Executive summary

In light of the low yield environment, digitalization, intense competition and the more and more increasing regulatory requirements, banks are being put under growing pressure. With this in mind, banks are increasingly being forced to assess sustainability of their business models, based on top management KPIs. The necessary quantitative analysis and derivation of possible actions for mitigating the profit drop can only be achieved by conducting an integrated, multi-period simulation.

Changes in the banking environment

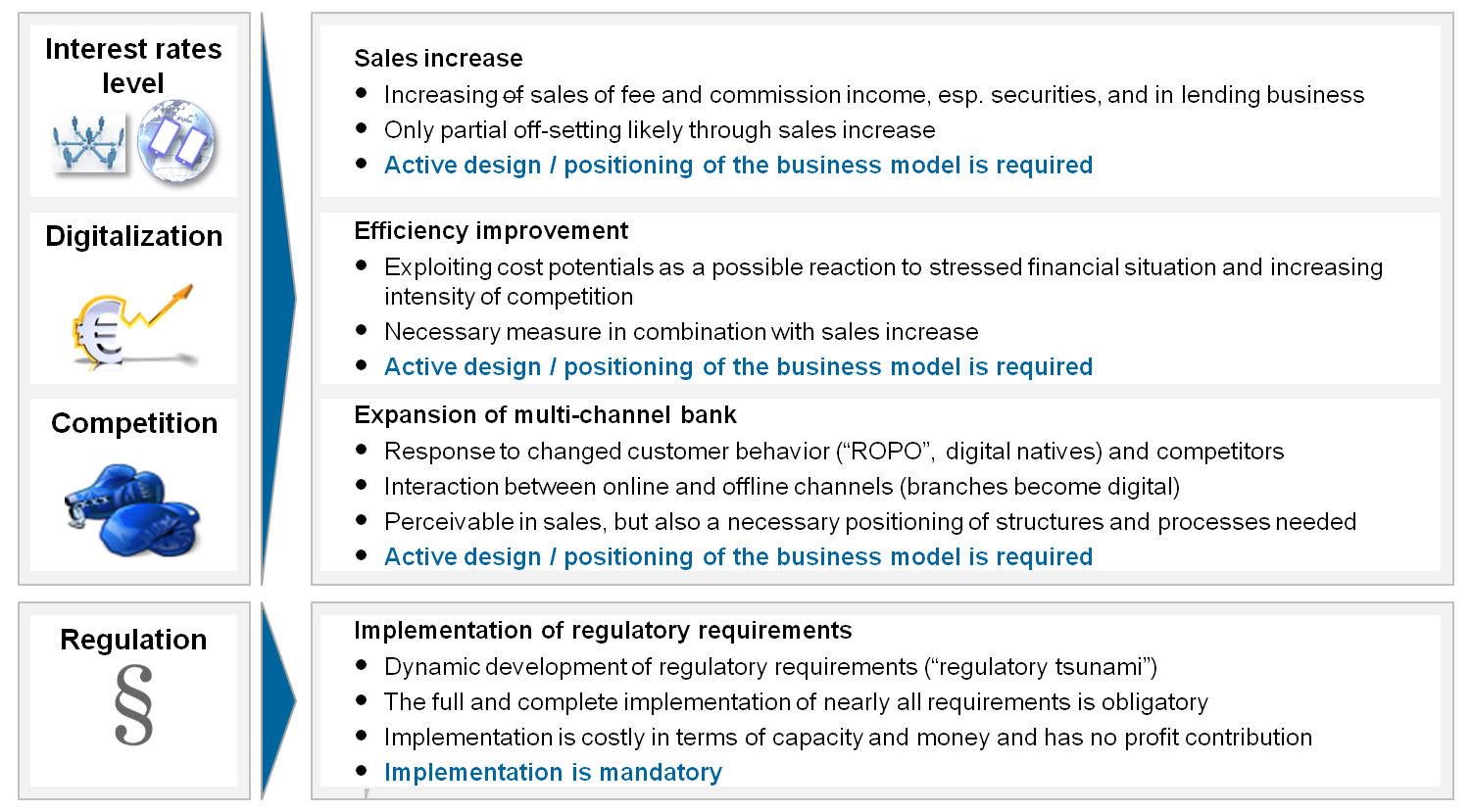

The banking industry has been exposed in recent times to increasing requirements in many perspectives and by various interest groups. Pressure for the banks especially stems from the occurrence of significant exogenous changes. Besides the historically low interest rates, digitalization and the increasing competition for customers pose the greatest challenges to banks. Further, the increasing regulatory requirements affect and might even endanger the business models of banks. Banks have to fulfill stricter requirements for capital and liquidity ratios (CRD IV, CRR, LCR, etc.) according to Basel III for example and also comprehensively document the process and advisory services in securities business according to MiFID II regulations. The supervisory authorities are shifting their focus back to P&L as a counterpart to present value. This becomes even more obvious when the German regulator requests information about earning potential in an ongoing low yield environment and sudden upward shifts.

