What is MAD?

The Market Abuse Directive (MAD) represents a legal framework whose objective is to protect the financial market integrity and to strengthen investor confidence. A strong economic growth within the European Union requires efficient and transparent markets as well as increased public confidence, thus any unlawful behavior on the financial markets is strictly prohibited under this Directive. Such behavior includes the use of information which is not publicly available (i.e. insider dealing), improper disclosure of inside information as well as distortion of market prices of financial instruments and dissemination of false and/or misleading information (i.e. market manipulation).

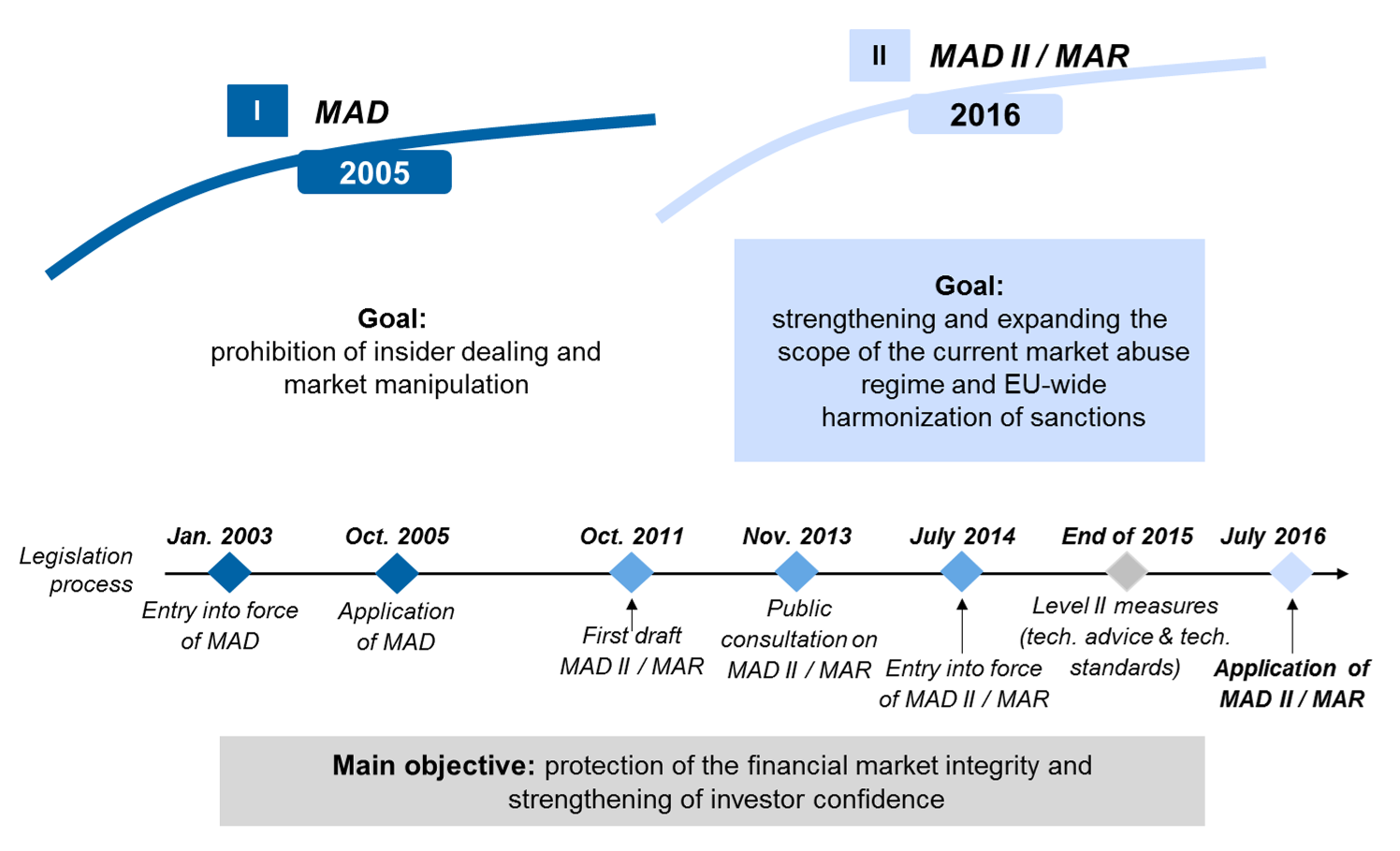

Originally adopted in 2003, the Directive aimed at preventing market abuse throughout the European Union by requiring the market participants to commit to transparency, closer cooperation and equal enforcement of the framework. Nevertheless, due to the considerable changes to the financial markets in the past few years and the new forms of market manipulation enabled by technological developments, the original Directive was deemed outdated and needed to be replaced. The figure below illustrates how the legislation process related to MAD evolved in time.

MAD II

In 2014, the Market Abuse Regulation (MAR) and the Directive on Criminal Sanctions for Market Abuse (CSMAD) were published in the Official Journal of the European Union and became applicable for all Member States on July 03, 2016. They replace the former Market Abuse Directive and are known as MAD II.

