Western European banks continue to lift the global top 100 banks

+6.5% QoQ TSR performance of Western European banks

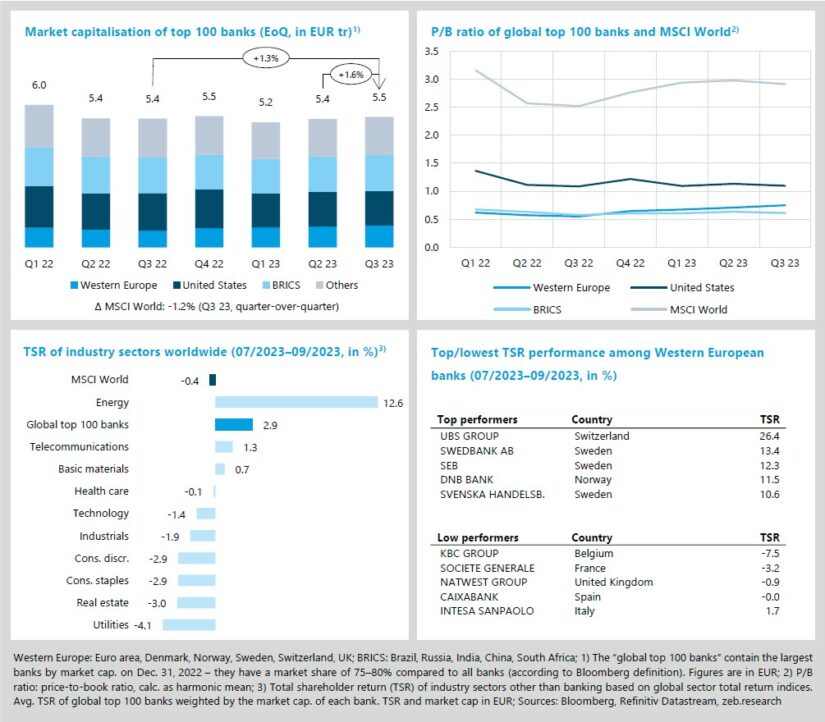

- Global top 100 banks, led by Western European banks, again posted a good TSR performance (+2.9% QoQ) in a difficult overall market (MSCI world: -0.4%).

- The still very large P/B ratio gap between Western European banks (+0.04x QoQ to 0.75x) and their U.S. peers (-0.03x QoQ to 1.10x) has narrowed again.

After the banking turmoil in Q1 23, the banking sector’s recovery, which already started in Q2 23, continues with the global top 100 banks almost reaching market capitalisation levels as at the end of 2022 (market cap. +1.6% QoQ, TSR +2.9% QoQ) – the main driver is once again the solid performance of Western European banks (TSR +6.5%, U.S.: +0.6%, BRICS: +2.1%). Banks are among the very few sectors that mostly profit from the significant increases in interest rates, while most other sectors are struggling with significant higher refinancing costs, in addition to high inflation, and limited economic growth perspectives (MSCI World market cap. -1.2% QoQ, TSR -0.4% QoQ). In this issue’s special topic, we shed light on the strong performance of Western European banks so far, what the monetary transmission channels have to do with it and why this success is unlikely to continue as strong.

- The still very large P/B ratio gap between Western European banks (+0.04x QoQ to 0.75x) and their U.S. peers (-0.03x QoQ to 1.10x) has narrowed again. Still, they remain below the 1.00x hurdle, signaling a continuing investor disbelieve that they will be able to regularly earn their cost of equity.

- With a TSR performance of +12.6% QoQ, the energy sector led the industry sector comparison in Q3 23 as OPECS’s production cuts caused historically low oil supply and a price increase by almost +30%. The worst performing sectors were hit hard by high inflation and interest rates.

- UBS ranked first among Western European banks in terms of TSR performance in Q3 23 (+26.4% QoQ) and overtook BNP Paribas in market capitalisation to take the second place behind HSBC in our Western European sample. After stock prices initially had moved sideways following the acquisition of Credit Suisse in Q2 23, quickly returning state guarantees and the decision to integrate the Swiss business of Credit Suisse led to a significant increase in investor confidence.

