State of the banking industry

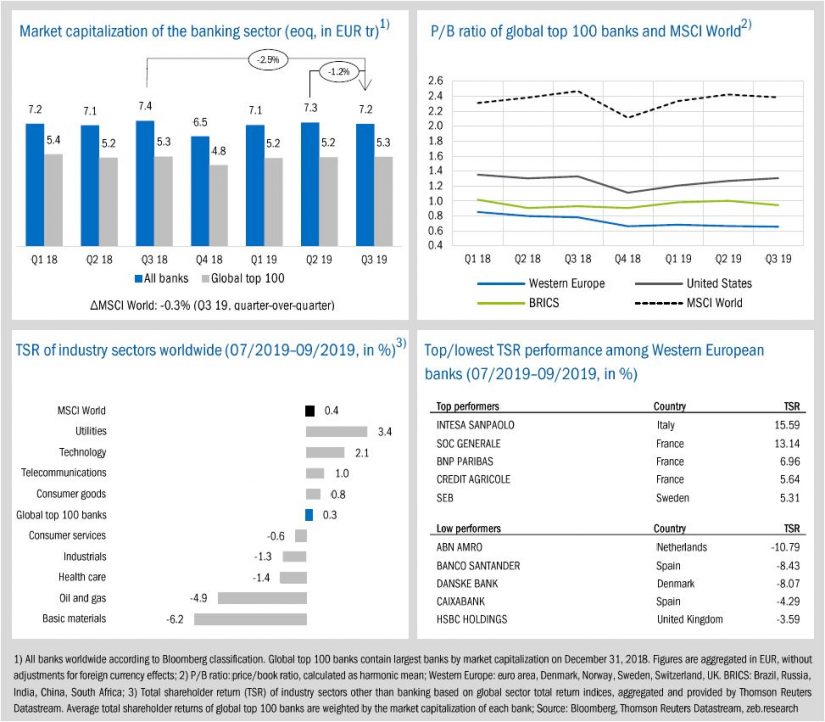

- Global top 100 banks stayed put in a very difficult market environment with an almost unchanged market cap. (+0.6% qoq) and a shareholder return of +0.3%.

- Regionally, U.S. banks’ average P/B ratio increased further to 1.31x whereas Western European banks valuation is still at a rock bottom value of 0.66x.

The global banking industry looks back on some mixed capital market developments in Q3 2019. Market capitalization of all banks declined by 1.2% but the largest 100 banks stayed put in a very shaky overall market situation. Global top 100 banks’ total shareholder return (TSR) was right in the middle of other industry sectors at +0.3%, where especially oil and basic material companies suffered from the global economic downturn, market uncertainties and trade wars.

- Market capitalization of global top 100 banks improved marginally by +0.6% qoq but “outperformed” the market which declined by 0.3%. Investors’ average TSR on top 100 banks was just +0.3% in Q3 2019, significantly lower compared to the beginning of the year (+8.2% in Q1 2019).

- Average P/B ratios developed differently across the regional clusters. Investors continue to favor U.S. banks, whose P/B ratios increased further to 1.31x, whereas BRICS banks fell below the important hurdle of 1.00x to 0.94x (-0.06x in Q3). Western European banks kept a P/B ratio of 0.66x at the end of the quarter.

- Among Western European banks, Intesa Sanpaolo’s TSR profited from very good first half 2019 figures incl. the best 6M since the financial crisis and strong operating improvements. French SocGen and BNP also developed surprisingly well. At the other end, news came out in September that ABN AMRO is under investigation for money laundering (but without any concrete results until now) resulting in the lowest TSR of all considered Western European banks.