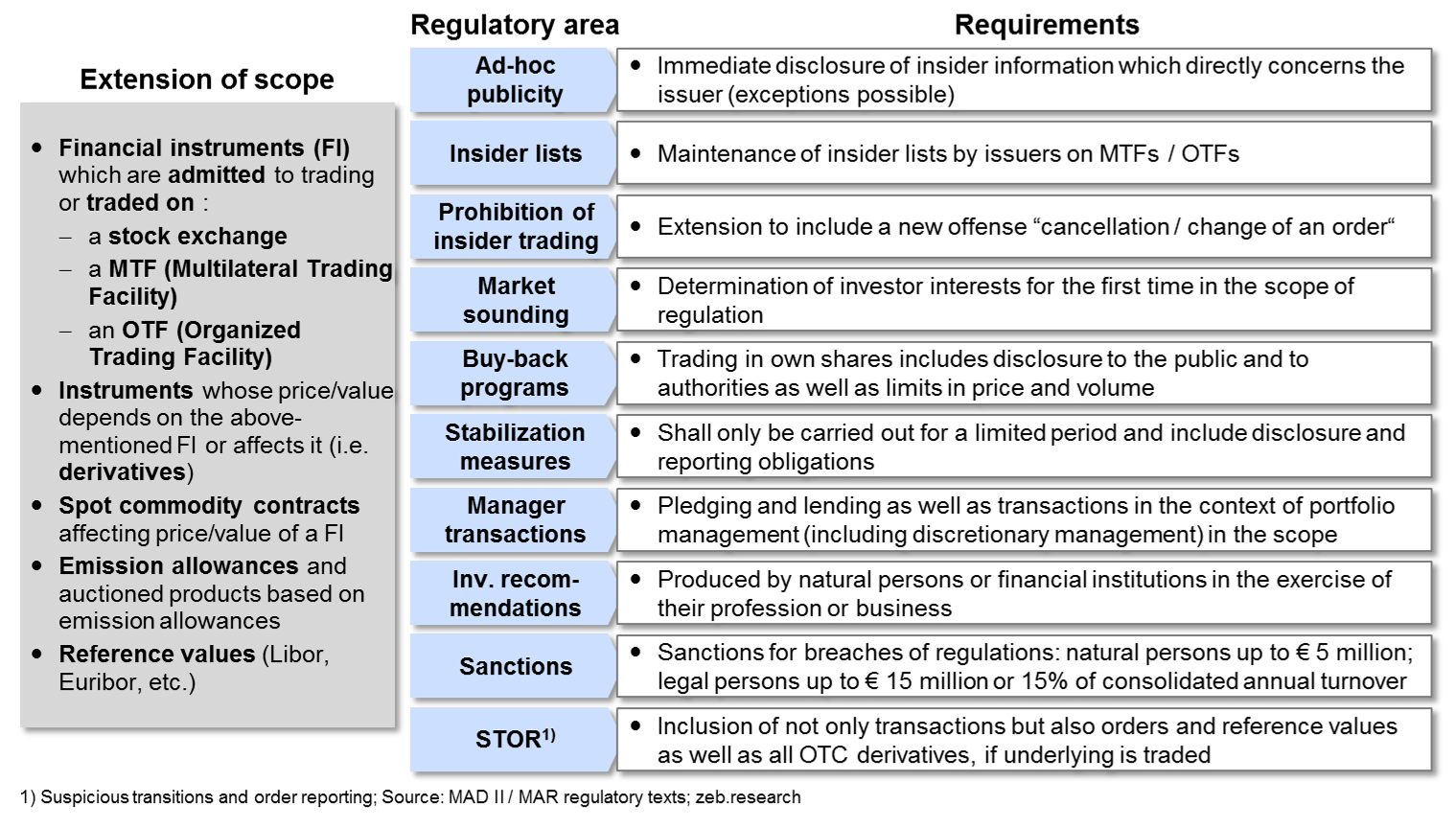

The purpose of MAR is to reinforce market integrity and investor protection by extending the scope of the current market abuse regime and by introducing new rules and regulatory areas. For instance, MAR doesn’t only apply to financial instruments traded on a regulated market, but also to those traded or admitted to trading on a multilateral trading facility (MTF) or on an organized trading facility (OTF), as well as to instruments traded over the counter (OTC) which might influence the price or rate of the financial instruments and commodities covered by the MAR definition. Moreover, manipulation of financial instruments might also take place outside of trading venues or just by having the intention to trade, i.e. placing orders without executing them.

Next, the scope of the Regulation covers attempted insider dealing, buy side firms such as asset management companies, manipulation of benchmarks and high frequency trading platforms as well as manipulation of commodity and related derivative markets. Finally, MAR introduces new and tighter administrative sanctions and measures, which include fines, imprisonment, supervisory measures as well as the publication of measures (i.e. “naming and shaming”).

Nevertheless, there are also some exceptions regarding the application of MAR. For instance, trading in own shares in buy-back programs or for the stabilization of financial instruments can be considered legitimate, if certain conditions are met, such as disclosure