Central banks walking a tightrope

+0.3% YoY real GDP growth in Q3 2023 in Western Europe

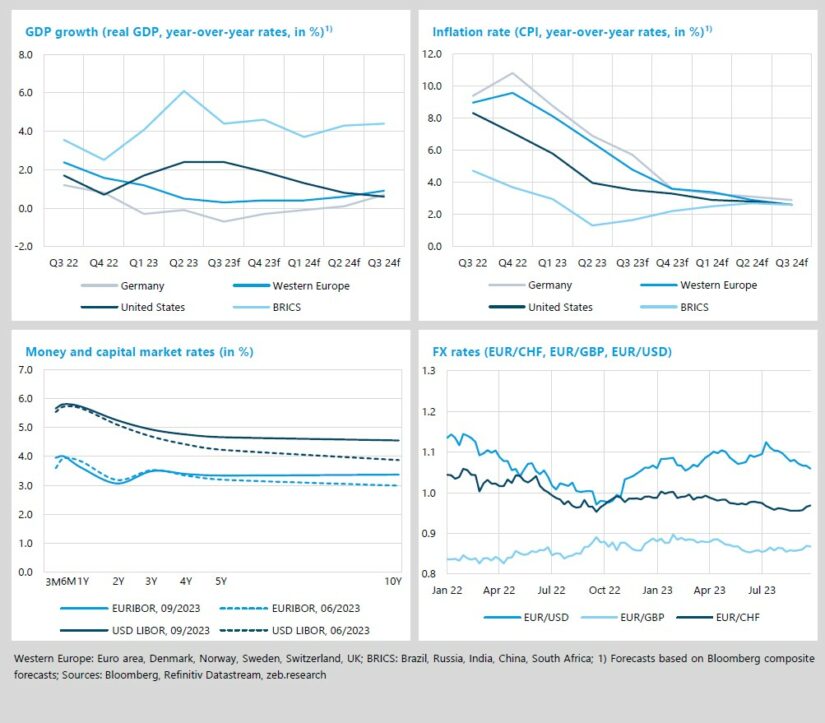

- Next quarters’ GDP growth rates are expected to remain low, but the restrictive monetary policy of central banks is showing success in reducing inflation.

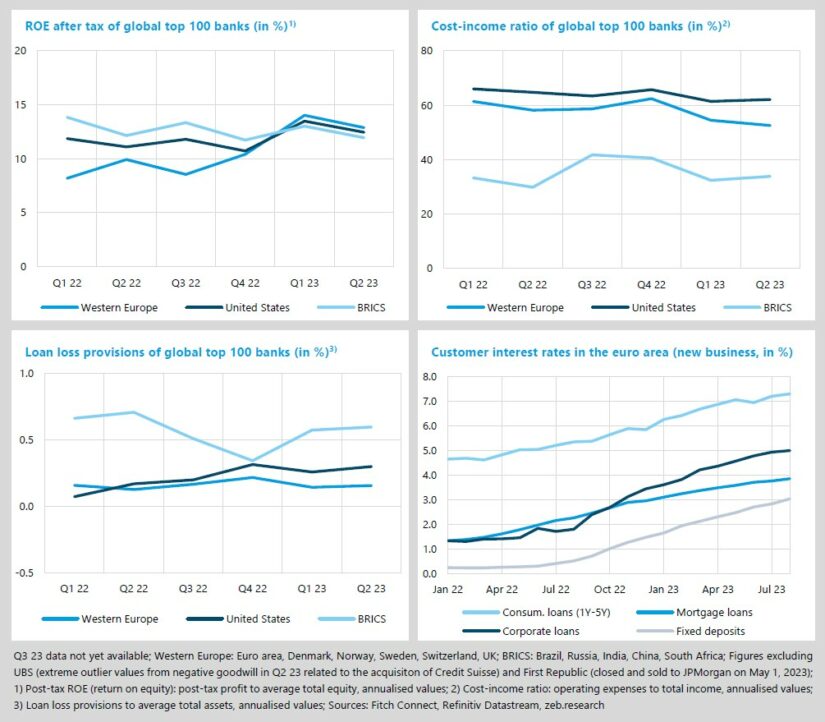

- Western European banks managed once again to come out on top in terms of profitability in Q2 2023, with an ROE of 12.9% (ex. UBS).

