What are E2E processes?

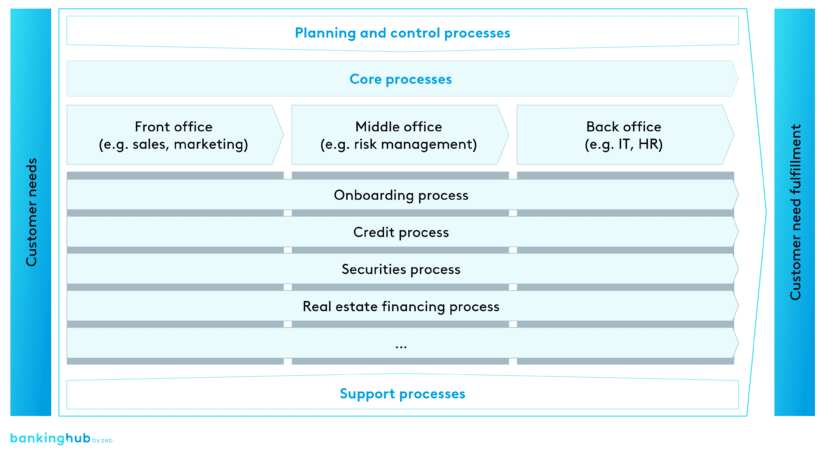

E2E processes encompass a ready-to-go service delivery concept that covers the entirety of customer needs – at least from their point of view. An E2E process is thus made up of all necessary consecutive (sub-)processes from the emergence of a customer requirement to its fulfillment (end to end) – from front to middle to back office (see Figure 1).

Identifying and clearly distinguishing E2E processes sounds easy in theory. But in reality, it is rather difficult to view processes in isolation from one another.

Particularly in large and complex organizations that offer a variety of products and solutions, the underlying processes are closely intertwined and very co-dependent with respect to, for example, application systems and organizational units.

E2E operating model

When a company aligns its processes to be developed along the entire value chain and implemented by its employees, this is known as an E2E operating model. Within such a model, the internal business and process architecture is adapted to the external customer view.

Developing an E2E operating model helps to reduce friction losses and redundancies, to clearly allocate responsibilities, and to more transparently measure the user-friendliness and performance of processes. This makes a company much more efficient, since E2E processes are more customer-oriented and interdisciplinary.