Managing data could be more than a necessary evil

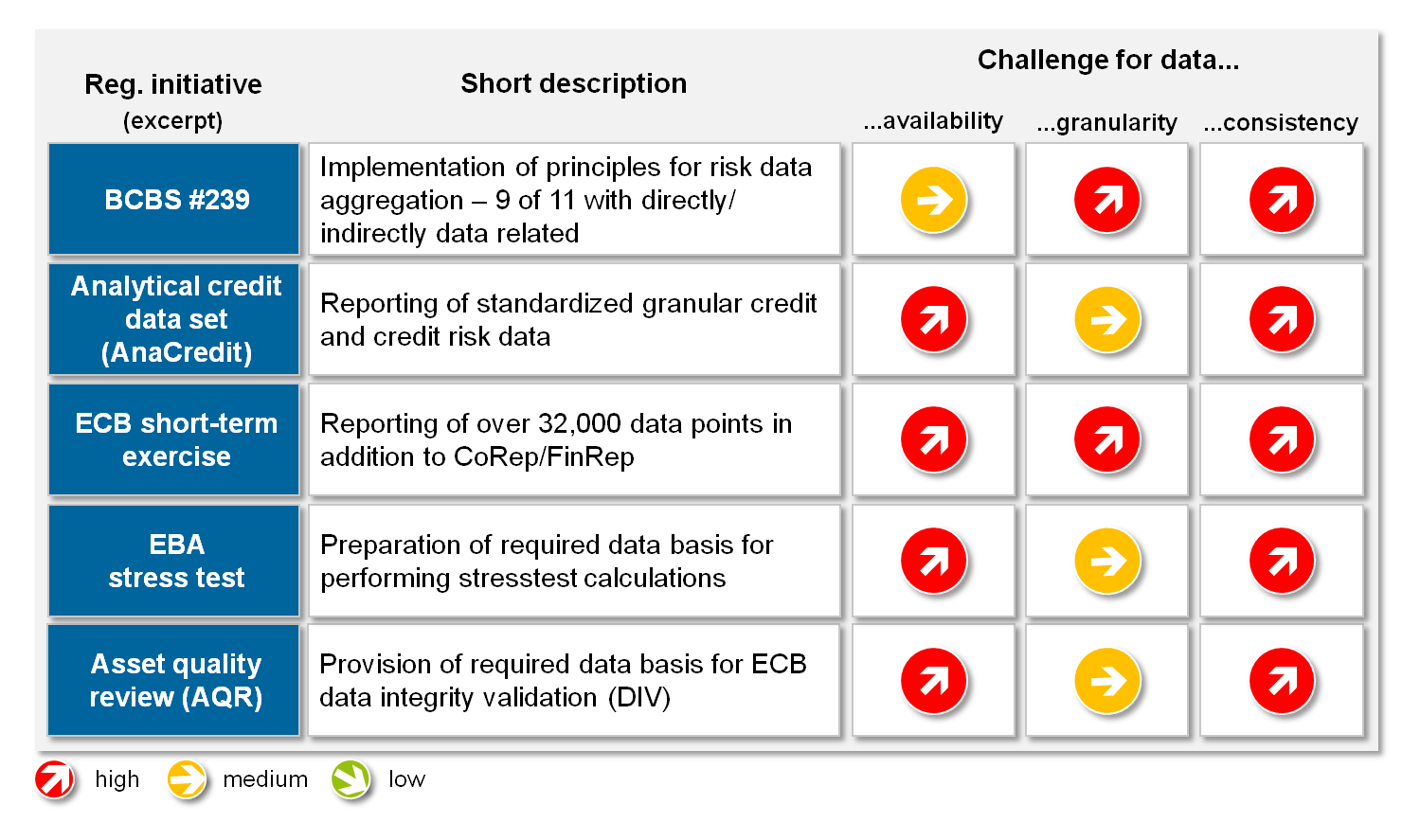

In particular, there are significant effects on how banks deal with their data. Some examples (BCBS #239, AnaCredit, ECB short term exercise, EBA stress test, AQR) for data challenges directly or indirectly arising from regulatory initiatives are briefly illustrated in Figure 1.

