The asset management market

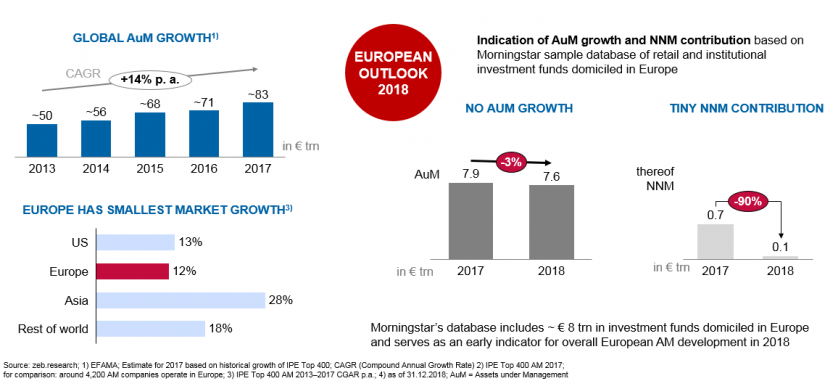

The asset management industry is growing rapidly – by a stable 14 percent per year over the past half decade. Global megatrends are driving this upward trajectory, such as the expanding middle class, the shift from deposits to financial assets, increasing life expectancy and growing urbanisation.

However, the industry’s enviable profit levels are facing increased pressure. There is downward pressure on fees due to weak investment performance, greater transparency, for example through investment consultants and regulatory initiatives, and the ongoing success of passive investments. There is upward pressure on costs due to the need to keep up with new regulations, the process of digital transformation and the increasing demands of tomorrow’s clients.

Even though assets under management have seen sound growth over the past years, the asset management business can be highly volatile due to the strong correlation between revenues and client behaviour with the capital market. As shown in figure 1, the year 2017 saw extraordinary growth of both assets under management and net new money, but 2018 put in a very poor show by comparison. Total assets under management, based on Morningstar’s sample group of institutional and retail investment funds domiciled in Europe, fell by five percent in 2018 compared to the previous year, with net new money crashing by 105 percent.

zeb European Asset Management Study 2019

To gain a clearer understanding of what exactly is going on in the market, zeb, with the support of Morningstar, carried out a major survey of asset managers which provides unique insights into the current state of the industry and its future outlook. Part of the objective of our survey was to identify which players are the most successful in the market and what lies behind their success, which trends will impact different business models going forward, and what action asset managers should be taking as a result.

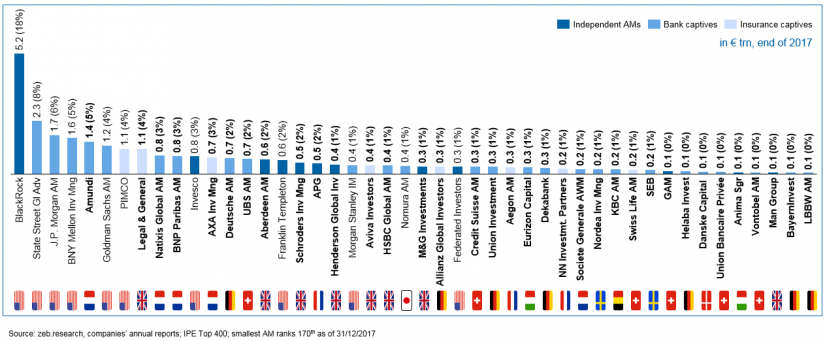

The basis for the analyses is a peer group of 46 of the largest asset managers with a strong footprint in European markets and with global AuM of more than EUR 29 trillion. Thus, the zeb European Asset Management Study 2019 covers one third of global AuM.

Summary of analysis results

The results of the zeb European Asset Management Study 2019 centre around three major categories:

1) COMPETITORS’ SITUATION

- Historically stable profit margins since increasing revenue pressure and slow cost saving efforts were overcompensated by natural industry growth

- Slowest growing and least profitable business observed for mid-sized providers, especially those that offer plain vanilla active management, i.e. these players are losing out to scale players of various shape and form as well as focused companies with a clear value proposition e.g. in the solution and speciality space, supporting the thesis of a “collapse of the middle” – a phenomenon also observed in other industries

2) PRODUCT Quality and asset flow

- Large shares of high-margin retail business[1] and/or alternative products are no guarantee for higher overall profit margins – it is rather the specific design of the business and operating model that drives profitability

- Industry-wide underperformance in key asset classes -– unexpectedly – has not had any negative impact on profit margins so far. However, the increasing regulatory-driven transparency will eventually guide the investors’ asset flows into (i) innovative, outperforming products, (ii) solution/outcome-oriented strategies, and obviously (iii) low-cost passive investments

- Additionally, aggressive market entries of new players are expected in the near future. As it can already be observed in Asia, for example, Big Tech companies are expected to redirect asset flows, especially in the retail business and particularly if these new players launch more comprehensive offerings through their platforms making full use of their strong retail client access

3) PRICING ENVIRONMENT

- Passive strategies are up to 90 percent cheaper for investors than their active equivalent, putting significant revenue pressure on (undifferentiated) active offerings

- The decline of revenue margins is ongoing in retail and institutional business across all asset classes, not just because of “passive pressure”, but also due to increased transparency and unsatisfactory investment performance

