The largest wealth transfer in history and its impact on wealth management

In addition to the abovementioned challenges in the financial sector, the private banking industry is currently on the edge of experiencing another major event: the great wealth transfer. In the US alone, more than USD 30 trillion are about to change hands in the next few decades.[1]

Baby Boomers, who are considered to be the wealthiest generation in the recorded history, are gradually reaching retirement age and will soon pass down assets to their heirs. This puts the next few years at the heart of the largest generational wealth transfer the world has ever seen.

Advisors age while clients rejuvenate. On average, more than 50 percent of the relationship managers are over 50 and they are getting older and older. Soon the wealth of Baby Boomers, whose relationship managers are also Baby Boomers, will switch hands to those of Generation X and the Millennials.

This new generation has its own expectations, needs and priorities, leading to an increasing generational gap between advisors and investors, and making it more challenging for some relationship managers to understand their new clients and to adapt to the needs and preferences of a younger generation.

This problem can be observed historically in statistical figures: according to InvestmentNews Data, 66 percent of heirs change their parents’ financial advisor after receiving inheritance.[2] Since most relationship managers fail to start connecting to their clients’ heirs at an early stage, they end up with a poor understanding of the heirs’ past and present situation and are unaware of their future goals and aspirations. As a result, the success rate of building a strong, long-term and trust-based relationship with the ‘new’ clients remains rather low.

When a new client base with new needs comes into play, banks have to adapt. The best solution is holistic advisory—an advisory approach that fully addresses current clients’ needs and aspirations and especially those of the new generations.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

From relationship manager to wealth architect

By shifting the focus from investment products to holistic client understanding, private banks and wealth managers switch to a new model—wealth architecture—in which relationship managers act as wealth architects.

Wealth architects advise their clients by holistically identifying and addressing their needs and by offering integrated solutions. As part of the holistic advisory approach, wealth architects not only fully understand their clients’ past and current situation, but also incorporate their visions of the future and provide support in implementing them.

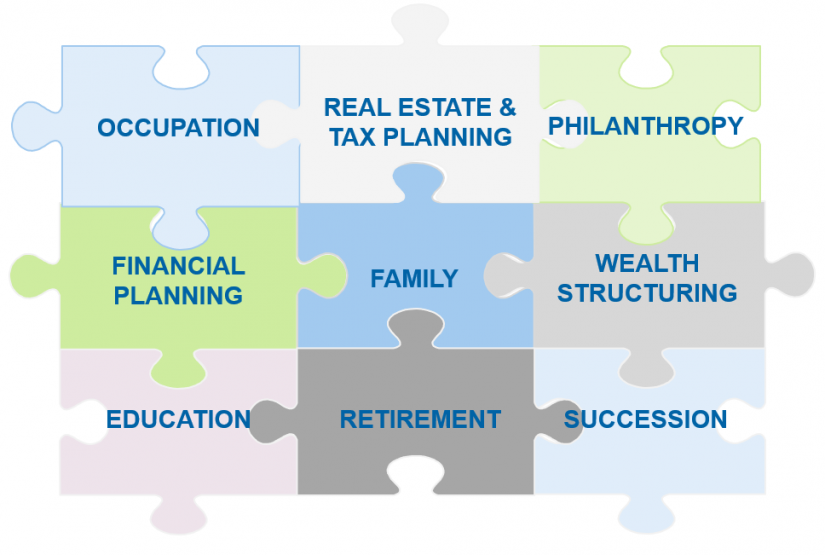

Consequently, this gives wealth architects the opportunity to gain a complete picture of their clients’ family situation, occupation, education, financial planning, wealth structure, retirement and succession plans, real estate and tax planning, as well as philanthropy and other projects (please see figure 2).

Many banks offer solutions regarding these topics but fail to combine their services in a meaningful way so as to provide one integrated and consistent solution. Hence, the key for most relationship managers is to get to know their clients by applying a holistic approach—knowing their individual circumstances, their strongest passions or their future plans—and helping them achieve their personal and financial goals.