In the U.S., Western Europe and especially Germany, growth rates in the upcoming quarters are expected to remain low. Q3 23 was the third quarter with a decline of German GDP and former readings have also been corrected downwards. It is only in Q2 24 that Germany is expected to return to a small growth of 0.1% YoY and thus leave recession territory. At the same time, the restrictive monetary policy of central banks is showing success in reducing inflation rates. All analysed economies and groups are expected to return to inflation rates below 4% by the end of this year. The target rate of 2%, however, is still a long way out. Given this challenging economic outlook, the ECB and the FED are likely to have peaked with their rate hikes and their challenge now is to figure out when, how strongly and how fast to return to a less restrictive monetary policy. The state of policy transmission, especially in bank interest rates, re-allocation of deposits and the bank credit cycle will be under close observation going forward (see chapter 3).

- While the economic growth forecast for the U.S. has improved slightly, the expected trough in Western Europe, especially Germany, is more pronounced than anticipated in the last estimates. However, markets still expect Western European countries to slowly recover in 2024, while the U.S. is expected to see positive, but declining GDP growth rates in 2024.

- In Q3 23, inflation further declined across Western markets, but remained significantly above the 2% target (U.S.: 3.5% YoY, Western Europe: 4.8% YoY, Germany: 6.9% YoY).

- Yield curves in the euro area and U.S. showed a modest normalisation. Short-term rates remained relatively stable, but 10-year rates rose by +38bp and +68bp, respectively. Whether we see a further flattening or even normalisation of yield curves going forward, has significant implications for banks.

In Q2 23, Western European banks managed once again to come out on top in terms of profitability, with an ROE of 12.9% (U.S. banks: 12.5%, BRICS banks: 11.9%). This beat of Western European banks was even realised without accounting for the extremely high negative goodwill profits UBS got from acquiring Credit Suisse, as these would have distorted the overall results significantly (aggregate ROE of Western European banks including UBS: 20.5%). Especially retail-focused banks had a second very good quarter in 2023, profiting from lagging policy transmission (see chapter 3). With these solid results, the 22 Western European banks (ex. UBS) in our global top 100 sample made up 21% of total net income – up from 17% a year ago and closing the gap to the 19 U.S. banks in our sample (U.S: banks: 22%, both in Q2 23 and Q2 22).

- In Q2 23, Western European banks were able to boost their total revenues by +9.2% YoY, while reducing costs by -1.3% YoY, cumulating in a significantly improved CIR of 52.6% (-5.6%p YoY). Profiting a bit less from the new yield environment, with revenues up +7.4% YoY, but suffering from inflation-induced cost increases of +3.1% YoY, U.S. banks showed a good but less pronounced improvement in their CIR by -2.6%p YoY to 62.1% (CIR of BRICS banks: +4.0%p YoY to 33.9%).

- While economic expectations remain on shaky ground, markets, as well as banks do not expect a worst-case scenario for 2024, so loan loss provisions remained relatively constant in Q2 23 across markets (U.S.: +4bp QoQ, Western Europe: +1bp QoQ, BRICS: +2bp QoQ).

- Corporate loan rates, and to a lesser degree mortgages, show first indications of reaching their maximum in the current yield environment. Without an unexpected further external impetus, they will likely stabilise around current levels. Consumer loans and especially fixed deposits still demonstrate a clear upward trend signalling a not fully completed rate transmission. Further moderate increases can be expected in the upcoming months.

Special topic – rate hike cycle coming to an end

- The central banks’ balancing act of tackling inflation without stalling the economy is going into the next round and banks are affected from all sides.

