate (3M EURIBOR) from a current value of 0.21% to 2.1% would lead to a dramatic rise in costs for cash collateral to cover the initial and variation margin (approx. 75% of collateral is covered by cash) from currently €2 bn to €22 bn (see also Fig. 2).

Thus, this calculation indicates the consequences of the interest rate turn that has already been initiated in the US for the collateral costs of banks, especially since expenses for the provision of additional liquidity and risk buffers as well as coverage for the increased RWA due to derivative transactions are not included in the values shown above. Considering the limited supply of government bonds due to the massive buy-up programs of ECB and Fed, evasive maneuvers away from cash collateral that is becoming more expensive towards alternative forms of collateral such as government bonds will hardly be possible and/or economically viable. Domino effects on repo and security transactions are also highly likely.

Apart from the effects on equity requirements and costs described above, the requirements for liquidity and risk management will also increase: Counterparty risks will increasingly be converted to collateral and liquidity risks; RWA management and collateral management become more interlinked via the above mentioned Basel III requirements, and scope for action resulting from collateralization in the case of counterparty, credit and exposure limits should be systematically utilized via a corresponding management function.

So what are the levers that banks can use to turn the above mentioned developments in their favor? Figures 1 and 2 allow the derivation of 4 major levers:

- Transaction volume based on the respective netting sets

- Collateral demand, e.g. based on the type of transaction (class of derivative, maturity, underlying, counterparty), the RWA management (LCR in connection with valuation method) or the management of required risk and liquidity buffers

- Operating costs to maintain the collateral management function or to implement the collateral management process based on various KPIs, such as level of automation, degree of vertical integration or service concentration

- Collateral costs, e.g. based on refinancing or opportunity interest rates, selection of collateral classes used and collateral available to internal management

