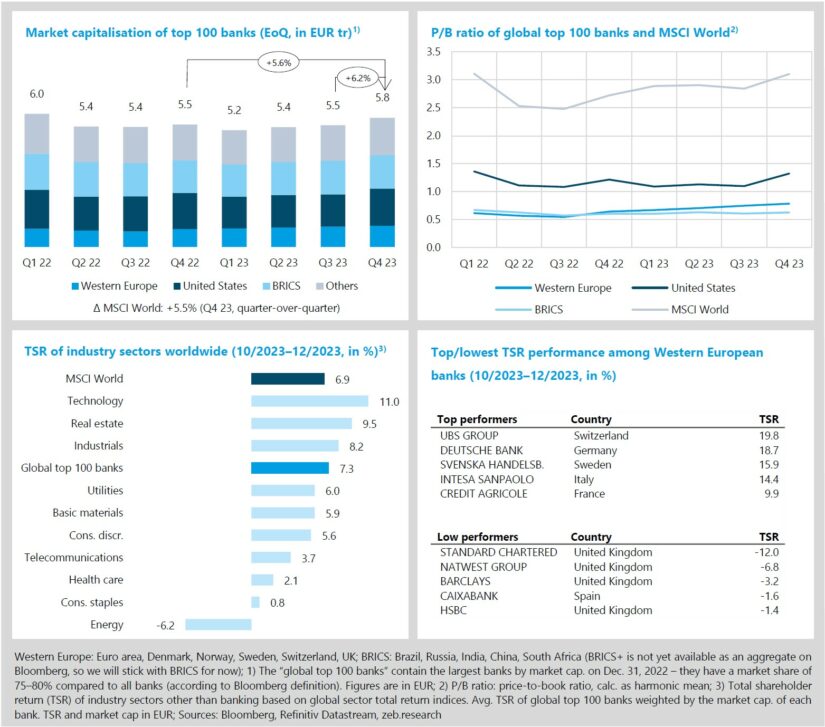

Strong year-end capital markets rally for global top 100 banks

Global top 100 banks outperform the market in Q4 23

- U.S. banks lifted the global top 100 banks with a strong TSR performance of +16.9% QoQ in a bullish market environment (MSCI world: +6.9%).

- ROE of Western European banks fell behind U.S. and BRICS banks in Q3 23 due to UK banks, which accounted for 4 of the 5 lowest TSR performers in Q4 23.

The prospect of central banks cutting interest rates within the first half of 2024 gave global capital markets a boost at the end of 2023 (MSCI World market cap. +5.5% QoQ, TSR +6.9 QoQ). At EUR 5.8 bn, the global top 100 banks achieved their highest market capitalisation in almost two years and managed to outperform the market (market cap. +6.2% QoQ, TSR +7.3% QoQ). The strong performance can mainly be attributed to U.S. banks which managed to increase their market cap. by 15.2% QoQ (Western Europe: +4.4% QoQ; BRICS: -0.1% QoQ). With prospects of declining yields and an economic recovery, banks may expect less pressure regarding the valuation of their assets, less risk for loan defaults, and – see this issue’s special topic on 2024, the transitional year to a new equilibrium – possibly a higher credit demand.

- Average P/B ratios increased in Q4 23 (MSCI World +0.26x QoQ to 3.10x). U.S. banks’ average valuation rose significantly by +0.23x QoQ to 1.33x, widening the gap to its peers from Western Europe (+0.04x QoQ to 0.79x) and BRICS (0.63x) again.

- The prospect of declining yields and a soft economic landing drove TSR performance of the technology and real estate sectors to the top in the industry sector comparison with +11.0% QoQ and +9.5% QoQ, respectively. Rising oil prices had made the energy sector the best-performing sector in Q3 23, the reverse effect ensured that the energy sector brought up the rear in Q4 23 (TSR -6.2% QoQ).