- What are the effects that can be observed in the monetary transmission channels, especially the interest and credit channels? What have been and will be the implications from a banking and business area perspective?

With the recent +25bp rate hike by the ECB, current market expectations are that the ECB and FED rate hike cycle has come to an end. Currently, the effects of this tighter monetary policy continue to be transmitted with a lag. Inflation across markets is starting to slowly recede and expectations point towards a normalisation, albeit above the 2% target rate. At the same time, GDP screenings and forecasts continue to worsen. The central banks’ balancing act of tackling inflation without stalling the economy is going into the next round and banks are affected from all sides. They are at the centre of central banks’ channels of rate transmission and are an integral intermediary of the real economy. In the following, we want to take a closer look at what this turning point in interest rate policy implies for banks. What are the effects that can be observed in the monetary transmission channels, especially the interest and credit channels? What have been and will be the implications from a banking and business area perspective?

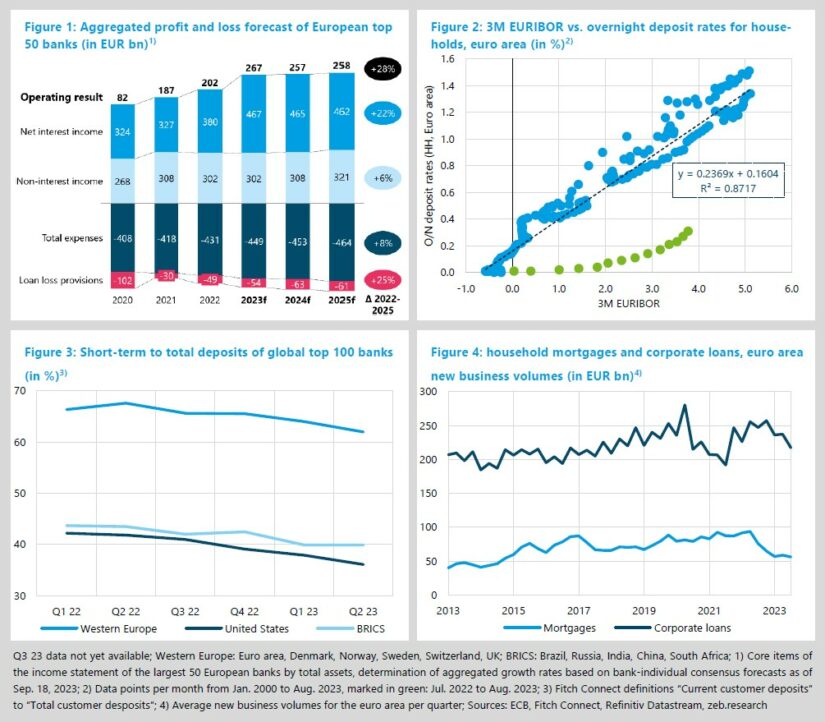

The strong ROE performance, especially of Western European and U.S. banks, in the first half of this year (see chapter 2) already suggests that 2023 will be a very successful year for global banking, the dominant driver being significant increases in net interest income. As already predicted in our 42nd zeb.market.flash issue on November 11, 2022, rising rates led to a rebirth of the deposit business and a sizeable increase in the income contribution of corporate and, especially, retail deposits. Against this backdrop, it is no wonder that institutions focused on retail and corporate banking have been among the strongest profiteers of the new interest environment. Considering analyst forecasts for the top 50 largest European banks, European banks profits will be significantly lifted in 2023, but then stagnate on this elevated level going forward (see figure 1). The sizeable increase in the net interest income in 2023 will likely persist, but inflation-driven increases in operating costs and a normalisation of loan loss provisions will curb some of these additional earnings and keep the overall operating result stable after the rise in 2023.

So, where does this significant increase in the net interest income come from? A more thorough look into the interest transmission channel helps to understand the expected strong increase in net interest income for 2023 and the more stagnant expected development thereafter, and provides an indication as to why retail-focused banks in Western Europe profited the most.