During the past few years, the banking industry has fundamentally changed. Fueled by the financial crisis, legislators and regulatory authorities have introduced an abundance of new regulatory requirements, which banks have to face. This regulatory flood concerns increased requirements for capital, liquidity, disclosure, etc. As a whole, they profoundly impact bank steering and the competitive positioning of banks for the foreseeable future. In particular, there are significant effects on how banks deal with their data. Some examples (BCBS #239, AnaCredit, ECB short term exercise, EBA stress test, AQR) for data challenges directly or indirectly arising from regulatory initiatives are briefly illustrated in Figure 1.

In addition, further initiatives such as EBA Cross Validation Rules, common reporting platforms or banks’ integrated reporting dictionary (BIRD) underpin the trend towards an increasing importance of harmonized and high quality data.

Besides efficiently complying with regulatory (external) requirements, steering and business departments benefit from handling data in a more sophisticated manner. For instance, consistent and reliable data strengthens steering departments with regard to improved decision making, effective control and increased respect and credibility with business areas. Similarly, harmonized data supports a better business understanding and enables clear communication on bank-wide level. Such a harmonized and high-quality data basis allows for performing analyses to better understand the strategic and operational value proposition as well as for gaining deeper insights into drivers of balance sheet positions and P&L for ensuring sustainable profit.