It is clear that the described changes have a major impact on banks and their profitability and the risk and regulatory ratios. The institutions ask themselves how to react to these challenges so that their business model can be successful in the long term. To do so, there are generally many possible measures including increasing sales, improvements in efficiency and expansion of the multi-channel strategy. Regardless of this, the implementation of the regulatory requirements remains mandatory.

Integrated analysis for testing sustainability of business models

But what ensures that the business model is sustainable? Which KPIs are relevant for this purpose? And how do individual measures or a combination of various measures influence the KPIs in different scenarios?

Banks now need to ask exactly these questions. There is, however, no single, correct answer. Many institutions define top management KPIs such as minimum returns on equity, minimum dividends or maximum cost-income ratios as strategic goals as part of their business strategy. The regulatory requirements, which must be always complied with, support but also limit the institutions’ strategic goals. The challenge of integrated planning comes from combining the various perspectives of P&L-based figures, balance sheet figures and regulatory ratios. KPIs such as the cost-income ratio or return on equity for the basis scenario of medium-term planning or further KPIs such as the Basel II interest risk coefficient to the current date can be determined relatively easily in isolated cases. If however a simulation of alternative scenarios is needed for medium-term planning or for determining future figures (e.g. based on cash flow), such as the Basel II interest risk coefficients[1] or the liquidity coverage ratio, then many institutions and their current systems quickly reach their limits.

The relationship between individual, relevant KPIs will now be elaborated with a simple example. A bank is planning to expand the volume of their lending business. If everything else remains unchanged, it is easy to see that this would generally lead to higher income and with higher income, the cost-income ratio would drop and the return on equity would increase. In order to determine how much more income could be generated through this measure, the necessary funding of the loan book expansion needs to be modeled. If the additional volumes are for example funded with the same maturity, then a positive margin would cause the earnings to increase due to higher, absolute net interest spreads and the present value interest rate risk would remain identical. If the funding is not structurally congruent, then different results might occur depending on the yield curve scenario from the measure. Also the KPI for the present value interest rate risk would rise, provided the funding caused an expansion of the maturity transformation position and everything else remained the same. But what impact does this measure have on the capital ratios, the leverage ratio or the liquidity measures for Basel III (LCR or NSFR) in the next year, or—to make it even more complex—in the entire planning period? And how will the interest surplus and thus the figures that rely on it develop if the interest rates in individual periods become negative?

This relatively simple example already highlights the fact that such analyses quickly push Excel tools beyond their limits. Further, scenarios with negative interest rates currently pose a major challenge to banks in simulations of interest surplus. This all means that a coherent calculation and multi-period simulation of the various perspectives is necessary.