- The recent boost in investor confidence following the acquisition of Credit Suisse continues to pay off for UBS, which achieved the best TSR performance in Western Europe for the second consecutive quarter in Q4 23 (+19.8% QoQ). Standard Chartered, which is listed in the UK and Hong Kong, ranks last among Western European banks (TSR -12.0% QoQ), as its net income suffered from the USD 697 m write-down of its stake in China Bohai Bank.

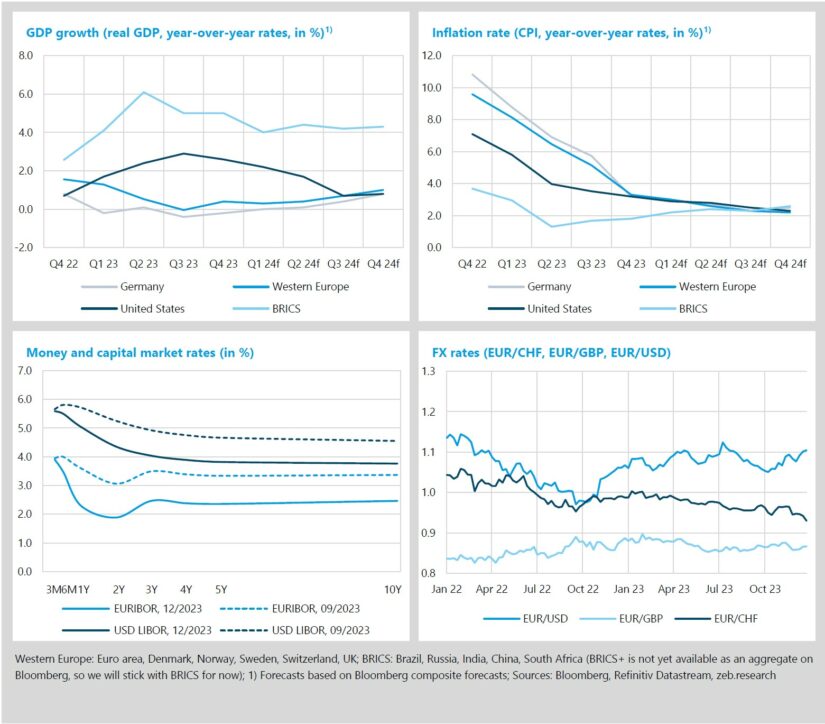

Markets anticipate early rate cuts amidst positive inflation readings

- A technical recession is expected in Germany at the end of 2023, whereas inflation fell faster than anticipated in Q4 23 (Western Europe: 3.3%; U.S.: 3.2%).

- Yield curves in the euro area and the U.S. shift downwards in Q4 23 as market participants anticipate early rate cuts in the first half of 2024.

The economic outlook in the U.S. and particularly in Western Europe and Germany remains dim. After Q2 23 retrospectively recorded slightly positive economic growth, two consecutive quarters of negative growth (Q3 23: -0.4%; Q4 23f: -0.2%) have now led to a technical recession in Germany at the end of 2023. Inflation rates in Western Europe and Germany, however, are falling more sharply than recently expected. In all regions considered, inflation reached levels below 4% in Q4 23. A further reduction is expected in the future, albeit at a slower pace, with inflation rates approaching but not yet reaching the target of 2% by the end of 2024. Overall, lower inflation and limited growth perspectives lead markets to expect a reduction in central bank interest rates within the first half of 2024. Consequently, yield curves in both the euro and the dollar area have shifted downwards in Q4 23 – see chapter 3 for details on determinants and current and expected developments regarding the long and the short end of the yield curve.

- Inflation continued to decrease in Western Europe, Germany, and the U.S. with rates of 3.3% YoY, 3.2% YoY, and 3.2% YoY in Q4 23, respectively. The BRICS countries managed to keep inflation below 2.0% YoY.

- The downward shift in yield curves in both the euro area and the U.S. reflects adjusted market expectations that central banks will cut rates already in the first half, potentially even the first quarter of 2024 – central bankers oppose these expectations, at least in terms of communication, and want to wait for further inflation and economic data. Long- and medium-term interest rates exhibited the greatest decline in Q4 23, with 1-year rates dropping by 131bp and 67bp in the eurozone and the U.S., respectively.

