With the publication of the final draft of the Regulatory Technical Standards on Prudent Valuation (EBA/RTS/2014/06) on March 31, 2014, the final regulations for the calculation of the “additional value adjustments” (AVA) for financial instruments recognized at fair value have been determined. Their publication in the Official Journal of the EU and thus their adoption into EU law are still to come. However, the EBA expects a retroactive application of the prudent valuation already from January 1, 2014. While financial instruments recognized at fair value are at the center of discussions, the new requirements affect not only IFRS users, but also institutions using national accounting standards.

A key task of a bank’s finance division is the management and valuation of financial instruments. If financial instruments are traded on a regular basis and in large volumes, the instrument’s price is observable directly in the capital market. Thus, the value can simply be derived from the market price. Valuation becomes challenging when financial instruments are illiquid and/or not traded on a regular basis or not at all. In such situations, valuation models are applied. Depending on the quality and robustness of the model and the availability of input data or provided histories, the values calculated for the financial instruments are more or less reliable.

In case of financial instruments belonging to the categories “available for sale”, “held for trading” or “at fair value through profit and loss” under IAS 39, the subsequent measurement is carried out at fair value. In this case, the value change of the financial instrument is recognized either in the profit and loss statement or directly in equity (“other comprehensive income”). Under the provisions of the Capital Requirements Regulation (CRR), both alternatives lead to a change in the Common Equity Tier 1 capital of an institution. Especially with regard to so-called Level 3 assets, there is a certain amount of room for interpretation in the determination of the value. If the value of a financial instrument is overestimated, the regulatory capital is overstated and, thus, the solvency of the institution is not measured accurately.

Due to this correlation between the value of financial instruments and solvency, the supervisory authority attaches great importance to a “proper” valuation. For example, in the context of the Asset Quality Review (AQR), a special review of selected assets of systemically important large banks in the euro area conducted by the ECB, external reviews are carried out with the aim of achieving an external, independent valuation of financial instruments (with a particular focus on Level 3 assets). If the supervision comes to the conclusion that the valuation of individual instruments does not meet the requirements, for each instrument a corrective amount to be included in the Common Equity Tier 1 capital is determined for the purpose of the upcoming stress test. In this context, it should be noted that the requirements lie within the IFRS valuation provisions and do not go beyond these.

