Cloud services in response to changing customer needs in the credit business

As a critical factor for production and modern customer interfaces, IT plays a decisive role for the success of overall business models. It is therefore – justifiably so – also increasingly taking center stage in the design of banks’ lending operations.

The development currently observed culminates in the hypothesis stating that banks must primarily develop into technology companies in order to consistently align their product and service offerings to the customers’ needs – both today and in the future.

Regardless of one’s attitude towards this radical demand, a future-proof alignment of the process and IT architecture using current digital technologies is inevitable in order to keep pace in the market and in competing for customers. This particularly implies that financial services providers must start using cloud technology now.

The market for cloud services has grown exponentially in recent years and offers institutions a wide range of potential benefits in the ongoing competition – not least with regard to building future-proof and customer-centric business models. Our publication “Cloud or out – leveraging cloud technology now” outlines the six areas of business potential opened up by cloud use.

Possible uses of cloud services in the credit business

Gap between aspiration and reality

The megatrend of digitalization is shaping all areas of our lives – banking included. Digital services define the interaction between customer and financial institution, while customer behavior in general has fundamentally changed: customers increasingly expect shorter response times (especially time to yes / time to money)[1], constant availability (24/7 capability) or accessibility via different channels (known as omni-channel approach).

In particular, new technology-driven competitors (e.g. fintech companies or GAAFA(+P)[2]) specifically address changing customer needs and thus use important customer interfaces in order to offer corresponding value-added services. In this context, digital customer proximity and efficient processes are considered a key success factor for all market participants.

The credit business in particular are characterized by a gap between reality and the level of customer demands. A largely manual credit process no longer fulfills customer expectations. Missing, incorrect or inconsistent information in the application procedure, time-consuming manual data entry/validation or a low level of process step automation (e.g. when signing a contract) are examples of factors that often render a credit process cumbersome and error-prone.

The sum of the individual challenges along the entire end-to-end credit application and processing path thus leads to unsatisfactory customer experiences – which frequently result in customer churn.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Service models and potential benefits in the credit business

Various technology-based optimization levers, which unfold their corresponding effect when applied individually, can be used to overcome individual challenges. When combined under one large cloud, however, the end-to-end loan application and processing path can be taken to the next level. Cloud services open up a wide range of potential benefits for addressing current challenges in the credit process and, in particular, changing customer needs.

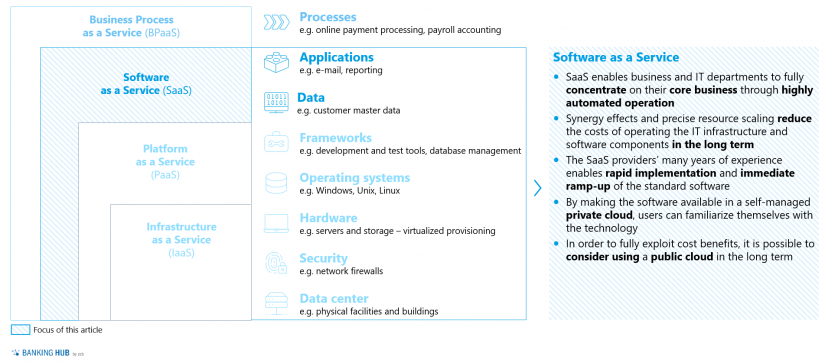

Different service models of cloud solutions offer various degrees of freedom and synergy potentials. Cloud technology can be applied in a variety of contexts, ranging from the use of pure infrastructure (Infrastructure as a Service), the additional use of operating systems and frameworks (Platform as a Service), and data and applications (Software as a Service) to the adoption of entire credit business processes. Figure 1 provides an overview of the cloud solutions’ individual service models.

Software as a Service (SaaS), in particular, is now established as an adequate service model at many institutions on the market that have taken the path to the cloud or have defined it for their organization. SaaS enables the business and IT departments to optimally focus on their core business through highly automated operations and thus offer value-added services to customers.

In addition, costs for operating the IT infrastructure as well as software components can be reduced in the long term through synergy effects and precise resource scaling. The SaaS providers’ many years of experience also facilitate rapid implementation and thus avoid the lengthy ramp-up of the standard software. By making the software available in a self-managed private cloud, users are able to familiarize themselves with the technology. However, in order to fully exploit cost benefits, it is definitely possible to consider using a public cloud in the long term.[3]

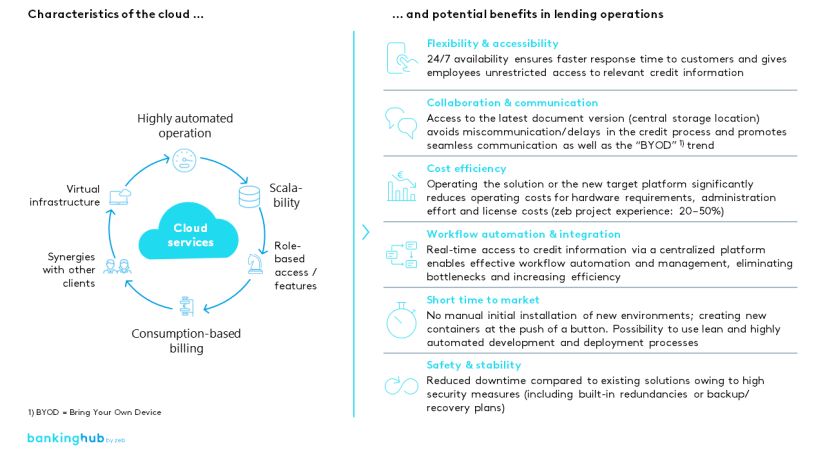

Especially in lending operations, SaaS models offer suitable application options to meet current challenges. Such features as highly automated operation, high scalability, role-based access options, consumption-based billing, synergy effects through additional clients and virtual infrastructure operation lead to a wide range of possible applications and thus to potential benefits in the credit business. Figure 2 summarizes the cloud characteristics and the potential benefits in lending operations.

