What are ecosystems?

Similarly to platforms, ecosystems act as intermediaries between supply and demand, i.e. consumers and several providers, but ecosystems are also used by various providers to link their differing service portfolios to better satisfy overall customer needs. An important aspect of ecosystems is the direct approach to fully (end-to-end) satisfy one or several customer needs. Due to the interaction of the different providers, the overall value is characterized by the “1+1=3” principle: the customer gains more value than from services provided individually. This causes two major strategic changes:

- Banks no longer need to be strong in every aspect of service provision; instead, they can focus on individual value creation steps in their portfolio.

- Higher customer satisfaction also increases the willingness to pay for a comprehensive service, which entails higher earnings for the individual providers despite the larger number of service providers.

Return to the main article: “Portals, platforms and ecosystems in corporate banking”

Success factors

As we pointed out in our second article, the institutions surveyed have so far implemented few corporate ecosystems. Similar to platforms, the idea of an ecosystem is featured prominently on many institutions’ strategic agenda. However, only few institutions actually initiate the conceptual design and implementation of an ecosystem in banking. This makes it even more important to focus on factors critical for success at an early stage.

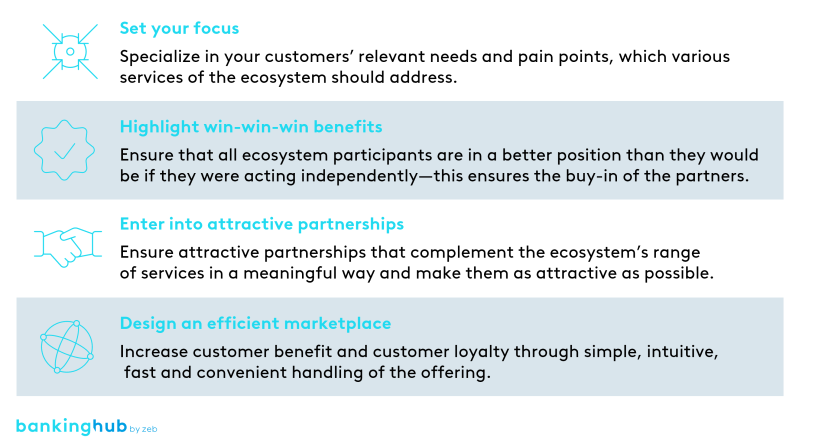

- Setting your focus: an ecosystem should focus on relevant customer needs around which the bank can orchestrate multiple, mutually complementary services. By combining different services, they can thus dissolve the pain points perceived by the customer.

- Highlighting win-win-win benefits: all participants (orchestrator, partners and customers) in the ecosystem must be in a better position than they would be if they were acting independently—this ensures that the partners buy in and the customers use the ecosystem to solve their problems.

- Entering into attractive partnerships: the orchestrator must initially win a sufficient number of “suitable” partners, who have an attractive offering and who complement the orchestrator’s range of services and those of the other cooperation partners in a meaningful way. In the later stages of the process, they should also make sure that they acquire further complementary partners.

- Designing an efficient marketplace: the offering itself must be simple, intuitive, quick and convenient to obtain and use. This increases active use by customers and producers and contributes to their retention in the ecosystem.

