The aim of integrated planning is to create transparency regarding the availability of resources and future resource requirements, to identify potential bottlenecks and to derive suitable measures for implementing the chosen strategies. Thus, integrated planning is a crucial part of the management cycle and harmonizes heterogeneous requirements of individual specialist topics from financial risk controlling to accounting, reporting and IT.

Our project experience shows that finance units in banks often face huge challenges in order to meet the increasing demands on quality of planning. The reasons are first and foremost

- locally developed and uncoordinated planning requirements;

- different target parameters for individual management areas and isolated strategic planning without a content-related connection to operational planning;

- a level of aggregation that does not reflect the importance of the planning object;

- planning results of upstream planning stages that are not binding and not supported by those in charge;

- planning processes that require enormous resources—in controlling as well as for all other stakeholders and

- the use of different planning tools without any technical or subject-related link to planning and insufficient workflow support

Success factors in the planning process

According to our project experience, the typical levers and success factors in the planning process comprise:

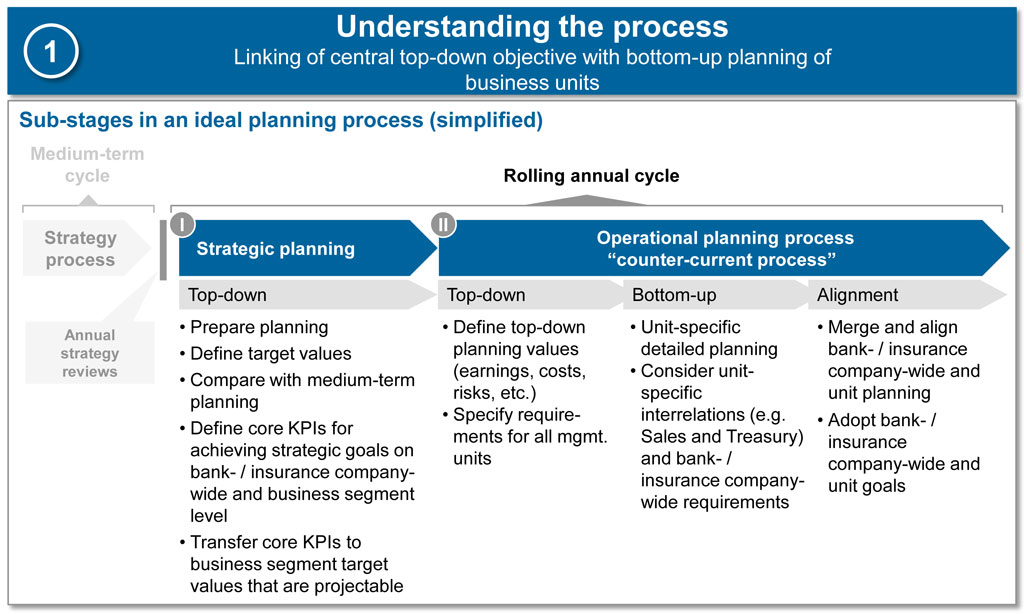

Process understanding

- A transparent “planning road map” with defined milestones for aligning and timing the overall process;

- Certainty for all parties involved with the help of a detailed and in-depth description of requirements, tools and templates to be used and the procedure

- A counter-current process to use local information while at the same time ensuring bank-wide requirements

