Special features of alternative assets

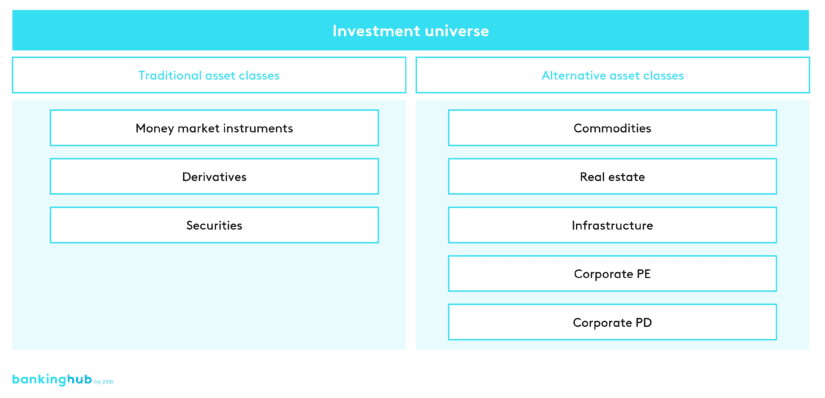

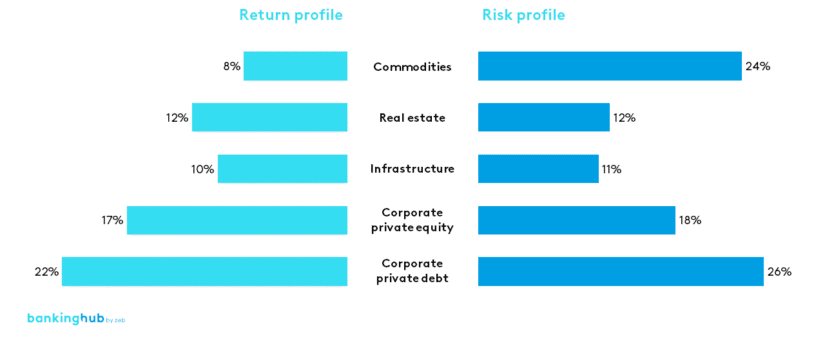

Since alternative investments (see figure 1[1]) are generally not traded on an exchange, there are some specific aspects to consider when comparing them to securities, money market instruments and derivatives. First and foremost, alternative investments are much less liquid than traditional assets and tend to have a low correlation with them. Secondly, the relatively high return and risk potential of these asset classes is often emphasized (see Figure 2[2]).

Alternative asset classes are generally less regulated and therefore less transparent. Finally, depending on the asset itself, the configuration of the investment and its legal wrapper is significantly more complex compared to standardized financial instruments.

Investments in alternative asset classes are primarily made by institutional investors, such as insurance companies, pension funds and family offices. This is mainly due to difficult access channels, high minimum investment amounts and long capital commitment periods. Institutional investors use alternative assets primarily for risk diversification, long-term capital accumulation and to generate stable, regular payouts.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Overview of selected alternative asset classes

Commodities are relatively easy to access – they can be purchased either physically or, as is common with capital market investments, in the form of various financial instruments, such as certificates or exchange-traded commodities (ETCs). Investments in commodities such as precious metals are often used for risk diversification in the portfolios of institutional and private investors and are regarded as a hedge against inflation. Furthermore, precious metals such as gold are considered a “safe haven” in bad times.

In general, we distinguish five categories of commodities:

- precious metals,

- industrial metals,

- energy commodities,

- agricultural goods

- and livestock.

Depending on the commodity category, there are differences in availability, storage, trading, and transaction costs. In addition to the various advantages, such as high liquidity and intrinsic value, however, there are also many risks to consider. Commodities are subject to short-term and extreme volatility since their availability also depends on external factors such as the weather.

Over the past few years, the amount of money invested in real estate worldwide has risen sharply and now stands at around USD 1.3 trillion[3]. This is largely due to the prolonged low interest rate environment, which has made this seemingly low-risk asset class much more attractive. In addition, real estate is comparatively easily accessible to the general public, either through direct investment or through fund vehicles.

The value of real estate and its development depend on the individual property (e.g. building fabric, fixtures and fittings) and are strongly influenced by local and individual factors such as macro- or micro-location.

On the one hand, real estate is differentiated according to its type of use, i.e. whether the property serves commercial or residential purposes. On the other hand, different investment strategies are distinguished:

- Core strategies are characterized by low risk and stable cash flows, for example through creditworthy tenants with long-term leases.

- Value-added strategies have a medium to high risk and initially generate low cash flows but offer growth potential. Such investment properties may have occupancy or maintenance problems, or they are located in peripheral locations with good future prospects.

- Opportunistic strategies refer to the riskiest investments, including, for example, properties with fundamental development needs. In addition to these categories, there are further differentiations such as core+.

