Challenges and success factors for an informed selection decision

In many banks, a high level of heterogeneity and complexity of the system landscape can be observed. Customized solutions, satellite systems and historically grown structures dominate the scene. For this reason, the expansion or adaption of the existing system landscape is usually linked to high IT costs and extensive implementation schedules. On top of that, the end of the life cycle of certain core banking systems and components due to technological progress and an increasing consolidation of suppliers in the market place is in sight.

In order to achieve long-term cost reduction, it is necessary to reduce the complexity of the system landscape, utilize economies of scale and take more account of standards. Therefore, considerations regarding the fundamental renewal of banks’ IT landscapes and particularly the modernization of the core banking process are strongly gaining in significance at the moment. Usually this involves changing the core banking solution, possibly also adjusting the underlying operating model at the same time.

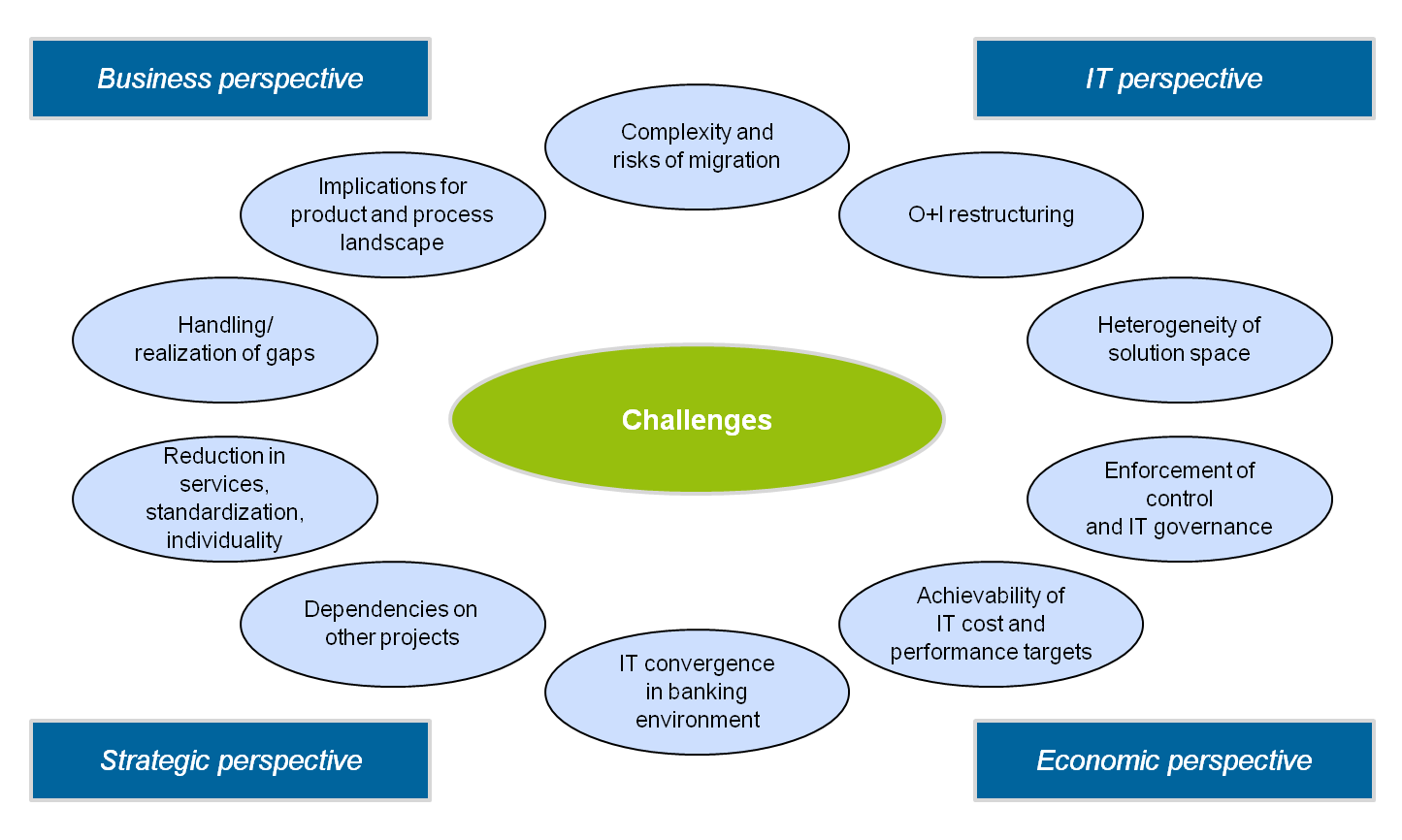

The challenge: Surgery on the IT’s backbone

Migrations and especially a change of the core banking solution are amongst the most complex IT procedures. Managing the variety and complexity of the issues to be considered – often at the interface of various disciplines (business, IT, regulatory, legal, etc.) – represents a major challenge.

At first glance, changing the core banking system (CBS) primarily impacts the IT landscape. However, at the same time there are considerable implications for the business products and processes supported, costs of changing and running as well as future strategic options. Therefore, an informed decision on the “right” core banking system has to take all perspectives into account.

