Since the 15th of September 2008, the day the music of global finance appeared to have stopped playing with the fall of Lehman Brothers, banks have taken front and centre in the regulator’s spotlight. Already in their spotlight prior to the financial crisis, the sheer amount of legislation aimed at banks has left bankers worldwide periodically predicting the end of profitable banking due to the increased costs of compliance. Currently, the costs of compliance for banks have been estimated at up to 14% of operating expenses1 (and are set to increase2). Applied to shadow banking, even a fraction of these compliance costs could require drastic changes to business models and spell the end of the rapid growth of shadow banking. All the more reason therefore, to examine what shadow banking is as it moves into the regulator’s spotlight.

What is shadow banking?

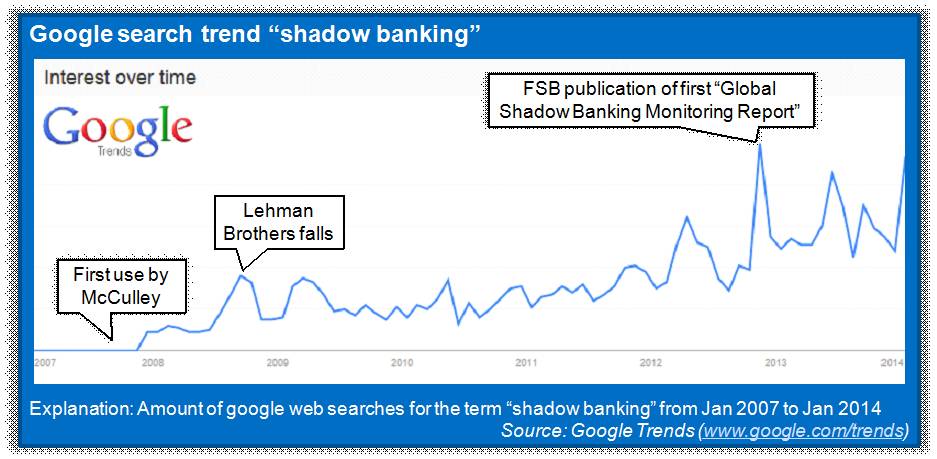

Encompassing the “levered up intermediaries [flying] below the radar of traditional regulation [and operating] in the shadows”, the use of the term has greatly increased since Paul McCulley of PIMCO first coined the term “shadow banking system” in August of 2007 (see figure 1). Instead of evoking images of shady, back-alley loan sharks, shadow banks are prestigious, well-known and rapidly growing (signalling both a high level of demand and trust). While a multitude of definitions have been formulated by business and academia, the Financial Stability Board (FSB) definition is considered paramount. According to the FSB, the shadow banking system incorporates “credit intermediation involving entities and activities (fully or partially) outside the regular banking system”.

The European Commission expands the official FSB definition to include two intertwined pillars in its definition. The first of these pillars includes five activities “outside the regular banking system”, any one of which would constitute a shadow banking activity. These activities include the “accepting [of] funding with deposit-like characteristics”; “performing [of] maturity and/or liquidity transformations”; “undergoing [of] credit risk transfers; and the “using [of] direct or indirect financial leverage”. The second pillar refers to “activities that could act as important sources of funding of non-bank entities”, prime among which are securitisation and the lending of securities as well as repurchase transactions.

One explanation for why defining shadow banking has proven so elusive is the equally difficult exercise of defining banking. Using luminated banking as a direct opposite to shadow banking may facilitate an understanding of what exactly shadow banking encompasses. Luminated banking refers to the activities performed by licensed banks, chief among which are the taking of deposits and the provision of credits – both of which are held in the bank’s own balance sheet. By contrast, shadow banking involves credit intermediation activities outside of banking regulation (i.e. without a banking license), does not involve the taking of deposits, and credits are usually not kept in the shadow bank’s balance sheets.

Shadow banking makes a daily appearance in the financial sections of any major newspaper – searching for BlackRock, Allianz Global Investors or Berkshire Hathaway results in literally millions of articles. Next to these shadow banking titans, asset management firms, ETFs, hedge funds, insurance companies, financing and leasing companies, money market funds, mutual funds, pension plans, private equity firms, bank holding companies and sovereign wealth funds are just some of the institutions involved in shadow banking.