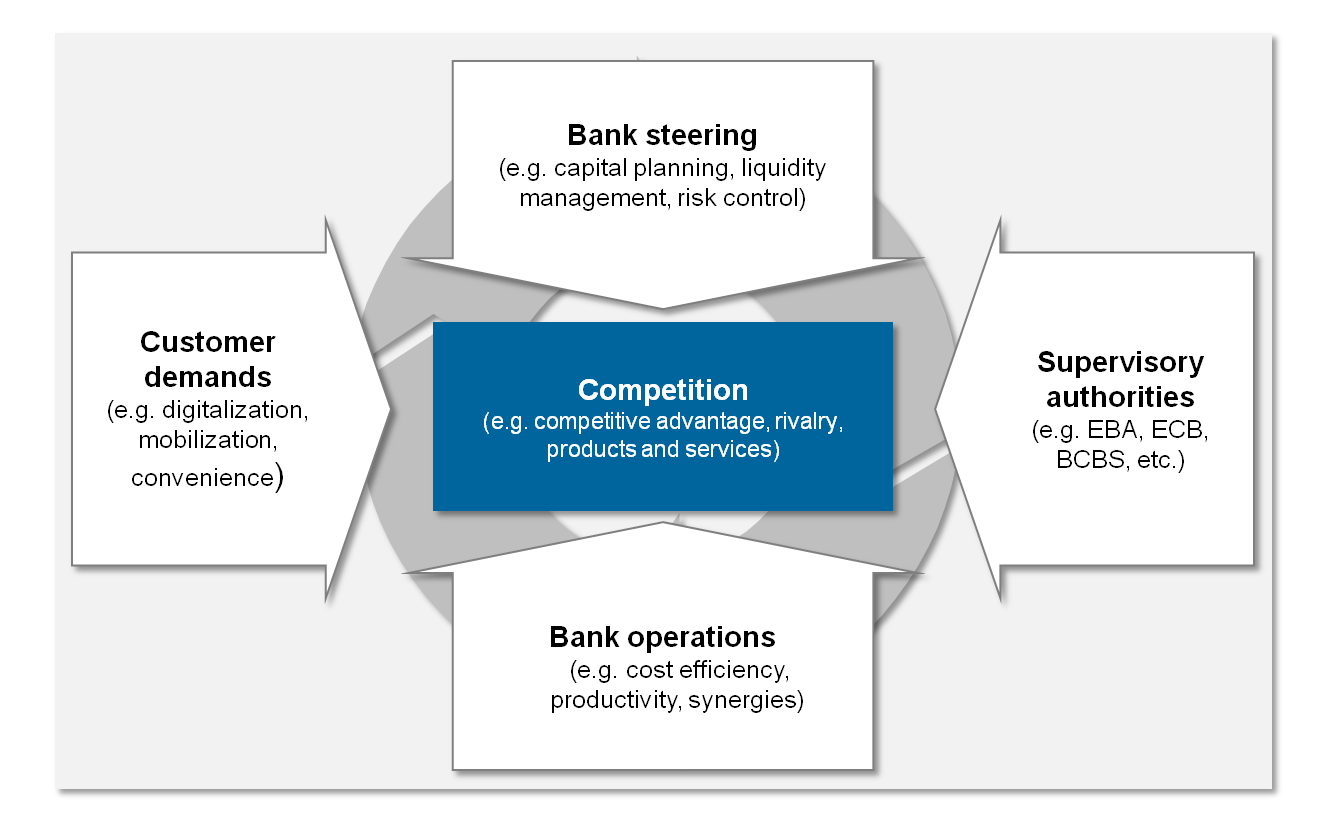

The benefits and especially the need for rethinking current practices of banks in handling data becomes more evident when considering the “five forces” acting in the banking sector (Figure 2).

However, the improvement of data utilization is neither a panacea nor a sufficient (pre)condition for adequately coping with the “five forces” in the banking sector. Nevertheless, it is both required from customers and supervisors as well as a necessary (pre)condition for improving bank steering and operations. Thereby, the generated added value could come in different flavors such as new customer acquisitions, regulatory compliance, redefinition of a business model and productivity gains. However, it still and largely appears to be “fallow, uncultivated land”.