- The EUR/USD FX rate rose over 1.10x in Q4 23, indicating market expectations that the FED, who started raising interest rates four months before the ECB, will also be the first to end the tightening cycle.

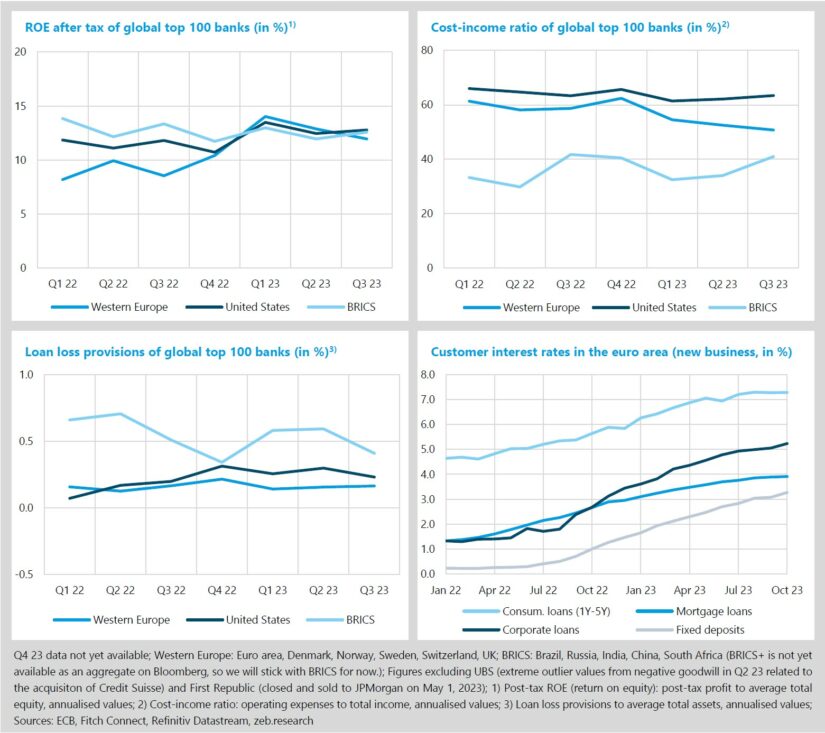

After two consecutive quarters in which Western European banks recorded the highest ROE among the global top 100 banks, they came in last in Q4 23 with an average ROE of 11.9% (U.S.: 12.8%; BRICS: 12.6%). UBS has again been removed from the sample of the global top 100 banks, so goodwill profits do not distort overall results. The ROE decline of Western European banks results primarily from a decrease in net income of around EUR 8 bn, of which around three quarters are attributable to UK banks. This development is also reflected in TSR performance in Q4 23, with four of the five lowest performers being UK banks (see chapter 1).

- Western European banks managed to increase their total revenues by +10.0% YoY and, at the same time, lowered costs by -4.9% YoY, resulting in a considerably improved CIR of 50.8% (-7.9%p YoY) in Q3 23. Because of the two opposing effects of slightly decreased costs (-1.3%p YoY) and revenues (-1.4%p YoY), the average CIR of U.S. banks remained roughly the same at 63.4% (CIR of BRICS banks:

-0.7%p YoY to 41.0%). - Only Western European banks slightly increased loan loss provisions in Q3 23 (+1bp QoQ). Despite the expected decrease in U.S. GDP growth rates for the upcoming quarters, S. banks lowered provisions by -7bp QoQ (BRICS: -18bp QoQ).

- Mortgage loans and fixed deposits are following the recently expected path. While the former remained roughly at the level of the previous quarter, the latter rose to 3.3% in October 2023, confirming the expectation of a rate transmission that has not yet been fully completed. For a view on overnight deposits see chapter 3 – here, the level of rate transmission is even more subdued in a historical context.

Special topic: 2024 – transitional year to a new equilibrium

- Global drivers of structural change, elections around the world, slow economic recovery and expected rate cuts are likely to make 2024 a transitional year.