Economic environment and key banking drivers

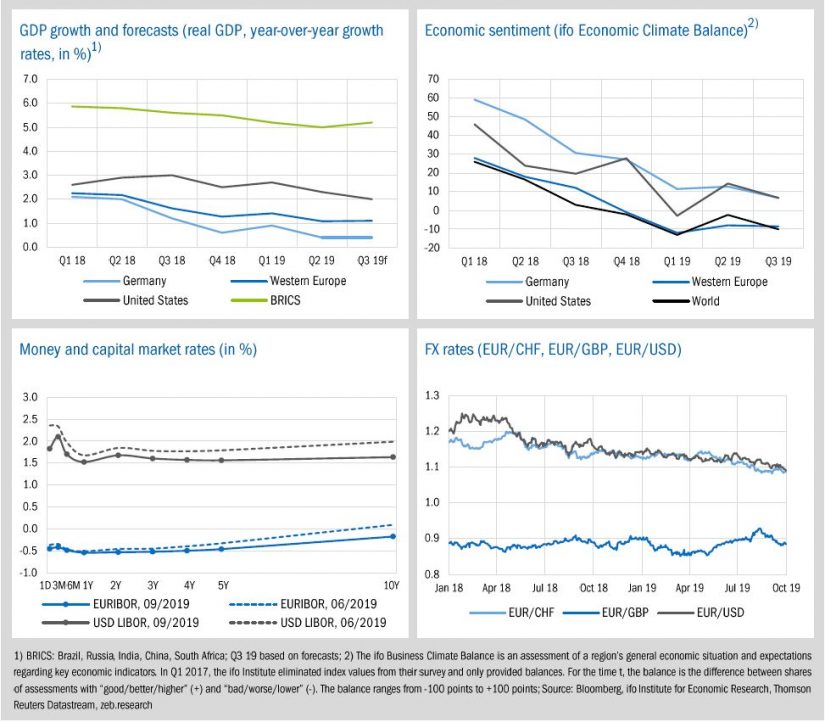

- In Q3, the overall environment was dominated by U.S. Fed’s and ECB’s interest rate cuts (U.S. Fed even twice), leading to lower yields and an inverse U.S. and very flat euro area yield curve.

- Economic growth rates remain on low levels and the overall outlook got worse as the overall business climate declined again in Q3 2019.

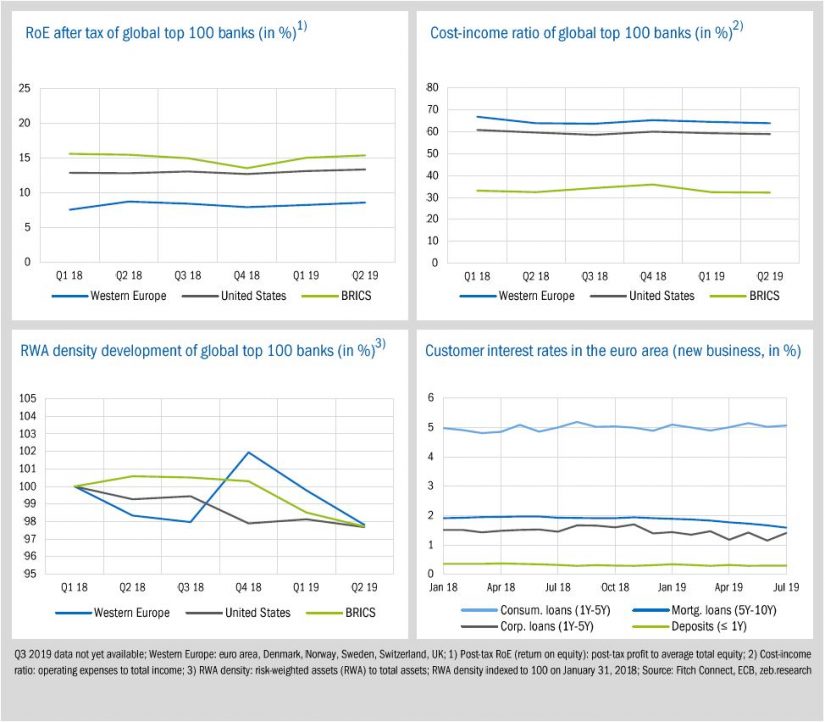

- Fundamental key performance indicators of global banks are still withstanding the downturn as post-tax RoEs and cost-income ratio remained stable.

As already predicted in the previous edition of zeb.market.flash, Q3 2019 was dominated by several monetary policy decisions. For the first time since the financial crisis in 2008, the U.S. Fed reduced their federal funds rate, not once but twice (July 31 and September 18) to 1.75-2.00%. On September 12, the ECB lowered their deposit facility rate to -0.5% and announced a ressurection of their asset purchase program but also introduced some relief for banks through a modification of long-term refinancing operations (TLTRO) and the implementation of a two-tier system for reserve remuneration. In the short run, the later two points will help European banks, but long-term effects of ultra-low and unnatural yield curves and how they affect the whole system of financial intermediation are unforeseeable.

- The monetary decisions of the U.S. Fed and the ECB have even worsened the current yield situation. In the U.S., the yield curve is nearly inverse. In the euro area, the slope decreased again and even long-term yields are now negative. In selected European countries the situation is even more dramatic. German and Austrian interest rates are far below the European average and especially long-term rates are even more negative.