The potential benefits in the credit business are manifold:

- 24/7 availability ensures faster response time to customers and gives employees unrestricted access to relevant credit information.

- Constant availability of the latest document versions (central storage location) avoids miscommunication or delays in the credit process, among other things, and promotes seamless communication. The bring-your-own-device trend is particularly noticeable in this context.

- In addition, a long-term use of the solution or the new target platform significantly reduces operating costs (in particular hardware requirements as well as administration effort and licensing costs). This offers institutions future competitive advantages in a market environment that is characterized by eroding margins in the lending business.

- Real-time access to credit information via a centralized platform enables effective workflow automation and management while eliminating bottlenecks and increasing process efficiency.

- Furthermore, time to market of new and future product features is reduced through the use of lean and highly automated development and deployment processes (i.e. creation of new containers at the “push of a button” and no manual initial installations of new environments).

- High security measures (including built-in redundancies and backup and recovery plans) reduce downtime.

Various cloud providers have established themselves on the market in the credit environment. Their service portfolios mainly focus on “compact” lending platforms. The corresponding range of services varies in the credit business: while individual solution providers focus on isolated cloud solutions (e.g. credit check and decision), the majority of providers offer end-to-end solutions that cover the entire credit application and processing path (from sales and demand identification to ongoing loan portfolio management).

Moreover, the providers present a heterogeneous picture with a spectrum ranging from well-known technology companies to focused niche players.

Cloud solutions: Advantages and regulatory framework

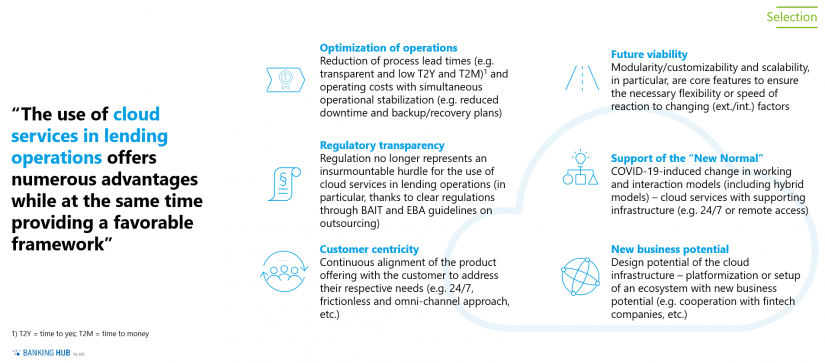

Using cloud services in lending operations offers numerous advantages coupled with favorable conditions (see Figure 3).

Cloud solutions in the credit business can leverage individual optimization potentials – i.e. reducing process lead times (including transparent and short time to yes and time to money) and operating costs, while stabilizing operations (e.g. low downtime and backup or recovery plans).

In particular, the core characteristics of modularity/customizability and scalability ensure the necessary flexibility or speed of reaction to changing (internal and external) factors and thus the future viability of the solution. As a result, cloud solutions enable a high degree of customer centricity – i.e. continuous alignment of the product and service offering with customer needs (e.g. 24/7, omni-channel approach, etc.) – and hold new business potential (e.g. platformization or setup of an ecosystem).

Furthermore, the cloud infrastructure represents an adequate means to support current collaboration models at institutions (“New Normal”) – especially through unrestricted (remote) access – which are gaining in importance especially in times of the coronavirus pandemic.

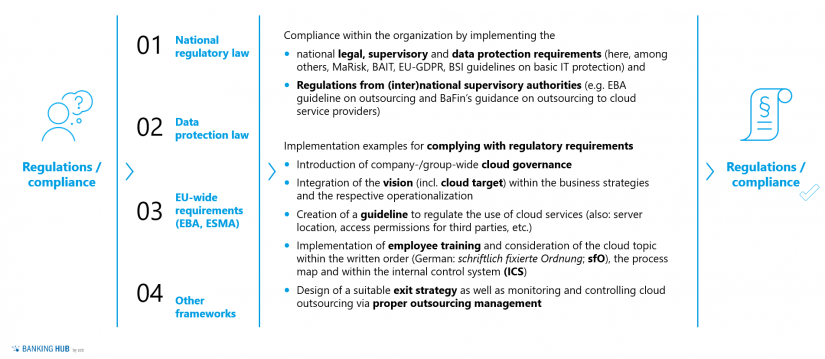

While the current regulatory environment causes many institutions to shy away from taking the step “into the cloud”, regulation is no longer an insurmountable hurdle for the use of cloud services – not even in lending operations (see Figure 4).

It is a simple matter to dispel the concerns – especially with regard to a data protection-compliant implementation, the processing of personal data by the US government and intelligence agencies as well as the German BaFin regulations. In this context, however, it is necessary to achieve compliance within one’s own organization by implementing national legal, regulatory and data protection requirements in order to ensure conformity with said requirements in the credit business.

Your way into the cloud: Contact us!

As partners of change we are happy to support you in taking your lending business to a new level and to accompany you on your way to the cloud.

Time-consuming and predominantly manual credit processes will soon be a thing of the past for you, too.

[1] “Time to yes” represents the period of time until final loan approval while “time to money” is the term for the period of time until final loan disbursement.

[2]GAAFA(+P) is an acronym for Google (Alphabet), Apple, Alibaba, Facebook, Amazon and PayPal.

[3] The public cloud is an infrastructure that is made available to the public. Corresponding computing capacities are located at the provider’s site and are accessed via the Internet. In the private cloud, infrastructure and computing capacities are maintained in a network in which the resources are allocated exclusively to the company.