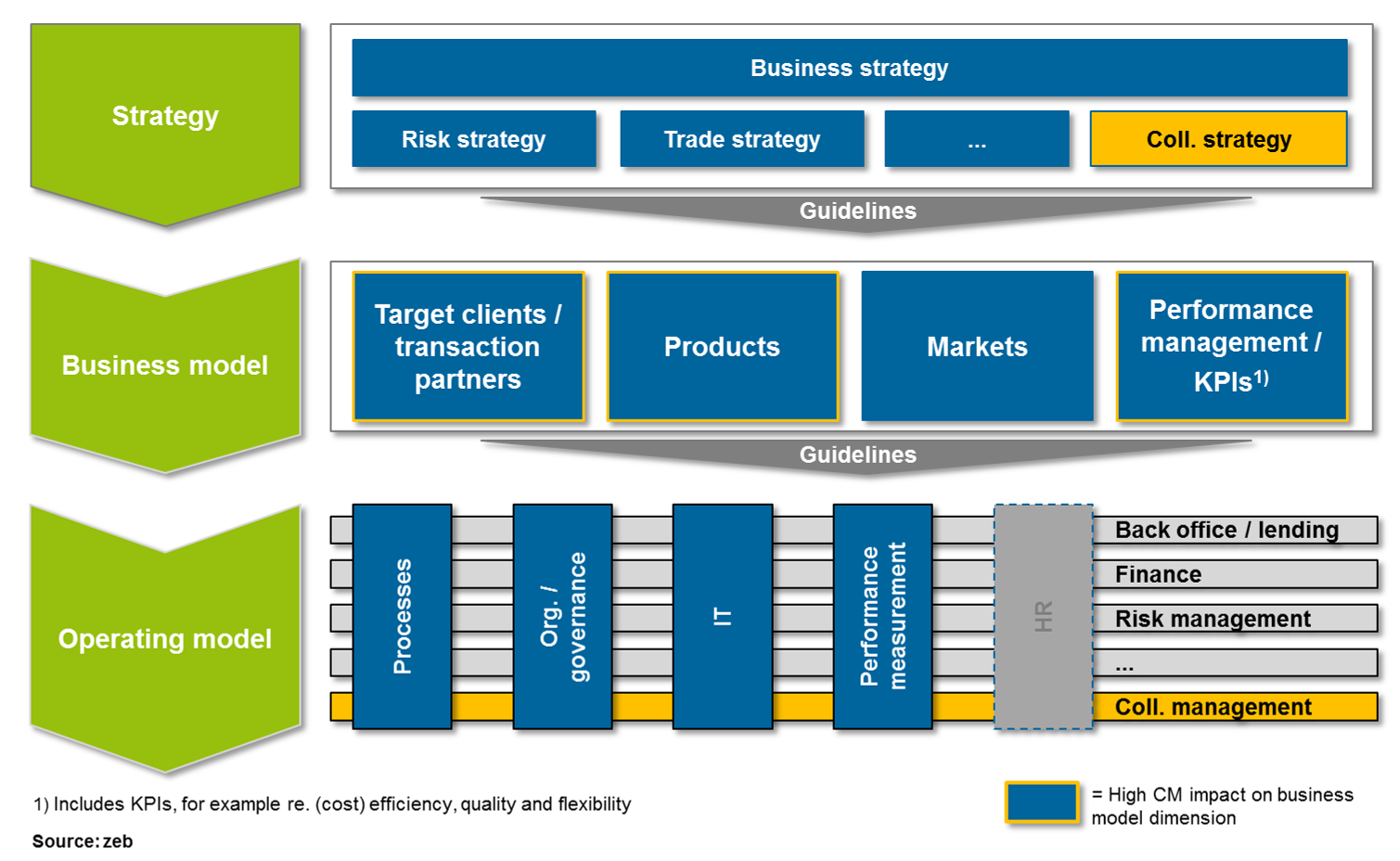

Holistic approach to topical areas of strategy, business model and operating model required to optimize collateral management by means of defined levers in banks

Given this background, what approaches are available to banks? zeb recommends a holistic approach to address the above mentioned levers in a targeted manner: In the target image, the institutions develop a company-wide collateral management which is anchored in its strategy, reflected in the business model and implemented via a separate operating model (see also Fig. 3).

These three areas will be discussed in more detail below:

Collateral strategy:

The collateral strategy is closely linked to the trade and risk strategy and provides essential strategic guidelines for the business model and operating model with direct impact on transaction volume (derivatives, repos, securities), collateral demand or collateral costs. The following activities must precede the development of a collateral strategy:

- Identification of status quo regarding the current transaction volume, the required collateral and the associated costs

- Driver analysis based on the above mentioned levers

- Derivation of scope for action & optimization potentials in the context of the company strategy to develop a strategic target image for collateral management

Resulting strategic guidelines refer for example to the product classes available for derivative transactions, types of transaction partners and types of collateral, but also the independence and degree of centralization of the collateral management function as well as the targeted degree of vertical integration.

Business model

The bank-wide business model details and refines the strategic guidelines. With reference to the collateral management function this means amongst other things the concrete scoping for transaction partners, products and collateral. The business model however also defines the concrete KPIs / management values such as the required collateral per notional and RWA in play, the spread for the collateralization costs (incl. refinancing spread of the collateral used), the performance of the portfolio netting or the process lead time of an OTC transaction from pricing and transaction input through to exchange and posting of the collateral.

