Both MiFID II and IDD can be relevant for banks and insurance companies

if they either are product providers or distributors of the respective products.

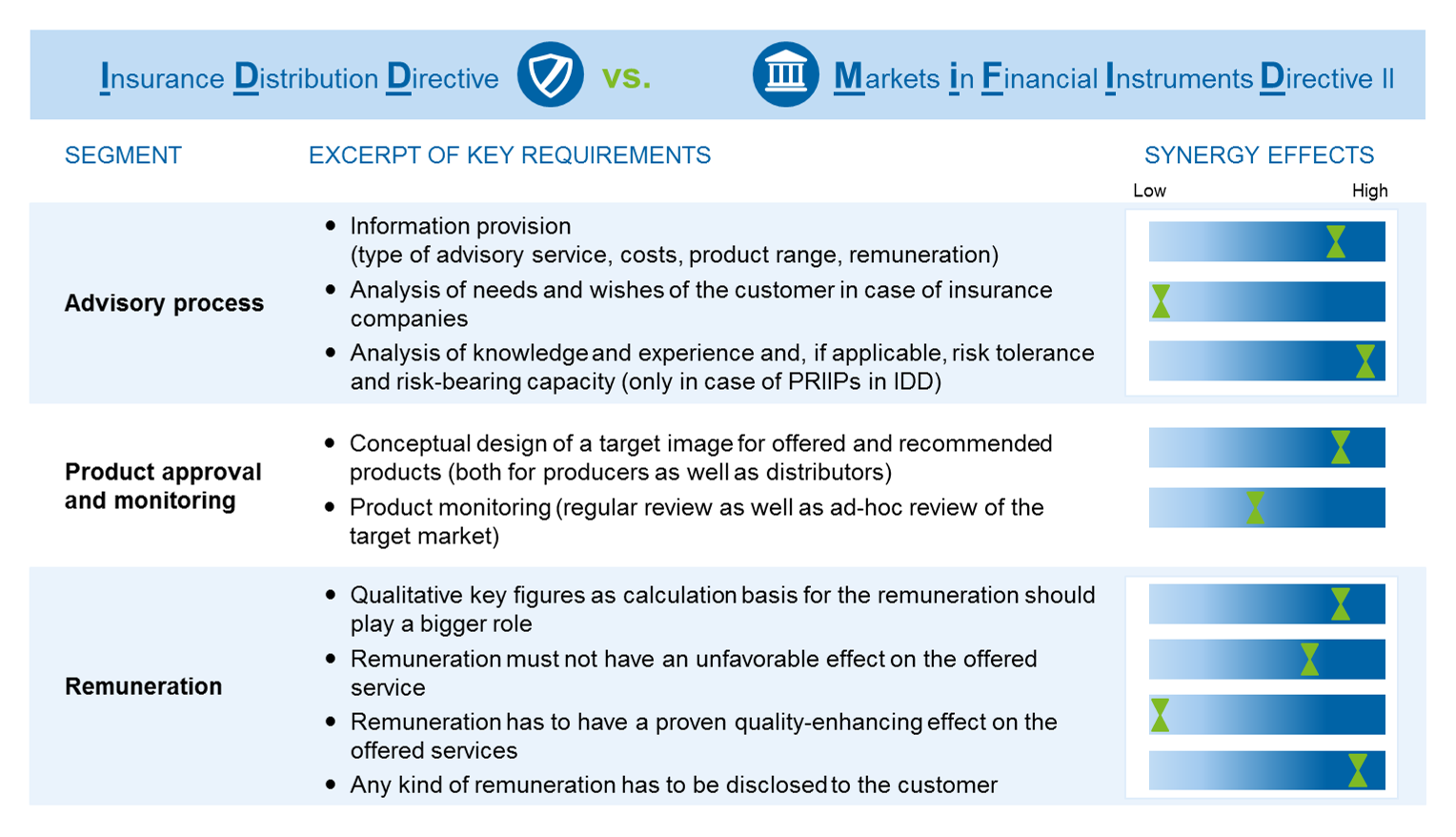

Thus, in particular the “Bancassurance” business concept is affected by both regulations which could result in major synergy effects provided that implementation projects are planned in time. This article deals with three key topics that are significantly influenced both by IDD as well as MiFID II: the advisory process, product approval and monitoring as well as remuneration. In three chapters below we analyse the parallels and differences between the regulations as well as potential room for creating synergy effects during their implementation. Due to the high relevance of these regulatory requirements for the retail business, this article only deals with requirements in this specific segment.

Advisory process

The key requirement for the advisory process in both regulations is to ensure an adequate and targeted advisory service in order to guarantee a high level of investor protection. From January or February 2018 onwards, specific information, such as on conflicts of interests (e.g. regarding remuneration), product portfolio and the type of the intended advisory service have to be communicated to the client in good time before the actual sales process, e.g. during onboarding. In addition, the product costs have to be stringently disclosed prior to the sales process – and in case of MiFID II the service costs have to be disclosed as well. If the client requests, an itemised breakdown shall be provided. It is an important part of IDD that the insurance distributor has to recognise and document the demands and needs of the client and that these demands and needs are reflected in the product selection during the advisory process. From January 1st, 2018 onwards, in case of an insurance-based investment product, the client has to be also provided with a PRIIPS KID (Packaged Retail and Insurance-Based Products Key Information Document). [1] Furthermore, the knowledge and experience as well as the risk tolerance and risk-bearing capacity of the client (in case if investment advisory services are provided) have to be analysed. At this stage the link to MiFID II is established since this regulation requires these client information as well. The client information has to be documented and bundled in the investors’ profile. This profile should take into account both regulations to not only prevent cases of liability but also use potential synergy effects.

Product approval and monitoring

The necessity to identify and recommend the most adequate product for the client during the advisory process is prominently disclosed in both regulations. The POG (Product Oversight and Governance) in the IDD provides that products have to be developed for a specific target market. As soon as review processes – which are to be introduced – reveal that a product is not sold to the intended target market or the product does not meet the needs, specifics and objectives of the clients anymore, the producers and the distributors are required to take actions. The product review processes which have to be conducted at least once a year, are a main driver for eliminating any unnecessary complex dimension from the products. Simpler products do not only lead to leaner review processes but also to reduced needs for specific trainings of the sales staff. Furthermore, a less complex product can also be advised in a simpler way and is in addition appropriate for a possible online sales strategy. The requirements for the product approval and monitoring process in MiFID II are very similar to those in IDD. Thus, it is recommendable for banks selling insurance products to unify the requirements from both regulations, for instance by taking into account insurance products and integrating their specifics already during the definition of a target market pattern. It becomes even more interesting when banks want to use tool-based solutions for these processes. A timely integration of insurance products during the specification of the requirements for such a tool can lead to significant synergy effects.

Remuneration

The primary goal of the new remuneration scheme is to prevent any conflicts of interests and thus improve the quality of services offered to clients. As a consequence, IDD and MiFID II will change the entire remuneration scheme of product vendors (banks, insurance companies and asset managers). In the future, it will not be sufficient anymore to remunerate based on purely quantitative figures, such as conversion rates or generated premiums — qualitative key figures will and have to play a much bigger role. Whilst IDD requires that the remuneration scheme does not have any detrimental impact on the quality of the service provided to the client, MiFID II provides much stricter regulations, in particular in terms of inducements. Under MiFID II, inducements in the context of the provision of investment services are only allowed if the advisory service was rendered non-independent (on the in-house product producers) and the inducement is designed to enhance the quality of the relevant service to the client. Both regulations require that all fees and benefits received by third parties have to be disclosed. As a result, the client has to be informed prior to the purchase of a product—as well as at least once a year afterwards in MiFID II—about all earnings as well as monetary and non-monetary benefits accumulated by the distributor in the context of the sold products.

Despite probably major obstacles caused by completely different systems at banks and insurance companies, synergy effects can be generated by harmonising remuneration principles of both regulations and a joint disclosure of the remuneration for insurance-based investment products as well as pure investment products towards the client.

Conclusion

Taking above mentioned reasons into consideration, banks and insurance companies will encounter diverse areas affected by MiFID II and IDD and thus it will be required to ensure their transformation in compliance with the regulations. It will result in synergy effects during the implementation of both regulations, in particular for banks selling insurance products.

After the identification of existing gaps in a first step, the key is a timely and appropriate implementation with a clear focus on sustainability—since the regulatory requirements not only entail efforts and costs, but also a huge opportunity to sustainably improve the business model and create long-term client satisfaction.

One response to “IDD and MiFID II – regulatory requierements with major impact on the business models of banks and insurance companies”

Michal

Also very interesting article on MIFID II:

https://www.linkedin.com/pulse/final-word-mifid-ii-from-fca-what-does-mean-practice-michael-hufton