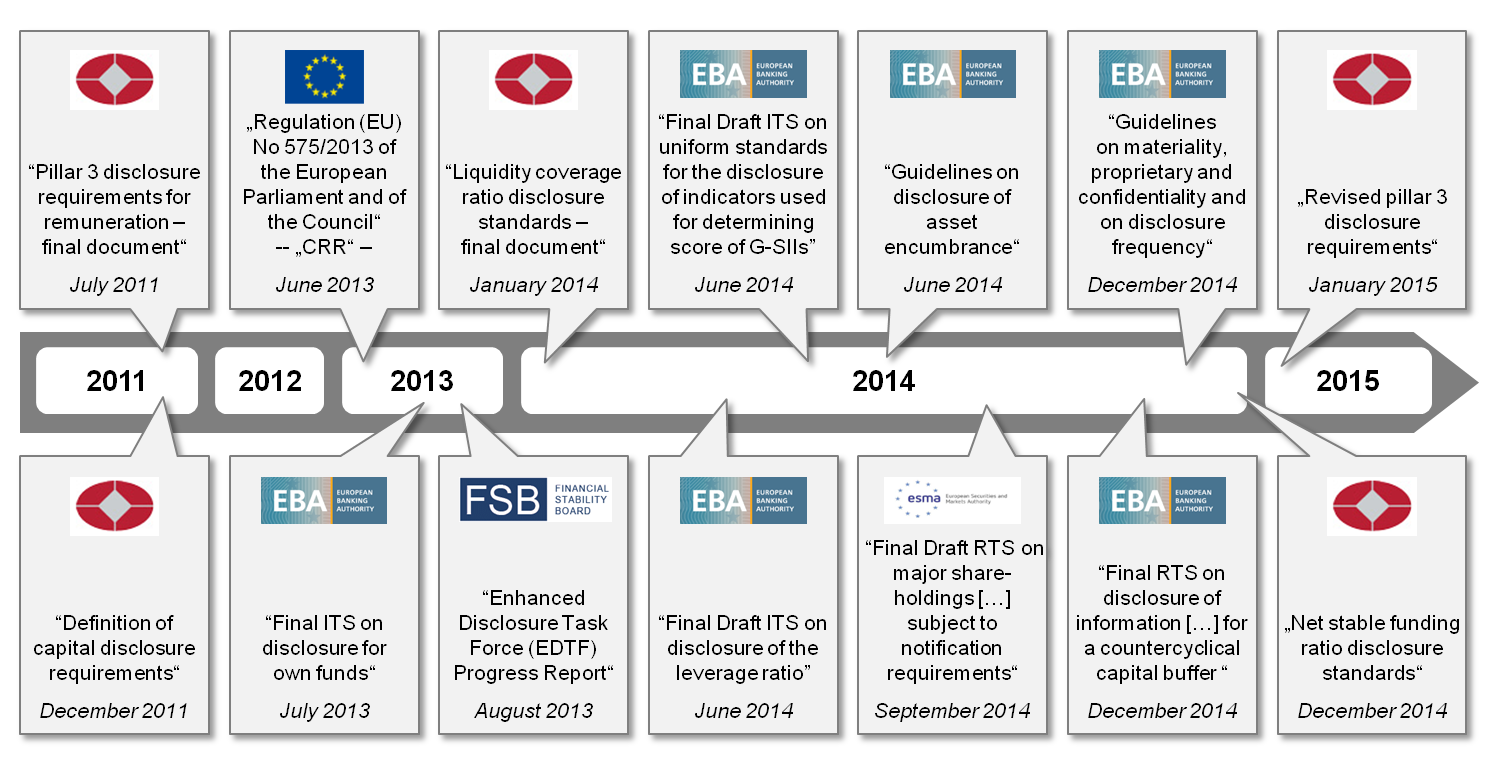

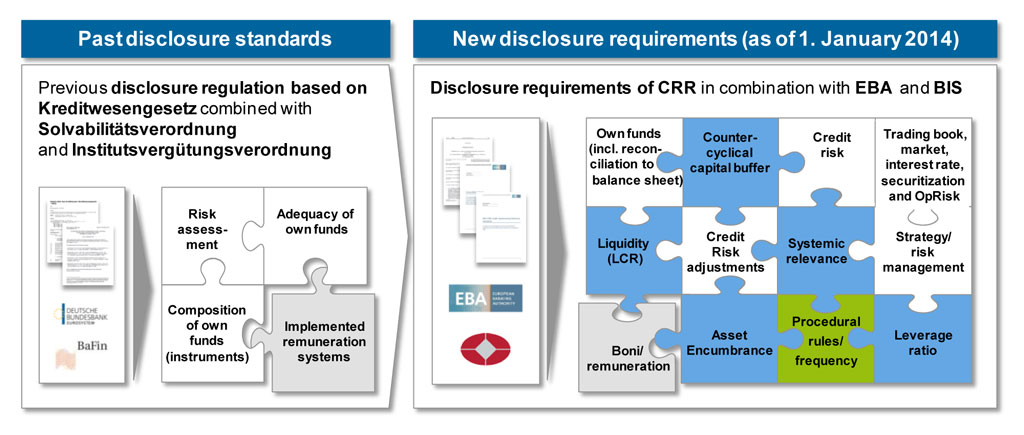

Whereas the national legislation according to the Kreditwesengesetz (KWG), Solvabilitätsverordnung (SolvV) and Institutsvergütungsverordnung (InstitutsVergV) solely addressed the disclosure of the risk assessment, the adequacy and constitution of equity together with the design of the compensation system, the new CRR requirements heavily exceed those information.

In the future detailed information regarding:

- Own funds (including a balance sheet reconciliation)

- Countercyclical capital buffer

- Leverage Ratio

- Encumbered and unencumbered assets (Asset Encumbrance)

- Indicators used for calculating the score of global systematically important institutions (G-SII)

- Remuneration policy and boni

In addition the application of materiality, proprietary and confidentiality with respect to the information to be published has been specified and the frequency of disclosure has been defined.

Along with the increased functional disclosure requirements for institutions the EBA introduced new comprehensive table- and reporting-like schemes which have to be filled with data and published for the purposes of the disclosure report by institutions. These requirements are extensive and lead to noticeably increased technical and procedural efforts when preparing the report. This in return begs the question: Are the increased requirements simply about the level of detail necessary for market participants to assess the risk profile of institutions intensively or is there a sheer incomprehensive and unmanageable information flood for external recipients and the institutions themselves about to be created?

By putting the following topics in the spotlight the answer to this question shall be given:

