Localization

Very strong position of Authorities: the Russian Central Bank as well as other authorities hold a very strong position and also use it, sometimes also in public. Commercial banks are required to adhere to strict operational procedures not only regarding tax and reporting, but also for payment processing in Ruble as well as FX, or loan debt repayment procedures. In addition, the Russian Accounting scheme is quite different from international standards like IAS.

Low complexity of products

Russian retail customers are used to standardized and simple banking products, like credit cards, fixed term deposits or credits. Need for more complex, treasury-related products is still low, therefore a core banking package running in a typical Russian bank needs to cover such less, compared to a typical, say, European bank.

User friendly and performing front-end

Numbers of transactions are very high and Russians are used to make their transactions mainly via branch-network, as still the share of transactions via internet and ATM outside major cities is quite low. Consequently, systems need to support high input performance, user friendliness is key.

Performance (e.g. close of business day performance)

Russia is the world´s largest country, spanning over nine time zones. Banks have to ensure continuity of customer operations starting from the opening of a new banking day in Vladivostok over the closure of the previous day in Kaliningrad. As most systems still rely on old-fashioned downtime close-of-business operations, large volumes need to be thoroughly planned and managed.

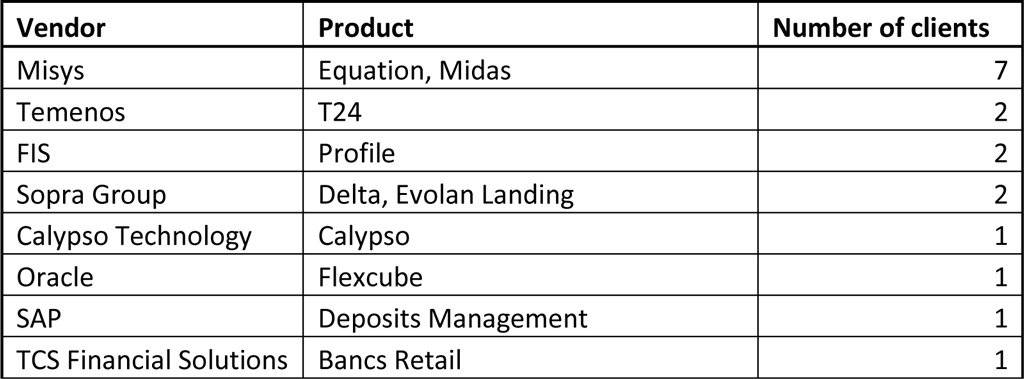

These requirements, as well as the mandatory support of the Russian language and Cyrillic characters make the Russian market difficult for international core banking, and lead to huge customization costs implementing them. Consequently, mainly international banks use such systems for their Russian entities, as they consider higher Group synergies and common structures:

Examples comprise Misys´ BankFusion Midas for Raiffeisen, or Flexcube in Unicredit, following respective standards established. Alfa-Bank, Russia´s 6th largest bank is the exception, as it runs Misys´ Equation for its large-scale retail operations. The other implementations refer mainly to smaller bank who Greenfield in Russia or provides niche services (investment banking or single-product).

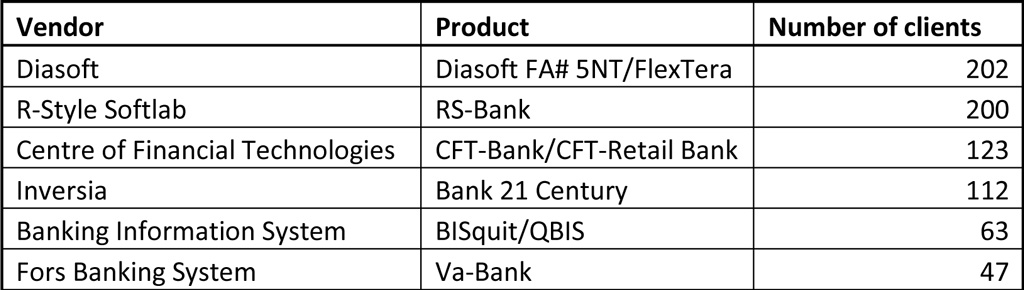

For the majority of the Russian banks, however, local systems are implemented:

These packages are promptly upgraded to accommodate the changes in the requirements of local authorities, are flexible enough from business point of view to cope with local requirements, and support local languages usefully. Also license and implementation costs are substantially lower than with international packages. However, compared to international vendors they have lower capabilities for invest in research and development.

Current market leader in terms of volume is Diasoft with two packages: Diasoft FA# 5NT and its successor FlexTera, moving the platform from Delphi to JavaEE, thus gradually improving the flexibility, scalability, and performance. We, however, see still potential for further improvement technology-wise, e.g. integration capabilities are still working with XML only. The lion share implementations are small and medium banks, however separate modules are used by top-banks (for example, Gazprombank has GL, VTB treasury back-office). Diasoft´s strategy targets South East Asia aside Russia and already resulted in a larger deal with Vietnam International Bank replacing Symbols of Sungard. Nevertheless, the company will likely remain a niche player for small and medium-sized banks, as even its new package still suffers from earlier deficiencies.

