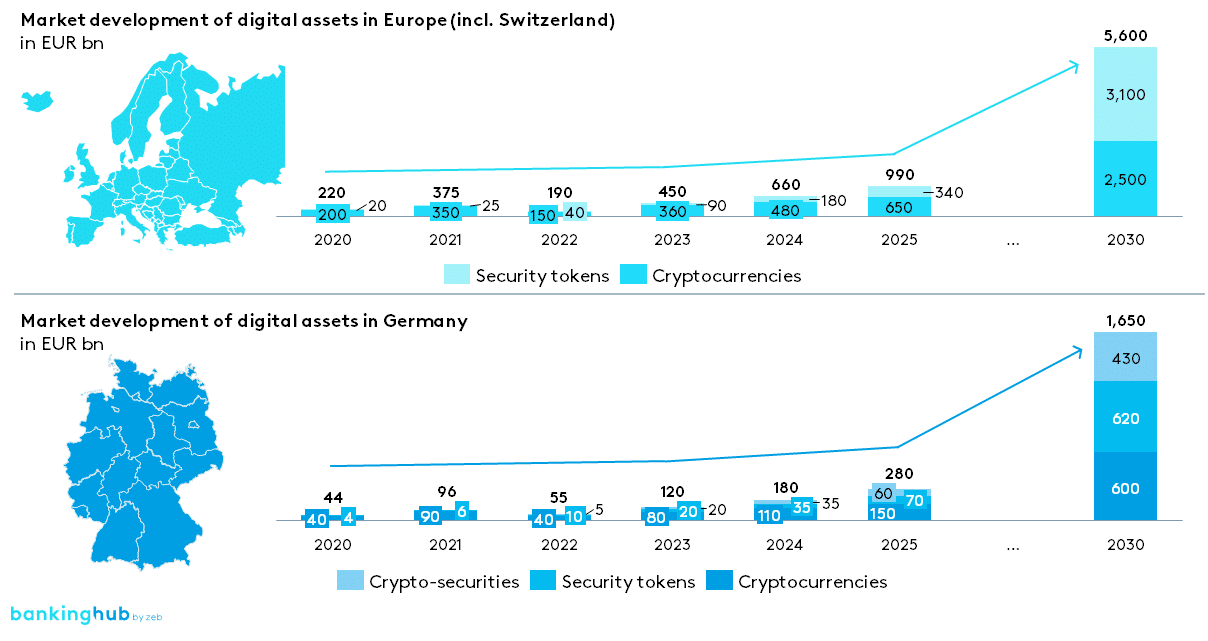

Forecast: market development of digital assets in Europe compared to Germany in EUR billion[1]

It shows that the market volume of digital assets in Europe (including Switzerland) is expected to be close to EUR 1 trillion in 2025, rising to EUR 5.6 trillion by 2030. Germany’s share of the European market for cryptocurrencies and security tokens is around 28%. In Germany, the market volume for all digital assets, including cryptocurrencies, is expected to increase by a factor of 2.5 between 2023 and 2025.

With the introduction of the eWpG and the creation of a new market infrastructure to enable this new type of issuance in the German financial market, crypto-securities (here including crypto-fund units and, in the long term, crypto-shares according to the eWpG) are estimated to reach a market volume of EUR 430 billion in 2030.

[1] Forecast for cryptocurrencies based on current market capitalization incl. growth rate of 35% (2023–2026) and 30% (2027–2030) p.a.; forecast for security tokens based on relevant asset classes (PE and VC, real estate, etc.) incl. weighted conversion rate of 0.18% (2022) and growth rate of 90% (2023–2026) and 50% (2027–2030) p.a.; Europe’s (incl. Switzerland (CH)) share of global cryptocurrency and security token market volume is ~20% (CH ~1%) / CH forecast for cryptocurrencies and security tokens based on CH share of global GDP; Germany’s (DE) share of global cryptocurrency and security token market volume is ~4.4%; forecast for crypto-securities based on crypto-securities issued to date in DE incl. growth rate of 80% (2023–2026) and 50% (2027–2030) p.a.; forecast increase of cryptocurrencies in 2023 and 2024 due to expansion of regulatory framework (especially MiCAR).