How to manage scarce financial resources in banks

Until the 2007 financial crisis, when regulatory capital requirements were lenient and liquidity was readily available, revenue growth and profitability were the major focus points for many banks. Since then, however, a more holistic understanding of financial resources has largely gained prevalence. Especially with the increasing requirements from various regulators around the globe, new topics arose on the top management agenda such as capital adequacy, liquidity and funding as well as balance sheet size and leverage. In conjunction with unfavorable market conditions like the ongoing low yield environment, the profitability of the banking industry has been suffering over the last few years.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

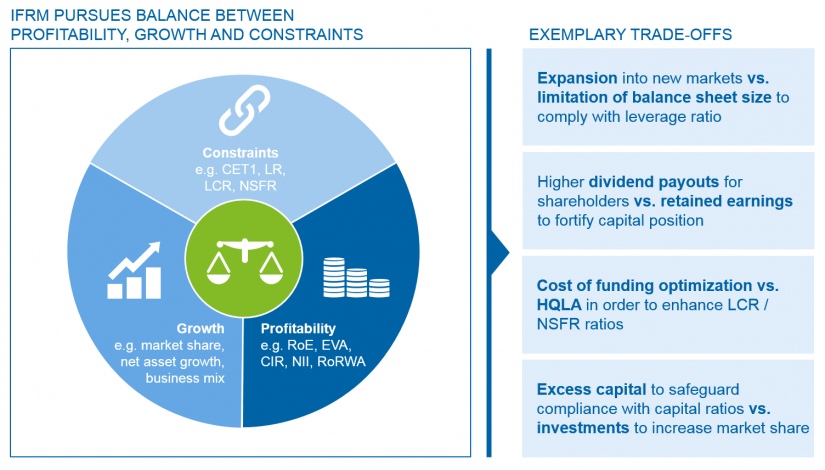

Therefore, top management focus has shifted to an efficient and effective use of the scarce financial resources at hand, taking into consideration all relevant constraints. In order to address this new management paradigm, we see a trend in banks to establish an IFRM aiming at balancing regulatory and internal resource constraints (e.g. risk bearing capacity) with the objectives to achieve growth and adequate profitability at the same time. Typical decisions that are subject to IFRM comprise, for instance, the expansion into new markets while limiting the balance sheet size to comply with the leverage ratio or the annual decision between satisfying shareholders needs by dividend pay-outs vs. a stronger resilience of the balance sheet through retained earnings. The scope of IFRM and typical trade-offs to be addressed are depicted in Figure 1.

While the importance of managing scarce financial resources is indisputable, our observations show that not all banks have fully incorporated this paradigm into their management processes yet. We see for instance in some banks that decisions about expanding market presence are still based on profitability and growth perspectives only without taking into consideration the increased leverage ratio exposure resulting from these growth ambitions. In our view, IFRM needs to be sustainably anchored in the organization to establish the change in mindset that is required to overcome the widely observed silo thinking.

Towards an integrated financial resource management (IFRM)

