What are security tokens?

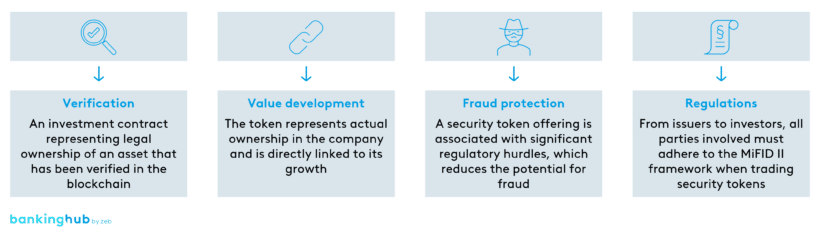

Security tokens include all cryptographic tokens that serve as investment vehicles for their holders and are classified as regulated securities. They grant their holders rights to the equity or debt of assets. These rights are comparable to those of a stock or debt security holder (e.g. claims to dividend-like payments, codetermination, repayment claims, interest).

The holders can thereby participate directly in the performance of a company. Since the issuance of security tokens is associated with significant regulatory hurdles, the risk of fraud is particularly low with these tokens.

Security tokens are securities in the sense of Art. 4 (1) no. of Directive 2014/65/EU (MiFID II) and therefore subject to securities regulation. On the European level security tokens are subject to the DLT pilot regime as so-called DLT financial instruments (tokens for stocks, bonds, money market instruments and fund units under certain conditions).

What security tokens are there?

Security tokens can be used to grant rights to both liquid and illiquid assets:

- Similar to classic securities, security tokens can grant rights to liquid assets such as stocks, debt securities or currencies.

- In addition, the fractionalization of security tokens makes it possible to grant rights to illiquid assets for which there is not yet a liquid secondary market. Examples of such illiquid assets include alternative investment funds (such as private equity funds), real estate, infrastructure projects, and collectibles such as art.