- What will be the effects on the short and the long end of the yield curve? What are the implications on revenues from maturity transformation, the loan and deposit business? Or in sum: how will the year 2024 turn out for banks?

2024 will likely be a transitional year to a new economic equilibrium that is slowly emerging at the horizon. The aftereffects of the COVID-19 pandemic, the ongoing war in Ukraine, escalating tensions in the Middle East and the rapidly intensifying effects of climate change are drivers for medium to long term structural changes. They challenge the EU to develop a clear strategy on supply chains, defence, export markets, strategic partnerships, energy supply and technology. With half of the world’s population, including the U.S., going to the polls in 2024, this strategy formulation must be developed with a lot of moving targets. The likely success of a lot of populist parties globally will further complicate the process.

As discussed in chapter 2, expected economic growth, especially in Europe, is limited and for some countries still in stagnation territory. Inflation is expected to further retract but to remain above the 2% target even by the end of 2024. Monetary transmission is already at its peak or at least close to it. The ECB and U.S. FED will play a key role in navigating through this transitional year with clearly communicated and decisive actions regarding the speed and intensity of policy rate cuts. This of course begs the question: what will be the effects on the short and the long end of the yield curve? From a banking perspective this has ample implications. What are the implications on revenues from maturity transformation? What will be the effects on the loan business, both, on the volume and margin side? What will happen to the – in 2023 extremely boosted – deposit margins? Or in sum: how will the year 2024 turn out for banks?