- Furthermore, the market sees increasing awareness and pressure for “fair pricing” by regulators and financial conduct bodies, currently especially enforced by the UK’s FCA

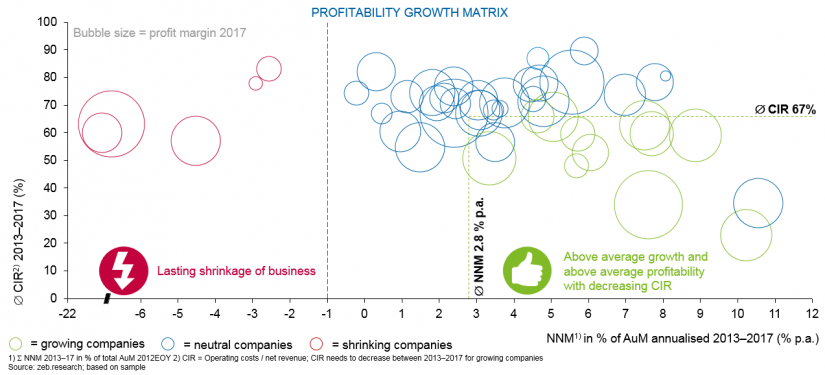

The zeb European Asset Management Study 2019 is based on an individual company level, enabling zeb to offer its clients company-specific KPI benchmarking. Out of the 46 analysed players, only 24 percent of asset managers are growing profitably while more than 10 percent have been continuously shrinking in recent years. The large bulk of around 65 percent of the analysed asset managers operate on an above average CIR level and below average growth level.

Figure 3: Individual company performance comparison across entire sample -> Figure 3: Company comparison for profitable growth

Figure 3: Individual company performance comparison across entire sample -> Figure 3: Company comparison for profitable growthScenario analysis: Simulation of possible future industry developments

Looking ahead, zeb expects the asset management industry to be impacted along various dimensions, several of which will change significantly in the future:

- Global megatrends, as explained earlier, will further boost demand for asset management services

- Further industry consolidation driven by the need for scale (cost efficiency, scope and customer access) will lead to more mega managers, e.g. Pioneer acquired by Amundi

- Passive will continue to grow and replace plain vanilla active investment strategies

- Satellites in real alpha, alternatives (private equity, private debt, infrastructure) and solution/outcome-oriented strategies will continue to rise and eventually become mainstream

- Digitalisation will be the main differentiating factor for cost savings and distribution channels

- Big data analysis will offer new opportunities for research and corresponding investment strategies and will also provide new insights in distribution

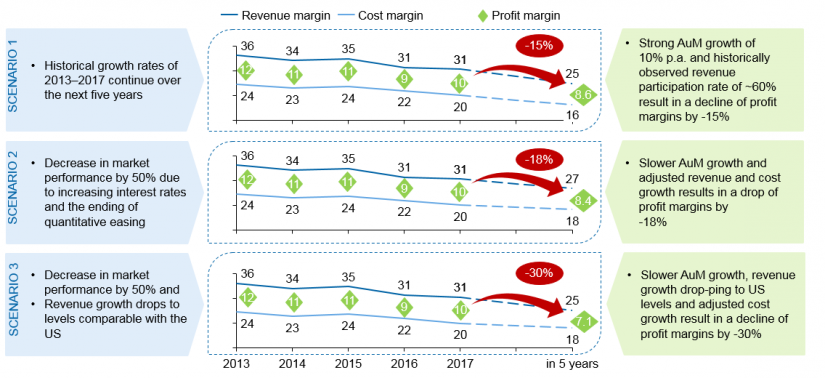

To analyse the quantitative impact of these developments on the asset management industry and its different business models, three future scenarios were defined.

- In Scenario 1 everything stays as it was, i.e. the historical growth rates from 2013 to 2017 continue

- In Scenario 2 market performance – the major driver of asset growth, as mentioned above – declines by 50 percent due to increasing interest rates and the ending of quantitative easing. The individual growth rates observed for net new money continue as before. However, the growth rate for revenues decreases due to the slower growth of assets under management for the different asset manager categories. Furthermore, the growth rate for costs is adjusted down 50 percent, to cater for a certain amount of flexibility with regard to variable costs and assumed cost cutting efforts. Fixed costs will remain at 50 percent.

- Scenario 3 assumes a decrease in market performance by 50 percent and a drop in revenues to levels comparable with the big US asset managers: down 30 percent for firms offering both active and passive products, and down 15 percent for pure active providers.[2] Developments for assets under management and the resulting adjustments for revenue and cost growth are as in Scenario 2. With the shift from active to passive products, we assume a 20 percent growth in net new money for firms offering both active and passive products, at the expense of pure active providers.

The simulation shows a negative outlook for asset managers’ key performance indicators in all three scenarios as a result of further price and thus margin erosion even though AuM were assumed to grow in all three cases. This observation, let alone the more differentiated results based on realistic variations of core parameters in the different scenarios, shows that the comfort zone asset managers may feel in could crumble significantly if no action is taken.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Recommendations and conclusions

Speculation about what the future holds is all well and good, but we firmly believe that strong recommendations and practical strategies are what asset managers need. Based on the analysis above we are now in a position to formulate five key recommendations (strategic positioning, distribution management, pricing, digitalisation of operations and data management) that will take asset managers into their discomfort zone – and, in so doing, ensure a successful, sustainable business in a highly competitive environment.