Prudent valuation

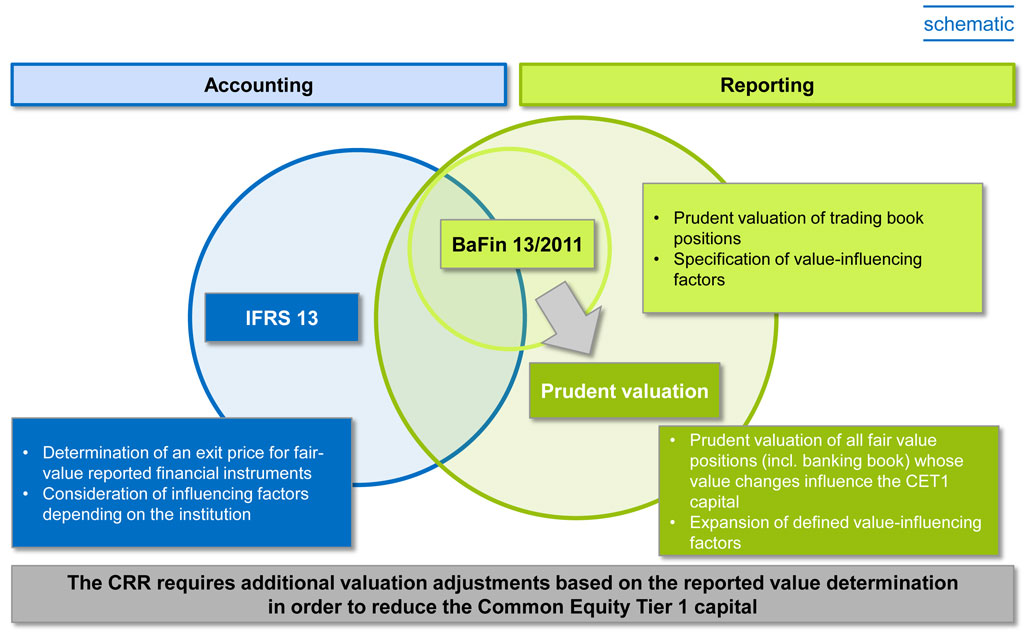

With the concept of prudent valuation, the banking supervision introduced the principle of a careful valuation of financial instruments. This affects in particular institutions applying IFRS, because these commonly use valuation at fair value; however, the application of prudent valuation is generally independent of the applied accounting standards and therefore also affects institutions applying national accounting standards, e.g. the German Commercial Code (HGB). The intention is to ensure that the solvency of institutions is not presented as being better than it actually is in consideration of prudential aspects. The concept of prudent valuation is incorporated in CRR articles 34 and 105 and requires institutions to conduct a prudent valuation of all assets recognized at fair value. If the prudent value is lower than the balance sheet fair value, the differential amount is to be deducted from the Common Equity Tier 1 capital fully and directly (no application of transitional regulations).

The requirement of a prudent valuation is not altogether new for banks. Already before the adoption of the CRR, several supervisory notices and circulars in the respective countries demanded the careful valuation of trading book transactions and the consideration of valuation adjustments for specified value-influencing factors. However, the concept of prudent valuation broadens both the scope of application and the range of value-influencing factors that have to be considered. In addition to trading book positions, transactions from the banking book that are recognized at fair value have to be considered as well; market price uncertainties were added to the value-influencing factors (e.g. in Germany the BaFin’s circular note 13/2011).

Calculation of the prudent value and additional value adjustments (AVA)

Depending on the volume of positions recognized at fair value, a simplified procedure or the basic approach for the calculation of the prudent value / additional value adjustments can be applied. The application of the simplified approach is admissible only if the total of the absolute fair values of the assets and liabilities recognized at fair value is lower than EUR 15 bn and if this threshold value is not exceeded at group level either. In the simplified approach, the additional value adjustments are generally defined as 0.1% of the determined value and subsequently recognized as a deduction position in CET1.

All positions recognized at fair value make up the body of transactions affected by the prudent valuation requirement. However, transactions where the changes in the fair value have no effect on CET1 capital may remain out of consideration. This includes exactly matching offsetting transactions, hedged transactions or transactions whose value changes have no effect on CET1 capital. Furthermore, transactions where the changes to the fair value only partially affect the CET1 capital only have to be considered proportionally in the calculation of the additional value adjustment.

