A first approximation

While blockchain was originally developed as a booking system for bitcoins, its range of possible applications go far beyond the cryptocurrency. As a decentrally saved and manipulation-proof database (ledger) of transactions, blockchain offers a completely new concept of infrastructure for registering, safekeeping and exchanging information, e.g. assets of any kind. These could be financial products, but do not need to be. Especially when considering the aspects of security, cost savings and speed of settlement, blockchain possesses major potential for disruptive changes to the intermediary services.

Still following?

A non-banking example

Assume you are an art collector. You are particularly fond of paintings from the 19th century. You are pleased with your beloved works of art, which you publicly display from time to time. Part of your motivation for exhibiting the paintings comes from the tax office, because you can only make tax-free capital gains if you exhibit the artworks in public from time to time.

This is where it becomes sensitive. Hopefully you know the history of your artworks without any gaps. And hopefully you informed yourself well before buying any works (you should know whether it was ever looted art). As soon as artworks that were unlawfully taken in the past are discovered by their legal heirs in an exhibition, it can become very difficult and expensive.

Many art collectors painstakingly reconstruct and prove the history of their artworks, for example through art exhibition catalogs. This works as follows: the 1954 exhibition catalog from Kunsthalle Basel states that this artwork belonged to family X at this point in time. The catalog from the NRW art collection from 1987 states that the lender at the time was family Y, etc. There is a lot of paper to search through for a large collection. Old exhibition catalogs, assuming you are even able to find them, can then cost CHF 1500 or more in Swiss antique stores.

What an outdated system! Blockchain saves this information decentrally in the world wide web (in the cloud). This is clear and manipulation-proof: bad for unlawful owners and catalog traders, but good for legal owners. Plus, there are tremendous application potentials. Think of blood diamonds, rare old-timers, plots of land and buildings in countries without land registries… and of course, assets and exposures in the financial services sector.

How does a blockchain work?

The blockchain technology can consistently store any kind of data information in a public history with a high level of security.

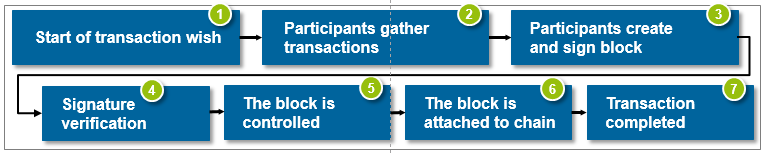

The way that blockchains work is described in the following seven steps:

- Person A wants to transfer an asset that is managed on the blockchain to Person B. The transaction is to be transmitted on the blockchain network.

- The network consists of individual participants (servers, laptop, smartphones, etc.). Certain participants are responsible for collecting multiple transactions in a block. By means of the unique transaction history of the blockchain saved by these participants, they check whether A even really possesses the asset.

- The participants can calculate a signature for the block for creating the block and adding a blockchain.

- The result of this task is to be checked and then uniquely characterizes the block. For verifying the signature, there are currently two concepts being discussed which could replace the existing concept of “miners” within the bitcoin version: 1. Technical approach: Multi-version concurrency control (MVCC) to ensure a consistent data basis, 2. Pre-prepared approach: single (certified) participants are given certain tasks.

- Once the signature has been successfully calculated by a participant, the block is sent to all other nodes. These then control whether the participants have worked correctly.

- The block is anonymously attached to the blockchain, which thus forms a transparent record of all transactions.

- All transactions contained in the block are thus complete and the asset is transfered from Person A to B.

Top companies have begun to invest in the potential benefits of blockchain technology. Already today, there is a major interest from investment banks which have gathered in the start-up R3 CEV. In the mean time, 35 large international banks have joined the initiative and the number is growing. But, there is also an increasingly intensive discussion and examination of the topic from many other banks on the market.

Can blockchain become a revolution?

It goes without saying that there are still numerous issues to be resolved.

- Who is the intermediary or supervisory authority in a blockchain environment? Is it even possible to use blockchain without an answer to these questions?

- In light of this, what are the reliable legal foundations?

- How strong is the security in practice, especially compared to the current transaction systems? (Also measured to the computational performance to be provided for security.)

- What roles can banks take and play within blockchain? Is blockchain just a technology that at its most basic benefits banks?

- What level of computational performance is required and how can this be provided?

- What kind of relationship does the investment have to the expected efficiency gains? Studies refer to sums to be raised that run At the same time, it is often much more difficult to realize efficiency potentials than expected.

This list is by no means exhaustive.

Blockchain can undoubtedly cause far-reaching changes to banking business; it has the potential to significantly reduce the structural IT costs, to simplify the process map beyond our imaginations, while also considerably increasing transaction speeds. In total, a substantial simplification is expected, which will also require fewer personnel.

All banks should ask themselves what the individual opportunities and risks they expect from blockchain technology are and derive their own approach from this position. The recommendation for financial service providers is thus clear: to be able to shape blockchain at an early stage, each financial institution must deal with the topic now. Everything else would constitute gross negligence.