Proponents point to the widespread use of the credit-intermediation activities provided by shadow banking as proof of its economic value and usefulness (in terms of efficiency, costs, risk diversification etc.). Not to mention, shadow banking keeps classical banks on their toes and thereby increases the innovation cycles and competition in the financial industry as a whole.

What are the main drivers of shadow banking?

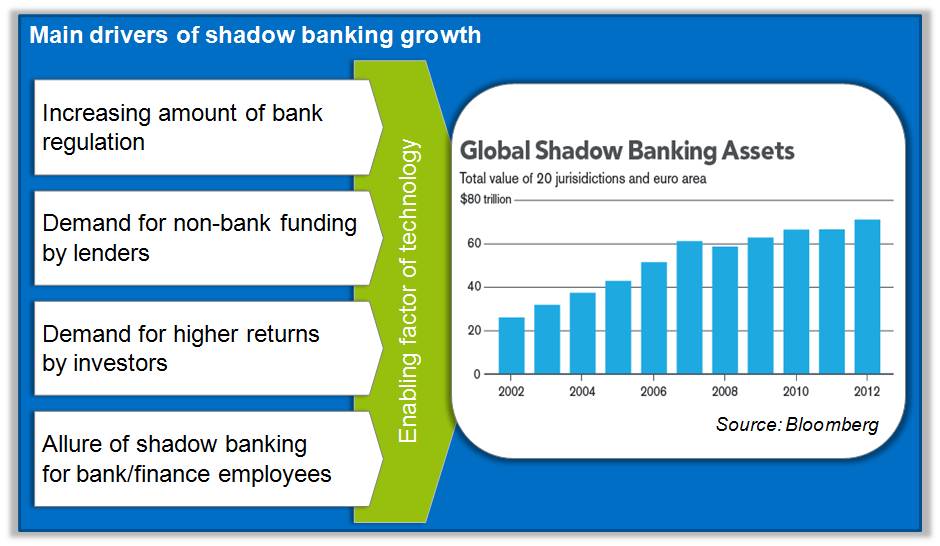

The main driver of shadow banking activities has been best put by Schwarcz of Boston University who posited that “increasing bank regulation will almost certainly increase shadow-banking demand”3. However, this regulatory arbitrage driver would be nothing without corresponding demand from both lenders and investors. Lenders appreciate the efficiency and flexibility of shadow bank loans – especially so if they cannot get funding from classical banks. Investors are lured by the lucrative returns offered by shadow banks – especially so when classical banking products are surpassed by inflation rates.

In addition to these three drivers (regulatory arbitrage, lender and investor demand), shadow banking would not have grown without the people and collective brainpower behind it. The allure of classical banking has paled in the face of arduous and complex regulation – gone are the glamorous banking days of the 80s. Instead, private equity firms, hedge funds and securitization firms have become the new “place to be” on Wall Street. This increased “sex appeal” has lead to a correspondingly high amount of brainpower and complexity behind shadow banking activities – to the extent that even Lord Turner of the UK’s Financial Services Authority warned that “any system this complex will defy complete understanding”4.

Even with the best and brightest being drawn to shadow baking activities, the explosive growth from $26 trillion in 2002 to $71 trillion in 2012 (see figure 2) could not have resulted without the enabling element of technology. Increasingly sophisticated IT-systems and better interfaces to markets have allowed shadow banks to borrow and provide funds at a rate rivalling the speed and efficiency of classical banks. The technological advances and computerization of securitization/tranching/structuring activities as well as the digitalization of capital markets has enabled the move of “work traditionally done by the banking system… to the shadow banking system”5.

Who is regulating shadow banks?

