A lot of noise in the press, but relatively few real changes

If Deutsche Bank and Commerzbank had merged, they would have created a new German large-cap bank with total assets of about EUR 1.8 trillion and around 140,000 employees. It goes without saying that it would have been nearly impossible to maintain these figures. This, among other things, might have led to the termination of the exploratory talks. The huge costs of the necessary IT harmonization and a foreseeable loss of customers also contributed to the fact that this merger is no longer considered a viable option for the time being.

So the big bang did not happen. This could also be said with regard to monetary policy—or maybe not, as the ECB’s monetary policy has once again been confirmed upon Mario Draghi’s departure from the ECB’s Executive Board. The key interest rate within the ECB’s sphere of influence remains at zero percent. Banks have to pay 0.5 percent negative interest on deposits with the ECB. What journalists call “loose monetary policy” is increasingly causing tension among banks and savers. However, it is unlikely to change in the near future.

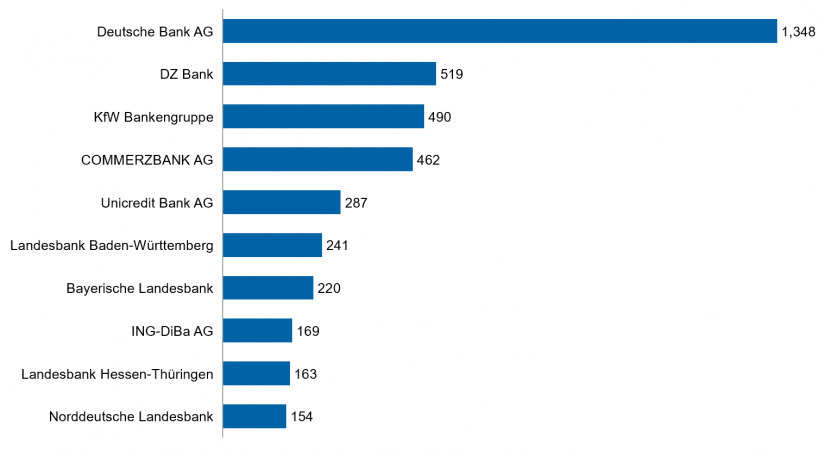

Top ten in the German banking market 2019

And so the German banking market again proved to be constant and stable in its fundamentals in the past year. A glance at the top group of German banks confirms this impression:

It hardly comes as a surprise that Deutsche Bank once again leads the top ten, followed by DZ Bank, which is the central institution of the Cooperative Finance Group (Genossenschaftliche FinanzGruppe). DZ Bank was able to maintain this position after the merger with WGZ Bank in July 2016. Apart from Commerzbank, which is ranked fourth, the top group of the German banking industry is dominated by German branches of large international banks (UniCredit Bank, ING-DiBa), development banks (KfW Group, NRW.Bank) and state banks (Landesbank Baden-Württemberg, Bayerische Landesbank, Landesbank Hessen-Thüringen, Norddeutsche Landesbank).[1]

State banks in Germany 2019

The state banks (Landesbanken) are central institutions of the Savings Banks Finance Group (Sparkassen-Finanzgruppe). Following the privatization of HSH Nordbank (and its renaming to Hamburg Commercial Bank), which was completed in early 2019, only the much smaller SaarLB remained in the Landesbank sector in addition to the four institutions mentioned above. This part of the German banking market has thus been reduced to five institutions.[2]

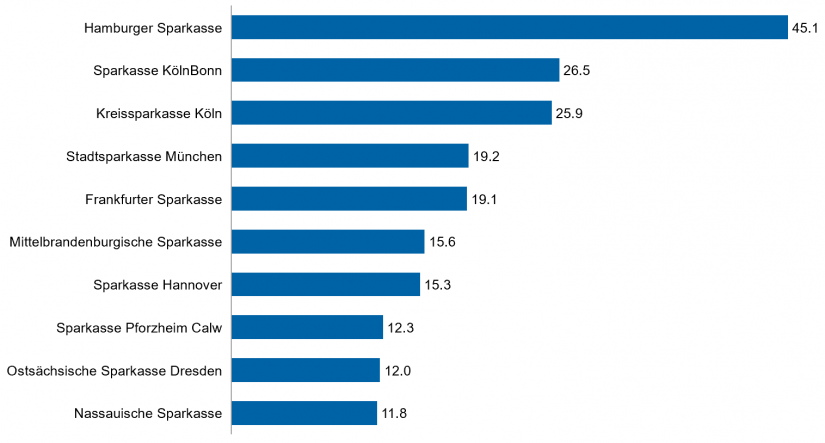

The Savings Banks Finance Group entered the banking market in 2019 with 385 institutions, compared to 403 in the year before. The consolidation indicated by these figures will undoubtedly continue; zeb recorded five savings bank mergers for 2019, although the long-term trend still indicates a constant and evolutionary process. The well-known mega trends demography, digitalization and low interest rates will continue to feed this process.