Own funds – A drastic enlargement of the disclosure volume

With the publication of the regulatory technical standard regarding the disclosure of own funds from the 20th December 2013 the European Banking Authority provides institutions with 3 major components to publish their own funds situation:

- Reconciliation to the balance sheet

Definition of methods for reconciliation between balance sheet equity resulting from the applied accounting standard and regulatory own funds according to CRR

- Own funds disclosure

Breakdown of own funds – including the amounts resulting from the transitory period described in the CRR – into own funds instruments, deductions and filters and capital buffers

- Disclosure of own funds instruments

Disclosure of own funds instruments divided by qualitative and quantitative information (e.g. issuer, issue price, coupon rate, ranking) for own funds instruments of Tier 1, Additional Tier 1 and Tier 2 equity

Particular importance in the context of own funds disclosure is being paid to the reconciliation methodology which requires institutions to break down their adjusted regulatory own funds situation compared to the balance sheet equity. From experience a technical as well as procedural segregation of data and responsibilities often leads to deviations between those two presentations of the capital situation.

It should, however, be noted that the extent of information to be displayed is rising: The implementing technical standard sets the scene for tables to be integrated with a fair bit of data that overwhelms some of the readers and faces institutions with huge challenges when it comes to the preparation of data. This emphasizes the existing balance act between increased transparency and an incomprehensible data flood particularly well.