Investment in infrastructure, such as transportation and telecommunications, has also increased in recent years. Today, the global investment volume amounts to around USD 850 billion[4]. This increase has been driven by both supply and demand.

On the one hand, it is increasingly difficult for the public sector alone to finance investments in the real economy. As a countermeasure, regulations have gradually facilitated access to infrastructure investments, and investments in specially regulated funds such as ELTIFs (European Long-Term Investment Funds) have therefore become a viable option to complement direct investments. On the other hand, the historically low interest rate environment has increased demand for relatively safe returns.

Infrastructure investments have three key characteristics:

- First, they extend over a long period of time – from the raising of capital through the construction phase to initial and ongoing operations – during which the funds invested are tied up.

- Second, infrastructure investments are generally highly illiquid. Existing holdings can only be sold through a corresponding network of investors with the necessary financial resources.

- Third, these investments are highly complex, not least because investors often need specific industry knowledge, for example with regard to local legal requirements.

One of the main attractions of infrastructure investments is that they tend to generate a stable, regular cash flow, which is of particular interest to insurance companies and pension funds with their long-term payout obligations.

Corporate private equity investments, i.e. investments in the equity of non-listed companies, have been growing steadily for years and now stand at around USD 7.1 trillion[5] worldwide. The comparatively low investment volume reflects the fact that only institutional investors have so far been able to invest directly in private equity.

This situation, however, is changing – individuals now also have the opportunity to invest in private equity funds. At EUR 10,000 or more, however, the minimum investment amounts customary in the industry are still relatively high, making these investments more likely to be affordable for the typical private banking clientele. In addition, the capital commitment is usually for ten years or more.

- A unique feature of private equity investments compared to other asset classes is that investors often seek to play an active role in the company, thus aiming not only for equity but also for access to networks, advisory services and the like.

- Another feature is that periodic income is uncommon, and the entire return on investment can only be achieved by selling company shares.

- Finally, it is important to note that both return and risk are highly dependent on the time when the initial investment is made. If it is in the early stages of a company’s development, such as the seed stage, when there is often only a business plan and a product prototype, the opportunities for return, but also the risks, are much higher than when investing in a company that has been in existence for some time and is raising capital solely to improve its equity ratio. Investment in newly founded or highly innovative companies is also referred to as venture capital.

Similar to the other asset classes, the investment volume in corporate private debt, i.e. the provision of loans without involvement of the capital market, has been increasing for many years. Since 2020, investment has continued to accelerate, and now stands at approximately USD 1.1 trillion[6] globally. This steady increase is mainly due to the stricter capital requirements for banks under the Basel regulations and the resulting withdrawal from some areas of lending, which has made financing through loan funds more relevant, especially for small and medium-sized enterprises.

Private debt investments can be broken down into different loan tranches and different investment strategies:

- The first of the three main tranches is the so-called senior debt tranche, i.e. the granting of senior or secured loans, while the second tranche – junior debt – is characterized by higher-interest but subordinated loans. Finally, there is a third tranche, called the unitranche, which is a mix of the two previously mentioned ones.

- A further distinction can be made: capital preservation loans, for example, are granted to companies with liquidity bottlenecks or high levels of debt, while growth loans are made available to financially strong companies with ambitions for (organic) growth, or to start-ups in the form of venture capital. Depending on the structure of the loan or the purpose of the financing, the risk-return profile of the investment changes.

- Other factors include the duration of the loan and the creditworthiness of the borrowers.

Short- to medium-term alternative asset trends

Various surveys show that alternative investments are an important part of institutional investors’ portfolios, and that this share could increase further in the coming years. The Investor Survey 2022 of the German Association for Alternative Investments (Bundesverband alternativer Investments), for example, shows that the majority of investors would like to maintain or increase their portfolio allocation to alternative investments, which currently stands at around 25%. J.P. Morgan’s 2022 Long-Term Capital Market Assumptions confirm this finding – alternative assets are an integral part of institutional investors’ allocation considerations.

What are the reasons for increasing the share of alternative assets in the portfolio?[7]

On the one hand, the coronavirus pandemic and Russia’s war of aggression against Ukraine heralded the end of an era of stable capital markets and made uncorrelated asset classes much more attractive. On the other hand, there are other developments that could further increase demand for certain alternative assets.

First and foremost, investors face inflation driven by supply shocks and low but rising interest rates. Given supply chain constraints and global nationalization efforts, inflation is unlikely to moderate significantly over the next few years, at least in the short to medium term. Consequently, investments in tangible assets, whose value usually increases in times of inflation, such as real estate and infrastructure, are becoming more attractive.