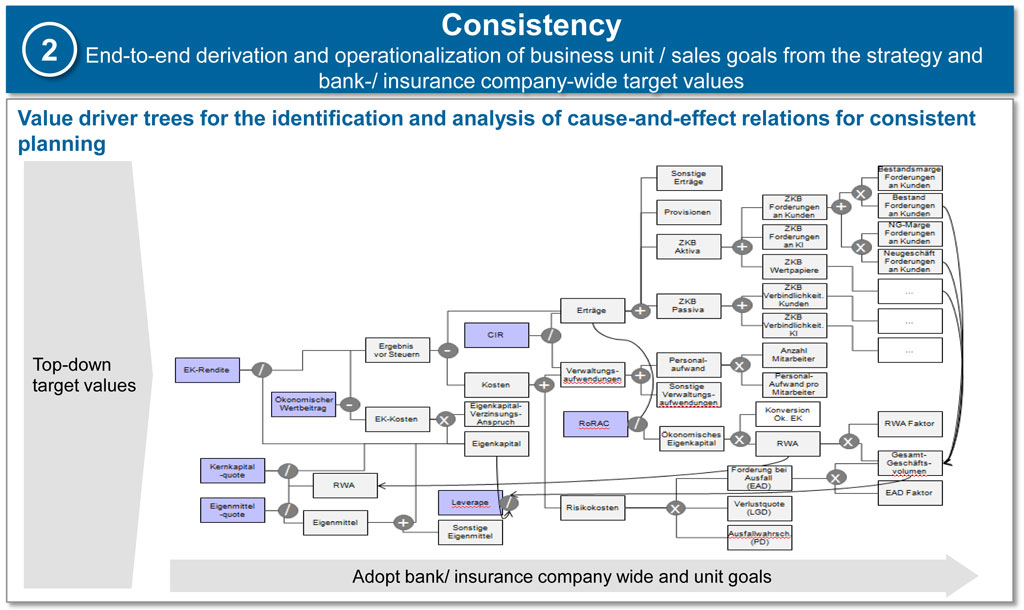

Consistency

- Defining the bank-wide strategy and transferring it into bank-wide goals;

- Planning (operationalization) bank-wide goals for business units using standardized KPIs;

- Breaking down the business unit target parameters of sub-units;

- Harmonizing definitions of concepts and calculation methods across the entire bank;

- Value driver trees as useful means to understand the business units and their potential to generate added value

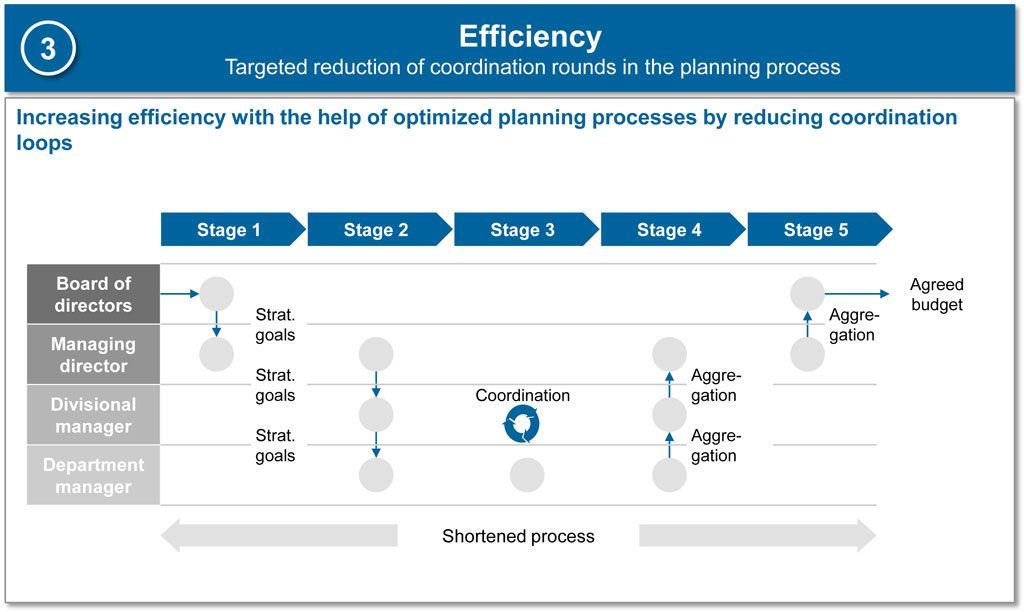

Efficiency

- Specification of sufficiently defined objectives for avoiding an incremental adjustment of planning on lower organizational levels to the strategic specifications in various coordination loops;

- Coherent communication of clearly defined and realistic objectives from “top to bottom” to eliminate coordination loops and shorten the planning process

