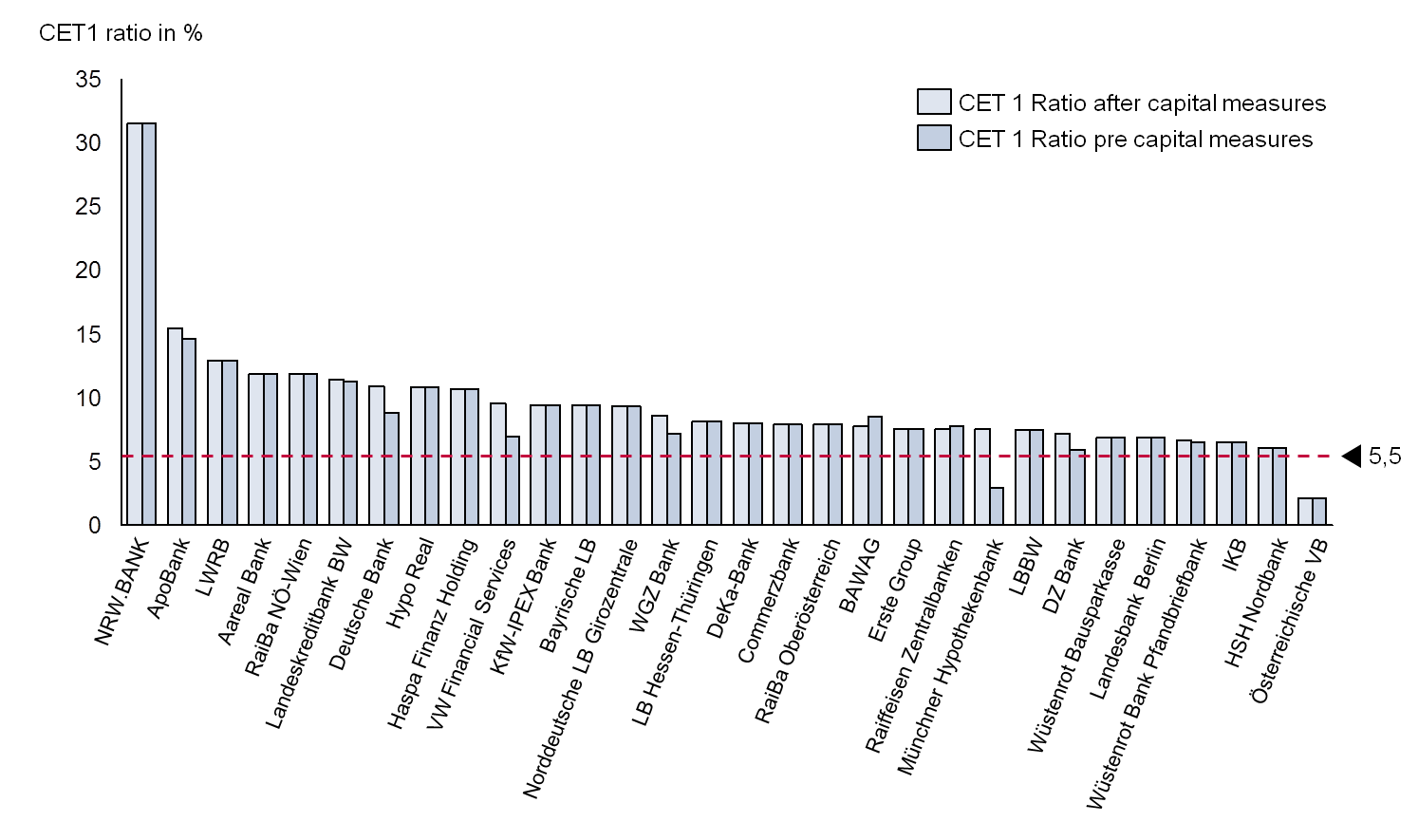

Stressed CET1 for German and Austrian banks

The observation above is illustrated by figure 1 for the banks in Germany and Austria: taking the capital measures into account, all banks, except for Oberösterreichische VB AG, have a CET1 capital ratio of more than 5.5 % for the adverse scenario.