and reporting obligations, time and volume restrictions, price conditions for the stabilization, etc. In other words, an increased level of transparency regarding these two topics is required in order to not be considered market abuse.

Similarly, the CSMAD provisions include common EU definitions for market abuse offences such as insider dealing, unlawful disclosure of inside information and market manipulation, as well as the concept of liability for legal persons (i.e. legal persons can be held liable for the aforementioned market abuse offences). In addition, given the weak and heterogeneous sanctions regimes of the Member States, the CSMAD made a complementary addition to MAR by introducing harmonized criminal sanctions across the Union with regard to insider dealing and market manipulation. In other words, all Member States are now required to implement local legislation for criminal offences and to ensure that the national competent authorities have the corresponding training and enough power to enforce the law.

All in all, several regulatory areas are covered by the MAD II framework such as insider dealing, market soundings, managers’ transactions, investment recommendations, suspicious transaction and order reporting, etc. The figure below illustrates an overview of the MAD II scope and requirements.

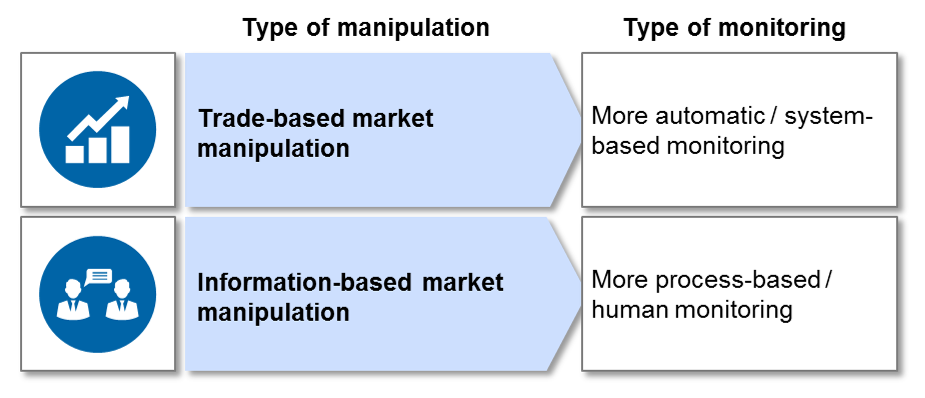

MAD II differentiates between two fundamental types of market manipulation: trade-based and information-based market manipulation, as illustrated below.