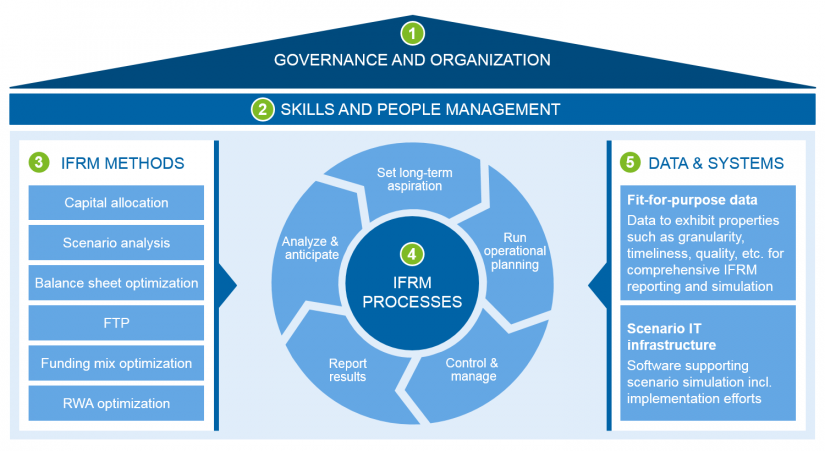

To anchor IFRM sustainably in an organization, five building blocks in particular should be taken into consideration and be mutually aligned (see Figure 2). The starting point for building and implementing a comprehensive IFRM is strong governance. Mandate and top-management buy-in for enforcing the use of IFRM in all decisions is key for a successful dissemination. If there is no tone from the top, IFRM will only be paid lip service and not achieve its full potential. We see in many organizations that substantial time and money has been invested into developing a comprehensive framework, but the framework has not come alive due to missing top management support. The idea of IFRM needs to be implemented via a fit-for-purpose workforce strategy, skill mix and embedded in the incentive structures of the organization (i.e. linked to bonus attribution). Governance as well as skills and people management set the stage for efficient IFRM process execution. Within the processes, specific methods such as capital allocation are applied. Data and systems that surpass the traditional system design typically encountered in finance and risk enable the application of these methods in the processes.

1. Governance and organization

While the will to implement IFRM in the bank needs to come from the top and be part of the management agenda, we see different ways to anchor IFRM within the organization in practice.

Banks that have high autonomy of divisions and lines of business usually show a tendency to have a decentralized approach to IFRM. This governance model is characterized by a very lean central team that sets aspiration levels, e.g. concerning the hurdle rates for profitability (derived from the bank’s value model), growth and relevant constraints. In addition, the central team defines the methodical foundations (e.g. calculation logic for KPIs) and aggregates the results of the respective divisions measuring the target achievement on group level. Everyday resource (re-)allocation decisions are taken autonomously by the divisions and lines of business within given boundaries. Proximity to the business is the key advantage of this organizational setup.

In contrast, there are banks that implement IFRM within a strong central team. This team is empowered to drive resource (re-)allocation discussions from the top, e.g. via a quarterly performance dialog. In this setup, divisions and lines of business are challenged by the central team, while the decentralized teams act on its behalf and have very limited power of decision-making. This setup is often referred to as ensuring an “optimal” allocation from the group perspective, but at the same time cannot always consider individual business specifics.

In essence, of course, there is no one-size-fits-all model. In practice, we have even observed mixed approaches that try to combine the benefits of both centralized and decentralized views. The individual setup needs to be tailored to the bank’s overall strategy, business model and organizational complexity, as well as other “soft” factors such as corporate culture. Regardless of the chosen model, a clear definition of roles and responsibilities as well as accountability are vital for the success of IFRM.

2. Skills and people management

The spirit of IFRM goes along with a strong “challenge and discussion” culture required to make decisions on resource (re-)allocation. In order to establish this culture, the right skill set and people management needs to be anchored in the organization as part of the workforce strategy. Typical areas with upskilling potential include, for instance, analytics for IFRM purposes. Strong analytical capabilities allow analyzing and commenting based on in-depth business knowledge on how to best resolve the inherent trade-offs of IFRM.

3. Methods

To balance the trade-offs resulting from profitability and growth aspirations, while fulfilling relevant constraints at the same time, IFRM can rely on a set of specific methods. They comprise in particular capital allocation, balance sheet optimization and funds transfer pricing as well as scenario analysis, funding mix and RWA optimization.

One method that has recently re-gained the limelight is capital allocation, especially due to the increased regulatory requirements arising from the planned “Basel IV” regime. Banks have shifted their approach to allocate capital based on the economic capital perspective to hybrid capital definitions incorporating, for instance, RWA and leverage ratio denominator in a combined way to better reflect bottleneck constraints in their resource allocation decisions. In order to evaluate the “optimal” resource allocation, most banks nowadays rely on scenarios and simulation capabilities. Our experience shows that most banks have already embarked on the journey to embed these capabilities in their processes, but struggle with the complexity of the underlying models.

