Why is mobility as a service relevant?

In fact, a recent large-scale survey in the larger Madrid region found that over a quarter of respondents (25.5%) believe they will no longer need to own a private vehicle in the future, given the growing availability of shared mobility services.[1]

In this context, the term Mobility as a Service (MaaS) is gaining traction – an innovative approach that combines different transportation options into a single, on-demand digital platform.

How does mobility as a service work, and how is it evolving

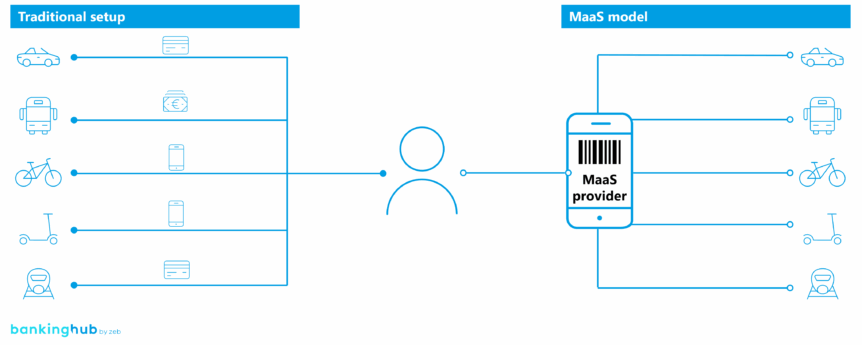

MaaS is a transformative concept that brings together different modes of transport to create a single digital service that can be accessed on demand. Through a unified platform – typically a smartphone app – users can plan, book and pay for trips that integrate public transport, car sharing, ridesharing and micromobility options like scooters and bikes. Rather than owning a car, users access mobility as a service on demand, with options tailored to their preferences and situation.

This shift is driven by broader trends, including rapid urbanization, advancing digital technologies and the urgent need to reduce carbon emissions. Together, these forces are reshaping mobility behavior, particularly in urban areas, where younger generations are increasingly favoring flexibility and access over ownership.

MaaS platforms already operate in many cities. Apps and services from providers such as Uber, Tier, Share Now or Jelbi (in Berlin) let users combine various modes of transport – from buses and trains to e-scooters and car sharing – into a seamless travel experience. What does this development mean for traditional mobility approaches?

In this article, we examine how new synergies are emerging in this dynamic environment and the business opportunities this could present to the established leasing companies. In a world where mobility is becoming increasingly networked, multimodal and flexible, a key question arises: how can they also participate in this megatrend?

How is the leasing market changing and what potential does MaaS offer?

Vehicle leasing has long been a core pillar of the mobility landscape, offering tailored financing solutions for both corporate fleets and private customers. Over the years, models such as kilometer-based leasing, residual value leasing, and full-service leasing have become well established. These solutions provide predictable costs, operational efficiency and relief from administrative burdens – particularly appealing to companies managing large or multi-brand fleets. In the private segment, leasing enables access to modern vehicles without the upfront investment of ownership, increasingly attracting younger, urban customers who prioritize flexibility.

However, as MaaS begins to change the way people access and experience mobility, leasing providers are at a turning point. While traditional leasing models have always been time-limited, they are typically designed for longer contract terms and ownership-oriented use, as opposed to the short-term, highly flexible arrangements of MaaS. As a result, they are not fully compatible with the on-demand, multimodal and usage-based nature of MaaS. Nevertheless, this shift does not reduce the need for vehicles but reshapes it. MaaS platforms are still heavily dependent on the availability, financing and efficient management of vehicles. This creates new opportunities for leasing providers to rethink their role in a more digitalized, service-oriented and integrated ecosystem.

Some industry players are already demonstrating what this evolution looks like in practice. Mobilize, Renault Group’s mobility brand, offers services such as Zity by Mobilize in Spain and Italy, Mobilize Share in multiple markets, and Glide.io in France and Italy, covering everything from free-floating car sharing to station-based rentals and corporate fleets. The vehicles powering these services are supplied through Mobilize Lease&Co, Renault’s dedicated leasing subsidiary, which delivers bundled packages that include insurance, maintenance, charging infrastructure and digital fleet management – all aligned with the operational needs of MaaS.[2][3]

Established global players are also moving decisively into this space. ALD Automotive – now operating under the Ayvens brand after merging with LeasePlan – is actively integrating leasing into digital mobility services. Its Move app, launched in the Netherlands, combines journey planning, payments and access to multimodal transport, including flexible vehicle use.[4]

A similarly innovative model is emerging in East Africa. In Kenya and Rwanda, BasiGo provides electric buses to public transport operators through a pay-as-you-drive subscription model. Instead of purchasing the vehicle, operators pay a deposit and are billed per kilometer driven. The lease includes charging, scheduled maintenance, cleaning, roadside assistance and insurance. BasiGo’s digital PAYD portal further supports operators with real-time tracking, diagnostics and payment management – a comprehensive solution that illustrates how usage-based leasing can support clean, efficient mass transit.[5]

These real-world examples show that some leasing providers have already entered the MaaS market. Yet the potential runs deeper. As more operators seek to avoid asset ownership, leasing providers are increasingly well-positioned to deliver fleet-as-a-service solutions. In this model, the leasing firm becomes a full-service mobility partner, offering not just vehicles, but end-to-end support – including maintenance, digital fleet tools and integration with platform backends.

Thus, leasing providers are entering a new chapter – one defined not by vehicle ownership, but by access, integration and service. In the MaaS environment, leasing providers can become key enablers of sustainable, flexible and connected mobility. Those ready to embrace this role will find themselves not just responding to change – but actively driving it.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Quantifying the potential: a market size in the EU of 14 billion per year by 2030[6]

The shift in the leasing business is not only strategically necessary but also economically attractive. A conservative projection from supplying car fleets alone for the European market shows that, assuming a MaaS usage rate of 10-13% of the urban population (approx. 35-50 million users)[7] and an average vehicle requirement of 20-25 vehicles per 1,000 users, there will be a need for 600,000 to 1.1 million vehicles in MaaS fleets by 2030.

Based on a projected annual leasing turnover of EUR 6,000–8,000 per vehicle, this results in an annual market volume of approx. EUR 3.5–9 billion for vehicle leasing alone. With additional services such as insurance, maintenance, telematics and data integration, the total addressable potential can rise to over EUR 14 billion per year.

Should leasing providers move beyond simply supplying vehicles and instead invest in developing mobility platforms, the potential could be even greater. Hence, the economic signal is clear: those who position themselves early can establish themselves as key players in the new mobility ecosystem.

To tap into the expanding market potential and move beyond existing use cases, zeb recommends taking action in the following areas:

A: Ecosystem strategy

- Begin by integrating into existing ecosystems and, with sufficient experience, capacity and opportunity, consider developing a proprietary MaaS platform.

- Collaborate with cities and transport authorities as a strategic fleet, financing and technology partner in public–private mobility networks, either through partnerships or via an in-house MaaS solution.

B: Product and service innovation

- Develop flexible mobility offerings: provide usage-based or short-term contracts tailored to high-utilization MaaS operations.

- Bundle fleet services: combine financing with fleet management, maintenance and telematics to deliver full-service solutions.

C: Organizational and operational enablement

- Build mobility-focused roles and teams: introduce roles like mobility partnership managers and data analysts.

- Invest in digital capabilities: enable API integrations, real-time vehicle data access and dynamic pricing models.