A trade-based market manipulation covers all actions and activities that send out false and/or misleading signals with the goal of using deceit to influence the prices of financial instruments in a certain desired direction. These include the execution of transactions as well as the placing, cancellation and modification of orders to trade. Detecting a trade-based market manipulation requires more automatic, system-based monitoring systems within investment firms, which can be set up based on the institution’s order and transaction business in various classes of financial instruments as well as on client, employee and market data.

An information-based market manipulation covers the dissemination of false, misleading information via media (including the Internet) or by other means. It includes the sending out of false, misleading details or data about a financial instrument or reference rate. In this case, investment firms need a process-based, human monitoring in order to detect this type of market manipulation.

Conclusion: challenges for the MAD II implementation

The implementation of the legislative framework is twofold. First, it concerns the MAR policies whose requirements need to be fully met by the financial institutions. Second, it includes the setup of an IT-based surveillance system for the prevention, detection and reporting of the suspicious orders and transactions (i.e. STOR software solution). In the Implementing Regulation (i.e. Level 2 measures), ESMA offers specific guidelines for the implementation of the Market Abuse Directive. Nevertheless, given the fact that the implementation of the framework involves almost all divisions of an investment firm and requires a comprehensive understanding of how all processes run together, it is deemed rather complex and challenging.

In order to ensure a successful MAD II implementation, the following steps need to be taken:

- Assessment of the institution’s business model

- Assessment of all orders and transactions based on risk level and complexity

- Derivation of scenarios and mapping them against the ESMA requirements

- Implementation of an IT-based surveillance system for the monitoring of the order and transaction business

- Development of working instructions for each of the MAR regulatory areas and training of the employees

While many investment firms have some kind of manual or semiautomatic monitoring for the reporting of suspicious orders and transactions, only a few institutions have in place high-level surveillance systems for the securities business. Nevertheless, there are challenges in this regard for both types of institutions. On the one hand, the challenge for the investment firms with a basic STOR solution is to create and implement a more complex and sophisticated IT-based monitoring mechanism, which is fully automated and able to generate alerts for various MAR scenarios with regard to their specific business model. On the other hand, the challenge for the investment firms with a more advanced STOR solution is to continually develop and improve it by adding more scenarios and by fine-tuning the existing ones. Thus, the goal is to have a true state-of-the-art IT-based surveillance system in place, which captures and controls the entire securities business of an investment firm.

In addition, when it comes to the organizational topics of “research and investment recommendations”, “market soundings” or “insider dealing”, the challenge for all institutions is to fully align these regulatory areas with the corresponding business requirements and to make sure that the previous MAD I and MIFID I requirements are also implemented.

Moreover, the successful implementation of all MAR regulatory areas calls for a full alignment and strong collaboration among various departments of an institution, especially the Compliance and Legal departments or the Investment Banking and the Capital Markets business units. Therefore, it is essential to create a dedicated team for the implementation of MAD II in order to ensure the best results.

Finally, as a last remark, it is important to mention that failure to comply with the MAD II requirements can lead to severe sanctions: for natural persons up to EUR 5 million and for legal persons up to EUR 15 million or 15% of the consolidated annual turnover, while severe infringements can be even penalized with imprisonment. In doing so, ESMA tries to discourage any unlawful behavior and protect the financial markets and its participants.

One response to “Market Abuse Directive (MAD II)”

Pingback: MAR And MAD Definition: The Market Abuse Regulation And Market Abuse Directive – Cab Risk