Status quo – A snapshot of the banking sector

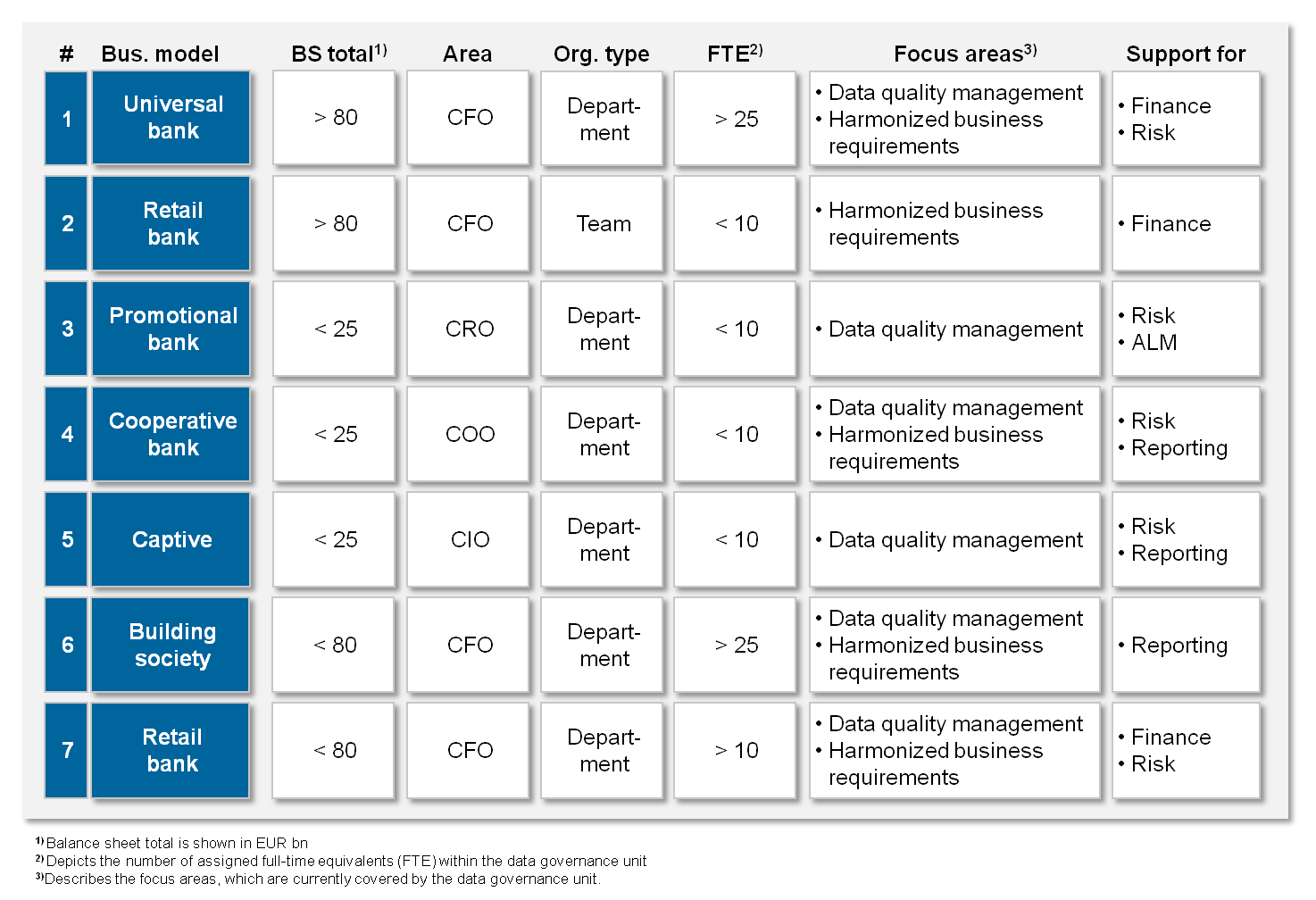

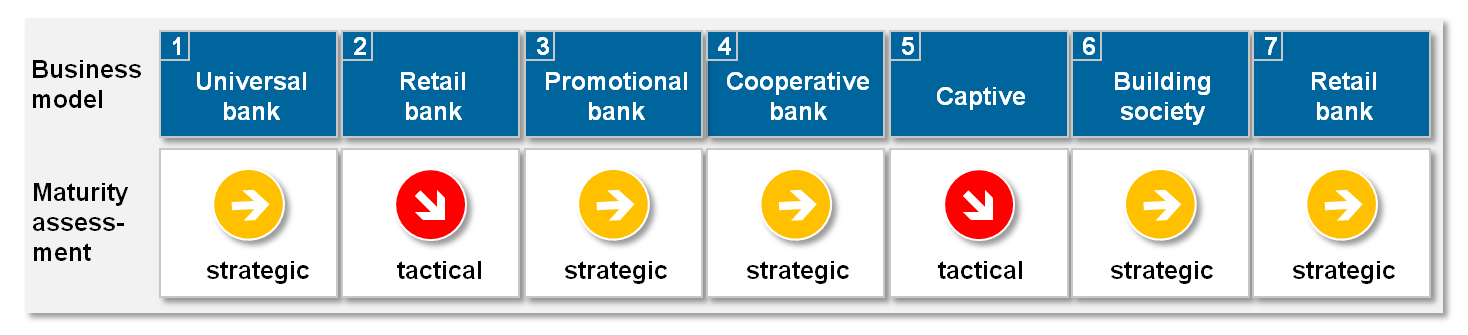

In the context of the hostile business environment banks have to face, one of the central questions is how banks “cultivate this fallow land”. That is, what measures are banks currently taking to enhance the utilization of data? To obtain an initial indication of the status quo, selected example banks with different business models and balance sheet totals are displayed and contrasted in Figure 3.

A closer look on the financial industry shows that the overall topic of Data Governance is still in its infancy. Especially in terms of organizational setup and bank-wide dedicated data responsibilities, financial institutions currently lack in their maturity.