IT perspective

The core banking system traditionally forms the “backbone” of the IT. It covers the main settlement functions and links the surrounding systems (satellites) via various interfaces. As a consequence, changing the core banking system bears considerable risks. Due to the sensitivity of the procedure it is necessary to obtain a complete picture of the system landscape and aside from the core functionality also take note of and assess the impact on surrounding functions and systems. Taking into account all interfaces and satellites, a comprehensive target image must first be created and then implemented. The introduction and deployment of the new target system in itself is highly complex. For this kind of procedure, additional IT topics, such as the migration of data from the legacy system, cut-over management, data quality management and the archiving of data must be included in migration planning. On top of that, changing the core banking system is often accompanied by organizational changes within the IT. Especially in the case of changing from in-house development to a standard software or from internal operation to an outsourcing model, the future service spectrum of the IT changes considerably. The required organizational changes must be assessed and implemented in parallel to the technical implementation.

Business perspective

Apart from the technical challenges for the IT, changing the core banking system often impacts the bank’s service portfolio and the respective process organization. Every core banking system comes with its own standardized processes and functions that need to be customized, which leads to an increase in implementation and operating costs. In the course of selecting a core banking system it is therefore important to check in how far standard processes of a core banking system can be used or whether service reductions are feasible and in which cases a customized expansion may be sensible or necessary in order to hold on to competitive advantages. Especially when replacing custom solutions that are tailored specifically to an institution’s requirements, significant process changes can be necessary.

Strategic perspective

A change of core banking system also brings up strategic questions. In particular, envisaged changes to the future direction of the business model, such as market positioning and product portfolio, must be included in the decision-making process. Conversely, in the course of a change in core banking system it is advisable to question the service and product portfolio in terms of costs, earnings and quantity structures and tidy it up in the sense of a proper “spring cleaning”. Sometimes, the complexity and effort of a change in core banking system can thus be considerably reduced.

Economic perspective

Apart from the three perspectives already mentioned, it is important to consider issues and challenges regarding economic viability and to develop a solid business case when changing the core banking system is planned. Looking at costs, one of the decisions that needs to be taken is which sourcing model (e.g. full service provider or merely outsourcing of the infrastructure) should be applied.

The considerable challenge of a migration project can be addressed by following a safeguarded approach that adequately takes all the above mentioned perspectives into account.

Success factors: Balancing THE breadth and depth of the assessment

Four main success factors should be taken into account when selecting a core banking system:

- Focusing on the relevant solution scope: The market for core banking solutions and the relevant components is relatively broad. Considering the potential effort, a comprehensive review of all options available is hardly feasible and would not really make sense. Many solutions can be discarded simply by applying a small number of exclusion criteria (e.g. references in the relevant market segment, operating system offered, etc.) connected to an institution’s core requirements. It is recommended to limit the relevant solution scope at an early stage and to compare only the remaining two to (at most) four options in as much detail as possible regarding the fulfillment of the requirements.

- Comprehensive look from all perspectives: The challenges described above show the variety of potential impacts that a change of core banking system can have on a bank. Therefore, when selecting a system, all of these perspectives should be taken into account and assessed, i.e. apart from pure function coverage, for example implications for IT architecture, organization, costs as well as strategic aspects should also be looked at. For this purpose, a comprehensive catalog of requirements and assessment criteria is necessary.

- Close interaction of business and IT: A sensible decision that takes all relevant aspects of a core banking change into account can only be made jointly by business and IT. In the context of project organization it is therefore important to ensure that there is no development of “parallel worlds”. To avoid this, double staffing the roles of project and sub-project manager and establishing joint project teams made up of business and IT staff is highly recommended.

- Bringing the organization on board: Changing the core banking system has considerable implications for nearly all parts of a bank. Since only a small proportion of staff is directly involved in the selection project, broad and target group specific communication regarding the objectives and implications of the change in core banking system and the reasons for the final selection decision are important. By this means, uncertainties can be prevented and subsequent resistance reduced.