Little has changed in the top group of German savings banks compared with previous years. Here, as usual, the field is led by Germany’s largest savings bank, Hamburger Sparkasse (Haspa), followed by Sparkasse KölnBonn, Stadtsparkasse München, Frankfurter Sparkasse, Sparkasse Hannover, Mittelbrandenburgische Sparkasse, Sparkasse Pforzheim Calw, Ostsächsische Sparkasse Dresden and Nassauische Sparkasse. The ranking of German savings banks correlates only moderately with regional economic dynamics, but rather precisely with the dimension of the mostly metropolitan business regions. If extended by three or four ranks, the list corresponds almost exactly to the list of the largest German cities.[3]

Figure 3: The ten largest savings banks in Germany as of December 31, 2018 (by total assets in EUR billion)

Figure 3: The ten largest savings banks in Germany as of December 31, 2018 (by total assets in EUR billion)BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

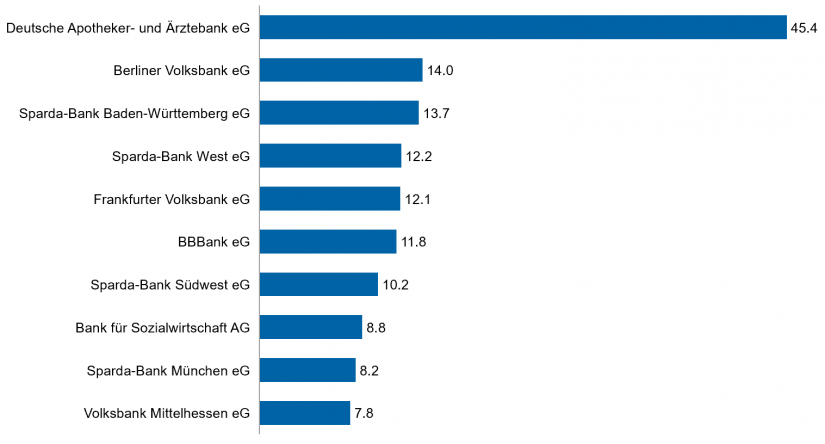

The ten largest cooperative institutions in Germany 2019

A different picture in the banking market 2019 emerges when looking at the largest cooperative credit institutions, since this banking group includes not only Volksbank and Raiffeisenbank institutions, but also smaller banking groups such as the 14 PSD Bank and the eleven Sparda-Bank institutions—both of which emerged from previous credit institutions for specific occupational groups, namely postal and railway workers. This heterogeneity results in a differently structured ranking.

In terms of total assets, Deutsche Apotheker- und Ärztebank again tops the list of the largest cooperative institutions in the banking market 2019. However, the top group is then dominated not so much by traditional Volksbank institutions as by four institutions of the Sparda banking group. In addition to the three largest Volksbank institutions (Berliner Volksbank, Frankfurter Volksbank and Volksbank Mittelhessen), BBBank (Badische Beamtenbank) and Bank für Sozialwirtschaft are also among the top ten of the Cooperative Finance Group.[4]

Bank für Sozialwirtschaft, a credit institution for organizations in the health and social sectors (senior and disability services, child and youth welfare) is quite typical of the German banking industry’s third sector. Other institutions with social, church or ecological commitment can also be found among the largest cooperative credit institutions, including Evangelische Bank (#11), GLS Bank (#18), Bank für Kirche und Diakonie (#19), LIGA Bank (#20), Bank im Bistum Essen (#22) and Bank für Kirche und Caritas (#23).