Geographical breakdown of relevant credit exposures and country-specific quotas – disclosure of the countercyclical capital buffer

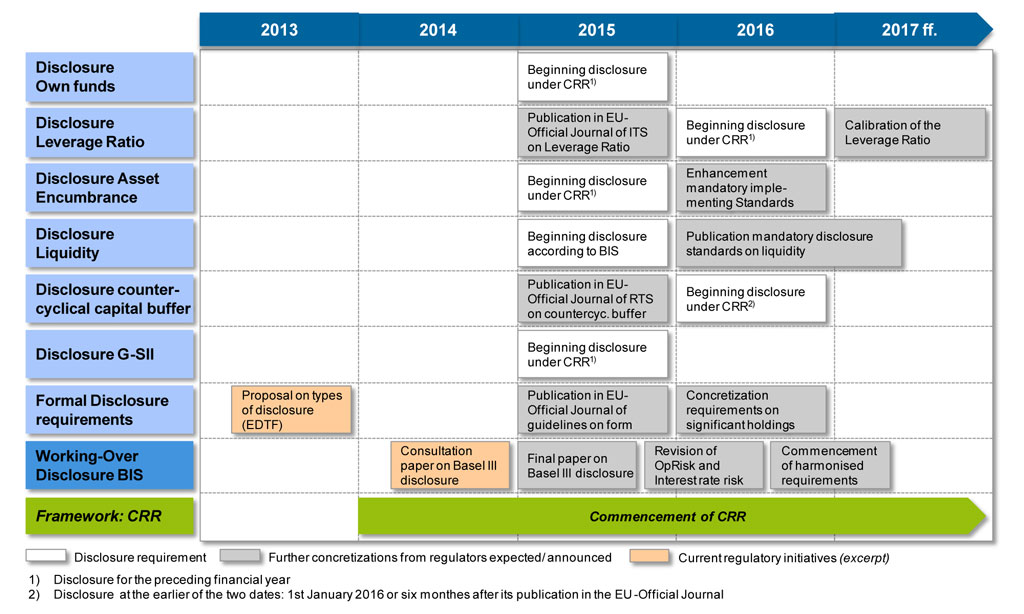

The regulatory technical standard (RTS) published on the 23rd December 2014 is dedicated to disclosure of information about the countercyclical capital buffer according to article 440 CRR und aims to enhance transparency concerning the composition and calculation of the capital buffer.

With two tables, those on the one hand break down the geographical location of the relevant exposure for each country (respectively subdivided into the applied method; standard approach or internal model method) and on the other hand show the institute-specific countercyclical capital buffer, the information necessary for understanding the calculation is disclosed on a very granular level. While the obligation to disclose these information either starts six months after the regulatory standard has been published in the EU Official Journal or on the 1st January 2016 at the latest, it is to be performed on a yearly basis.

For institutions this requirement means collecting information about the geographical location of relevant exposures. In doing so, the main challenge will be the availability, the derivation and the consolidation of information from different data sources of subsidiaries and consequently the consolidation on a group level.

Leverage ratio – disclosure of a risk-independent leverage coefficient

Within the final draft of the implementing technical standard (ITS) on the leverage ratio released on the 5th July 2014 institutions are required to publish four tables containing the capital essential for the leverage ratio as well as the total balance sheet sum adjusted for off-balance sheet and derivative transactions. The disclosure covers, on the one hand, quantitative details concerning the leverage ratio calculation basis and, on the other hand, qualitative descriptions of the management regarding excessive leverage and impacting factors.

An entry into force of the ITS on the leverage ratio was originally planned for 1st January 2015. However, the publication in the Official Journal of the European Union is still outstanding at this point of time. After the publication institutions may only have 20 days left until the final obligation to meet those requirements.

Through article 456 paragraph 1 CRR the EU Commission had the right to issue a delegated act regarding the calculation of the leverage ratio. The final legislative act published in October 2014 itself did not contain any concrete legally binding disclosure requirements but implicated an adjustment of mentioned requirements by a change in calculation of the ratio.

Information about Asset Encumbrance – new territory in disclosure

The EBA guidelines on Asset Encumbrance from 27th June 2014 address the disclosure requirements for institutions with respect to encumbered and unencumbered assets.