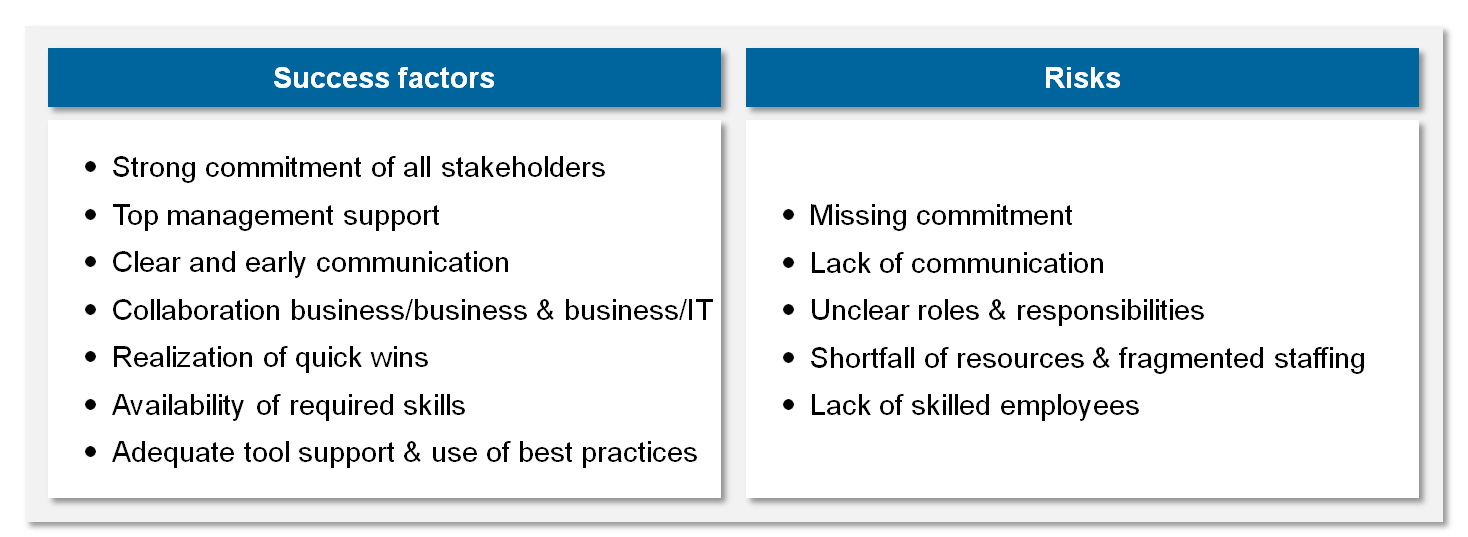

Additionally, this comparison reveals a couple of success factors and risks when developing and operating such organizational structures and functions. It has been recognized that crucial prerequisites are clear and early communication in combination with strong commitment of all stakeholders and are supported by the top management (Figure 4).

This comparison indicates that banks started to progress towards an enhanced utilization of data to not only better meet the regulatory requirements but also to improve bank steering and operations. Nonetheless, leveraging the full potential demands for reorganizing the currently rather fragmented and isolated activities by a holistic and well-founded approach.