Integrated simulation with standard software

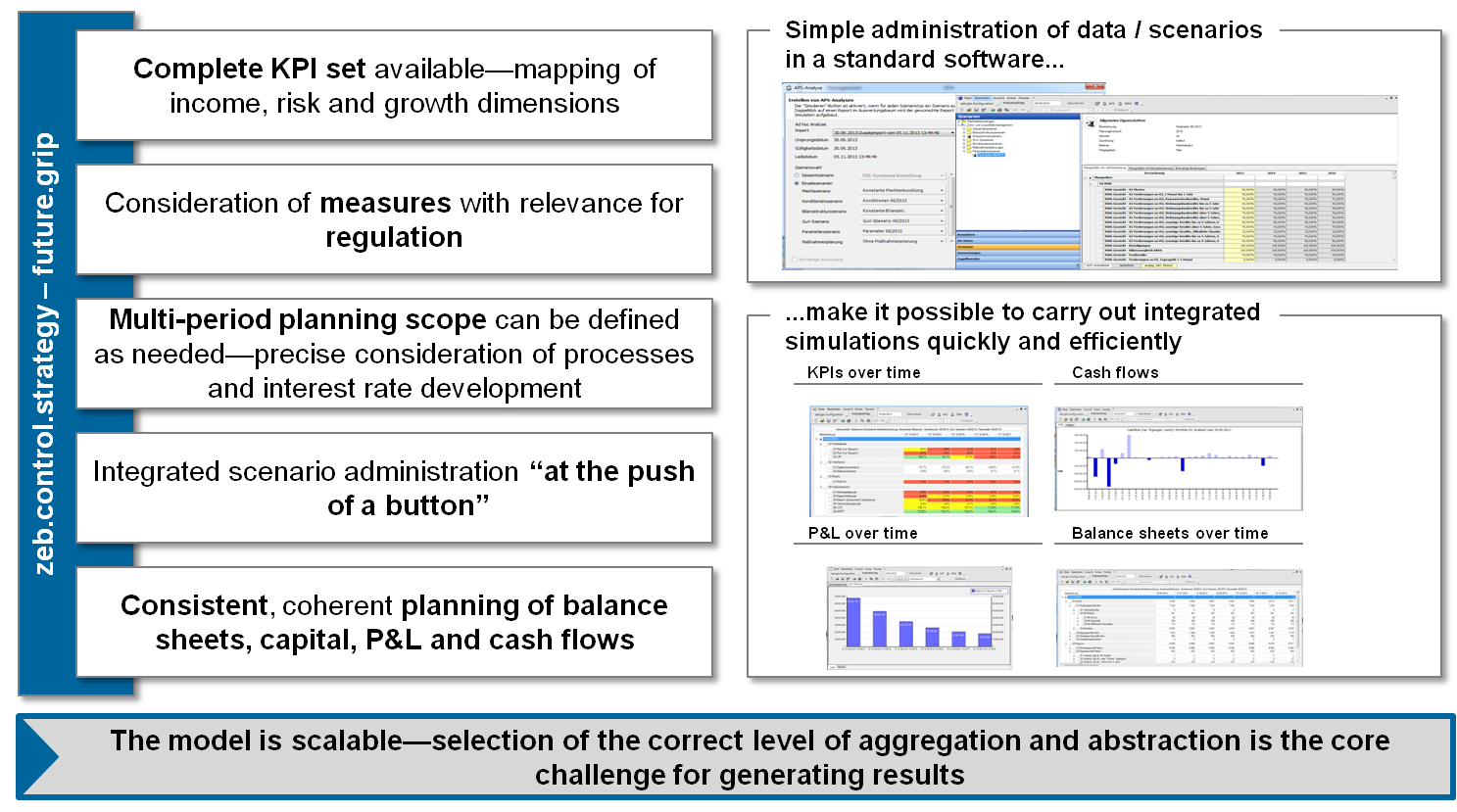

As described above, the solution is an integrated simulation of balance sheet, P&L and regulatory ratios for linking dependencies and effects. zeb.control.strategy – future.grip[2] is one example of a solution. The tool can be integrated into the existing IT and process landscape. For many institutions, there is already the possibility to use an established interface to get quality ensured data out of the source systems. The simulation is combines, on the one hand, balances and cash flows to the key date and, on the other hand, scenarios and parameters that are defined specifically per bank. In this way, both the existing data and the new business plans are incorporated into the tool. When considering the alternative scenarios mentioned above such as different market or volume scenarios, this allows the flexible set up so that the effects of potential shifts of the yield curves or alternative volume developments can be simulated on the KPIs.

Besides growth rates and important profitability KPIs, risk and regulatory key figures are also calculated for the planning period. The plan values are summarized in a KPI report, which shows for instance the common equity Tier 1 capital and the equity ratio, the Basel‑II interest risk coefficients, the leverage ratio, but also the liquidity ratios liquidity‑coverage‑ratio (LCR) and net‑stable‑funding‑ratio (NSFR) in a clear, multi-period overview. If desired, a “traffic light” system can be established for the most important figures so that potential targets‑ and missed thresholds can be highlighted. For this purpose, zeb.control.strategy – future.grip can be scaled as needed in order to allow the required balance between precision and possible inefficiency.

It is important to remember that the purpose is to support the strategic planning and simulations as well as deriving respective actions for the best-possible profit contribution and not just a contrived key date observation of individual KPIs. Moreover, using planning assumptions, the relevant management measures are to be assessed using an 80:20 approach in order to derive landmark decisions for management.

Conclusion and outlook

The current situation of ongoing low interest rates and constantly growing regulatory requirements poses the challenge to banks of testing their own business model and its long-term sustainability. This requires a comprehensive check of the strategically relevant perspectives which by using existing tools and processes is currently costly, manual to a high degree and thus error-prone. The solution offers an integrated, multi-period simulation of KPIs in a standard software which allows to quantify the effects of decisions for various scenarios based on the strategically relevant KPIs at the required detail level and at the press of a button. This sets the necessary prerequisite for assessing various alternatives (such as the question of consolidation or growth, going solo or merging) as part of the strategy development and for ongoing checks and simulations. This assessment is quantitatively supported and ensures the necessary reliability in the process.