One example of a European top 50 bank illustrates the typical challenges: the bank recently launched a project to introduce a sophisticated simulation methodology to allow for comprehensive balance sheet optimization. This method per se required iterative simulations to maximize performance given the desired ambition level in certain scenarios. In a first instance, the project failed as a very large number of external and internal input parameters had been collected and connected with net interest income and cost parameters. On top of that, risk and resource constraints were not considered in the initial design. With a relaunch of the project, aiming to find the right level of abstraction by reducing the number of input parameters, and at the same time adding risk and other constraint elements, a powerful method was developed.

4. Processes

IFRM processes cover an entire cycle from setting long-term aspirations for constraints to the analysis of current resource usage and allocation. Deriving the long-term aspiration is a starting point for any financial resource allocation decision. IFRM encourages top management to explicitly state the ambition level for all KPIs that are used for evaluating the financial resource performance, such as RoE, leverage ratio, LCR, NSFR, CET1 ratio. The targets should be closely linked to the risk appetite that the bank has defined. To support operational planning and plan validations, these targets must be broken down to the lines of business and linked with value drivers (external and internal).

By incorporating the key IFRM metrics into the regular reporting processes, classical control-and-manage processes can be triggered, e.g. in a quarterly performance dialog between group center and divisions. A key success factor to enable an effective and efficient performance dialog is a combination of standardized reports enhanced by in-depth analytics of the current performance. A typical pitfall can be observed in extensive customized reports that lead to discussions about the figures themselves.

5. Data and systems

Based on our observations, insufficient data and IT system limitations are among the main challenges banks need to master when introducing IFRM. In an ideal world, IFRM would have access to integrated internal finance and risk data enriched by external market data in a flexible data warehouse / data lake architecture. So far, we have seen no bank that has implemented such an ecosystem on a fully-fledged basis. However, we see promising initiatives to surmount the current shortcomings that could be leveraged for IFRM. Among those initiatives, one can name BCBS 239 and the concept of an information factory. With regulatory driven initiatives such as BCBS 239, banks are obliged to integrate finance and risk data and have a profound understanding of data lineage across various systems. The information factory concept is a more technically driven approach to enhance data quality and availability. This concept drives the industrialization of data provision and represents an essential step towards digitalization in finance and risk.

On top of high-quality, integrated data, simulation engines are essential IT tools that support IFRM. The selection and implementation of such engines is closely linked to the methodical aspects of simulation capabilities like the intended application scope (e.g. simulation vs. balance sheet optimization), the data and technology available at a bank as well as the IT strategy. Typically, when selecting a simulation engine, banks are forced into a trade-off decision between flexibility on the one hand and standardized logic delivered with the solution on the other hand.

Conclusion

The latest financial crisis and the following myriad of newly introduced regulatory initiatives, which increased both the extent and the overall complexity of capital, liquidity and other funding requirements, have demonstrated the importance of managing scarce financial resources within banks in a holistic manner. Nowadays, the need to strike a balance between growth, profitability and constraints and incorporate this paradigm of IFRM into the DNA of an organization is becoming increasingly apparent. When introducing IFRM, banks must ensure that governance, people management, as well as methods, processes and IT & data are fully aligned in order to support making trade-off decisions. Based on various client discussions, we see banks gradually coming to an understanding that IFRM can become a decisive success factor for balancing strategic ambitions regarding growth and profitability with binding financial resource constraints.

2 responses to “Integrated Financial Resource Management (IFRM)”

Morne Labuschagne

Hi, thank you for the very insightful article. Where can I get more info on this, regarding the techniques, skills needed, technology, framework development etc.

This will be highly appreciated

Rene Isaacs

Thank you for this article. It really helps to understand IFRM especially during this time of COVID19

Thank you.

Rene Isaacs