Furthermore, in keeping with the spirit of social change, investors are seeking greater sustainability in their portfolios. Investments in infrastructure are particularly well suited for this purpose. Promoting renewable energy, for example, can reduce global carbon emissions. Alternatively, investments in commodities may be classified as sustainable under certain circumstances. For example, investing in forest land can provide a steady stream of income through the sale of timber as a sustainable building material, while at the same time the forest land can be managed sustainably, which can contribute to carbon sequestration. Finally, technological innovation is often driven by young, independent companies, providing ideal opportunities for venture capital investment.

However, volatile capital markets and inflation are also fueling uncertainty and fears of recession, which are having a significant impact on investors’ risk appetite and investment behavior. It remains to be seen whether the latter will primarily focus on the many reasons for investing in alternative assets and whether the surveys on the increasing shares of alternative assets in portfolios will prove true.

Developments in alternative assets on the supply side

The supply side, too, is already showing signs of an increase in alternative asset offerings. On the one hand, as in previous years, regulators are expected to continue to drive forward access to alternative asset classes for retail investors, both in the form of direct investments and through inclusion in fund offerings. Pioneering initiatives include the 2013 European Venture Capital Regulation (EuVECA) and the 2015 European Long-Term Investment Fund Regulation (ELTIF). The EuVECA Regulation has set relatively loose conditions for launching venture capital funds, while the ELTIF Regulation has created a framework to promote long-term European investment in the real economy, targeting in particular private investors who have so far not been able to invest in infrastructure projects.

In addition to the regulatory framework, asset managers are also looking to gradually expand their product offerings to include alternative asset classes, either by incorporating alternative assets into existing funds or by launching new products exclusively geared to alternative investments. The main driver is the fierce price war fueled by the emergence of passive solutions and the resulting low margins on traditional products such as equity and multi-asset funds.

In addition, offering alternative products allows asset managers to differentiate themselves from their competitors. For example, traditional financial products can be used as core investments in a holistic approach to managing customer funds, while alternative assets can be used as satellites, primarily to generate returns.

Long-term development of alternative assets

The amount of money invested in alternative assets is also expected to increase over the long term. Blockchain technology can break down assets into small shares, known as security tokens, thereby making them accessible to a large number of people at low cost. This technology also enables decentralized recording, validation and execution of transactions that are immutable and thus largely tamper-proof.

Regulators have recognized these advantages, and the German government, as a pioneer in the European Union, is gradually creating a legally secure framework for token trading. As early as June 2021, the first cornerstone was laid with the German Electronic Securities Act (eWpG). The next step is expected in 2023 with the EU-wide Digital Ledger Technology Pilot Regime, which is aimed at investment firms, market operators and CSDs, and will enable the operation of a digital ledger market infrastructure.

Implications for market participants

The question arises as to what the developments outlined above mean for the various market participants, both on the demand and the supply side.

For investors, such as insurance companies, pension funds, family offices and, where applicable, private individuals, two key questions arise in light of the market developments.

- First, should alternative assets be included in a portfolio, taking into account their different risk-return profiles and their low correlation with traditional asset classes?

- If the answer to this question is yes, then another question arises: how is the investment made? There are several options. In addition to direct investments or investments in suitable securities, it is possible to acquire shares in funds that contain alternative investments. Alternatively, an asset management mandate can be signed, whereby the investor leaves investment decisions to the respective asset manager.

Against this background, regulators are also called upon to lay further legal foundations for investments in alternative assets. In this context, well-functioning markets, such as the private equity and venture capital market in the US, could serve as a model. It is also important to further expand the basis for token trading and to make alternative assets available to private individuals in terms of easy access, lower minimum investment amounts and shorter capital commitment periods.

Asset managers will take advantage of the regulatory framework and successively expand their range of alternative asset classes in order to differentiate themselves from the competition and, above all, to benefit from the still prevailing higher margins. However, since alternative assets differ greatly from traditional assets in terms of value creation, the question arises as to whether asset managing companies should build up / expand the expertise by themselves or obtain it through the acquisition of specialist firms.

Offering alternative assets requires fundamental changes in the structure and processes of both the front and middle office. Assets such as real estate or infrastructure companies, for example, are only included in a portfolio after extensive due diligence and contract negotiations, and in addition, it should be borne in mind that such properties also need to be managed. This includes tasks that go beyond the typical fields of activity of an asset manager, such as the development of property strategies and technical or leasing management. Consequently, skills and expertise are required that are not available among the typical staff of an asset management company. Property-related activities can alternatively be outsourced, although finding the right partner is made more difficult by what is currently still a limited offering.

As a long-standing partner of established banks and asset management companies in Europe, zeb has always kept a close eye on changes in the capital markets, investor needs and the conditions in a wide variety of institutions. Drawing on extensive knowledge and experience in the field of alternative assets and their integration into portfolios and organizations, we have been supporting asset managers in developing and expanding their range of services for many years. As partners for change, we help our clients master the only constant – change – and support them with expertise and foresight in dynamic times.