Procedure: Stringent approach with clear decision points

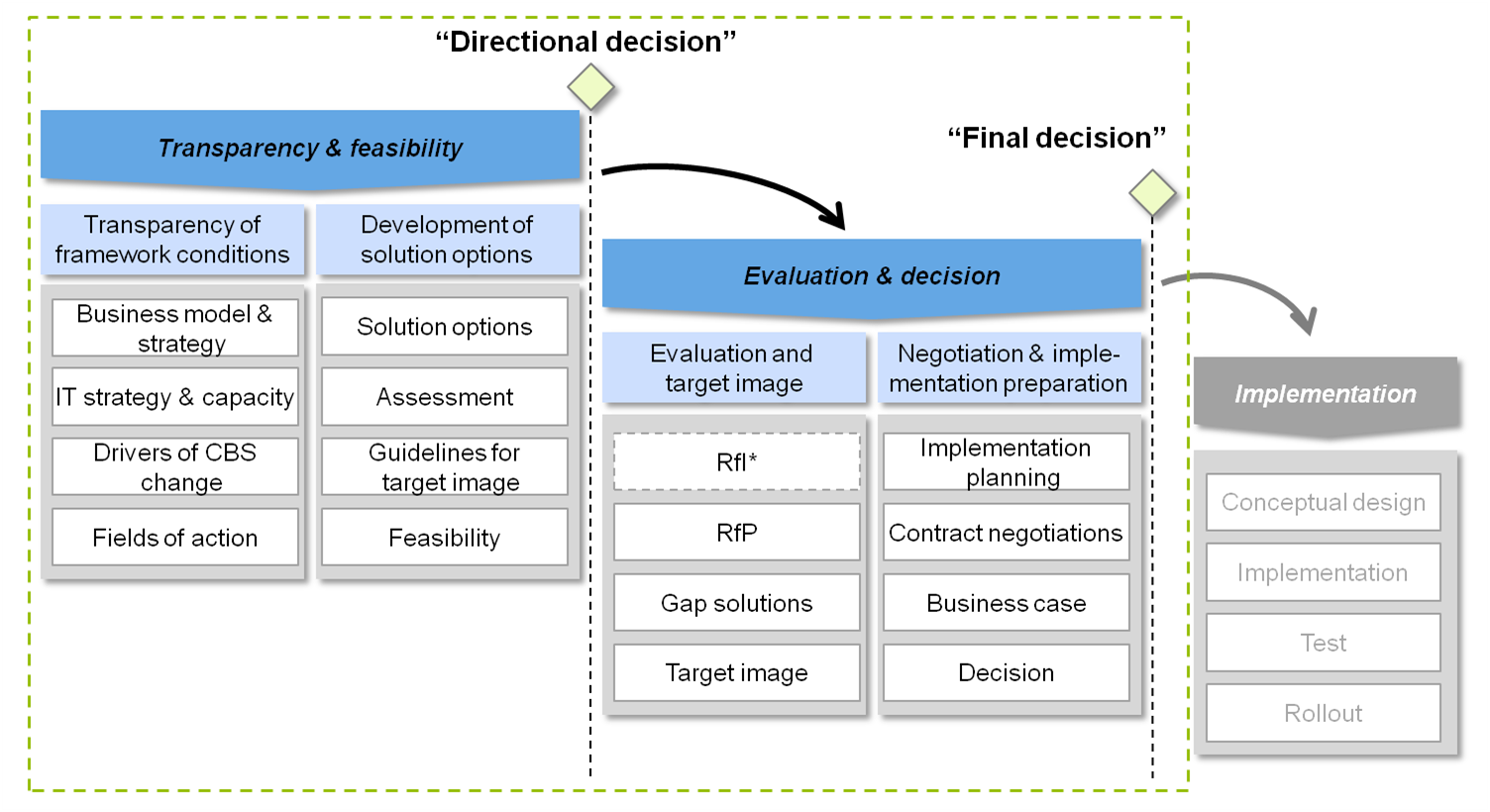

A stringent approach which – apart from the success factors described above regarding the selection and implementation of a new core banking system – also includes clear decision points within the selection process is essential for the success of a migration project.

The process model shown above is divided into two stages, each with a clearly defined objective.

In the first stage entitled “Transparency and feasibility”, a fundamental directional decision regarding the feasibility of changing the core banking systems is taken. In order to come to such a decision, the framework conditions for the migration project are analyzed during this stage. On the one hand, the business and IT strategy must be outlined in this context. The focus must be placed in particular on the target products and processes as well as the IT architecture and costs. On the other hand, the drivers for a change of core banking system must be identified. Based on this, sensible solution options can be derived and assessed in the framework of the feasibility analysis.

In the subsequent second stage entitled “Evaluation and decision”, the selection decision is made. For this purpose, the main requirements for the new core banking system are defined and assessed and information about potential suppliers obtained (RfI). Based on this information, a shortlist is then created. The shortlist serves as a basis for the request for proposals (RfP) which is sent out after detailing the main requirements with a focus on critical issues (e.g. costs, implementation and migration approach). Afterwards, a detailed target image is created, potential alternative solutions including gaps are discussed and a preferred supplier is suggested. As a last step, the final selection decision is followed by the implementation of the migration project.

The introduction of a new core banking system offers the chance to achieve long-term cost reductions within the IT and to support the fulfillment of new requirements at the same time. Apart from these opportunities, there are of course also challenges and risks. If the success factors described are taken into account and a stringent approach with clear decision points in the selection process is followed, these can however be minimized and handled more easily.

2 responses to “Changing the core banking system – the agony of choice”

Robert

How long does this exercise take? Does out require the bank shutting down for the entire time?

Toni Zeuner

Hello Robert,

the selection process usually takes months. It depends on the institute and complexity thus it can also take more than just a few months. This is a very individual matter.

During the selection and implementation process is isn’t necessary to shut the bank down. The bank switches to the new core banking system over night. The customer doesn’t get disturbed.

Contact us if you have more questions on the selection process or the implementation phase.

Best regards

Toni Zeuner