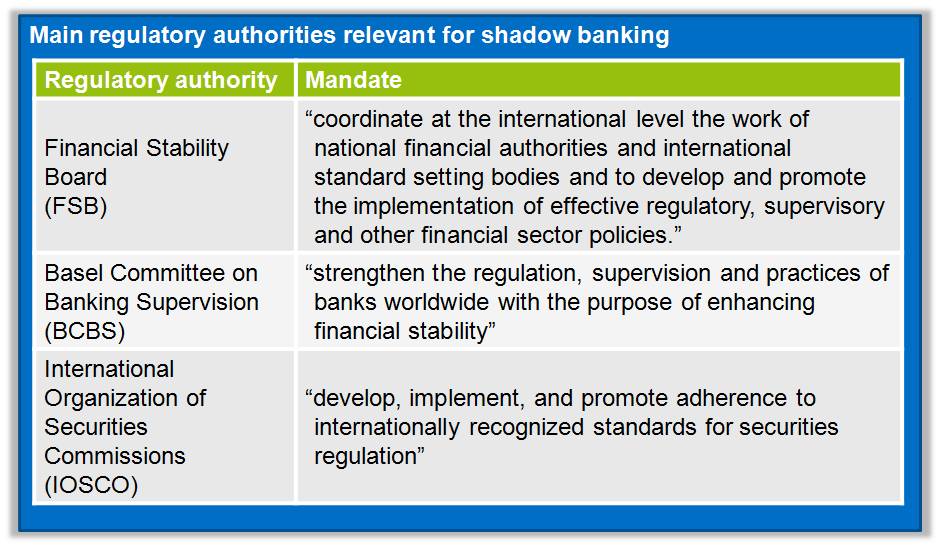

When defining the authorities involved in regulating shadow banks, there are three central international entities, the Financial Stability Board (FSB), the Basel Committee on Banking Supervision (BCBS) and the International Organisation of Securities Commissions (IOCSO) (see figure 3). So high is the political pressure on finding an international approach, that we will not focus on regional efforts such as those afoot in Europe, the UK, the United States or China.

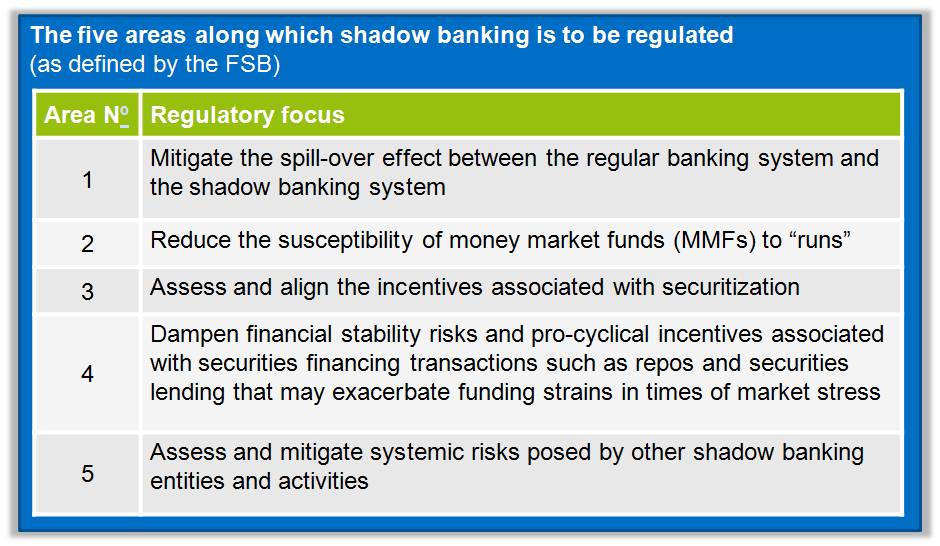

The FSB was formally tasked with developing recommendations for “strengthening [the] regulation and supervision of shadow banking” (in collaboration with the BCBS, IOCSO and other international bodies) by the G20 during the November 2010 Seoul summit. In October 2011, the FSB announced that five workstreams would focus on measures to strengthen the oversight and regulation of shadow banking (see figure 4). Over 60 in number, member institutions of the FSB range from supranational organisations (such as the World Bank or the European Commission) to the regulatory authorities and central banks of 24 countries.

The BCBS, in its role as the “primary global standard-setter for the prudential regulation of banks”, has supported the FSB by focussing on issues such banks’ equity investments in funds and international banks’ large exposures. While explicitly stating that the supervisory standards and guidelines of the BCBS have no legal force, the BCBS expects individual national authorities to implement its standards and guidelines. Considering that the world’s largest banks are headquartered in the 27 member countries, the BCBS has a very considerable and commanding influence (see e.g. the BCBS’s “Regulatory Consistency Assessment Programme”).

The IOSCO has, in close coordination with the FSB and other regulatory entities, focussed on the securitization aspects of shadow banking (e.g. hedge funds, MMFs, ETFs or ABS). As the main governing and standard-setting body of the International Organization of Securities Commissions (IOSCO), the IOSCO Board’s membership spans 95% of the world’s securities markets in 115 jurisdictions (and counting).