Data Governance Target Operating Model

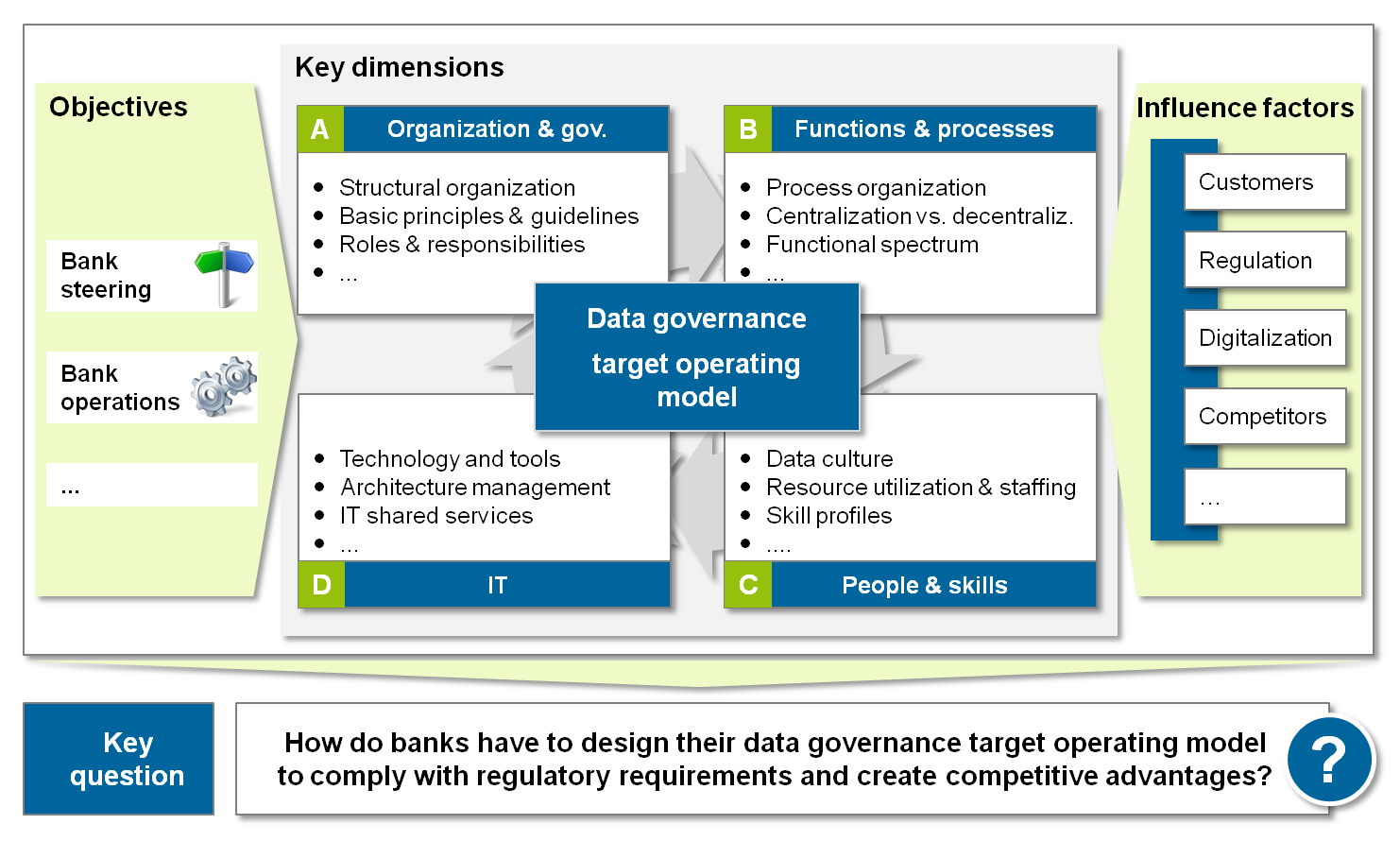

The Data Governance Target Operating Model (TOM) provides a holistic approach for developing and operating a bank-wide Data Governance model. This framework goes beyond conventional approaches to data management by comprehensively utilizing the value of data across the entire bank (Figure 5).

The design of a Data Governance TOM fitting the specific purpose of the bank at hand requires balancing the (internal) objectives in bank steering and operations as well as coping with the (external) influencing factors such as customer demands, increased regulation, the trend towards digitalization and upcoming competitors. In this tense environment, the main challenge lies in reducing complexity by adequately shaping all of the four TOM dimensions, which act as key levers for successfully developing and operating a Data Governance model.

1) Organization and governance

Basis for implementing the design of a Data Governance TOM lies in the definition of the organizational anchoring, dedicated roles and responsibilities as well as clear decision and escalation structures. One proven organizational format to capture the required organizational setting is a so-called Data Governance network. By focusing on bank-wide service for information and data management, it corresponds to a kind of “virtual organization”. This organization is headed by a centralized Data Governance unit. This unit does not only have a clear mandate and area of responsibility but is also equipped with a dedicated budget as well as equidistance and independence from other departments. Closely related to its organizational independence, such a unit also needs strong commitment and sponsorship by the management board in order to deliver its services related to information and data management across all divisions.

After basic characteristics of a Data Governance unit have been outlined, an interesting question concerns the process of its implementation with a particular focus on the initial stages. At the very beginning, it is important to set up an overarching and extendible Data Governance framework including the definition of and bank-wide commitment to Data Governance principles. Based on this framework, the main focus should lie on the establishment of a harmonized and high-quality data basis, which lays the foundation for a better utilization of data. Needless to say, such activities have to be carried out in close alignment with IT and also require the definition of a bank-wide IT strategy and standards. This may sound pretty simple and straightforward; however, taking this path means to overcome major obstacles. Therefore, it is essential to have well-working structures and bodies for decision making and escalations in place.

2) Functions and processes

While the first dimension rather addresses static aspects, the second dimension of the Data Governance TOM emphasizes dynamic aspects (i.e. processes organization) to provide answers to the question of how to achieve the desired goals of Data Governance. In principle, the key processes of Data Governance reside on a strategic and operational level. The basic difference between these two process levels lies in the underlying time horizons. Correspondingly, the strategic level has a larger time horizon (e.g. > 1 year) and comprises basic processes such as budget and personnel planning. Processes to both define a forward-looking Data Governance strategy as well as decompose this strategy to feasible pieces are often forgotten, but especially important at the beginning of setting up Data Governance. For instance, a three-year roadmap sets the guardrails and provides direction for Data Governance activities.