Only when the clients and their families feel well understood and cared for will they be able to develop full confidence in their advisors and choose to remain loyal to their banks, not only for the next five years, but for 20 to 30 years.

Let’s imagine the case of a couple in their fifties. They own a family business and have two children in their twenties, who are part of the millennium generation. The father wants to retire in the next few years and pass over his company to the oldest daughter.

In line with the holistic advisory approach, a wealth architect will not only focus on taking stock of their investment portfolio, but will also initiate discussions about the needs of the family: do they, for example, have sufficient financial means to maintain their lifestyle? Do they have the best retirement solutions in place? What are their succession plans and what is the most tax-efficient way of transferring wealth and passing over the company?

While answering all these questions, the wealth architect can also come into contact with the heirs and learn more about them. By initiating deeper and more meaningful discussions with the clients, wealth architects move beyond the pure investment focus and seek to identify the real purpose of the clients’ wealth. And last but not least, by connecting to the entire family in early stages of the business relationship, wealth architects can bridge the communication gap and thus eliminate potential generational problems.

The need for holistic advice seems obvious, but it is not implemented everywhere yet. A study carried out by Age Wave in partnership with Bank of America Merrill Lynch, estimated that “85 percent of people who work with a financial professional have not had a single conversation about their hopes and dreams for retirement”.[3]

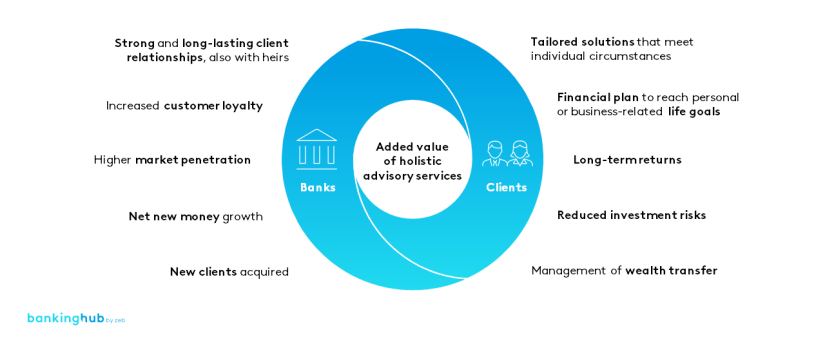

Yet such conversations must not be neglected considering the tangible added value that they could generate for both the customers and the banks themselves (see figure 3).

Holistic advisory in itself is not a new approach—many banks in the US, Asia or UK have already been using it for some time. While traditional advisory models have prevailed so far on the European continent, the implementation of a holistic advisory approach is slowly gaining in importance.

However, in order to increase the chances of a successful implementation of holistic advisory, banks need to be aware of some imperative aspects:

- Defining the topics for holistic conversations is not enough. Banks need to develop a concept on how to carry out meaningful dialogs in order to find the best solutions for their private banking clients. In addition, the concept must support the overall strategy of the institution and be engrained within the organizational culture—as a new and better way of delivering advice. Finally, banks must ensure that the target operating model supports the new advisory model as well and enables greater efficiency and adaptation.

- zeb’s experience has shown that supporting the relationship managers with comprehensive client books is indispensable. Banks must ensure that the relationship managers’ client books provide a full picture of their clients’ situation and that all client data is available in an easy-to-understand and functional manner.

- Aggregation technology plays a major role, not only in improving efficiencies and reducing costs, but above all in providing goal-based holistic solutions. Having in place state-of-the-art financial planning and reporting software as well as portfolio management tools might not be enough, in particular if they fail to communicate and share data among themselves. Therefore, aggregating the existing client data from inside and outside the bank and using it in a systematic way to address client needs is of central importance for all private banks and wealth managers.

Last, but not least, it is important to understand that holistic advisory is not a one-off exercise but rather a new way of advising clients. Hence, it must be a recurring process with continuous improvement and adaptation to the needs and wishes of the new client base. This is the only way to put private banks on the right track towards increasing both their clients’ and their own added value in the long term.