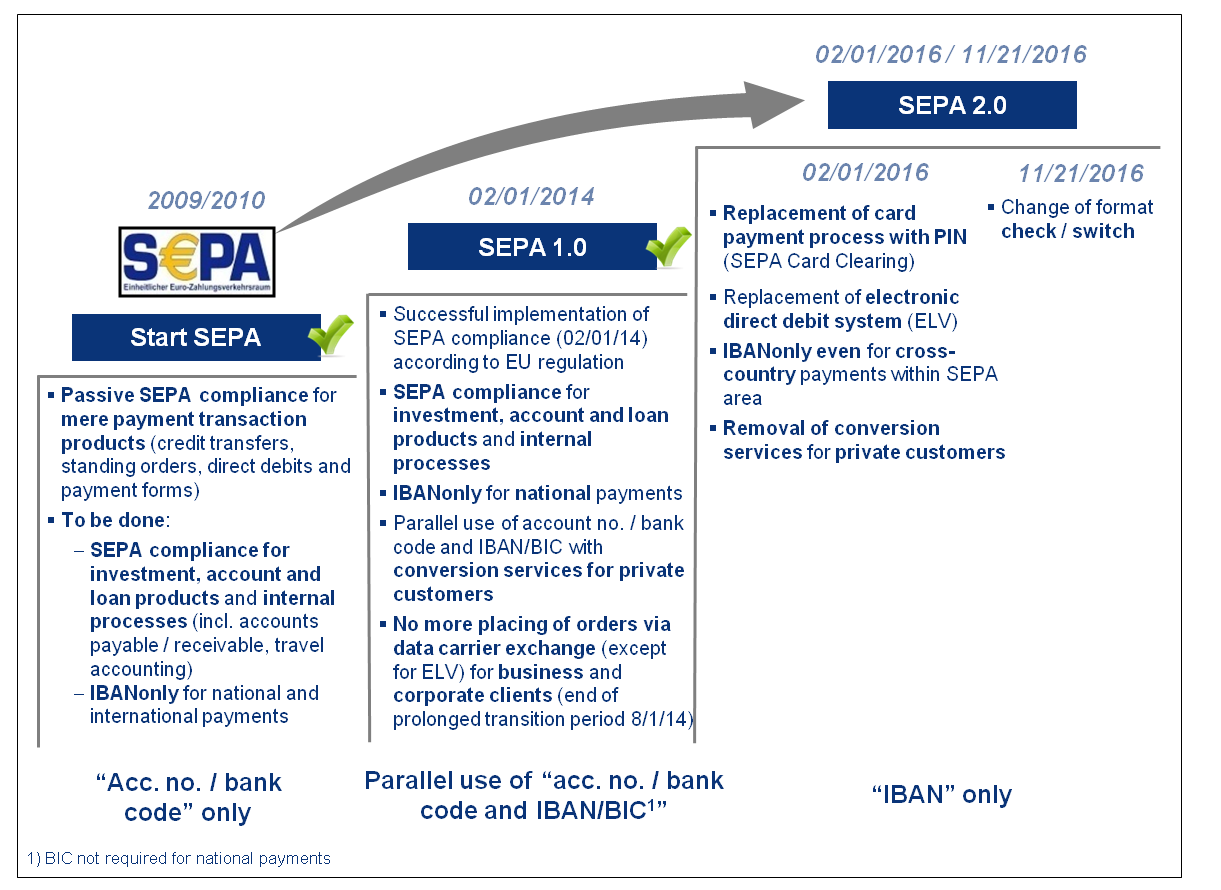

SEPA 1.0—Successful creation of SEPA compliance by 01/02/2014 and 08/01/2014

The SEPA credit transfer and SEPA direct debit as well as IBAN and BIC have become an integral part of our everyday life since last year at the latest. According to figures of the German Banking Industry Committee, the SEPA share of credit transfers accounted for 100% at the end of 2014. Insurances, utilities and associations collect their premiums and part payments exclusively via SEPA direct debit mandates. Terms such as creditor ID and mandate reference have become familiar to consumers by now. Payment transactions run without fault and efficiently as usual. Single disruptions and questions from customers are clarified in a bilateral customer bank relationship like in the past. Hence, Germany can conclude a successful completion of SEPA 1.0.

The investments required on the part of the banks in the years 2012 – 2014 have been immense. They accounted for a high six-digit up to sometimes eight-digit EUR amount per year, depending on the size of the institution. This can be attributed to the particularly high complexity of the adjustments of IT portfolio and transaction systems as well as the customer entry interfaces, the urgent need for adjustments of relevant forms and correspondence as well as the comprehensive customer communication measures in preparation for 02/01/2014.

SEPA 2.0—End of electronic direct debit system (ELV) and “IBANonly”

Stage 2 (SEPA 2.0) of the SEPA migration requires the implementation of the remaining contents pursuant to EU regulation 260/2012 as well as national accompanying laws by 02/01/2016. These comprise in particular the creation of SEPA compliance for card payments, the end of conversion services for consumers as well as “IBANonly” for cross-country payments within the SEPA area.