Digging into the data

Though public attention is primarily focused on the stressed capital ratios, we believe that the difference between actual and stressed capital ratios is interesting as well, since it provides additional insights on the vulnerability of banks and banking systems. In order to analyze the data published by the EBA we have calculated the “stress sensitivity” of bank capital requirements which is defined as the relative increase in CET1 in the stress scenario in order to keep the CET1 ratio constant.

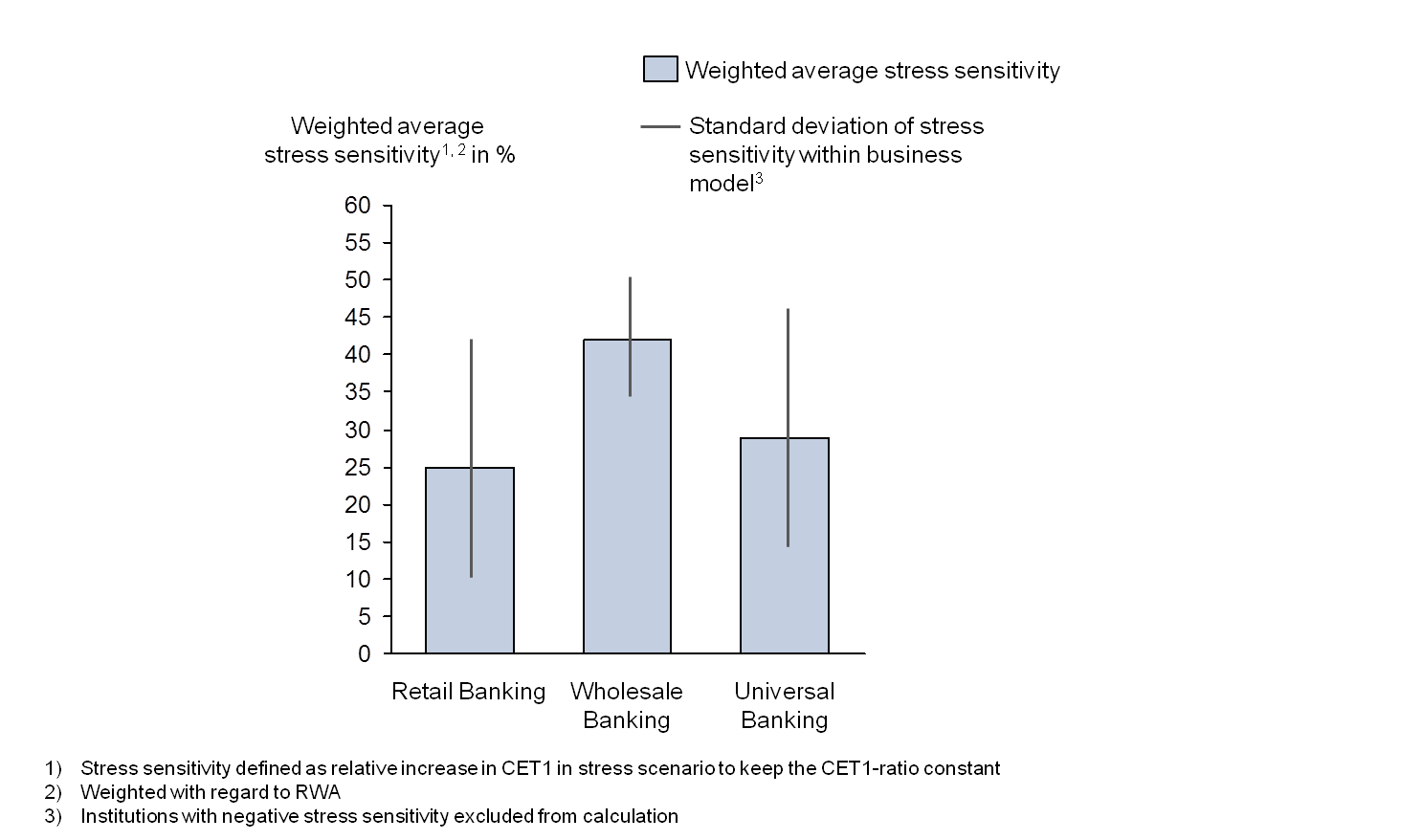

Clustering stress sensitivity by business models (based on the major source of earnings) does not yield unexpected results: on average, wholesale banks are most sensitive and retail banks are least sensitive to an