How has the Polish economy developed over the last 30 years?

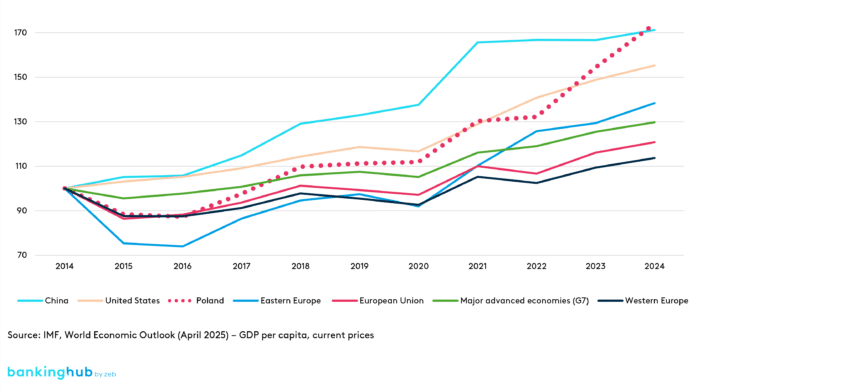

With steady GDP growth, nearly doubled exports, EU integration and a rising middle class, Poland is one of the fastest-growing economies in Europe and ranks among the top countries globally in terms of GDP per capita development, following challengers like China, Ireland or Vietnam. However, the development of its capital market has failed to keep pace with this broader economic success.

Despite its strong economic fundamentals, capital inflows to the Polish capital market have remained limited. The overall pool of investable opportunities has been small, market activity has stayed subdued, and equity returns have lagged behind major international benchmarks.

However, signs of change are emerging. Rising financial awareness in younger generations, inflation-driven search for alternatives to bank deposits and the growth of voluntary retirement savings products are all fueling interest in capital markets.

Strong economic fundamentals, but lagging capital market response

Over the past 30 years, the Central and Eastern European region has experienced unparalleled economic growth. Poland’s economy grew at a staggering rate comparable to China’s following the collapse of 45 years of socialism in 1989.

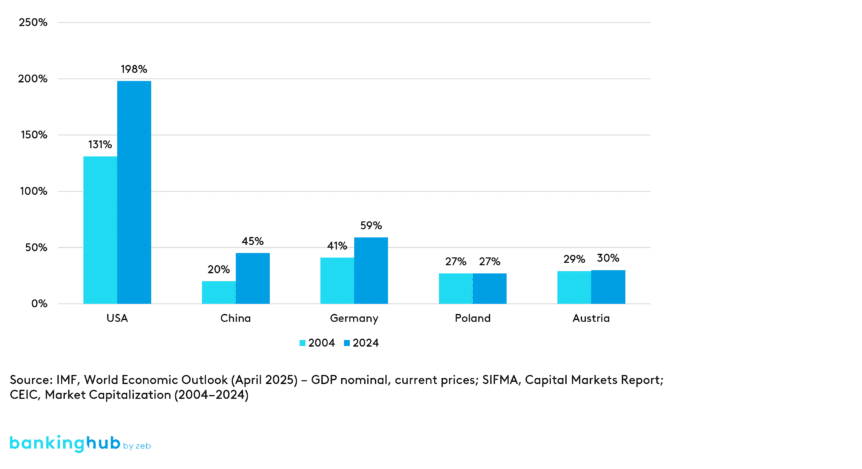

However, compared to Western nations, particularly the United States, the Polish capital market’s contribution to this growth has been rather negligible. This is mainly because both Poland and other European countries have remained predominantly credit-oriented, especially in contrast to the equity-driven financial landscape of the United States. According to OECD data, more than 70% of corporate financing in Europe still relies on bank loans, compared to less than 20% in the United States, where capital markets dominate. This credit-oriented model can be largely attributed to several structural and historical factors.

Firstly, the underdevelopment of capital markets in the early 1990s meant that bank lending was the most accessible and trusted form of financing for both companies and individuals alike. Commercial banks, many of which were privatized and modernized during this period, quickly became the dominant financial intermediaries.

Secondly, the legacy of central planning, combined with relatively low disposable household income, left a lasting void in the private investment culture. Financial literacy regarding capital market instruments remained limited, and although stock exchanges had been established or revived (e.g. the Warsaw Stock Exchange in 1991), they were largely perceived as risky and inaccessible to the general public. Consequently, traditional bank deposits persisted as the primary vehicle for saving, with private investment in equities remaining significantly below EU averages. For instance, in 2023, less than 7% of Polish households invested directly in the stock market.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

How is the Polish capital market gaining public trust?

As outlined above, the Polish investor’s profile and possibilities have been limited. However, we observe profound socioeconomic changes and strategic initiatives, which may result in attracting Poles to the capital markets. Historically characterized by caution, conservatism and a strong preference for traditional savings products such as bank deposits, the Polish investor today is gradually shifting towards becoming a more active, diversified and, above all, market-aware participant. Several factors are driving this evolution.