The conversion of card payment transactions (replacement of “electronic direct debit system” with migration of payments from DTA to XML format pursuant to ISO standard 20022) to regulation-compliant procedures is made within the SEPA Card Clearing. All submitters and recipients of electronic cash, ATM as well as money card transactions are concerned. The required work within the conversion is on schedule (conceptual design and test phase almost completed) allowing the incremental rollout to start in April. The completion of the rollout is planned for Q4 / 2015.

The transition period with conversion services for consumers will end on 02/01/2016 as well enabling the parallel use of account number and bank code as well as IBAN and BIC in domestic bank transfers. The customer then will only have to indicate the IBAN (“IBANonly”) in case of cross-country payments in the SEPA area as well (for domestic bank transfers already since 02/01/2014). The BIC will no longer be necessary. However, the BIC will still be required in interbank payments for payment transactions since it is needed for routing the payment. Payment services will have to be able to deduce the BIC from the IBAN of each country within the SEPA area. Currently, there aren’t any standardized requirements for the derivation of the BIC of international IBAN except for Germany (use of bank code file).

On average, investments in the amount of several million euros per institution will be required by 02/01/2016 despite expected, significantly lower implications for customers within the implementation of SEPA 2.0 and the related, significantly lower communication costs. This is caused by the conversion of the payment transactions for card payments to the new XML format and the comprehensive adjustments for ensuring “IBANonly” in the access, portfolio and transaction systems and processes as well as the adjustment of payment-relevant forms and documents.

SEPA 3.0—What is left of SEPA 2.0 and adjustment of “check / change”

It is to be assumed that issues of the original SEPA 2.0 scope or remaining issues will be to be implemented even after 02/01/2016 (topics originally planned for the implementation, but delayed due to budget restrictions or topics where manual workarounds are continued). Corresponding positions within the planning of regulatory portfolios are to be provided.

The conversion of the check and change clearing to the SEPA format is to be ensured after the completion of stage 2 of the SEPA migration even if it is not part of the EU regulation 260/2012. Deutsche Bundesbank rescheduled the conversion data, originally planned for 02/01/2016, to 11/21/2016 in order to prevent possible resource problems and the overlapping of planned customer test phase with the migration phase of the SEPA Card Clearing. As of this date, the check / change clearing will no longer be possible in the old format due to the cessation of the DTA transaction branch in the European retail payment transactions. The required investments (depending on the corresponding product portfolio and the underlying quantity structures) account for an average medium, one-digit million amount for 2015 – 2016 per institution according to first estimates.

Conclusion

The successful development of the SEPA conversion so far is celebrated as another partial victory on the way to a standardized European payment transaction area based on the legislative body (European and national). The advantages for customers, such as the more comfortable and secure payment transactions in the SEPA area, may as well outweigh the disadvantages, in particular the longer “account number”. Moreover, customers were hardly affected by disruptions during the conversion so far due to the efficient implementation and proactive communication by their banks.

Currently a negative understanding still prevails on the part of banks that is due to the high implementation complexity and the high adjustment and resource needs as well as the resulting costs. Nevertheless, banks have several opportunities to mitigate the budgetary implications of the SEPA migration. A temporary easing of the budgetary situation can be achieved, for example, by rescheduling / canceling single plans (as far as no EU regulation is infringed) and/or by continuing manual workarounds. In addition, many banks plan to introduce additional / increased fees for services related to high costs, e.g. processing of paper-based customer orders in order to generate additional earnings or to direct the customer to more cost-efficient procedures for the bank. Additional earnings can result thanks to extended information and reporting services which could be implemented based on an extended information transfer in payment transactions.

2 responses to “SEPA – A bottomless pit?”

Grzegorz Hansen, mBank SA, Poland

Interesting summary. However, it looks like a total standardosation in which focuses on uniformity of rules and elimination of legacy payment instruments. This may (does it?) contrast with payment systems of non-EUR EU local markets where innovation and developent happen without limits and results with creation of new and faster payment solutions: e.g. two new, competitive “immediate payment” systems in Poland (both based on UK’s Faster Payments idea). Can it be said, that SEPA in EUR-zone, bringing so much needed standardization, also slows down (by absorbing so much resources) the developement of new initiatives?

Felix Miederer

Harmonisation is the main driver of SEPA by establishing EU-wide payments standards targeting to make all payment transactions as fast, cost-efficient and safe as domestic transactions (benefiting clients). Furthermore it sets the basis for innovative payments solutions and possibilities for value-adding services, as it forsters competition.

But it is true that especially from 2012 – 2014 a lot of resources and change-the-bank budget was spent to ensure SEPA compliance, lowering the change-the-bank budget for real business development (e.g. for development or acquisition of new service offerings or new and innovative payment methods).