adverse scenario as illustrated in figure 2; note that we have weighted the sensitivities with regard to RWA to determine the averages.

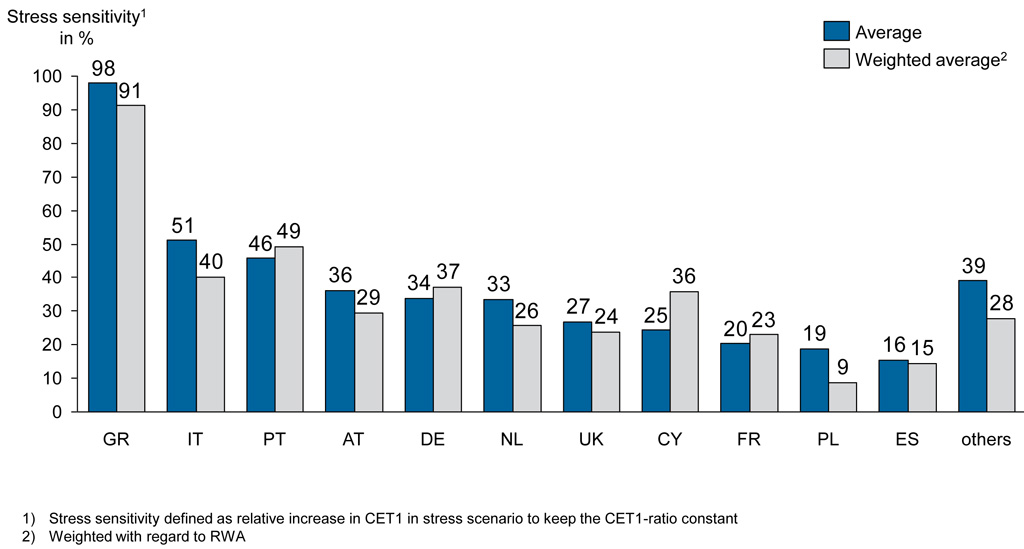

Clustering stress sensitivities by bank origin provides an additional perspective as shown in figure 3.

It confirms the vulnerability of the banking systems from Greece and Italy, the countries which account for 12 out of the 24 banks failing the stress test. Greece and Italy show high weighted average stress sensitivities (91% and 40%) compared to other European countries. Results on country-level indicate that stress-sensitivity depends on a range of determinants including general macro-economic stability, structure of the banking system, and prior efforts to clean up the banks’ balance sheets.