Following disclosure requirements are in the spotlight:

- Encumbered and unencumbered assets (divided into market and notional value)

- Received collateral (breakdown into collateral actually used and market value of collateral received)

- Declaration of associated liabilities which are related to collateral received or encumbered assets (carrying amounts)

- Additional explanations to the meaning of “Encumbrance”

The disclosure of values is performed at least on an annual basis. As a foundation for those values institutions shall use median values of at least quarterly data on a rolling basis over the previous twelve months. For the institutions the exceptional challenge lies in making sure that the availability and the derivation of relevant data for either reporting or disclosure is at hand. Relevant information on asset encumbrance and collateral are mostly in the hands of different responsibilities of various divisions within the institutions, so that problems regarding the granularity, the possibility of reconciliation and consistency of data may occur – also and especially in combination with already existing regulatory initiatives such as the calculation of the liquidity coefficient Net Stable Funding Ratio (NSFR).

After the expiration of one year the European Banking Authority plans to review these guidelines and transfer them into a mandatory technical standard (submission to the EU-commission is planned for the beginning of 2016)

Global systemically important institution? – Even more to disclose!

Global systemically important institutions (G-SII) are obligated by the implementing standard (ITS) published at the 5th June 2014 to disclose indicators that are used for determining the score of G-SIIs. The mandatory disclosure for those particular institutions starts at 1st January 2015.

The annual disclosure covers five categories (size of the institution, interconnectedness within the financial system, substitutability of the institute, complexity, cross-jurisdictional activity) which in turn have twelve indicators assigned to them. Also included in the disclosure is information which respectively leads to the indicator values.

For concerned institutions, that were either determined by the regulators or feature an exposure volume of over 200 billion Euro, the challenge of the technical availability of data and information arises. Also technically demanding is the preservation of consistency throughout different reports and reporting levels as well as the consolidation of data pools.

Disclosure of remuneration policy – A very sensible topic

According to remuneration policies institutions have to create a high transparency according to article 450 CRR. The fulfillment of these standards requires a categorization of employees, whose professional activities have a material impact on its risk profile, together with the disclosure of relevant information. The requirements aim for both qualitative and quantitative aspects of the remuneration policy. Besides the distribution between variable and fixed income detailed information about the linkage between compensation and success plus the performance criteria on which the entitlement to variable components of remuneration is based shall be provided.

For management and employees, who have a material impact on the institutions risk profile, the following details are required:

- Amount and forms of variable remuneration, split into cash, shares and options

- Amounts of outstanding deferred remuneration and amounts of outstanding remuneration reduced during the financial year

- New sign-on and severance payments and the number of beneficiaries of such payments

- The number of individuals being remunerated 1 Million Euro or more per financial year.

Oftentimes the remuneration policy report is published separately from the other parts regarding the risk situation that are included in the disclosure report. This practice may also be interpreted as an evidence for an otherwise emerging overload of information for potential readers.

Materiality, proprietary and frequency of disclosure – For the first time framework conditions for the disclosure report

On the 23rd December 2014 the European Banking Authority met the implementing obligation resulting from articles 432 paragraph 1, 432 paragraph 2 and 433 CRR to publish the final draft of the guidelines regarding the topics materiality, proprietary and confidential information as well as disclosure frequency.

Strengthening market discipline constitutes the primary objective for this paper: so called “Disclosure Waivers”, which shall both prevent an information overload for addressees of the disclosure report and a publication of sensible information, are up until now institution-specifically defined and often only elucidated to a minor degree. The same applies for the disclosure frequency that exceeds the annual interval according to article 433 CRR. Here again institutions may decide independently whether and at what point in time an increased frequency is necessary.

Resulting information asymmetries and in transparencies are now faced by the EBA with guidelines which provide institutions with definitions and explanations regarding material, proprietary and confidential information and moreover declare cases where information is left out to be the exception rather than the rule. In order to ensure a transparent and between institutions consistent application of “Disclosure Waivers” there has to be an indication along with a rationale when leaving out information. Furthermore institutions have to provide more general information instead of the left out proprietary/ confidential details. The disclosure frequency is assessed based on indicators such as the relative size of the institution in its country of domicile, total balance sheet assets or the overall risk profile. Fundamental information (for example for the own funds structure or for the leverage ratio) have to be published more than annually when fulfilling the indicator requirements.

The requirements regarding the materiality might help to reduce the amount of information in the way that information assessed as irrelevant by the institutions themselves may be waived. Flooding the reader with information containing little to none significance shall therewith be avoided because the left out data in fact lessens the volume of the report but doesn’t lead to a biased comprehensive picture of the institutions risk profile.