- The macroeconomic effects of monetary policy actions are still not noticeable. In Q3, the economic climate suffered further across all considered regions and European/U.S. GDP growth rates remained at their low levels or declined.

- Looking at FX rates, the “long-term descent of the euro” continued with regard to the Swiss Franc and the U.S. Dollar (EUR/CHF -7.1% and EUR/USD -9.2% since January 18) whereas the EUR/GBP rate is still a roller coaster ride due to ongoing Brexit uncertainties.

Looking at fundamental banking KPIs, global banks are still somehow withstanding all negative economic factors from the first half of 2019. BRICS banks still achieved an average post-tax RoE of above 15%, while U.S. banks even improved to 13.3% and European banks nearly reached their costs of equity with a post-tax RoE of 8.5%. However, RoE is by nature a lagging indicator and does not yet reflect the recent deterioration of the economic environment. We expect a relatively difficult second half for banks and overall deteriorating results.

- Compared to previous year figures only U.S. banks were able to improve their profitability in Q2 (+0.5pp yoy) but other regions remained nearly stable (Western European banks: -0.1pp yoy, BRICS banks: -0.1pp yoy). Excluding Deutsche Bank, which reported the majority of its current restructuring efforts in Q2 2019 and posted a post-tax loss of EUR 3.1 bn for the quarter, the average RoE of remaining European banks even improved by +0.4pp yoy.

- In Q2 2019, average CIRs of U.S. and BRICS banks decreased on a year-over-year basis (U.S.: -0.7pp, BRICS: -0.2pp). Western European banks showed no overall improvements compared to Q2 2018 (+0.0pp yoy), despite UK banks which were able to improve their efficiency significantly (-5.6pp yoy).

- The flattening of the EURIBOR yield curve during the first months of 2019 is also reflected in the development of euro area customer rates. Especially interest rates for mortgage loans (5Y-10Y) decreased further and are now down to 1.59%, -38bp since June 2018. This is a remarkable drop as banks’ customer rates are typically more or less “sluggish”.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic

Banking and Corporate Social Responsibility

- Aside from financial KPIs, customers, employees and investors are becoming increasingly aware of companies’ social responsibility impact.

- It is crucial to agree on a common, company-wide definition of terms and objectives to achieve a clear alignment of efforts and a consistent vision.

- Successful inward and outward communication must be based on a consistent management framework that allows taking active measures and controlling impacts long-term.

More than ever, peoples’ buying decisions rely on more than just usual criteria such as price or service quality. Customers aim to procure services from companies that can demonstrate the lowest possible carbon footprint and operate sustainably in the interest of society. Equally, employees and investors are becoming increasingly interested to know what initiatives companies are launching on topics such as CO2 emissions, recycling or fighting poverty. The question of Corporate Social Responsibility (CSR) is thus gaining more and more importance along the entire value chain. This is especially true for the banking sector whose image has been severely tainted in recent years due to tax scandals, accusations of money laundering and not least due to the global financial crisis.

Numerous initiatives were launched at top levels to improve transparency for customers, employees and investors regarding companies’ (not just banks’) contributions to the welfare of the community. For instance, in Germany high-profile representatives of 30 companies have formed an association named “Value Balancing Alliance” aimed at measuring value added to society. Similar initiatives, although less mature, have recently been launched on Wall Street, where 181 leading US executives and CEOs agreed on a new objective of their “Business Roundtable” association. The prioritization of the (short-term) shareholder value, which has long been the only mantra on Wall Street, is relativized in the revised “Statement on the Purpose of a Corporation” in favor of the value generated for other stakeholders such as customers, employees, suppliers and members of the community. In addition, several internationally operating banks have recently signed the United Nations Environment Program Finance initiative’s (UNEP FI) “Principles for Responsible Banking” and the German BaFin is also focusing on the issue, albeit from more of a risk perspective.[1]

In the heat of the moment, however, it is easy to forget that the term “Corporate Social Responsibility” is open to interpretation. Differentiation and definition are therefore key in order to achieve a clear focus. The decision on a definition (such as the one adopted by the European Commission: “CSR is defined as companies’ understanding of their positive and negative impacts on society and the environment. So companies prevent, manage and mitigate any negative impact that they may cause, including within their global supply chain.”) cannot be made in isolation from fixing the goals. Potential goals can include boosting the financial performance as expressed by the total shareholder return and a higher market valuation, but also the realignment of the business model to improve sustainability—they are not mutually exclusive. In this context, it is crucial to agree on a common, company-wide definition of terms and objectives at the highest level in order to achieve a clear alignment of efforts and a consistent target vision.