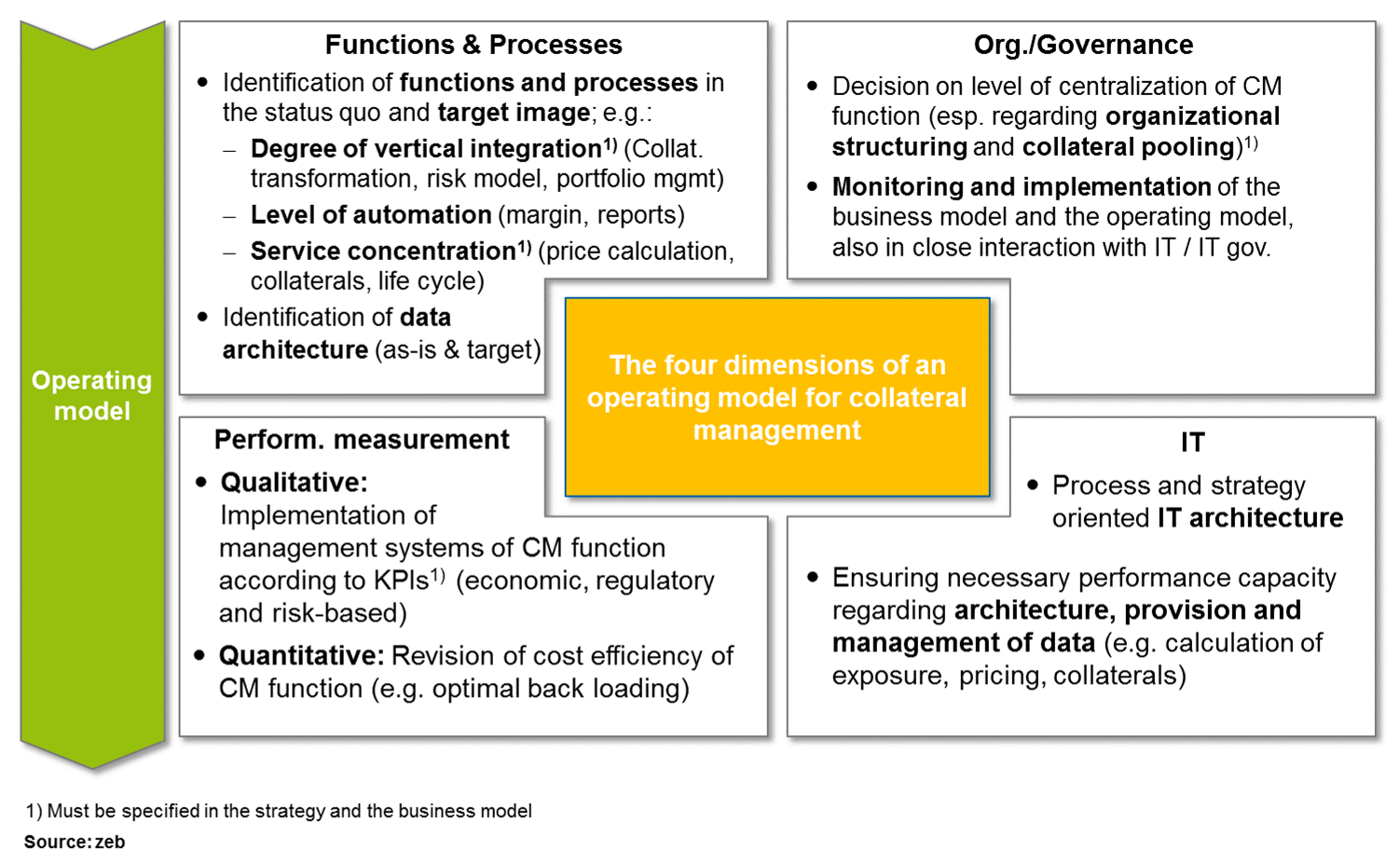

Operating model

The operating model operationalizes the requirements of the strategy & business model and through its characteristics it determines the actual performance capacity of the collateral management function. It could be said that the operating model represents the “engine room” and thus the core of collateral management (see also Fig. 4).

The core elements are:

- Functions & processes (e.g. degree of vertical integration, level of automation & service concentration)

- Org./Governance (e.g. degree of centralization of the CM function regarding organizational structuring and number of collateral pools available for collateralization)

- Performance measurement (management systems analogous to the KPIs defined in the business model, centralized monitoring unit for cost efficiency) and

- IT (provision of the required IT architecture & IT performance for the defined functions/processes)

CONCLUSION: A holistic look at the collateral management function with a view to strategy, business model and operating model is essential

Together with the client and using a dedicated framework, zeb develops tailored solutions whose direct or indirect impact on transaction volume, collateral demand and costs as well as operating costs can be measured individually.

Transaction volumes can be optimized by means of intelligent trading processes, netting systems or product strategies. Coverage of the demand with suitable collateral for the trading obligations entered into can be optimized by means of a cost-optimized selection and especially management of collateral. Appropriate pricing strategies increase the transparency of a trade’s collateralization costs even in the front office and enable adequate pricing. Suitable management parameters / KPIs in connection with the selection of optimized risk models for the calculation and provision of collateral increase efficiency and improve the interaction with risk strategy. Higher operating costs due to ever increasing and new requirements, e.g. from clearing and reporting, can be addressed via targeted process automation, adjustments to the degree of centralization and vertical integration, the implementation of life cycle management or an optimization of the IT architecture.

Regardless of which levers are applied in the individual case—the holistic look at the collateral management function with a view to strategy, business model and operating model is essential in order to meet the challenges posed by regulations, the market and technological progress. The increased importance of collateral management in banks is thus reflected—albeit in various ways and degrees—in a variety of current implementation projects: a change towards an independent, centrally managed function, asset class and profit center that makes a significant contribution to the future competitiveness of banks.