A clear indication about the attractiveness of the Russian core banking market was given by Asseco, the large Polish System Integrator, in 2013, as they bought Russian´s long-standing provider R-Style Softlab. Substantial research and development efforts resulted in a new version marketed in Russia and CIS. The package heavily uses Oracle technologies and targets universal banks, giving them the ability to build a centralized back-office, and including several channels being managed. This increases the attractiveness of the package for the larger banks and ensures scalability of current implementations.

CFT´s products (CFT-Bank for universal banks and CFT Retail Bank for retail banks) are best on Russian market regarding scalability, complete coverage of local reporting requirements even out-of-the-box, which results in a higher price tag than for its competitors. CFT-Bank and CFT Retail Bank are used by big Russian players like Gazprombank, and Uralsib, and also Sberbank for three regions.

Inversia introduced “Bank 21 century” in 2000, the product was developed based on Oracle DBMS. The system is attractive to smaller banks due to its ability being integrated with Russian´s local payment system. Research showed improvement potentials within its deposit module as well as with scalability; however as initial costs are lower and installed base is high, sales were stable in the past.

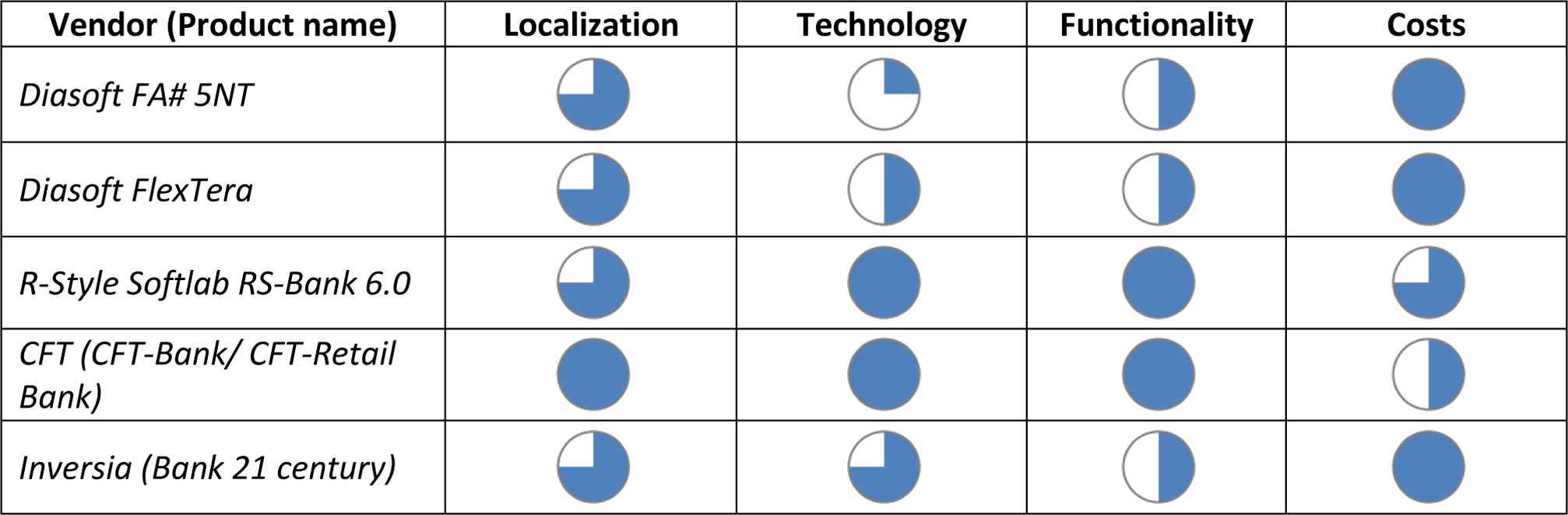

Table 3: Assessment of Russian local vendors and their products / Source: zeb research, Russian Banking Forums and periodicals

Table 3: Assessment of Russian local vendors and their products / Source: zeb research, Russian Banking Forums and periodicalsRussian´s smaller and medium-sized banks tend to local packages due to sufficient functionality coverage (normally, complex products are not needed, as outlined above), lower costs and better localization than with international packages.

Future perspectives

We believe this trend will even reinforce, as the local vendors constantly improve the functionality of their packages. However, for larger Russian banks, constraints like size of the company, capacity limitations, experience of running large-scale implementation, and outdated technology make it difficult to rely on smaller companies for a vital thing like core banking. Therefore, we see best chances for R-Style Softlab and CFT, as these companies have highest coverage of local functional and regulatory requirements, and pretty modern platforms. They enjoy success stories among top Russian Banks, too, and have sufficient capacity to run large-scale implementation projects.

Consequently, Inversia and Diasoft will remain niche local players, with a focus on implementation of standard packages within strict deadlines.

As regards potential sanctions against the Russian Banking sector, local core banking packages would definitely be faster in supporting newly established national networks. Measures being discussed deal with transaction management or clearing. Given that Russia really implements or fosters own national systems for payments and credit card settlement of their interior market, like PRO100, a support by local core banking systems seems to be more likely, adding another argument for a typical Russian bank to go with a local system.