In contrast to the strategic level, processes on the operational level have a shorter time horizon (e.g. < 1 year) but are equally important. These processes predominantly result from the key functions of the Data Governance model. Key functions include BDM and DQM activities, as illustrated in Figure 3, but are not limited to them. Depending on the scope of the Data Governance unit, operational processes could cover areas such as data delivery, IT operations, demands and requirements management, etc. For instance, data quality management encompasses processes for the definition of data quality indicators, measuring, reporting and monitoring data quality as well as solving data quality issues.

With regard to the order of implementation, it is equally difficult but necessary to find a balance between strategic and operational processes. On the one hand, strategic processes lay the foundation and provide direction (e.g. Data Governance road mapping). On the other hand, operational processes (e.g. data quality management) enable the delivery of quick and tangible results, which are essential to demonstrate the added value on bank-wide level.

3) People and skills

Target-oriented organizational forms as well as effective and efficient processes are major components of Data Governance. Nonetheless, all this is of little value as developing and operating a vibrant Data Governance stands and falls with the “right” people. As in many other cases, the human factor constitutes the critical component. Roles and responsibilities defined in the Data Governance organization need to be staffed with skilled and experienced people. Thereby, skill profiles could be “interdisciplinary” in terms of combining business and IT know-how, leading to a balanced mix of skill sets. It has to be taken into account that adequately fulfilling the areas of responsibility related to distinct Data Governance roles (e.g. Data Governance manager, data quality expert) can hardly be done in part time. This implies that fragmented resource allocation has to be avoided and rather substituted by full-time staff capacities. To ensure this and the “right” mix of skill profiles, it is common to hire new staff.

Experience has shown that having the “right” personnel in place is only one thing. The other important thing is to continuously educate and train not only the Data Governance staff but rather all affected bank employees. In the narrow context of Data Governance staff, education and training is relevant to allow for growing into their new roles step by step and for gradually improving their skill levels. In the larger context of the entire bank, the challenge of spreading the knowledge about Data Governance is far greater. It is therefore recommended to apply a multi-staged education and training program. This program is tailored to the specific situation so that it is capable of addressing the various knowledge needs and skill levels across the entire bank. In addition, dedicated Data Governance roles could act as multipliers and, as such, close knowledge gaps in a decentralized manner. Despite all the euphoria, one should not be under the illusion that bank-wide education and training for Data Governance in order to establish a data culture is done easily and quickly.

4) IT

The last dimension of the Data Governance TOM closes the yet missing link to the IT area. This link is of utmost importance because developing and operating Data Governance heavily relies on the collaboration between business and IT. Basically, this collaboration touches many topics including not only the exchange of technical expert knowledge but also common use of tools, technology, etc. For instance, the manifold Data Governance functions and processes require adequate tool support that provides sophisticated capabilities (e.g. automation, functionality) as well as easy usage for a bank-wide application. Such tools, e.g. for data quality management, business data modeling, metadata management have to be customized and grounded on a future-oriented technology. Decisions about tools and technology have to be aligned with the IT department. Referring to the data challenges illustrated in Figure 1, the need for close collaboration between business, IT and the Data Governance unit becomes evident.

Given this importance, the question of how to achieve an effective and efficient collaboration arises. It can be observed that there is a deep-rooted gap between business and IT. It is a major challenge to overcome this gap and set up adequate and common working structures and processes. It is exactly at this point where Data Governance could be used as a control lever to close this gap and provide the infrastructure for collaboration. In this context, experience shows that this collaboration has to be initiated on the first day because changing the conventional approach takes quite some time.