Process model

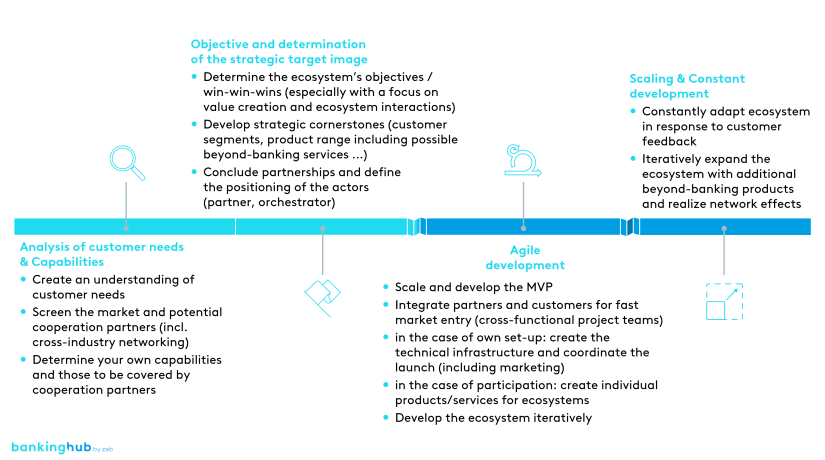

The development of digital ecosystems, especially for corporate customers, is still in its infancy in the German speaking countries’ financial sector. In future, however, we expect banks to be able to serve complex needs outside their core competencies, i.e. as a beyond-banking service, by integrating a wide range of partners. We recommend the following four steps for a successful implementation:

- Analysis of customer needs & capabilities: a focused, customer-centric business model is crucial for the ecosystem. For this purpose, banks should first identify relevant customer needs or pain points that the ecosystem could address. A thorough look at the market allows banks to assess the current market offering, potential cooperation partners and their respective capabilities. Finally, they should gain transparency about their own capabilities.

- Objective & determination of the strategic target image: based on the initial analysis, banks should define their objectives, including the strategic cornerstones such as the targeted customer segment, the product range and possible beyond-banking services. In the course of this process, they should also conclude the relevant partnerships and determine the positioning of the respective players, thus creating a win-win-win situation for the orchestrator, partners and customers.

- Agile development: banks should develop the ecosystem in an agile manner by involving partners and customers. Furthermore, they have to take charge of creating the technical infrastructure and coordinating their implementation.

- Scaling & constant development: following the launch of the ecosystem, banks should constantly review the possibilities for further improvement. This includes, in particular, the integration of beyond-banking services that sensibly expand the range of services offered. To this end, they should regularly include the customer perspective in order to identify the desired beyond-banking services.

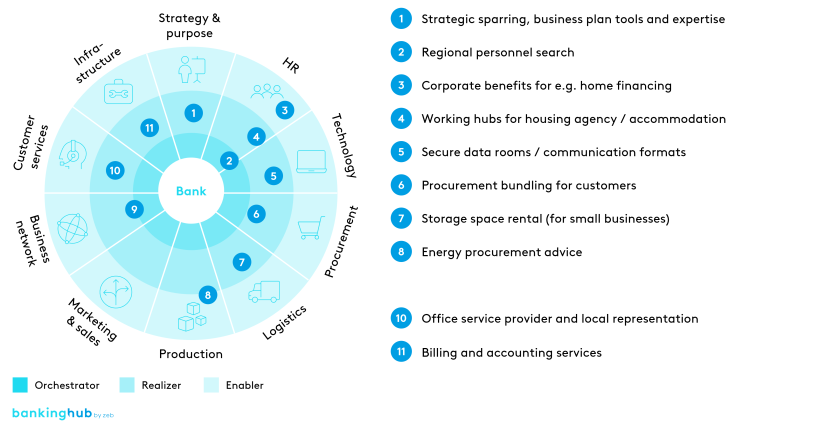

Design example in corporate banking

The zeb.CC ecosystem framework serves as an orientation for the possible design of an ecosystem. Its basic idea is to create a consistent customer experience and to serve the needs of corporate customers. For this purpose, the framework comprises ten potential fields of action that banks need to address. These are derived very fundamentally from a company’s environment and attempt to depict the relevant areas holistically and to structure them in a simple manner. In addition to classic banking knowledge, operating the topics also requires non-banking skills. For topics such as logistics, for example, banks have to develop appropriate competencies or integrate them into the ecosystem with the help of cooperation and partnerships. Furthermore, they need to achieve a critical mass in order to actually establish the ecosystem.