Pass-through rates of household (HH) and non-financial corporation (NFC) loans are high and approximately on historical levels (see chapter 2). As such, margins in the loan business have been fairly stable and transmission of monetary policy rather direct. Pass-through rates in the deposit business, especially with HHs and their overnight (O/N) deposits, however, were very low in a historical context and are only slowly catching up with the new yield environment. Figure 2 displays the, historically, close relation of 3M EURIBOR rates and euro area HH O/N deposit rates (R² of ~87%) and highlights the current anomalies that we see in the period from July 2022 to August 2023 (green dots). Considering the whole period, the pass-through rate in O/N deposits was ~24%. So usually, a 1%p increase in the 3M EURIBOR would translate to a 0.24%p increase in the O/N deposit rate for HH. Looking at the green dots, we can see that pass-through rates since July 2022 have only been at ~8%. Based on the historic relation, customer rates on O/N deposits should be at 1.06%, but in August 2023 they were merely at 0.31%. This slow adjustment has been mostly favourable for banks, as the huge gap between the 3M EURIBOR and O/N deposit rates, indicates the significantly increased margins to be earned in the deposit business.

During the low and zero yield years, market participants continuously shifted their deposit holdings from fixed and saving deposits, which lost their yield advantage, towards non-maturing short-term deposits. Figure 3 displays the share of short-term deposits to total customer deposits for the global top 100 sample. The first finding is that short-term deposits are significantly more dominant in the overall share at Western European banks, when compared to U.S. and BRICS banks. Second, with the return of more favourable long-term/fixed deposit offerings, households and corporates start to re-balance their portfolio. From a high of 68% short-term to total deposits at Western European banks in Q2 22, the ratio fell to 62% in Q2 23 and will likely continue to decline. With such a high share allocated in short-term deposits and slow rate transmission cumulating in high margins, the extremely successful first half of 2023, particularly by retail-focused Western European banks, is no surprise.

With some lag, however, the interest transmission channel gains some traction now. As soon as the initial re-balancing is completed and customer rates have caught up with market rates, the profit contribution from (retail) deposits will normalise to levels seen before the low/negative yield environment, as well. The other side of the coin, however, is also that in view of the current turnaround in interest rates, market and model risks of refinancing based on short-term deposits can become effective. The re-balancing phase, thus, comes with great challenges for banks, from modelling non-maturing deposits in order to better understand deposit in- and outflows, having an overall good command and understanding of their banking book, as well as successful execution of a risk-adjusted pricing strategies.

The other side of rising interest rates materialises in the credit transmission channel. Loan demand is adjusting to higher rates – so far, in a challenging but orderly fashion. Figure 4 shows the monthly new business volumes as averages per quarter in HH mortgages and corporate loans for the euro area. Especially the significant -40% drop in mortgage loan volumes from a peak in Q2 22 to Q3 23 highlights the strong effect that the central bank’s measures already had. However, new business volumes are still above the levels we saw prior to the low/negative yield environment when mortgage demand was at a peak. While the mortgage business currently shows some indication of a normalisation on a lower level, new business volumes in corporate loans are still declining and approaching the levels seen during the COVID-19 pandemic.

The question going forward will be whether we end up in a downside risk scenario or whether the orderly process across transmission channels will continue. Downside risk to the sketched-out developments would be a further deterioration of the economy, paired with high levels of uncertainty due to the multiple global crises that affect prices as well as investment decisions across industries. In a worst-case scenario, this could result in higher loan loss provisions and incline banks to reduce loan supply in fear of higher losses by tightening their lending standards significantly – which would lead to a credit crunch. Which would then amplify the recession and imply even higher loan loss provisions for banks. The expected base case, however, is an orderly transmission where loan demand finds a new and stable equilibrium, albeit one that will be lower than that prior to the rate hike cycle. A significant pick-up would require distinct growth implications from the overall economy, which are not expected until the end of 2024.

Overall, the return of interest rates is a blessing for most banks, especially for those that closely monitor and manage the associated risks. The way forward will – hopefully – be one of an orderly normalisation.