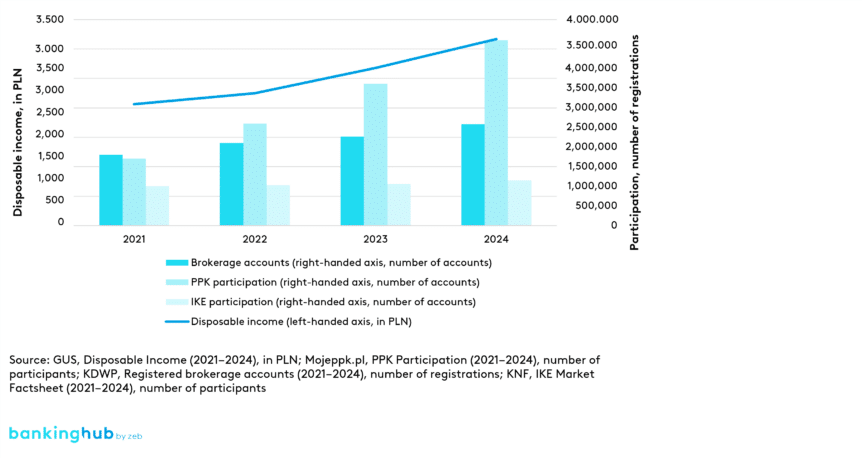

Firstly, the increase in disposable income has been a significant enabler. Since the 1990s, sustained economic growth has improved living standards. With essential needs largely satisfied, Polish households now seek higher-yield opportunities, increasingly viewing investment as a tool for long-term wealth accumulation rather than a luxury for the few.

Secondly, young generations are actively seeking more efficient ways to manage and grow their money. Millennials and Generation Z, who have entered the workforce in a fundamentally different economic and technological environment than previous generations, are showing a pragmatic approach to personal finance. Rather than relying solely on traditional savings, they are increasingly turning to investment options that promise better capital growth and are demonstrating a greater willingness to engage with equities, ETFs and other market instruments.

Thirdly, the post-pandemic economic environment has triggered a shift away from traditional savings products. Persistently low interest rates rendered bank deposits nearly unprofitable, while inflation, peaking above 18% in 2023, eroded the real value of savings. Faced with declining purchasing power, Polish savers began seeking alternatives, turning to equities, bonds and diversified investment funds to protect and grow their wealth.

Furthermore, Polish society remains deeply influenced by risk aversion and a strong preference for owning “material and safe” assets, traits that shape local investment behavior. Due to high-risk aversion and limited financial literacy, bonds and term deposits continue to dominate household financial portfolios. Regarded as safe and reliable investments, real estate became increasingly popular among affluent Poles during the low-interest rate environment of the pre-pandemic and pandemic years. This trend accelerated after the outbreak of the war in Ukraine, causing housing prices to triple in many cities since 2018.

However, by 2025, this boom showed signs of slowing down. According to GUS data, new apartment sales have plateaued across Poland (excluding Warsaw), rental prices have begun to decline, and in some cities, the number of rental listings now exceeds actual demand. While this shift may raise concerns, it should not be mistaken for the onset of a housing bubble.

Poland’s continued economic growth ensures a strong underlying demand for housing. However, when combined with a declining fertility rate, this trend suggests that real estate may no longer yield the exceptional returns witnessed in previous years. With interest rates expected to fall further, offering limited appeal for bonds or deposits, an increasing number of investors are likely to pivot toward equities and other alternative assets, such as cryptocurrencies, in search of higher yields.

Moreover, pension initiatives have increased investment participation. Programs such as the Employee Capital Plans (PPK) and voluntary savings options like individual retirement plans (IKE and IKZE) have systematically introduced broader segments of society to capital market products. Significant tax incentives and automatic sign-up functions have particularly encouraged long-term savings behaviors that align with investments in the equity market. In 2023, the value of assets accruing from voluntary contributions to the pension sector increased by 44.1%, amounting to PLN 74.8 billion. Employee Capital Plans (PPK) reported the fastest growth rate (81.6%).

Finally, the emergence of fintech platforms has made markets far more accessible. Digital investment platforms and mobile apps have removed traditional entry barriers, offering low-cost, user-friendly solutions for retail investors. Fintech companies, such as Trading212, eToro, OANDA TMS Brokers, XTB and Revolut, as well as increasingly digitalized brokerages owned by major banks, are shaping the investment landscape. These firms focus on offering various forms of investment advisory services, ranging from fully digital to human-assisted. They provide real-time access to markets, educational resources and easy portfolio management. These features especially appeal to younger generations who expect seamless digital experiences.

What are the future prospects for the Polish capital market?

The Polish capital market is undergoing a significant transformation and becoming increasingly attractive to retail investors. A new generation of investors is engaging more actively with capital markets. This shift is not only visible in market data, with individual participation rising steadily, but is also reflected in the evolving needs of our clients. Financial institutions and market participants are increasingly seeking strategic advice on how to position themselves to capitalize on the opportunities presented by this new wave of retail engagement.

As economic fundamentals remain strong, the Polish capital market is poised to play a larger role in supporting long-term growth and wealth accumulation.