What has been done?

In the past, shadow banking has not been comprehensively regulated and was only affected by a first wave of “patchwork” legislation such as EMIR (European Market Infrastructure Regulation), Basel III (CRR/CRDIV), and AIFMD (Alternative Investment Fund Managers Directive). For example, the CRR (Capital Requirement Regulation) requires banks to increase the risk weighting of their exposures to unregulated financial entities (i.e. their exposure to shadow banking). In order to prevent such a patchwork approach, the current focus is on establishing rules and guidelines specifically focussed on shadow banking.

Originally focussed solely on exposures to shadow banking, the BCBS has expanded its review of the risk-based capital requirements to banks’ exposures to all funds (incl. those acting as shadow banking entities). The final suggestions as to the regulatory capital treatment of these exposures can be found in the “Capital requirements for banks’ equity investments in funds”. The rules contained therein will apply from 1st of January 2017 and will apply to all banks’ equity investments in all types of funds that are held in their banking book (including off-balance sheet exposures) – a clear indication of the political momentum behind the efforts to regulate shadow banking.

The BCBS has also released a “Supervisory framework for measuring and controlling large exposures” – all aspects of which must be implemented in full by 1 January 2019 (without any possibility of grandfathering for existing exposures). This framework aims at ensuring that “if a single counterparty or group of connected counterparties was to suddenly fail [it/they] would not endanger the bank’s survival as a going concern” and applies to all internationally active banks. The prudential regulatory approach by the BCBS is reflected in the stipulation that banks “must consider exposures to any counterparty … [except for] sovereigns”.

In addition to the binding legislation affecting shadow banks, a range of non-binding proposals/recommendations have been published by various organisations. Among the most important recommendations are the two FSB policy frameworks – the “Policy Framework for Strengthening Oversight and Regulation of Shadow Banking Entities” and the “Policy Framework for Addressing Shadow Banking Risks in Securities Lending and Repos”, both published on the 29th of August 2013. While FSB recommendations are not legally binding, the massive political clout behind these recommendations will ensure that enough pressure and effort is expended in the pursuit of a globally uniform approach, the most ambitious goal of international regulation.

Similarly non-binding and relying on implementation by national authorities, the IOSCO has published several papers on shadow banking, of which four recent recommendation papers are of central importance to shadow banking. The “Policy Recommendations for Money Market Funds” includes 15 recommendations aimed at Money Market Funds. The “Global Developments in Securitisation Regulation” includes 10 recommendations spread across three categories: “incentive alignment and risk retention”; “transparency and standardisation”; as well as a catch-all category of “further issues” which includes, among others, recommendations on accounting and underwriting. The “Principles for Ongoing Disclosure for Asset-Backed Securities” includes 11 principles meant to complement the already existing “Disclosure Principles for Public Offerings and Listings of Asset-Backed Securities”. Similarly, the “Principles for the Regulation of Exchange Traded Funds” contain 9 principles “intended to guide the regulation of ETFs and foster industry best practices in relation to these products”.

How quickly a recommendation can take on a more binding character was recently shown on the 29th of January 2014 when the European Commission adopted a “Proposal on transparency of securities financing transactions“– a proposal which contained many elements of the FSB recommendation.

Lastly, the efforts to monitor shadow banking have resulted in various public and private institutes publishing regular reports – chief among which is the FSB’s “Global Shadow Banking Monitoring Report“.

What next?