The trouble ahead

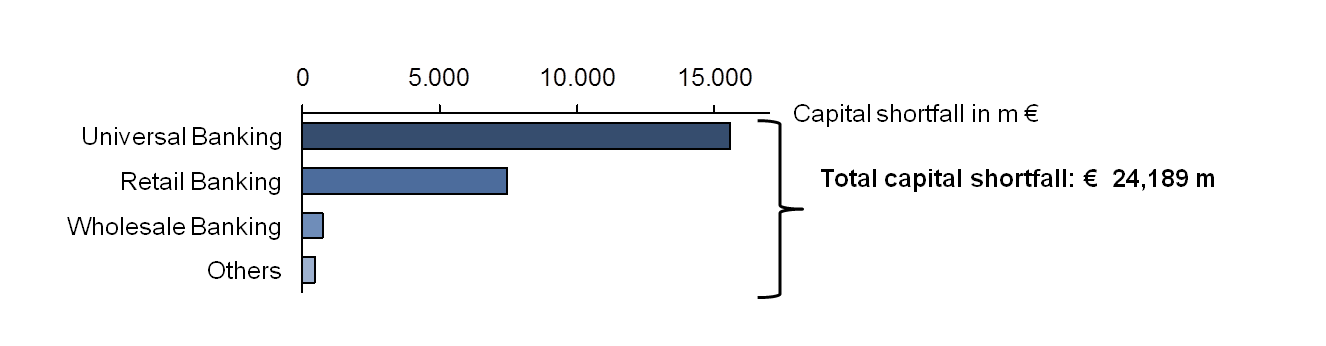

Reconsidering the overall moderate results of the 2014 stress test, the effects of Basel III have not been mentioned so far. Given the upcoming stricter regulation of Basel III, we have estimated stressed CET1 ratio under the Basel III fully loaded regime by banking model and by country in figure 4 and 5:

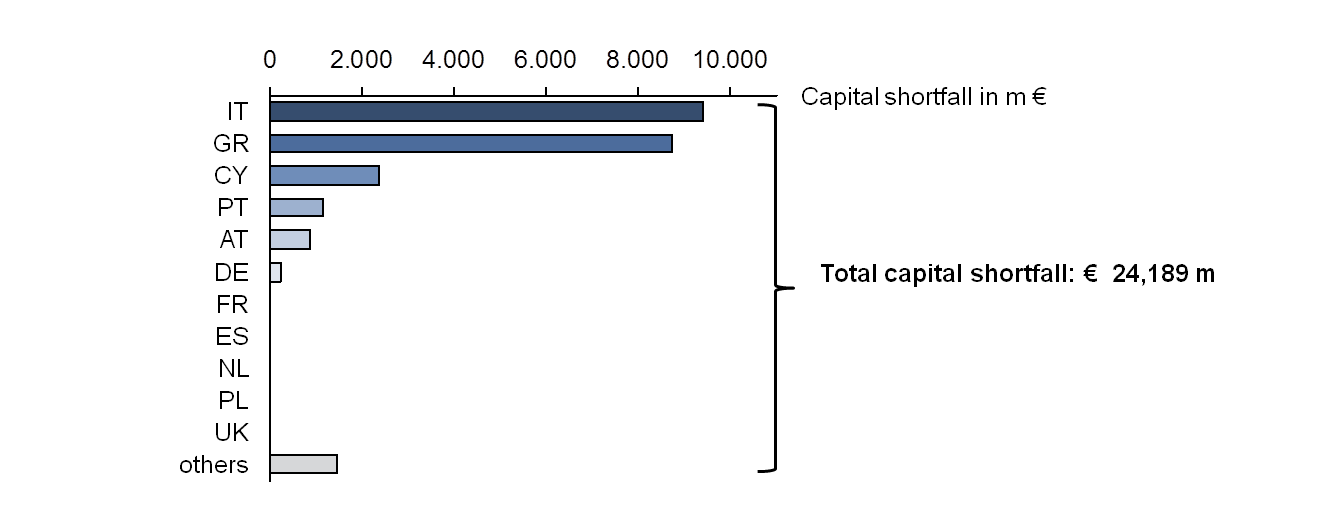

The results above indicate that capital ratios will stay under pressure and that capital management will remain on the top management’s agenda. Our analysis sheds light on where further trouble might arise going forward: Other things being equal, Southern European banks would need additional capital of more than EUR 20 billion if the stress test had been performed under the Basel III fully loaded regime (cf. figure 4 and 5). To cope with this challenge, capital managers have to orchestrate the whole range of capital management, ranging from disciplined risk taking to the issuance of innovative capital instruments.