Taking a look into the future…

An evaluation, whether or not the described disclosure requirements increase the overall transparency and thereby make for an enhanced comparability or overwhelm the addressees by producing an incomprehensive data flood, is certainly dependant on the information needs of the readers. Nevertheless the disclosure volume undoubtedly increased by a fair margin, so that a general interpretation regarding the added value isn’t as easy.

Considering the still to be published final concretizations or rather publications in the EU Official Journal on disclosure of encumbered and unencumbered assets, indicators for general systemically relevance, countercyclical capital buffer and the calibration of the leverage ratio there will also be a high level of momentum in the regulatory disclosure. This is even more true – besides the topics previously mentioned – for the disclosure of liquidity which hasn’t yet been mandatorily regulated by the EBA. Having said that a regulatory standard from the EBA based on the 272. paper of the Basel Committee on Banking Supervision (associated with the Bank for International Settlement, BIS, January 2014) named Liquidity coverage ratio disclosure standards is expected. Information on the Liquidity Coverage Ratio, which will be launched progressively from the 1st January 2015, will be presented in a consistent scheme in accordance with the BIS-guidelines. What’s even more controversial than the extent of information to be published is the frequency with which the Liquidity Coverage Ratio is calculated. The proposed disclosure cycle is based on data presented as simple averages of daily observations over the previous quarter. This data has to be calculated on a daily basis. A target that seems to be ambitious and considering the existing complex data structures and processing the expectations towards the implementation by the EBA are held high.

Alongside the European Parliament/ Council and the European Banking Authority the BIS also addresses further disclosure requirements for institutions. Mainly the application of Review of the Pillar 3 disclosure requirements (BCBS consultation paper 286, June 2014) is hereby in the focus of consideration. With 47 templates and tables in total an even more detailed disclosure report shall be published. The level of detail and the scope of necessary information vary depending on whether the structure is fix or variable. Apart from the depth of information the disclosure frequency increases equally up to a quarterly basis.

If the passage of the guidelines from the BIS happens as advised in the consultation paper, institutions look forward to a variety of new documents to publish with a significantly increased frequency. All in all the different initiatives and publication drafts from the EBA and the BIS reveal one thing: The required extent of disclosed information increases and the danger of a potential “data flood” for respectively through the institutions rather rises than lowers.

Conclusion

Resulting from the entry into force of the CRR and therewith extended disclosure requirements institutions face two major challenges:

On the one hand strengthened requirements demand information on a very granular level, which are at the moment not available at the institutions in the necessary depth. Particularly demanding are the identification and availability of appropriate data, because quite often the institutions need to enlarge their systems and infrastructures in order to provide the essential information. In addition the reconciliation and consistency with respect to the data pools and levels of consolidation play a major role – the interfaces for regulatory reporting are versatile but mostly remain unused. This again leads to significant data quality problems.

On the other hand procedural conditions should be matched to the new regulatory requirements. Responsibilities, contact persons and the time frame for preparation of some/ new topics for the disclosure report are to be settled, communicated and adequately documented. Particular attention within this context receives the institute-specific definition of materiality and proprietary and the monitoring of relevant disclosure indicators. For a lot of institutions there is also a need to catch up on already published and still to be released requirements in order to structure the report. For ensuring the clarity, completeness and understandability a restructuring and qualitative descriptions of content are moving more and more in the focus to “provide market participants with accurate and comprehensive information regarding the risk profile of individual institutions” (Article 431 paragraph 3 CRR). Related with this goal is the requirement of establishing suitable methods to make sure such information is given to market participants. Moreover this planed, ambitious regulatory agenda highlights the benefit for institutions of an ongoing and contemporary monitoring of relevant publications released by the regulators in favor of an adequate reaction to new standards.

Ultimately the enhanced disclosure requirements should not only be understood as a burden but also as a chance to entail a competitive advantage over creditors and competitors together with an increase in attractively for clients and shareholders. Because disclosure reports, in addition to the financial statements, are more and more perceived as an important source of information for stakeholders. A comprehensive, clearly structured and the regulatory requirements fulfilling disclosure report suggests a professional appearance which with respect to the aimed comparability between institutions may add noticeable value.