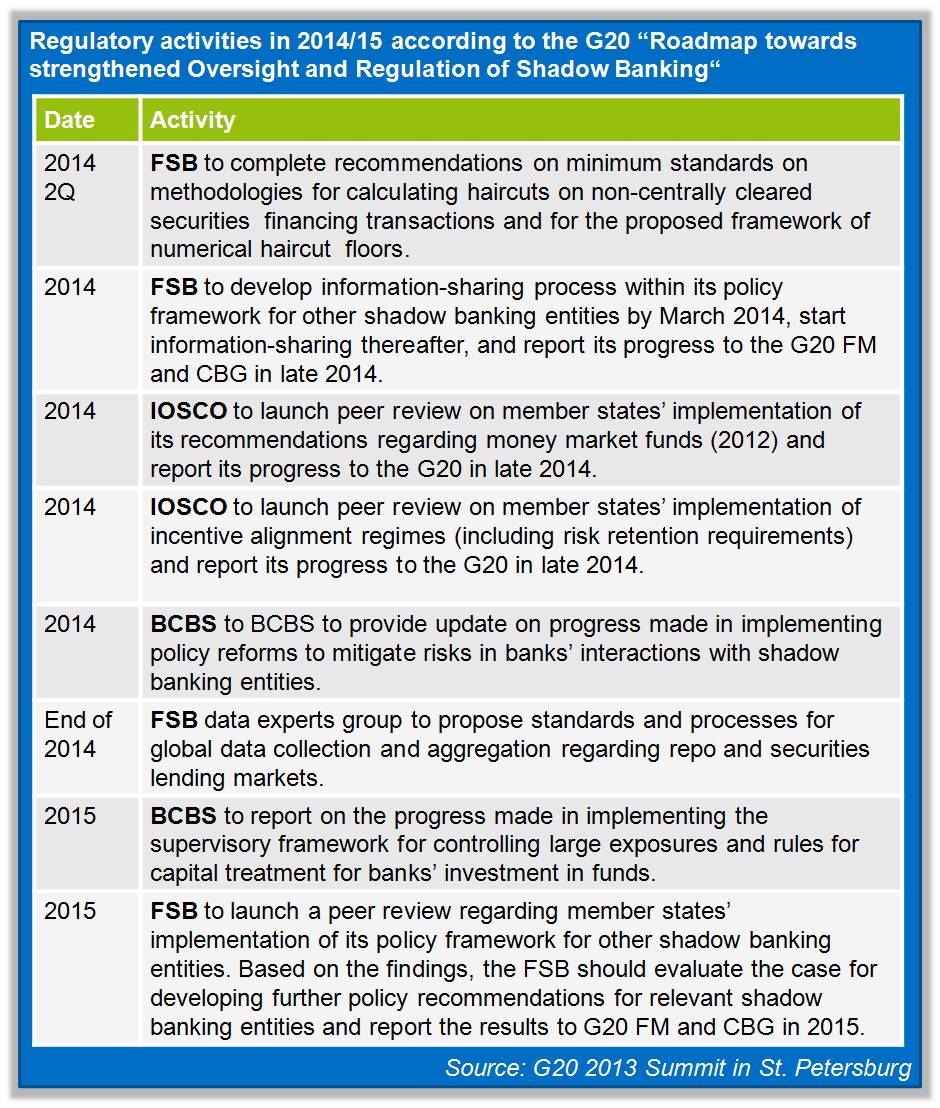

As hinted in the previous section, the patchwork approach to regulating shadow banking is being succeeded by a comprehensive, global set of rules. This international approach was set in motion by the G20 in November of 2010 and concrete regulatory actions have followed since then. The main regulatory activities of the next two years were laid out in the 2013 St. Petersburg G20 summit “Roadmap towards strengthened oversight and regulation of shadow banking” (see figure 5). Evident is that the political will to regulate shadow banking has remained indisputably strong.

Equally revealing, the IOSCO warned in its “2013-14 Securities Markets Risk Outlook” that although “important progress in managing the risks … in the shadow banking sector [have been made] … not all activates and institutions are regulated or fully understood yet” – signalling that shadow banking will remain on the IOSCO’s (and therefore on the FSB’s and BCBS’s) agenda.

How should institutes engaged in shadow banking react?

Despite differing definitions on what exactly shadow banking is and a wide variety of regulatory activities, one thing is certain: Shadow banking regulation is here to stay. Considering the political momentum as well as the sheer amount and already substantial complexity of regulatory efforts surrounding shadow banking, entities involved in shadow banking activities need to analyze the impact of existing and planned regulation on their business models. This impact analysis should cover the products and services offered and take into account the different regulatory landscapes of individual countries/markets. Additionally, individual entities or industry associations may want to take less of a reactive approach and proactively engage in efforts to shape regulatory endeavours at a stage where these are still malleable.

If entities engaged in shadow banking do not take coming regulation seriously, they may end up playing a costly game of catching up with increasingly numerous and complex regulations – one need only look at the effect of regulation on banks which have already been in the regulator’s spotlight.

Any and all questions and comments are warmly welcomed and will be answered by the authors.