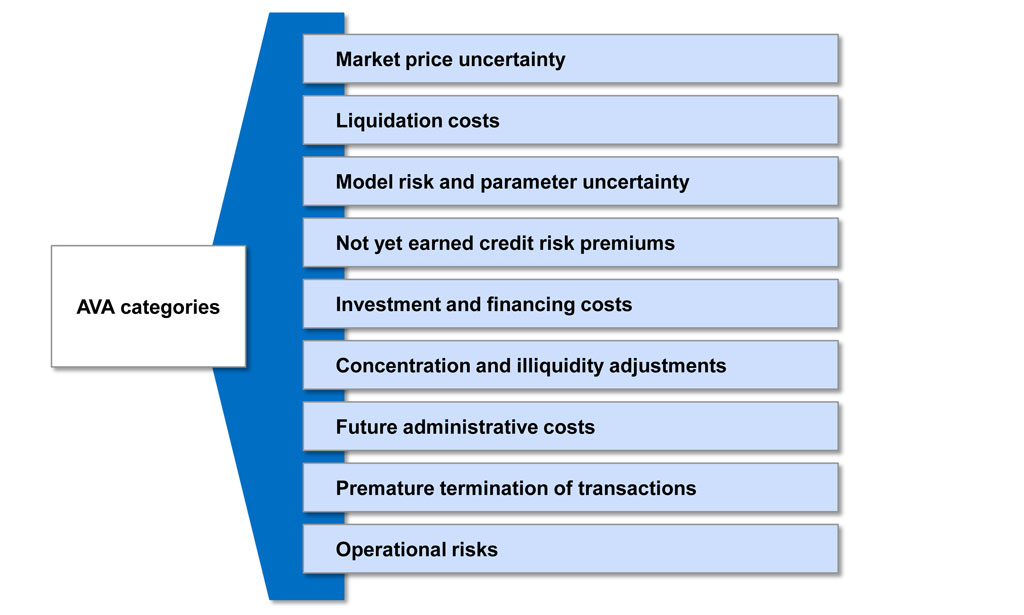

If the threshold value of EUR 15 bn is exceeded (at single institution level or group level), the application of the basic approach is obligatory. Here, value adjustments for nine specified sources of uncertainty (see figure 2) have to be calculated and subsequently aggregated following a specific logic. Value adjustments that have already been recognized in the balance sheet (i.e. which have already reduced the regulatory capital) can be set off against the additional value adjustments, provided they correspond to one of the sources of uncertainty specified by the supervision. Thus, a reconciliation of value adjustments should be carried out in order to reduce the amount of deduction.

Qualitative requirements

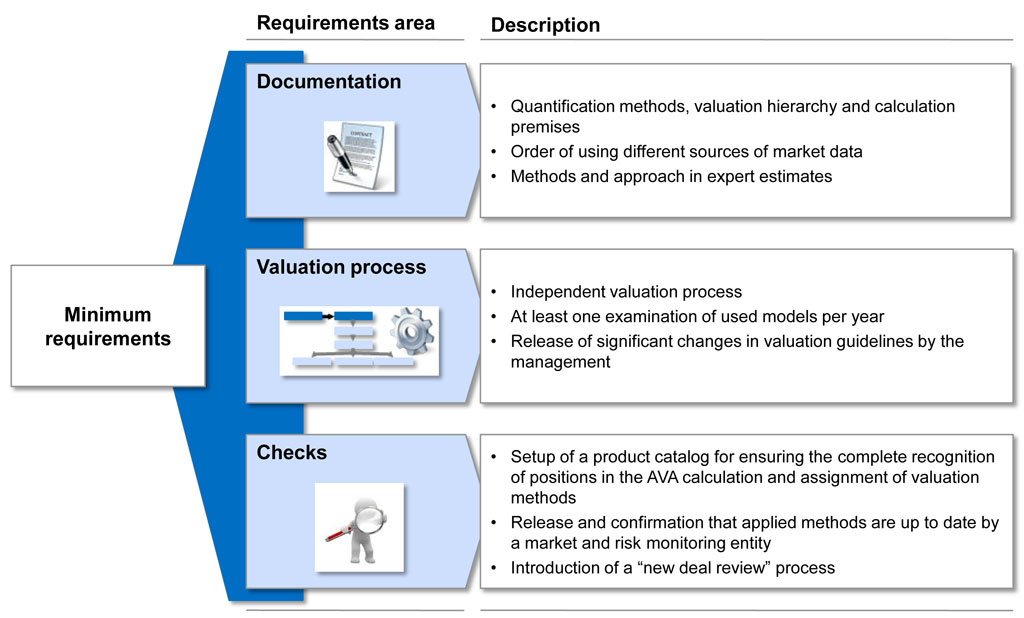

In addition to the calculation of the additional value adjustments, the banking supervision formulates further qualitative requirements for the valuation process. Alongside the documentation of the prudent value calculation procedure, checks for a review of the appropriateness of the calculation results are defined.