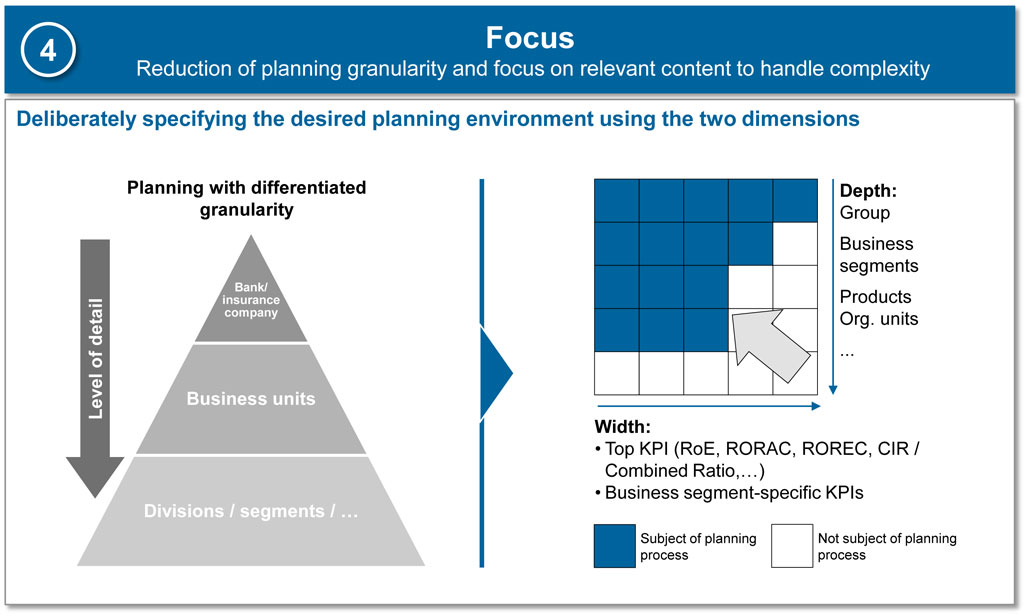

Focusing

- Deliberately specifying the desired planning environment based on a set of KPIs of the total bank as well as on strategic framework parameters (e.g. regulations) in two dimensions: “width” (number of KPIs) and “depth” (organizational level);

- Identification of streamlining potential through an active search for dispensable contents in evolved structures

- Streamlining planning in “detail and foundation” by

- using purely automatic distribution methods / algorithms

- outsourcing detailed planning to decentralized units (with defined docking points for overall planning via central core parameters)

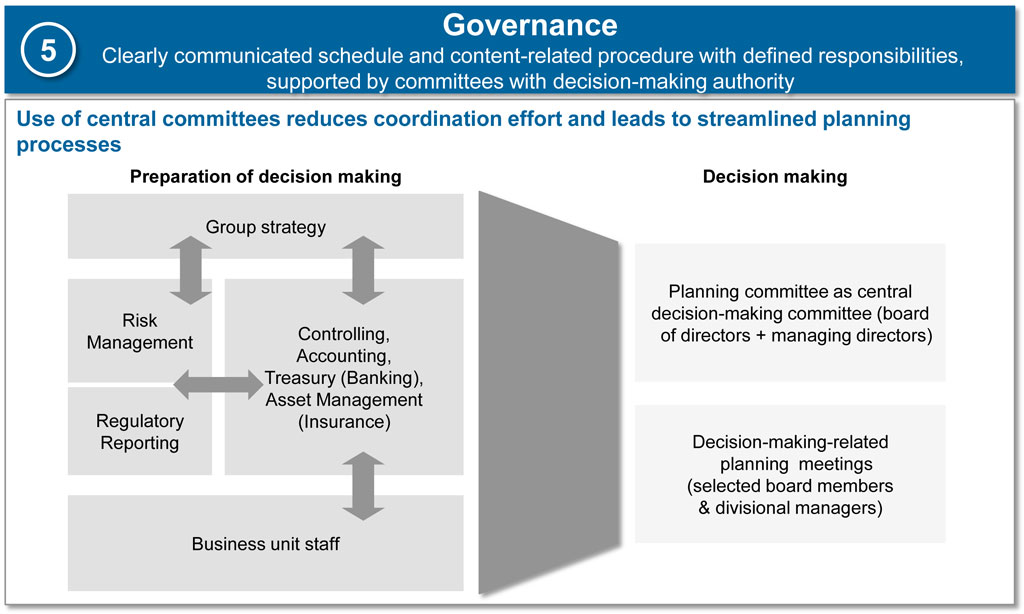

GOVERNANCE

- Use of central committees and central specifications as well as assessments for reducing coordination efforts during planning