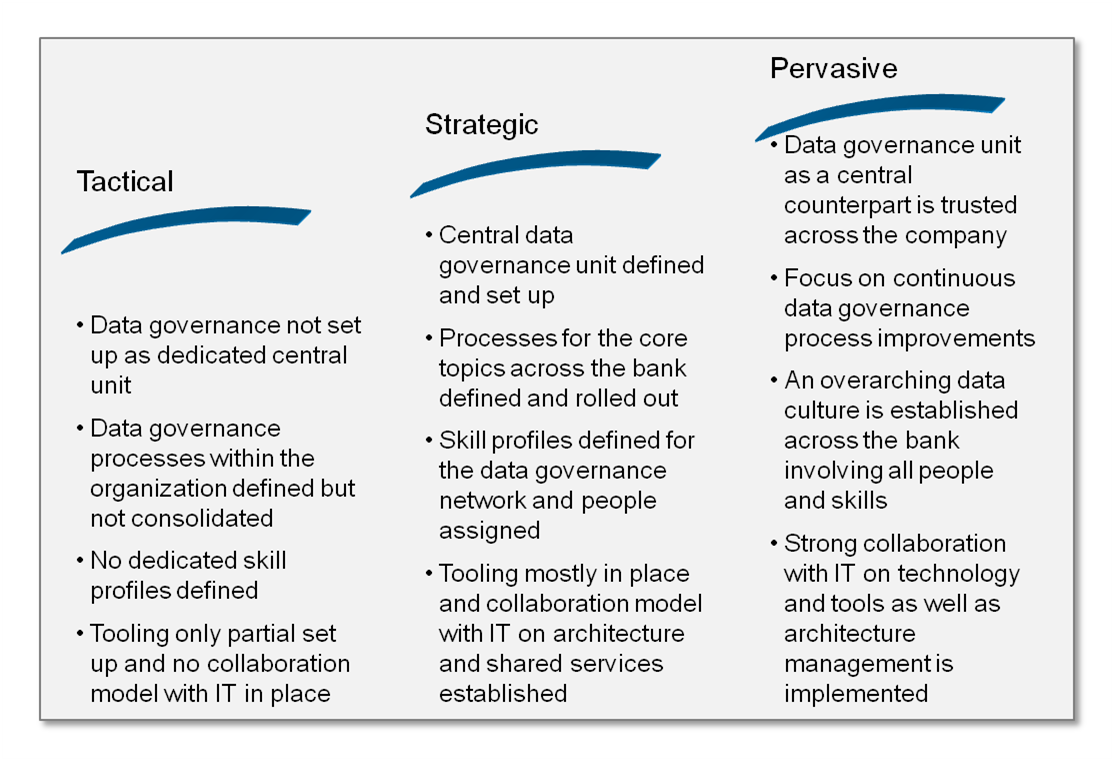

Taking all four key dimensions together leads us to an evolutionary view distinguishing between three consecutive maturity levels of Data Governance (Figure 6).

In the target image, a central organizational unit is heading and coordinating the overall bank-wide Data Governance network. This unit assumes responsibility for optimized data utilization by supporting its users in the respective business areas and IT. Clearly defined processes and functions significantly enhance the data user satisfaction and trust in data, while at the same time reducing or even avoiding costs caused by insufficient data harmonization and quality. To be able to encounter present and future data challenges, high competency and skills have to be guaranteed by dedicated training of all bank employees in the area of data management. A strong collaboration between the Data Governance unit and IT as final piece of the puzzle strengthens effectiveness and efficiency by aligning steering, business and IT.

Referring to the market snapshot (Figure 3), the Data Governance TOM and its stages of development allows for providing a rough assessment of the different maturity levels of the respective banks (Figure 7).

According to this figure, the banks at hand predominantly exhibit a strategic maturity level and in some cases even a tactical level. This means that first measures towards setting up a Data Governance have been initiated. In most of these cases, small organizational units established such measures with a focus on few functions or processes for specific parts of steering data. Likewise, this assessment clearly shows that there is still a long way to go and tremendous efforts are needed for the target state of a pervasive Data Governance.

Conclusion

The Data Governance Target Operating Model is not an option. It is the logical consequence from the ongoing shifts and changes in the business environment. On the one hand, it is required by external influencing factors such as changing customer demands and increased regulatory requirements. On the other hand, it is essential for improved bank steering and operations by better utilizing data. For creating value added and a sustainable competitive advantage, there is no viable alternative for the top management to put the Data Governance Target Operating Model on its agenda.

2 responses to “Data Governance Target Operating Model”

Pingback: RegTech - BankingHub

shopiawilson

Thanks for sharing the helpful knowledge about the data governance target operating model, that is a nice blog.