Figure 4: The ten largest cooperative institutions in Germany as of December 31, 2018 (by total assets in EUR billion)

Figure 4: The ten largest cooperative institutions in Germany as of December 31, 2018 (by total assets in EUR billion)Still, the majority of cooperative institutions are “traditional” Volks- and Raiffeisenbank institutions. 875 were still there at the beginning of the year, but here, too, the consolidation in the industry has led to a continuous reduction in the number of institutions. The fact that the consolidation is somewhat stronger in terms of numbers than in the savings bank sector is, of course, due to the larger starting base. zeb recorded 30 mergers in the Cooperative Finance Group for 2019. From a certain meta perspective, a trend towards the formation of larger institutions can be recognized for this banking group. For comparison: average total assets in the Cooperative Finance Group still amount to approximately EUR 1 billion, whereas the Savings Banks Finance Group reaches around EUR 3.3 billion—this could be a quite realistic target corridor.

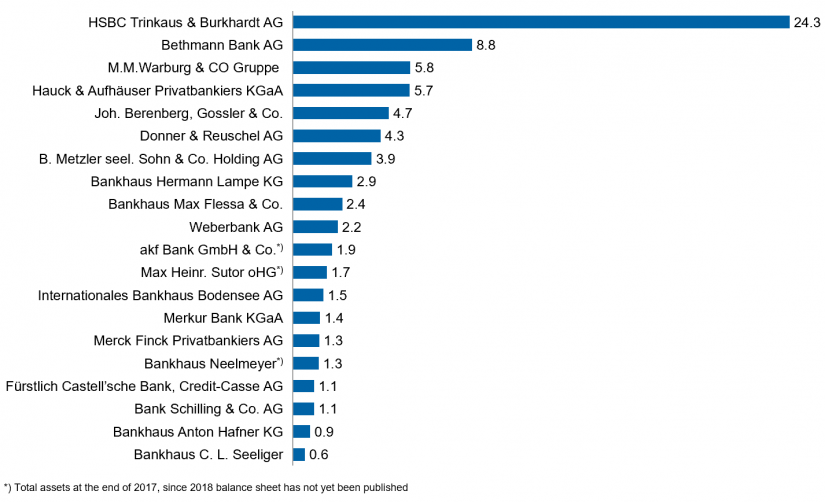

The twenty largest private banks in Germany

In last years’ retrospects of the German banking market’s development 2018, we did not yet specifically focus on private banks. So we are going to have a closer look in this article on the banking market 2019. The following chart shows the twenty largest private banks in Germany (by total assets).[5]

Figure 5: The 20 largest private banks in Germany as of December 31, 2018 (by total assets in EUR billion)

Figure 5: The 20 largest private banks in Germany as of December 31, 2018 (by total assets in EUR billion)HSBC Trinkaus & Burkhardt, a subsidiary of British HSBC Holdings, leads the list by a wide margin. It is followed by numerous, very renowned private banks throughout Germany.[6] This exclusive sub-market of the German banking industry has noticed some movement, too: the Hamburg-based private bank Joh. Berenberg, Gossler & Co. (#5) sold its business with some 160 independent asset managers and a volume of around EUR 8 billion to the Donner & Reuschel banking house (#6). Donner & Reuschel belongs to the SIGNAL IDUNA Group.

For several months already, the Oetker family, who owns Bankhaus Hermann Lampe, has been considering a sale of the traditional bank. Merkur Bank (#14) and Bank Schilling & Co. (#18) now operate under the name Merkur Privatbank. This merger has created one of the largest owner-managed private banks in Germany with total assets of more than EUR 2 billion. And due to the merger of Bremer Kreditbank and Oldenburgische Landesbank (OLB), Bremer Bankhaus Neelmeyer (#16) is now part of the “new” OLB Bank.

These are the most striking transactions that have occurred in this section of the German banking market. In addition, numerous institutions are already planning or reviewing further strategic decisions. The digital transformation of the financial industry, the constantly low interest rate level and the resulting pressure on deposits, costs and earnings have noticeably increased the pressure to adapt in the private banking segment. Here, too, further consolidation is to be expected, as in the entire German banking sector.

Conclusion—banking market 2019

Have we forgotten anything in our review? Fintech companies? Investor groups? We have certainly not forgotten these organizations, but we have become accustomed to the fact that the new market participants impact the financial sector just as much as institutions of the cooperative and savings bank finance groups, as well as large banks and traditional private banks.

From zeb’s point of view, the sector will continue to consolidate, it will have to press ahead with cost optimization, provide creative—sometimes controversial—answers to the pressure on earnings and develop sector-specific solutions for the digitalization of its services. This will not happen without a further reduction in the number of institutions and not without further job cuts, but as in previous years, it will happen without disruptive events and