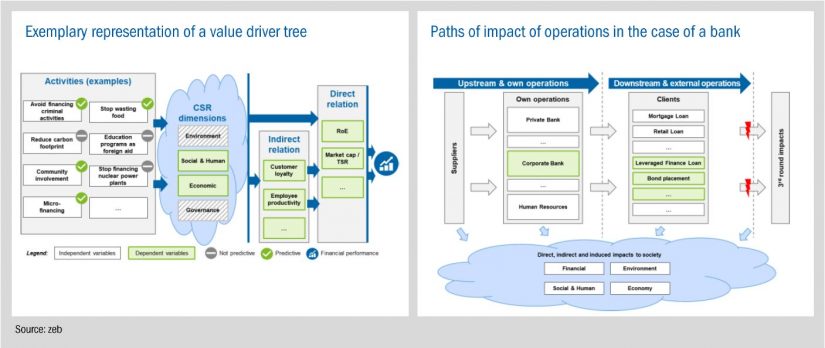

Based on such a clear objective, the next question to be answered is which dimensions out of Environment, Social & Human, Economic and Governance and what activities in the respective dimensions support the defined goal. There are many methods of analysis, such as value driver trees, that can help to answer this. For instance, initiatives to reduce the financing of criminal activities could have a positive impact on the bank’s image in society (CSR dimension “Social & Human”), which, in turn, can improve customer loyalty and thus stabilize the return on equity (RoE) over time. By contrast, reducing the carbon footprint has a positive impact on the environment, but may not necessarily result in an increase in RoE as these initiatives may lead to higher operating costs. In-depth knowledge of the business model combined with statistical analyses serve as the foundation for defining these value driver trees.

Using this cause-and-effect analysis and based on the defined goal, it is important to identify those activities that result in the generation or the destruction of value or are otherwise relevant. CSR activities and impacts are highly dependent on the sector in which the company operates. For banks, two paths of CRS impacts must be differentiated in general (see the figure below). First, upstream and own operations have a CSR impact for the bank itself and its suppliers—e.g. employment impact due to wages, environmental impact due to the use of office premises, water and energy consumption. Second, downstream and external operations include any impact at the customer level which is indirectly supported or financed by the products and services offered by the bank—e.g. environmental damage due to financing a new factory. Third round effects, like the environmental impact of products manufactured by a bank’s customer, are large complexity drivers and should not be considered in early analyses. Over time and with increasing experience, the range of analysis can be expanded. Our figures below illustrate these points.

Once the goal, the operations and the desired paths of impact have been defined, the various activities and their impact regarding the value generated for the environment should be measured. Although a wide variety of methods can be applied, not all activities can be directly translated into a monetary value and should instead be valued qualitatively (e.g. a normalized score can be used and activities and their impact can be reported individually on a balanced scorecard). Appropriate reporting depending on the defined goals is necessary to achieve the desired transparency and trigger the required actions. As the majority of banks so far have little experience with measuring value generated for the environment, it is recommended to start with internal monitoring and reporting. The use of scorecards has proved to be particularly efficient in this context. It involves a structured list of activities and the value they generate, separated into CSR categories, i.e. effects are only aggregated vertically (i.e. in a hierarchical manner). The objective is to generate a report similar to a balanced scorecard which can be used as an additional management tool to complement the traditional financial reports.

Once the required level of transparency and acceptance has been achieved internally, a consistent management framework that defines required measures and responsibilities across the entire company should be specified. It allows taking active measures as well as controlling impacts long-term. Actively managing the generated value is the only way to ensure a comprehensive view and shows whether the set targets have actually been attained. In this context, well established standards, such as the UN Sustainable Development Goals, should be used for guidance.

It is important to remember that any cause-and-effect link between CSR activities and financial performance has not yet been entirely proven. Numerous studies (some of them by zeb) have returned unclear results. Based on the actual objective of measuring the value created by CSR, a suitable definition as well as the scope of measuring, i.e. what to measure in which categories, must be established. It is recommended to start with a narrow definition which can be gradually expanded over time and based on the necessary experience. In-depth knowledge of the bank’s business model and the interdependencies, from suppliers to customers, is fundamental. Only then can those activities that actually impact the desired goals as well as their implications in the CSR categories (Environment, Social & Human, Economic and Governance) be identified.

For further insights on this widely discussed topic, we strongly recommend our article about “CSR – Corporate Social Responsibility”: