How will these industry megatrends impact incumbent wealth managers?

All of the trends mentioned above individually and in particular their accumulation poses a substantial threat to the business model and modus operandi of wealth managers, who operate internationally. The corporate superstructure of these firms is often fragmented and characterized by unmanageable levels of complexity, which can be summarized by the following 4 symptoms:

- Their international footprint increases the regulatory exposure as the requirements of all locations involved in a specific business context must be satisfied cumulatively. The related extraterritoriality risks (e.g. applicability of MiFID requirements on non-EU customers) often lead to a certain ambiguity on the overall state of compliance and drive the need for additional control instances.

- Their broad customer base leads to a heterogeneous product and service offering, which drives their need for specialization and therefore has a negative effect on the scalability of most value creating activities.

- Entangled management layers lead to slow and cumbersome decision-making processes, which reduce the company’s strategic flexibility and often prevent a well-structured allocation of functions and resources to the different units and locations.

- The split of the value chain across many different legal entities and/or branches leads to operational inefficiencies caused by the lacking alignment of the process and system landscapes.

All of these symptoms have a negative impact on the group’s profitability. In order to counter them effectively, project experience of zeb suggests that especially for the larger wealth managers, a simplification of their business and operating models can be very effective.

What is needed to better understand the complexity drivers?

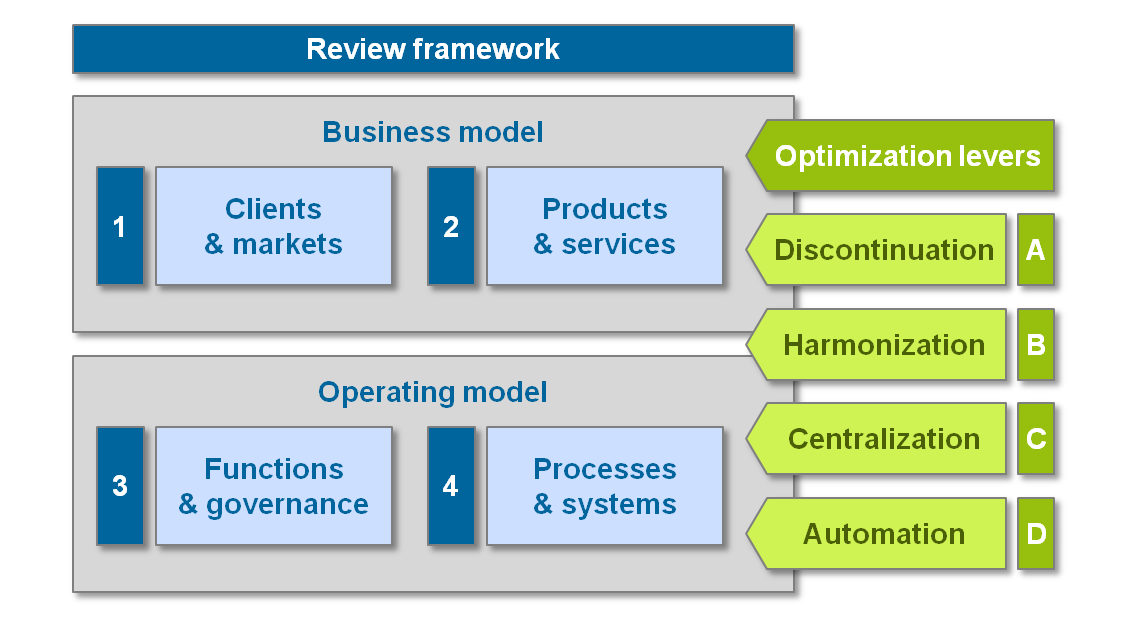

Prior to the start of the simplification exercise, it is advised to gain transparency on complexity drivers leading to the subsidization of non-profitable activities, regulatory risks and operational inefficiencies. As they might be related either to the business or the operating model, a holistic review should cover both elements:

The business model review targets the overall strategy with particular attention to the covered markets and the product and service offering:

- The review of clients and markets challenges the company’s international footprint in light of the regulatory exposure and the specific market share. It aims to identify structures where the administrative efforts are unsustainable in terms of the strategic importance of a specific market or client category.

- The product and service assessment reviews the scalability of service provisioning by assessing the potential to reduce the regulatory exposure or increase economies of scale and by comparing the specific production efforts to the related product or service penetration and revenue potential.

The operating model review targets inefficiencies related to functions and governance as well as processes and systems:

- The assessment of functions and governance aims to increase the company’s ability to cope with uncertainty. This step typically involves assessing the decision-making process itself, the criteria for the allocation of resources and functions, the organizational setup and incentive schemes.

- As processes and systems are often intertwined, the review of both elements is strongly linked. It targets the entire value chain and particularly focuses on process or system breaks and interfaces, which require manual intervention and therefore increase efforts and the likelihood of errors.

What can wealth managers do to simplify their business?

After having identified the key complexity drivers, there are four levers to simplify the business and operating model. They build upon each other and should therefore be executed sequentially:

- The first step focuses on the discontinuation of selected business model elements. It aims to reduce the regulatory exposure by discontinuing activities related to non-strategic markets that add substantial extraterritoriality risks. It also aims to improve scalability by discontinuing products and services with insufficient penetration or profitability.

- The remaining elements of the business model are subject to a harmonization initiative, which aims to define common product and service standards across all markets and client segments in order to enhance the scalability and flexibility of client services. To realize its full potential, this step also involves refining the operating model, thereby aiming at harmonized governance and decision-making processes to further enhance flexibility and standardized processes to drive scalability beyond a pure product or service view.

- Based on the harmonization efforts, it is possible to further strengthen the operating model through a centralization of functions. This step not only helps to reduce regulatory exposure by cutting the number of intra-company relationships; it also drives economies of scale related to know-how bundling and the concentration of operative tasks in dedicated centers.

- These economies of scale can be further increased through the automation of processes and systems. Having a harmonized setup with few large processing centers, will help the bank to substantially reduce systems breaks and increase the share of straight-through processing.

To achieve the described target picture, it is key to not only focus on the initiative outlined above, but to also pay close attention to the analysis and simplification process itself. As any “simplify the bank” initiative may have a broad scope and substantial impact on the entire organization, the implementation of such initiatives will require the transformation project to effectively manage its own complexity as the zeb project experience suggests.