Note: On February 26, 2025, the EU Commission published the so-called “Omnibus” package and other draft amendment regulations to the taxonomy. These drafts are aimed at simplifying the reporting obligations and also affect the contents of this article.

At the time of writing, however, they are still in the feedback phase. It is currently still unclear when exactly the final versions will be published, which of the proposed changes they will contain and when they will become legally binding.

Due to the high level of regulatory uncertainty, the contents of this article do not cover the current state of changes to the requirements. However, we do provide information on where changes are possible. The key issues for implementation considered in this article remain of crucial importance.

What changes will the new EU taxonomy reporting templates in 2025 bring?

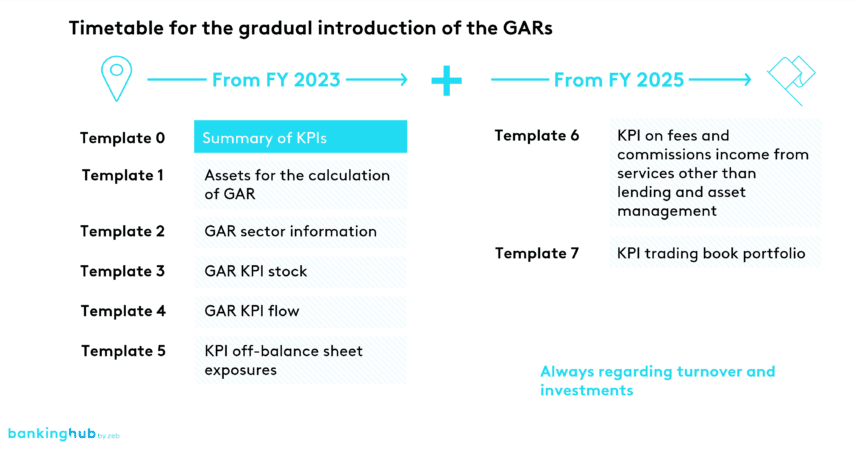

As a central component of the EU sustainable finance framework, the scope and reporting obligations of the EU taxonomy will be further expanded this year in order to further promote the planned transition towards a climate-neutral economy by 2050. Previously, banks’ sustainability reporting pursuant to the taxonomy comprised five key reporting templates, supplemented by specific templates for nuclear and gas energy activities.

From the reporting year 2025 onwards, the scope of reporting will be expanded to include two additional templates: reporting template 6 on fees and commissions and reporting template 7 on the trading book.[1] Moreover, the number of banks subject to the reporting requirements will increase significantly in 2025. Starting this year, all large companies that meet two of the following criteria are required to report: more than EUR 50 million in turnover, more than EUR 25 million in total assets, or more than 250 employees. From 2026 onwards, these criteria will be adjusted to significantly expand the scope of the EU taxonomy even further.[2]

Contrary to previous plans, the Omnibus initiative (SWD(2025) 80) could change the scope of reporting yet again, potentially making a significantly lower number of banks subject to the reporting obligations. The current proposal envisages raising the thresholds for the reporting obligation to more than 1,000 employees and a turnover of more than EUR 450 million. In addition, a delegated regulation (Ares(2025)1546172) on the EU taxonomy proposes postponing the entry into force by one year, to January 1, 2027. The first reporting year would then accordingly be 2026.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What are the concrete challenges?

Three questions on the implementation

The following three questions and answers address the main changes and challenges resulting from the implementation of the new EU taxonomy reporting templates.

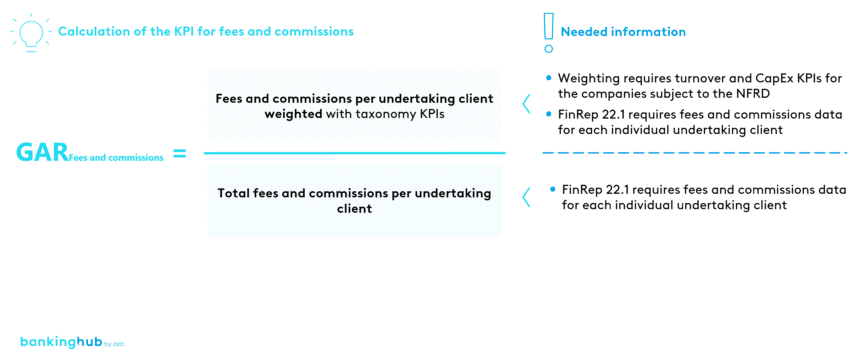

Does every bank have to fill out all reporting templates?

The taxonomy reporting templates are generally mandatory. Under current regulation, there have so far been no materiality thresholds below which reporting is not required (this could change as a result of the Omnibus initiative). In the reporting template on fees and commissions, banks must therefore disclose the extent to which their fees and commissions income complies with the taxonomy, even if the amount of relevant fees and commissions income is only marginal. They are obliged to ensure compliance with the taxonomy in terms of both the turnover-weighted KPIs and the CapEx-weighted KPIs of the counterparties from which they collect the fees and commissions. That means that they have to fill out the template twice and submit both versions.

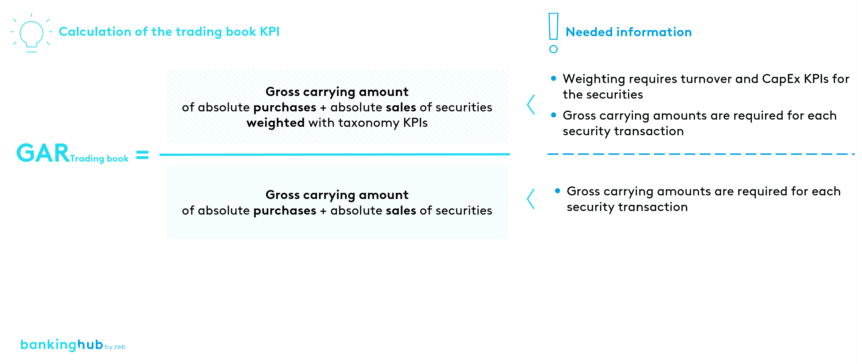

Unlike the reporting templates for fees and commissions income, the new reporting templates for the trading business only have to be filled out if the trading portfolio plays an important role for the bank. This is particularly the case if the bank does not have a small trading book within the meaning of Art. 94 (1) CRR ((EU) 575/2013), i.e. less than 5% of total assets or EUR 50 million. These banks are obliged to fill out and submit two reporting templates for their trading business: one to document the taxonomy compliance of their trading activities based on the turnover-weighted KPIs of the companies whose securities are traded and another based on the CapEx-weighted KPIs of these companies.

The introduction of a general materiality threshold of 10% in the EU taxonomy is being discussed as part of the Omnibus initiative. This would include that KPIs such as fees and commissions or the trading book do not have to be reported if they account for less than 10% of the bank’s turnover.

What are the challenges posed by the reporting template for fees and commissions?

The reporting template for fees and commissions raises two major challenges, which can be summarized in two steps. The first step is to identify the fees and commissions that are within the scope of the reporting template. In the second step, these fees and commissions are allocated at customer level.

The scope of the reporting template includes all fees and commissions income not generated by the bank’s assets under management or lending business, including fees and commissions income from custody, private banking and capital market advisory services for undertakings ((EU) 2021/2178). The challenge is to identify and differentiate all relevant income. This requires an in-depth analysis of the chart of accounts.

Once the first challenge has been overcome, the bank has to ensure that its income data is sufficiently granular, i.e. allocatable at customer level, in order to determine the data’s taxonomy eligibility and compliance. Income is often recorded in G/L accounts, which is why allocating it to individual customers is particularly challenging. Many banks need to first create a link between their customer and income data. Once this is done, they have to calculate the taxonomy values of the individual income figures. To this end, it is advisable to aggregate these figures at customer level, in the course of which they can be offset against the ratios. In reporting template 6, income is broken down by counterparty so that it can be aggregated at customer level.

This also necessitates a certain level of granularity for the customer data. The scope of the reporting template includes corporate clients (financial and non-financial undertakings) as well as a collective item for counterparties that are not subject to the NFRD/CSRD and therefore do not publish taxonomy ratios. This also means that information about the client’s counterparty sector is required. Private customers are not included in the scope of the report.

What are the challenges posed by the trading book reporting template?

Quantitative information within the meaning of reporting template 7 is only required if the trading book is not insignificant. Apart from that, qualitative information on the size and composition of the trading portfolio must be provided.

The main challenge with regard to the quantitative information in reporting template 7 is currently the regulatory uncertainty surrounding the interpretation of the requirements. At present, banks have to implement the requirements without being able to rely on FAQs and similar guidelines from the EU Commission or the Institute of Public Auditors in Germany. The interpretational uncertainty concerns both individual pieces of information in the reporting template itself (e.g. when it comes to the scope of counterparties recorded that are not subject to the disclosure obligations pursuant to the NFRD) and the question of how much weight to give to trading or other KPIs when aggregating them into an overall KPI across all reporting templates.

Another challenge is the recording of trading transactions. Due to the constantly changing markets, the reporting and transaction dates as well as exchange rates used in the system play a crucial role. Similar to fees and commissions, the bank’s relevant trading activities must be identified. While trading transactions in bonds and equity instruments are included in the scope of application, derivatives aren’t. Delimitation issues arise in particular for transactions involving structured financial products with derivative elements such as reverse or mandatory convertible bonds, but also for certain transactions that do not involve trading, such as share splits or reclassifications.

How can banks meet the challenges?

In order to meet the challenges posed by the two new reporting templates, it is advisable to clearly define the scope of application at the bank at an early stage. In addition to IT experts, experts from the front and back office should be involved to ensure a successful functional and technical implementation. Moreover, banks are well-advised to start integrating the data flow into their IT infrastructure and carrying out validations using real data (e.g. through mock-ups) early on, as experience has shown that many questions that need to be clarified arise during this phase. This will allow them to ensure the availability of the required data as well as a smooth and regulatory-compliant reporting process.

The Omnibus paper is currently causing regulatory uncertainties. In more concrete terms, it is being discussed whether to postpone and/or reduce the reporting obligations regarding the reporting templates for fees and commissions and the trading book. Despite these potential changes, it is recommended to start implementing the new reporting templates at an early stage. The fundamental implementation challenges described in this article remain unchanged and require an appropriate lead time.