- Introduction of a top management planning committee with decision-making authority with the following tasks

- Implementation of planning meetings with a focus on decision-making and the necessary decision-making authority in order to foster the planning process (e.g. adoption of a total bank planning)

- Final definition, monitoring and guarantee of the central objectives as well as coordination of planning of the business units

- Reduction of the burden of the executive board

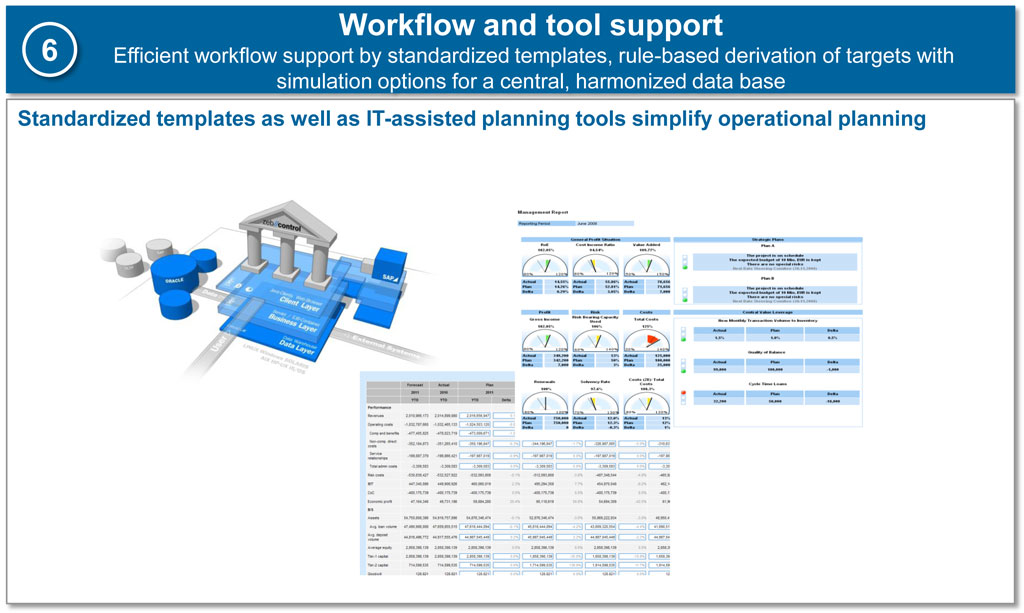

Workflow and tool support

- Increase of efficiency and quality of a complex planning procedure by using standardized templates and processes

- Practiced decentralized data preparation and acceleration of central data aggregation

- Reduction of sources of errors and minimizing coordination efforts in order to increase processing speed

- Developing planning routine

- Simplification of operational planning activities by IT-supported planning tools without fulfilling all planning requirements “out of the box”

- Reduction of manual activities—harmonized level between standardized tool support, healthy pragmatism and manual efforts necessary

- Minimizing sources of errors (wrong entries)

- “Enforcing” standards

- IT-supported generation of contents for supporting the planning experts

- Reduction of actively planned and coordination-relevant parameters based on expertise of all parties involved

- Rule-based derivation of possible targets by means of tools

A necessary optimization of the planning process often concerns several of the above mentioned approaches at the same time. Many banks face complex challenges in order to realize the desired improvements for the annual planning process. These challenges can be traced to the development of appropriate methods and technical concepts, process-related adjustments as well as the development and implementation of suitable IT tools for supporting the workflow.