Integration of the prudent valuation into total bank management

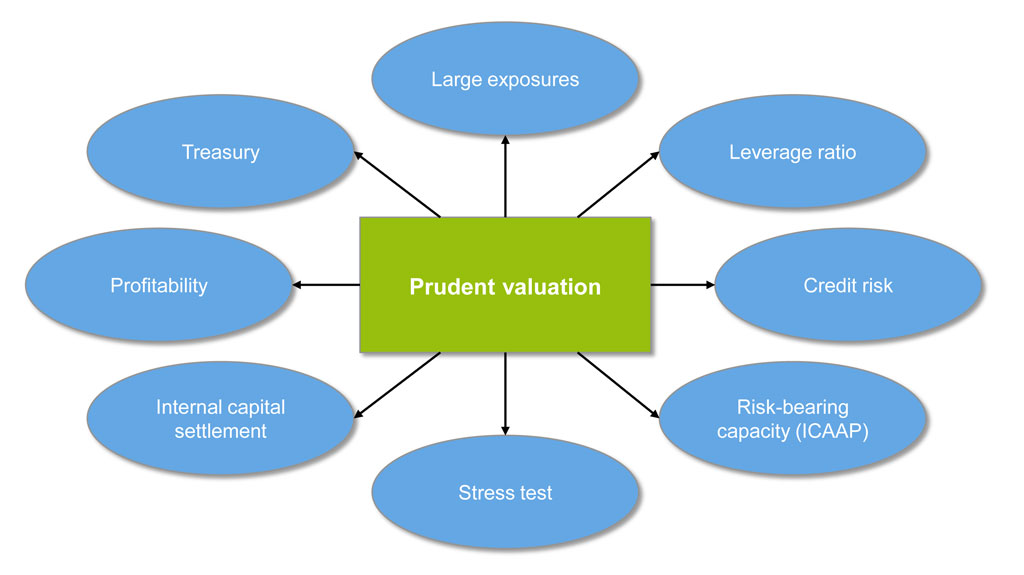

In addition to fulfilling the requirements for the calculation and documentation of the prudent value, the effects have to be considered also in other areas of bank management.

An increased deduction position from the CET1 capital leads to reduced allowable own funds. As a consequence, the limit for large loan exposures drops and additional risk positions can be classified as large exposures. In some cases, this can lead to capacity bottlenecks in the administration and monitoring of large loan exposures.

Moreover, a deduction from the CET1 capital is reflected in the capital key figure for the calculation of the leverage ratio. The positions to be deducted in the calculation of the core capital are not considered in the overall risk exposure key figure. However, the deduction has a stronger impact on the capital, leading to a deterioration of the leverage ratio.

For the calculation of the credit risk, the additional value adjustments can be offset, as a risk weighting of 1.250% has already been applied through the capital deduction. Regarding the use of the standard approach for the calculation of equity requirements for credit risks, this means a reduction of the basis for calculation. For the internal ratings-based approach, it means a consideration in the comparison of the expected loss with the determined value adjustments.

The requirements regarding prudent valuation originate from the equity requirements of Pillar 1. However, an integration into the economic risk analysis under Pillar 2 is also recommendable. In the context of a going concern analysis in a risk-bearing capacity calculation, the required regulatory capital is usually not available for covering incurred risks. Here, the additional value adjustments from the prudent valuation have to be considered as well. Furthermore, the stress-testing framework should be expanded and the effects on the valuation of financial instruments should be taken into account. On the one hand, separate stress tests could be developed for assessing the effects of different capital market developments on the regulatory equity capital. On the other hand, existing stress test scenarios should be revised, in order to ensure that the effects on the additional value adjustments are considered as well.

As the additional value adjustments are deducted directly from the CET1 capital, this aspect has to be included in the internal capital allocation and the profitability calculation. Given that the CET1 capital usually constitutes a bottleneck factor and causes the highest equity costs, a cause-based cost allocation can provide a corresponding management impulse.

Actively influencing the additional value adjustments is possible and should be included in the treasury strategy as an additional finance and risk management perspective.

Conclusion

The final version of the concept of prudent valuation was published on March 31, 2014 by the EBA and has to be applied by credit institutions retroactively as of January 1, 2014. Moreover, it is now already an assessment aspect of the asset quality review. The concept comprises quantitative requirements regarding the calculation of the additional value adjustments as well as qualitative requirements regarding the documentation, execution and review of this calculation. However, these requirements grant banks a considerable degree of discretion with regard to the implementation. Furthermore, the prudent valuation has substantial implications for various areas of bank management. Hence, banks should not aim for a mere regulation-compliant implementation of the qualitative and quantitative requirements, but should rather strive for an integrated implementation, including the effects on total bank management, in order to make the effects of prudent valuation systematically transparent and to be able to manage them appropriately.