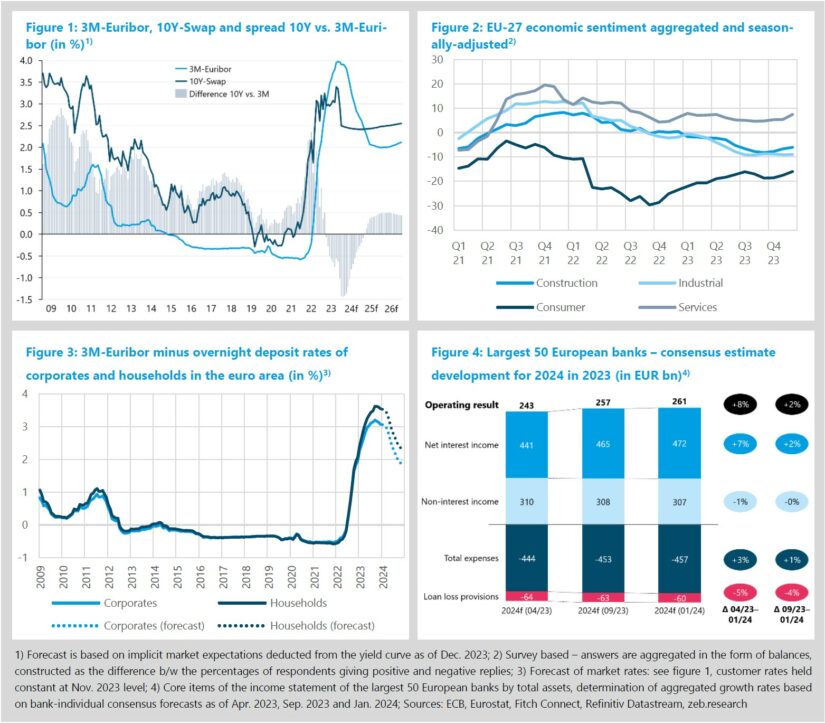

Usually, banks can generate sizeable revenues via their treasury department from maturity transformation. A “normally” shaped yield curve in which the interest rate at the short end is lower than at the long end of the curve is a prerequisite for this. Figure 1 displays the 3M-Euribor as well as the 10Y-Swap from 2009 to the end of 2023 as well as a market rate-implicit yield forecast for 2024 to 2026. The grey bars highlight the difference between the 10Y-Swap rate and the 3M-Euribor and act as a yardstick for the potential to generate revenues from maturity transformation – on average +125bp from January 2009 to February 2023. The persistent inversion of the yield curve – see chapter 2 – led to an average difference of -46bp for the whole of 2023. So, the boosted deposit business came at the price of negative revenues from maturity transformation. Looking at the implicit yield forecast that captures the expectations of market participants on the development of the different parts of the yield curve, 2024 will be even worse from a maturity transformation point of view than 2023.The average spread in 2024 will approximately be -80bp, starting at -140bp and ending the year at -20bp. Of course, the actual development will depend on the decisions of the ECB regarding the timing and intensity of rate cuts, that will heavily impact the short end of the yield curve, as well as the expectations of market participants regarding future inflation developments. According to current implicit market expectations, the spread between the 10Y-Swap and the 3M-Euribor will turn positive again in February 2025, marking 2024 as a transitional year from a maturity transformation point of view and one of the longest periods of an inverted yield curve ever.

In the last issue of the zeb.market.flash, we showcased the effects higher market rates have on the new business volumes in loans via the credit transmission channel. So far, the situation has not improved – new business volumes remain subdued. Considering the current GDP outlook (see chapter 2) and the economic sentiment indicators for Europe in figure 2, at least the first half of 2024 will likely be a shaky path to recovery. Apart from the service sector, economic indicators are in negative territory. A glimmer of hope comes from the small recent improvements within the construction sector – despite “insufficient demand” overtaking “shortage of labor” as the number one factor limiting building activity for the first time since the COVID-19 pandemic. The drop at the long end of the yield curve in Q4 2023 improved financing conditions for commercial real estate and mortgages and was likely a welcoming sight for the industry. However, market expectations (see figure 1) do not indicate a further significant decline, so that loan demand will have to adjust to the emerging new equilibrium in long-term financing conditions. For banks, the challenge will be to find an optimal level of risk aversion to limit defaults while fostering and profiting as much as possible from the shaky economic recovery. Pricing excellence and generating risk-adjusted returns will be key.

For the deposit business, 2023 was a superb year – see our last issue. But what will happen in 2024? The short end of the yield curve is more relevant for the deposit business than for the loan business. As discussed before, the short end is primarily impacted by the decisions of central banks. Looking at the implicit market assumptions on the 3M-Euribor in figure 1 and in contrast to the loan business, the deposit business can expect a more favourable market environment. However, as figure 3 indicates, the extremely good conditions of 2023 are likely to fade out in 2024. Figure 3 shows the difference of 3M-Euribor rates and the overnight deposit customer rates of corporates and households in the euro area as a rough indicator for the revenue potential in the overnight deposit business of banks. With a conservative assumption of a continuation of the December 2023 conditions for customer rates and the market-implied adjustments of the 3M-Euribor during 2024, the profitability of the overnight deposit business will remain at historical highs but will also begin its adjustment path to a new equilibrium. Banks with a primary relationship with their customers, the ability to capture additional market share and excellent pricing practices will continue to benefit from the favourable market conditions.

Figure 4 showcases the development of analyst expectations on the performance of Europe’s largest banks in 2024. In April 2023, uncertainty regarding the interest rate developments and steps by central banks were still dominating expectations. Fears for a severe economic slowdown were more pronounced. In September 2023, expectations already turned more positive, but the first cuts in policy rates were still expected for the second half of 2024. With the forecast from January 2024, the significant drop at the long end of the yield curve is already priced-in and analysts now expect 2024 to become an even better year than they expected it to be over the course of 2023. Less pronounced loan loss provisions indicate towards a base case scenario assumption where the European economy is not going to fall back in recessionary waters, but rather see a slow recovery in 2024. However, expectations on cost developments have also increased over time, indicating that smart efficiency gains will be vital for banks to succeed in 2024. This year, AI will not help in that endeavour, but might do so in the future. Managing the demographic change from a workforce perspective will be challenging but a prerequisite for lasting success across European banks.

Overall, 2024 is set to be a promising year for European banks. However, banks should not expect the same windfall profits from the deposit business as in 2023. It is “back to work” for European banks. The treasury departments need to be vigilant and active; risks must be monitored closely; pricing needs to be excellent to successfully compete for attractive deposits and the hopefully recovering loan business.